How I Paid for My Dream Vacation

My plans to celebrate a milestone birthday with my twin sister forced me to rewire my otherwise risk-averse investing mindset.

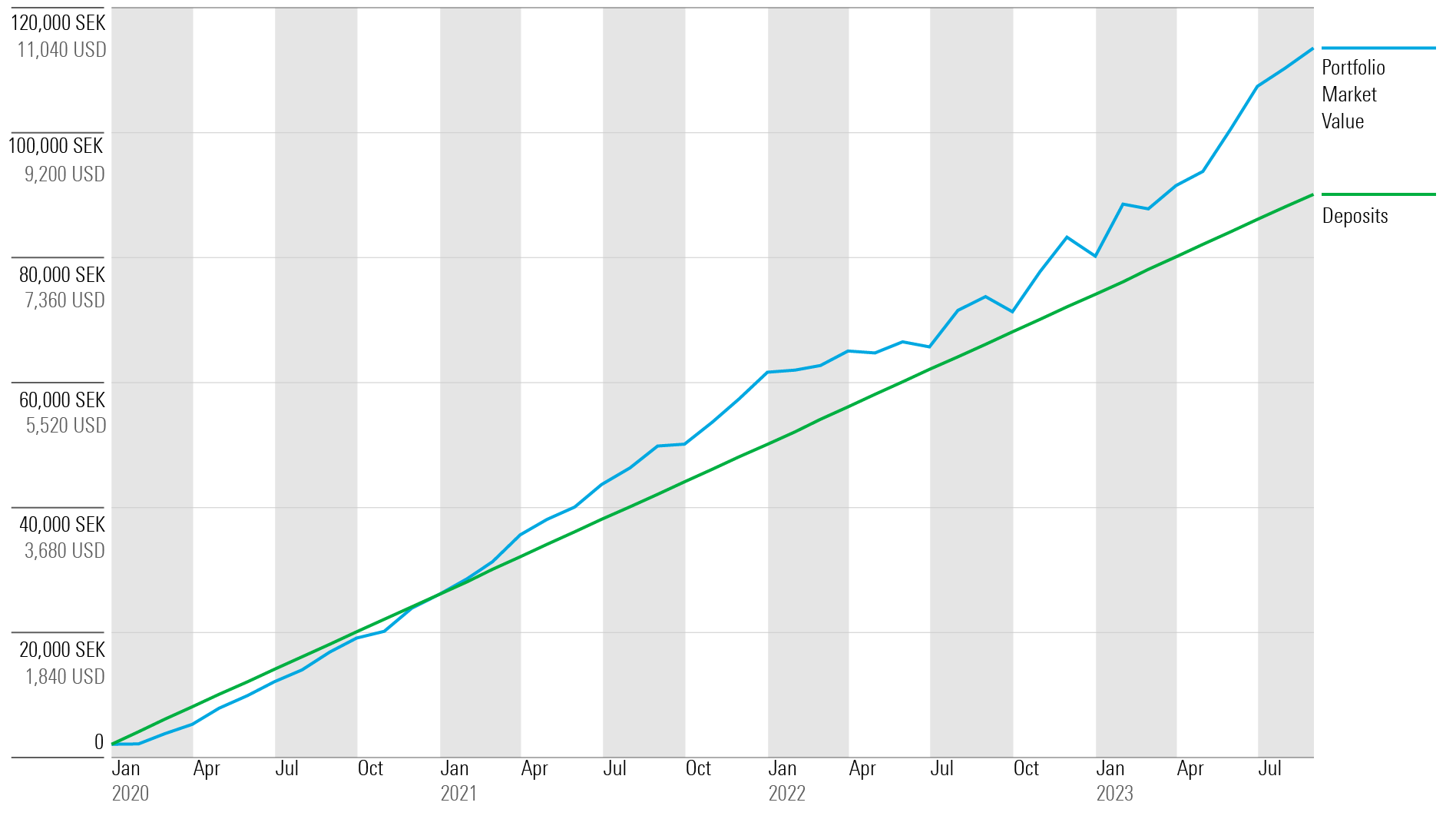

My twin sister and I are turning 30 this month. To celebrate, we decided to travel and let equity markets help us pay for it.

