How to Use Large-Cap Stocks in a Portfolio

A look at the benefits and risks of these investments, plus our favorite options.

What should be in your portfolio? The specifics will depend on several factors, such as your goals, time horizon, and risk tolerance, but large-cap stocks are a good choice for inclusion in nearly every investor’s portfolio.

In this series on portfolio basics, I’ll explore some of the fundamentals of putting together sound portfolios. I’ll examine the most widely used types of investments and what you need to know to use them effectively in a portfolio.

What Are Large-Cap Stocks?

Large-cap stocks are defined based on their market capitalization (also known as market cap), which measures the total value of a stock’s shares outstanding, or the number of shares that are publicly traded multiplied by the current stock price.

Morningstar defines a stock as large-cap if it lands within the top 70% of aggregate market capitalization for a given market, such as the United States, Europe, or Canada. (Currently, stocks with market caps of about $12.8 billion or more qualify as large-cap.) Stocks with larger market caps tend to be widely recognizable names, such as Apple AAPL, Microsoft MSFT, and Amazon.com AMZN.

By definition, large-cap stocks make up the majority of the available market, so it makes sense that they should make up a significant portion of most investors’ total equity exposure.

What Are the Advantages and Risks of Investing in Large-Cap Stocks?

Large-cap stocks have several advantages. Because they’re widely held by so many investors, they’re extensively researched and liquid. Their sheer size means their performance is generally a pretty good gauge of the equity market overall.

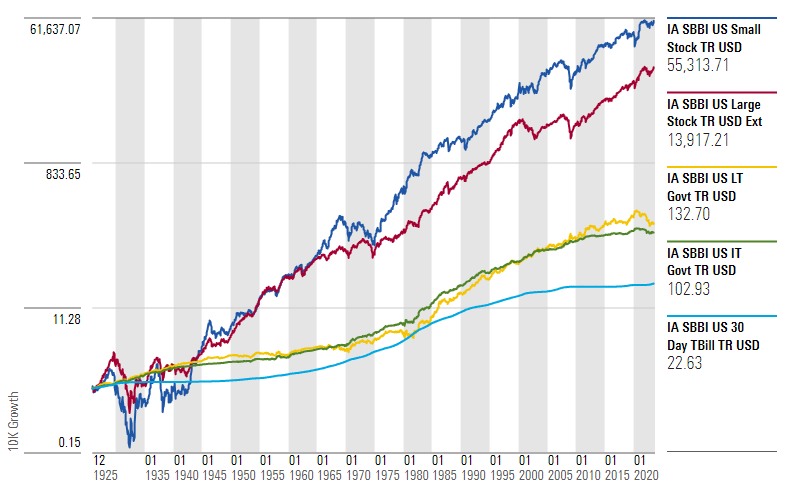

As shown in the chart below, large-cap stocks have generated strong returns over time. Over the 97 years since 1926, small-cap stocks have fared even better, with an annualized performance edge of about 1.5 percentage points per year. However, large-cap stocks have outperformed in more recent periods, such as the 14-year timespan following the global financial crisis.

Growth of $1 Over Time

Along with their return potential, stocks come with certain risks. In contrast to bonds, which offer more certainty about their value at maturity, stocks are inherently riskier. And while bondholders receive periodic interest payments (typically at a set rate) in exchange for lending money to the bond issuer, the value of a stock is both difficult to model and constantly changing.

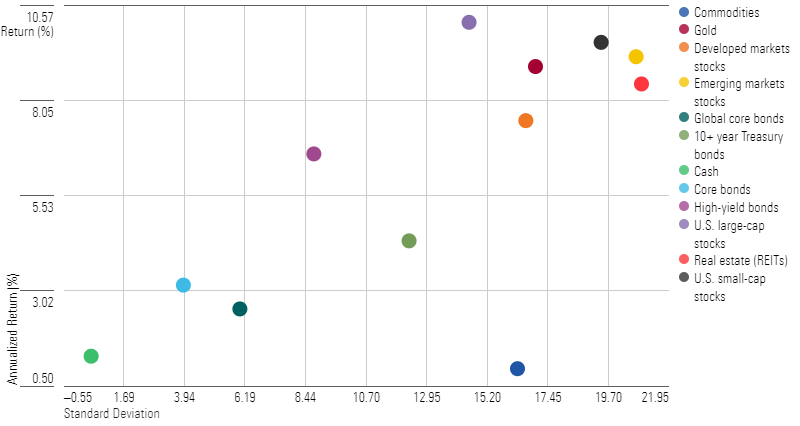

This means that large-cap stocks come with relatively high risks and returns. The table below shows annualized returns and standard deviations for large-cap stocks compared with other major asset classes over the past 20 years.

