How to Use Gold in Your Portfolio

What you need to know about the advantages and risks of investing in gold.

Gold is one of the oldest forms of money; gold coins were first used in the Kingdom of Lydia (now part of Turkey) in about 550 B.C. Gold has also long been used as a store of value as well as an investment asset.

In this series on portfolio basics, I’ll explain some of the fundamentals of putting together sound portfolios. I’ll start with some of the most widely used types of investments and walk through what you need to know to use them effectively in a portfolio.

What Is Gold?

There are two primary ways to invest in gold: buying the commodity directly (gold bullion) or buying shares in companies that mine and sell gold (gold equity). Because gold stocks have both financial and operating leverage, their results tend to magnify the impact of changes in the price of gold. They’re also significantly more volatile than bullion, which only depends on the underlying commodity price. In this article, I’ll mainly focus on gold bullion, which is a better fit for investors seeking a hedge against market-related risk.

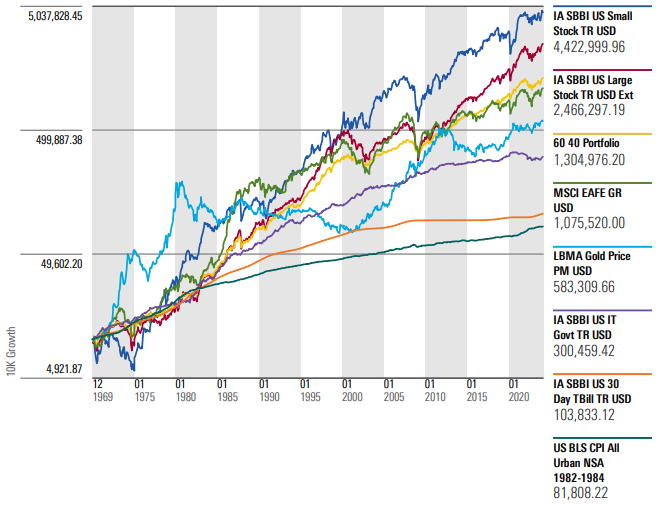

Long-Term Growth of Gold and Other Asset Classes

As the graph above illustrates, gold has been a so-so long-term performer. Before the collapse of the Bretton Woods system in 1971, the price of gold was fixed at $35 per troy ounce. Since then, the price has risen significantly. However, gold’s long-term returns have lagged both US stocks and a diversified portfolio combining 60% in stocks and 40% in bonds.

Gold aficionados often point to gold’s ability to hold its value over time. As a guideline, it’s often said that one ounce of gold should roughly translate into the price of a high-quality men’s suit. I’m not an expert on men’s apparel, but gold’s current price of about $2,000 per ounce seems high enough to cover the cost of an acceptable suit.

What Are the Advantages and Risks of Investing in Gold?

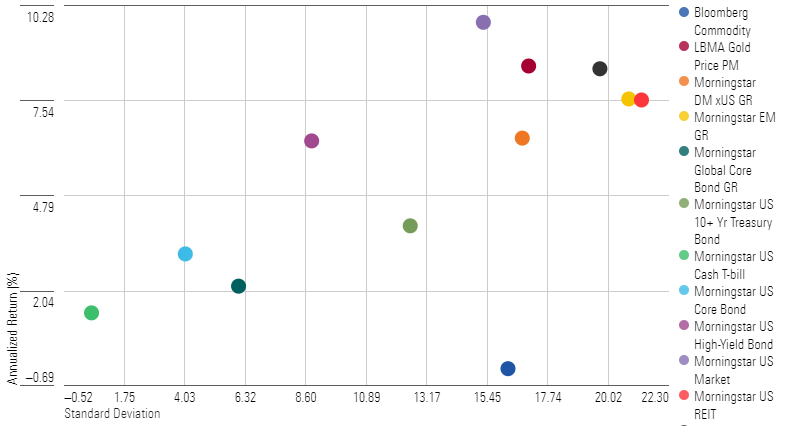

In terms of return generation, gold has been a decent performer over the past 20 years. But as shown in the scatterplot below, volatility has been relatively high, as well.