This put us on a three-year investing journey that forced me to let go of some deeply held principles.

At the start of 2020, just weeks before the pandemic, both of us were binging the reality TV show “Below Deck.” The series is set on a yacht, which got us daydreaming about sailing ourselves: What if we could save enough to charter a boat for a week?

Confronting Risk—and the Possibility of Staying Home

We each committed to setting aside 1,000 Swedish kronor each month (or about USD 90) toward our vacation. However, a quick calculation dashed our hopes of scraping together enough money by our birthday that way.

To have any hope of achieving our goal, we needed to expose our savings to risk—including the risk of possibly staying at home if we fell short of what we needed. But this was a risk we were willing to take to hit our trip goal.

How We Invested for Our Big Trip

We decided to put our savings to work in an investment fund. The responsibility of choosing the fund fell on me, the financial journalist—though my sister, a career pilot, is no stranger to risk herself.

Here are some of the factors I considered:

Low fees and global exposure: I set out to find a fund with low fees and global exposure. I could have mitigated risk by diversifying into multiple funds, but given the experimental, one-off nature of it all, I opted for a single fund that still holds thousands of different assets.

Morningstar ratings: I evaluated funds using the Morningstar Rating for funds and the Morningstar Medalist Rating for funds, along with how funds stacked up against others in their Morningstar Category.

The fund I picked: The chosen fund, upon which our big birthday trip would depend, was Storebrand Global All Countries, an index tracker with a 0.30% management fee. It has a 4-star Morningstar Rating and sits in the cheapest quintile of its category. Its low expense ratio and solid People, Process, and Parent pillars earn it a Morningstar Medalist Rating of Silver, suggesting this share class should be able to deliver positive alpha against the lesser of its median category peer or the category benchmark.

A Rocky Start

January 2020 made for an interesting starting point to invest for this trip.

We witnessed the fastest stock market decline in history, supply chain disruptions, surging inflation, unseen rate hike cycles, and a war in Ukraine in the three years since. Throughout it all, our steadfast commitment to setting aside SEK 1,000 in the fund has remained solid. And despite many shocks, the stock market has rebounded time and time again.

In the past year, the historically weak krona has worked in our favor, too, at least in terms of the fund’s performance.

However, our purchasing power abroad is a different story.

Funds invested in markets where the local currency strengthens against the krona will have their krona-denominated returns amplified.

The Payoff and Vacation Destination

In the years since, we’ve put a total of SEK 90,000 into the fund (about USD 8,100). By mid-September, our investments had grown by 45.6%, resulting in an additional SEK 26,000 (USD 2,350) boost.

The secret sauce to coming out on top? As it turns out, do nothing and enjoy the ride.

We didn’t go for the yacht. In the end, we opted to extend our journey.

Neither of us had been to Japan before, so that’s where we started. Then Bali, where the rest of our family will join in on the birthday bash.

There’s one drawback here: Sweden’s currency has been battered by a real estate crisis, a weak economic outlook, and a limited scope of further central bank action. If its slide continues, we may need to draw on other savings during our trip.

Nonetheless, our little investing project will pay for the bulk of it.

Portfolio Returns: A Gift to Our Future Selves

It’s Nice to Mix Things Up—in Travel and Investing

Such a speculative endeavor is best kept separate from your long-term financial plans. But departing from my usual long-termist and risk-averse self was quite fun. Plus, it afforded me a little luxury that might have otherwise been out of reach.

Don’t get me wrong: Long-dated investments are important. Personally, I find a balance far more fulfilling. It gives me the opportunity to fully appreciate life here and now.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ES7BXTSJ6N4RT5GG2X7PQAHRLI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)