Trailing 20-Year Risk and Return: U.S. Large-Cap Stocks and Other Assets

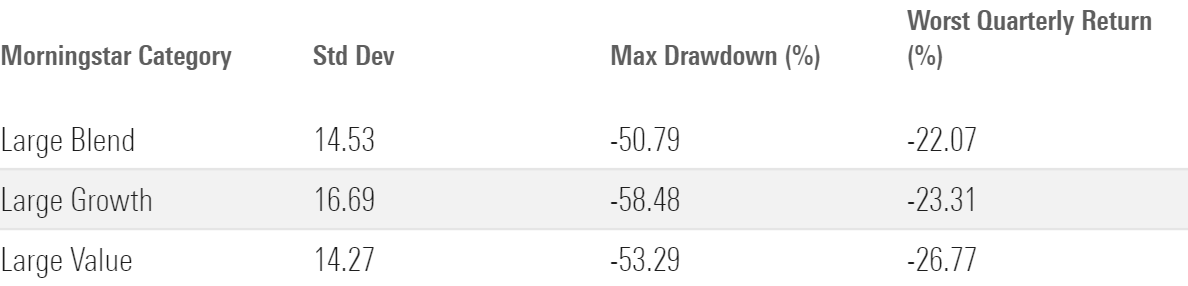

Historically, large-cap stocks have lost as much as 50% or more during market drawdowns, such as the global financial crisis that started in late 2007 and the tech stock correction that started in 2000. On a quarterly basis, they’ve been subject to losses as large as 20% or more. That said, large-cap stocks go up more often than they go down—helping them generate rewarding returns over time.

Other Risk and Drawdown Stats (Since 1990)

How to Invest in Large-Cap Stocks

There are two main ways to invest in large-cap stocks: by purchasing individual stocks or by purchasing a fund.

Buying individual stocks isn’t as hard as it used to be, as many brokerage firms now offer commission-free trades as well as fractional shares, which allow investors to buy smaller slices of a given stock if they don’t have the assets available to cover the full share price.

But buying individual stocks also comes with additional risks. If you own one stock (or even as many as 20 different stocks), you’ll be subject to stock-specific risk—meaning that the odds of things going poorly are much higher than they would be with a diversified portfolio. In 2021, for example, about 1 out of every 6 large-cap stocks lost 10% or more, even though the overall market generated positive total returns of about 26% for the year.

For most investors, broadly diversified index funds are the best way to invest in large-cap stocks. Few active managers have been able to consistently outperform the overall market over time. Index funds, on the other hand, harness the market’s collective wisdom about the relative value of each stock included in a given benchmark. They’re also cheaper: Investors in actively managed large-cap stock funds pony up annual expenses of about 88 basis points, on average, but the typical passively managed large-cap stock fund charges less than half of that.

If you only own one large-cap stock fund, I’d focus on large-cap blend rather than large value or large growth. Large-cap blend typically provides the broadest exposure to the overall market, and isn’t as subject to market vicissitudes that can cause growth and value stocks to swing in and out of favor over multiyear periods.

When Do Large-Cap Stocks Perform Best?

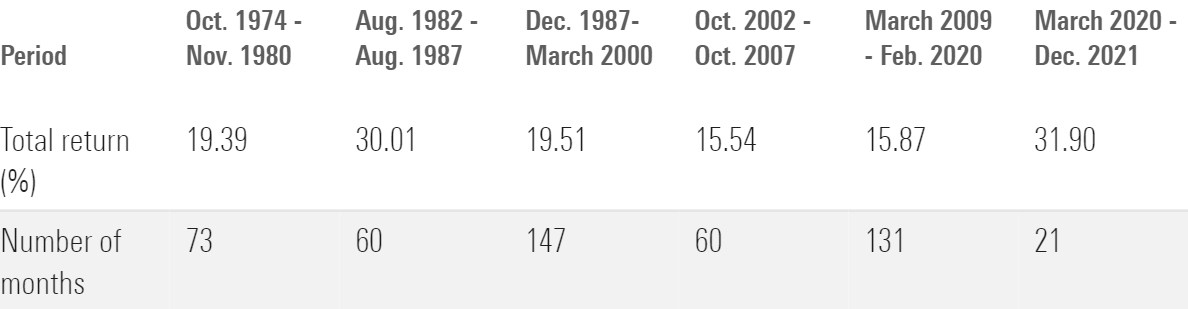

Large-cap stocks typically perform best during periods of strong economic growth, rising corporate profits, declining interest rates, and low inflation. The table below shows annualized returns for large-cap stocks during several recent bull markets.