Trailing 20-Year Risk and Return: Gold and Other Assets

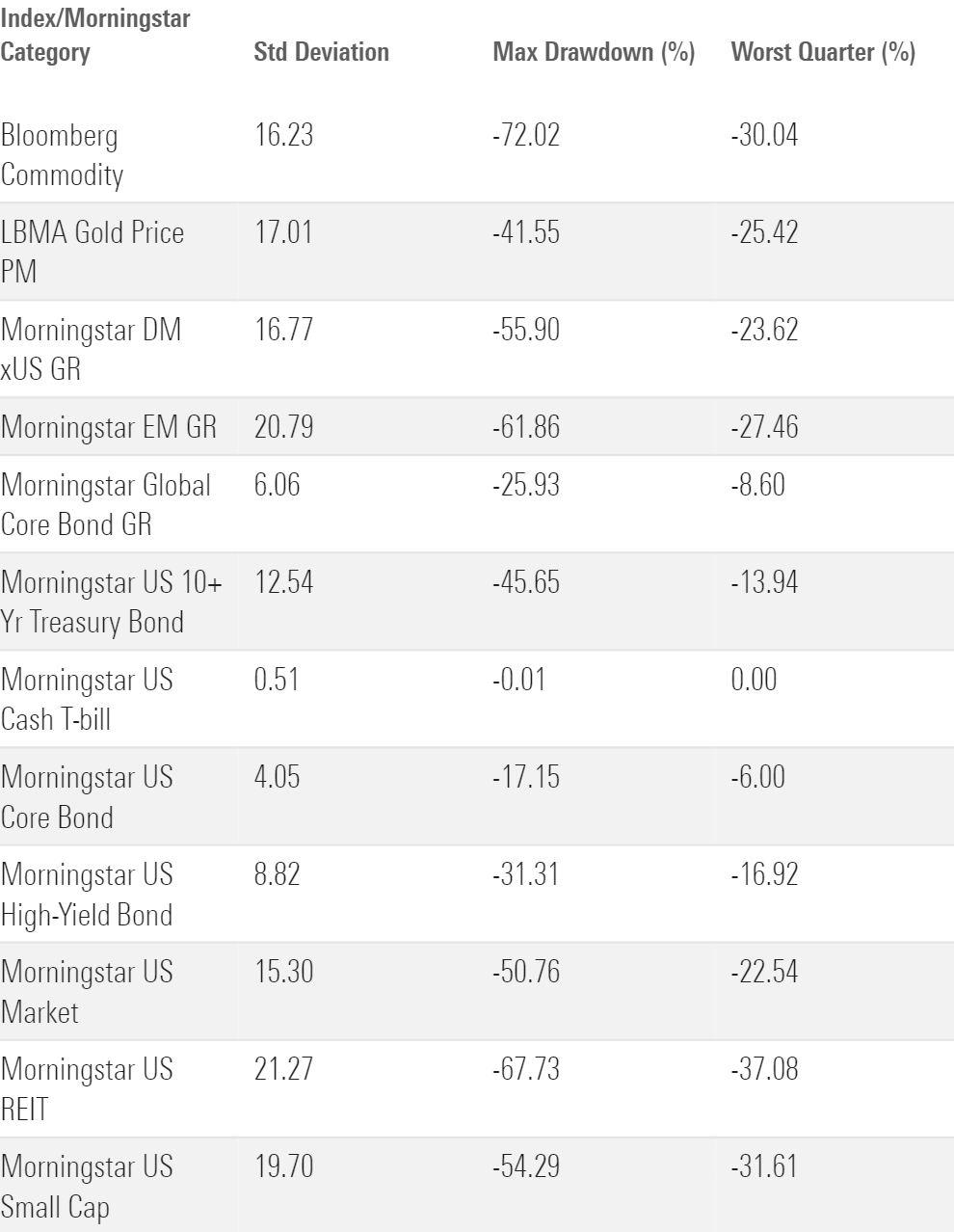

Gold has also been subject to a fair amount of downside risk, although its downside risk profile is more moderate than that of other commodities.