Returns for Large-Cap Stocks in Recent Bull Markets

How Long Should I Hold My Investments in Large-Cap Stocks?

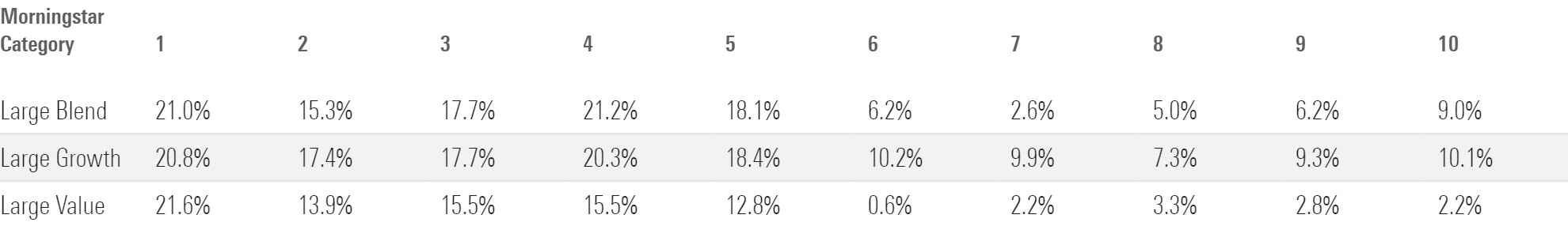

Morningstar’s Role in Portfolio Framework recommends holding stock funds for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years.

The idea is to minimize the odds that an investment is in the red at the same time that you need to access the money to fund a goal.

Over a five-year period, for example, returns for large-blend and large-growth funds have been negative about 18% of the time. Over a 10-year period, the odds of incurring a loss are significantly lower.

Frequency of Losses Over Rolling Periods Since 1990

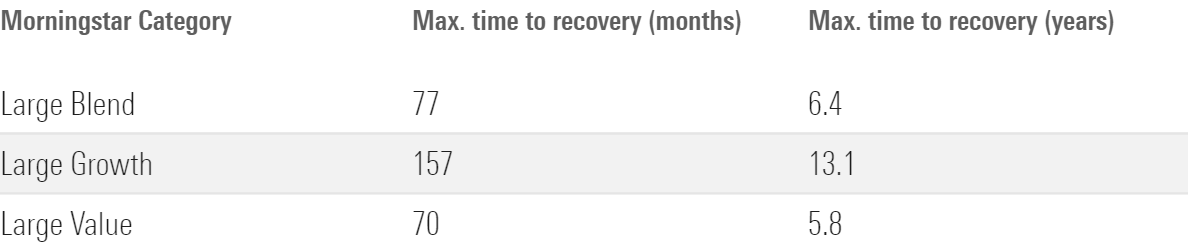

Another way to think about this issue is by looking at the maximum time to recovery, or how long it typically takes for a given fund category to recover after suffering a drawdown. As shown in the table below, large-blend and large-value funds have historically recovered within about six years. Large-growth funds have taken as long as 13 years to win back their losses after a market downturn.

Maximum Time to Recovery for Large-Cap Stock Categories Since 1990

How Much of My Portfolio Should Be in Large-Cap Stocks?

The answer to this question largely depends on your portfolio’s overall asset mix.

If you’re investing for a short-term (less than two years) or intermediate-term goal (two to six years), you’ll probably want to tilt your portfolio more toward cash and bonds. If your time horizon is long enough, however, a larger stock allocation may make more sense.

Within the equity portion of a portfolio, it makes sense to use the overall composition of the market as a starting point. Large-cap stocks account for more than 70% of the market’s overall market capitalization; as a result, they’re generally a good proxy for the performance of stocks in general.

That’s particularly true for large-blend funds, which we recommend as core holdings that could make up as much as 40% to 80% of a portfolio’s assets. Large-value and large-growth funds fill more specialized roles; we consider them “building blocks” that could make up as much as 15% to 40% of a portfolio’s assets.

What Are the Best Large-Cap Stock Funds?

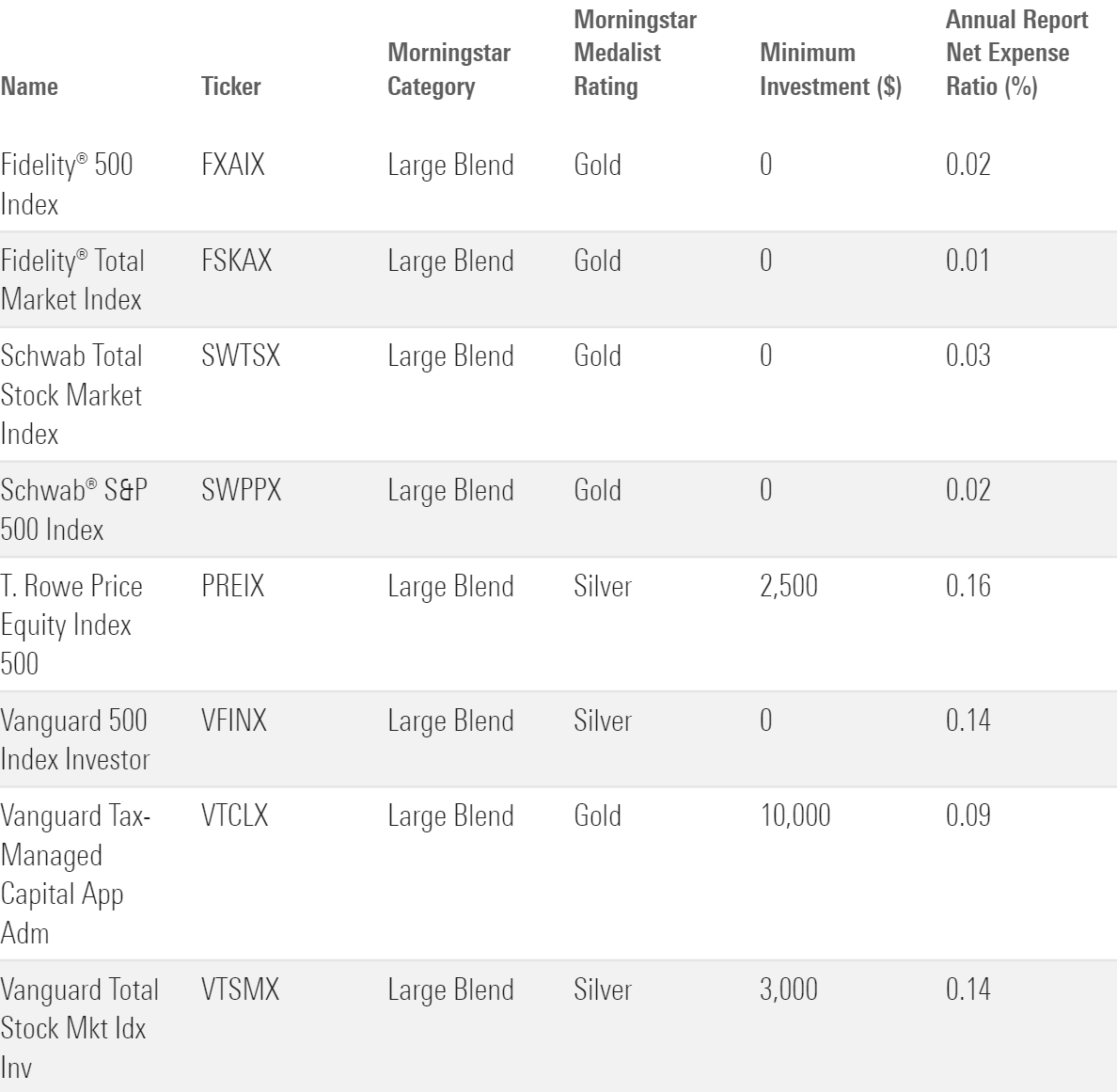

The table below shows a subset of highly rated index funds focusing on large-cap stocks. I’ve focused on large-cap blend funds that are broadly available through major brokerage platforms, with low investment minimums and ultralow expense ratios.

A Few Highly Rated Large-Cap Stock Funds (Index Funds)