Drawdown Stats: Gold and Other Assets

How to Invest in Gold

If you’ve been watching late-night TV or visited your local Costco, you’ve probably seen advertisements for gold bars or coins. Owning gold in physical form often appeals to people trying to prepare for worst-case scenarios, such as the need to flee during a war. And in fact, having gold coins stored in the basement or attic has been a lifesaver for some families at times, such as during World War II.

But owning physical gold has some disadvantages: namely, storage costs and the risk of theft. During ordinary times, investors are usually better off owning gold through a mutual fund or ETF.

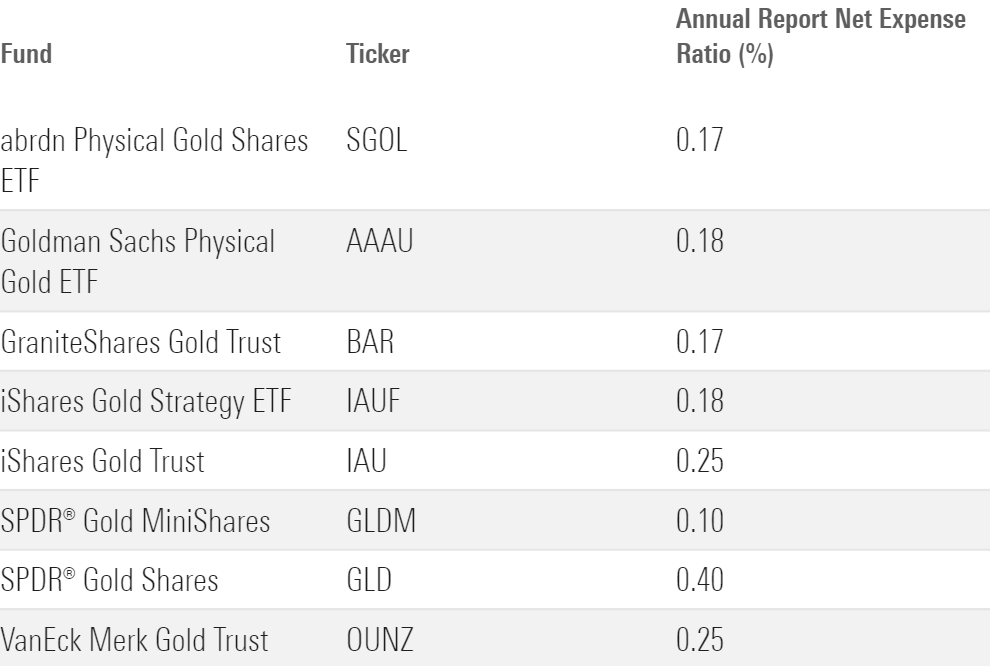

The table below shows a subset of gold funds with relatively low expense ratios. (Note: Morningstar does not currently provide Morningstar Medalist Ratings on gold funds and other funds in the commodities-focused category.)

Selected Gold Funds

When Does Gold Perform Best?

Despite its short-term volatility, gold has a long history as a safe haven. The price of gold is largely independent of other asset classes, and it has also traditionally been used as a refuge against weakness in the dollar. It can also serve as a hedge against inflation and market volatility.

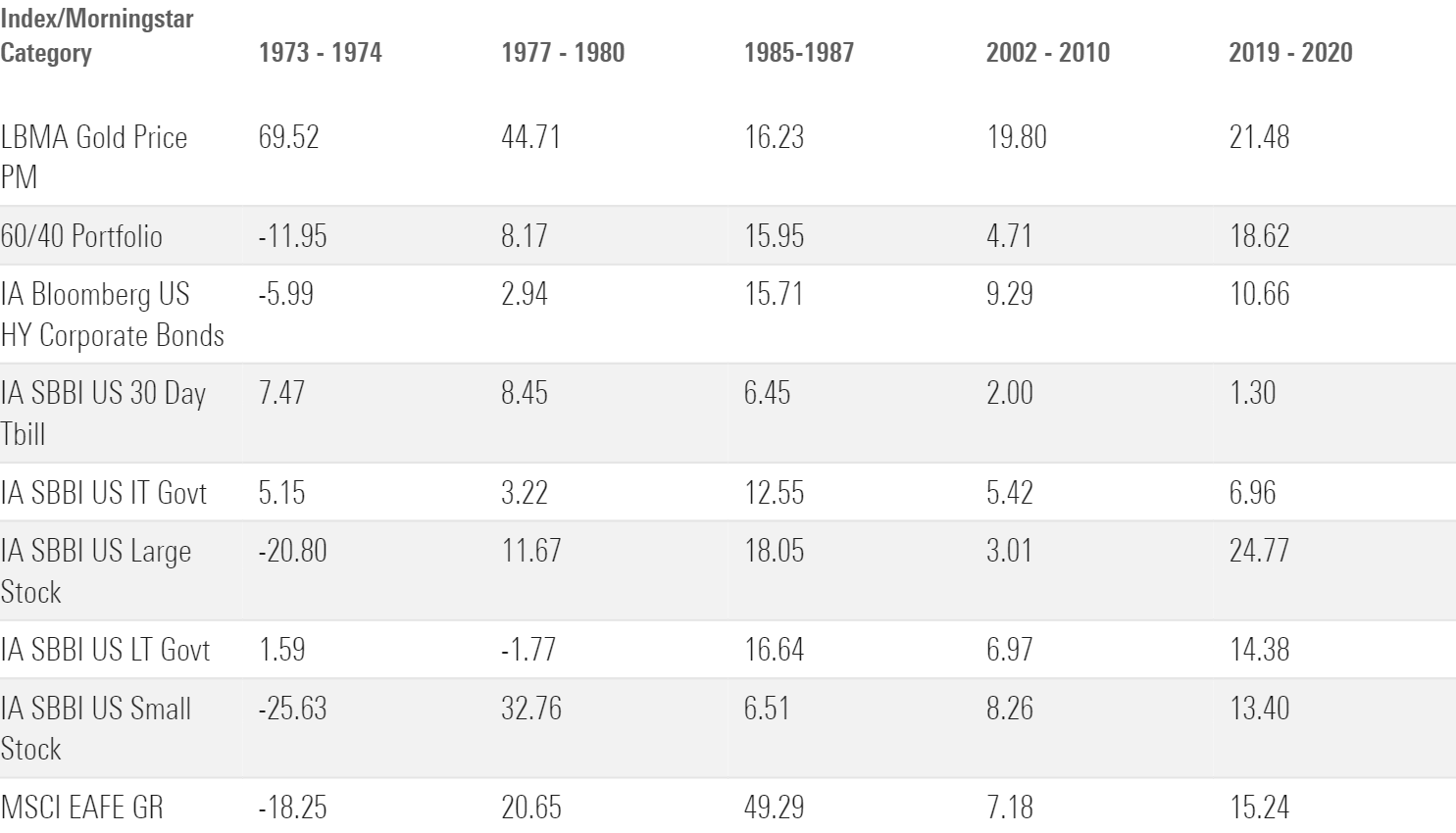

The table below shows annualized returns for gold during some of its strongest periods.

Annualized Returns During the Best Times for Gold

How Long Should I Hold My Investments in Gold?

Morningstar’s Role in Portfolio framework recommends holding gold for at least 10 years. We came up with this guideline partly by looking at the historical frequency of losses over various rolling time periods ranging from one year to 10 years. We also considered the maximum time to recovery, or how long it usually takes to recover after a drawdown.

How Much of My Portfolio Should Be in Gold?

As with other specialized fund categories, Morningstar’s Role in Portfolio framework recommends that individual investors keep their gold exposure limited (which Morningstar defines as 15% of assets or less).

On balance, gold has a pretty reliable record as a safe haven in times of market turmoil. It can also provide significant diversification benefits, as its correlation with both stocks and bonds is typically very low. However, it’s better viewed as an insurance policy than as a core holding given its lackluster long-term returns.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)