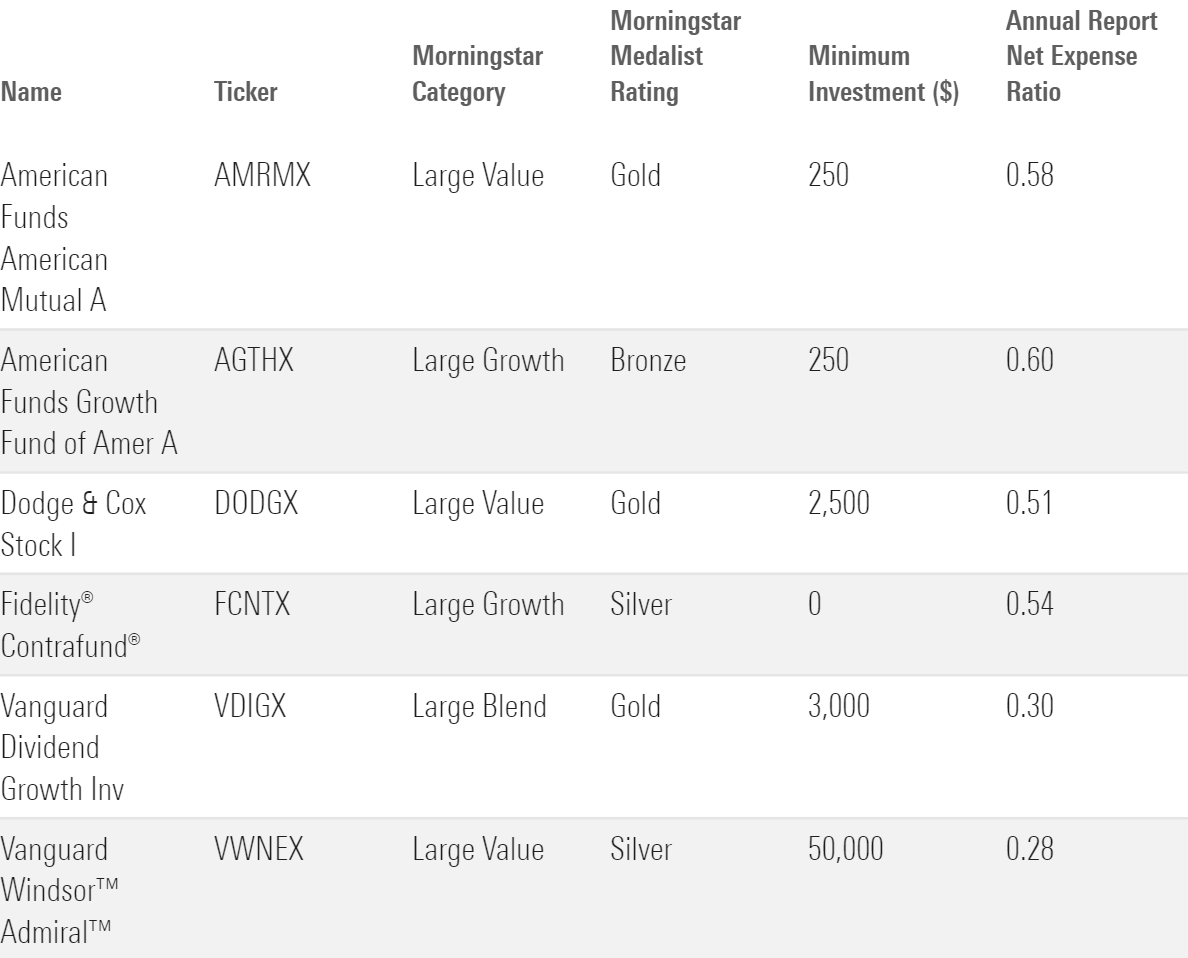

The list below includes a few actively managed funds from Russ Kinnel’s “Thrilling 31″ list, which features funds with relatively low expense ratios, high Morningstar Medalist ratings, portfolio managers who have invested at least $1 million in their own fund, and above-average returns during the manager’s tenure for at least five years.

A Few Highly Rated Large-Cap Stock Funds (Actively Managed Funds)

What Funds Pair Well with Large-Cap Stock Funds?

If you’ve already added a large-cap stock fund to your portfolio, a bond fund or international-stock fund could be a logical addition.

- Bond funds typically help buffer against losses in years when the stock market is down (although rising interest rates and unexpectedly high inflation led to sharp losses for both stocks and bonds in 2022). Bond funds have also often had negative correlations with the equity market, which can help improve risk-adjusted returns for a portfolio that includes both stocks and bonds.

- International-stock funds can provide more complete exposure to the global market. U.S. stocks currently make up about 60% of global market capitalization, but non-U.S. stocks account for the remaining 40%. And while correlations between U.S. and non-U.S. stocks have trended up over the past couple of decades, international stocks can offer diversification benefits. There are also certain periods in which international stocks have had a performance edge.

- Small-cap stock funds can also make a good complement to large-cap stock funds. They offer some diversification benefits and might enhance returns over longer periods. If you select a “total market” index fund, though, you probably don’t need to add a separate small-cap stock fund. Most “total market” indexes provide broad exposure across the entire market-cap spectrum.

Should I Invest in Large-Cap Stocks?

As long as you have a long enough time horizon, large-cap stocks are a key foundation for nearly every investor’s portfolio. They’ve produced outstanding total returns over time, and are one of the best ways to generate wealth for long-term financial goals.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)