Why Some Say Investors Should Be Wary of Corporate Bonds

Treasury bonds offering similarly attractive yields with less risk are a safer bet should a recession hit.

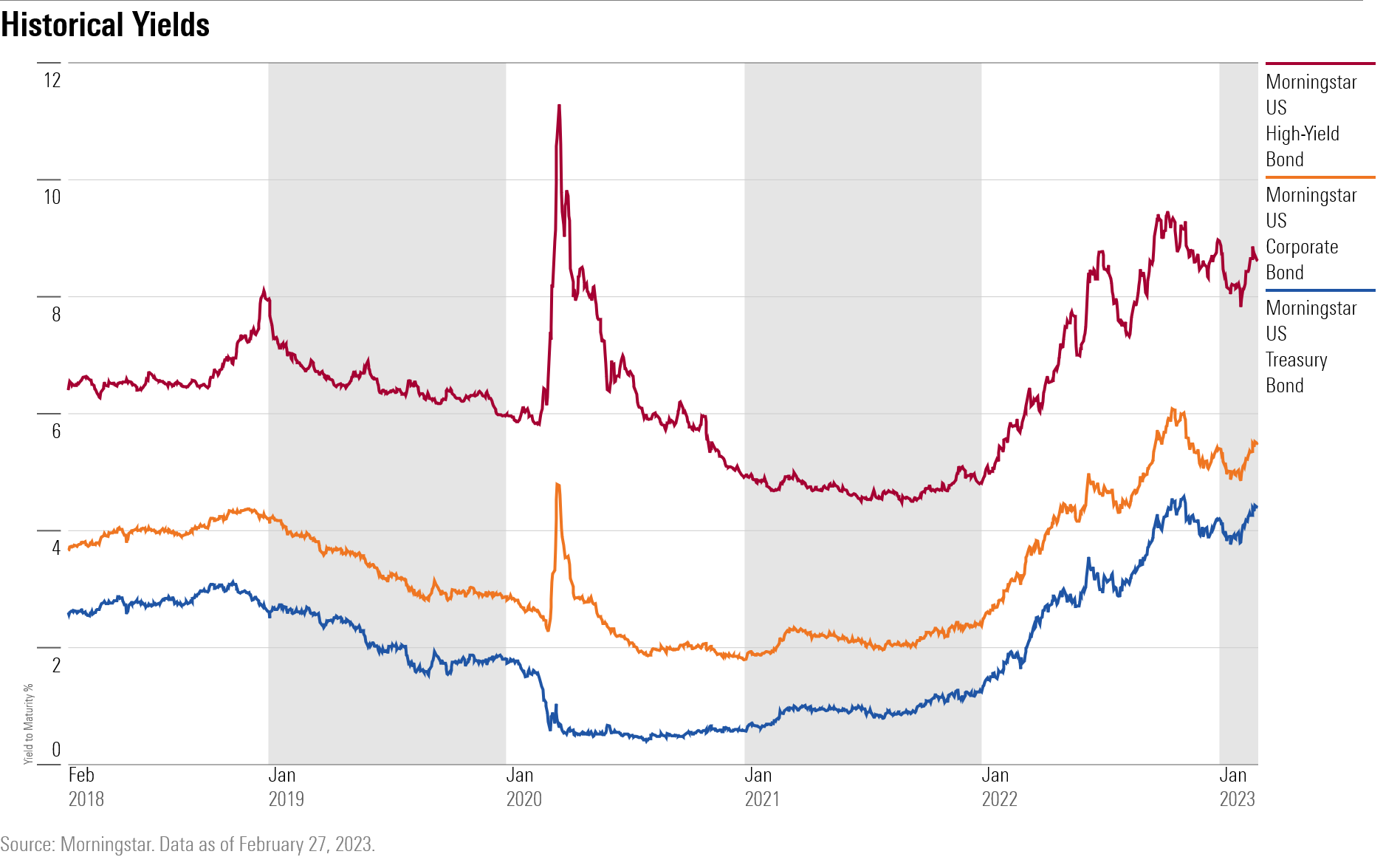

Investors have been pouring money into investment-grade corporate bonds, attracted by the fattest yields in a decade and the hopes of better total returns than those offered by stocks.

Yet, some veteran bond managers are cautioning investors to cool their jets.

The concern is that investors are not being adequately compensated for the risks associated with corporate bonds at a time when an economic slowdown is looming.

Credit spreads, which represent the difference in yields between relatively risk-free U.S. Treasuries and corporate bonds, currently don’t reflect the potential hazards of credit-rating downgrades or defaults that corporate bonds carry in addition to interest-rate risk.

That means that despite the somewhat loftier yields on corporate bonds, investors may be better off with slightly lower payouts but less risk on U.S. government bonds, some say.

“If you’re concerned about the possibility of recession, these current valuations in investment-grade credits aren’t very appealing,” says Alfonzo Bruno, associate portfolio manager for outcome-based strategies at Morningstar Investment Management. “I would rather hang out in safer fixed income where I can still get paid a decent yield.”

High-Yielding Corporate Bonds Are Drawing Investors

With yields of 5.5% on the Morningstar Corporate Bond Index—having hit 6.0% in October—$672 million has flowed into U.S. investment-grade bond funds since the start of the year, according to Morningstar Direct. The heightened interest comes after an especially punishing 2022 that saw double-digit losses in both stocks and bonds as interest rates shot up at the fastest pace to a level not seen in more than 40 years.

Companies have been rushing to take advantage of the demand with a record $156.2 billion of investment-grade corporate debt issued in February 2023, bringing the total to $301.4 billion for the year to date, according to the Securities Industry and Financial Markets Association.

High-Quality Corporate Bonds Not Priced for Recession Risk

A possible recession could spell trouble for the category as corporate profits could come under pressure, raising the risk of downgrades or, worse, defaults. Lately, investors have been spooked, too, by the prospect of the Federal Reserve raising rates higher than previously thought and keeping them at that level for longer, which is a negative for bonds because prices move inversely to yields.

After stuffing $4.3 billion into high-quality corporate-bond exchange-traded funds in January, investors pulled $3.6 billion from the group in February as nervousness has grown toward the category. Indeed, in the month of February, the Morningstar Corporate Bond Index was down more than 4%. In contrast, about $11 billion combined flowed into ultrashort and short government-bond ETFs.

“People are waking up to the deteriorating fundamentals,” says Michael Contopoulos, director of fixed-income research and strategy at Richard Bernstein Advisors.

Contopoulos points out that credit spread levels “have never been this tight and something’s got to give, and that will be credit spreads.” Since October 2022, the spread between U.S. Treasuries and investment-grade bonds has narrowed to 1.25 percentage points from 1.65 percentage points.

“One shouldn’t be overweight corporate bonds here,” Contopoulos says. “You can get virtually the same yield in Treasuries without the same risk. Two-year Treasuries have rarely been cheaper relative to investment-grade bonds.”

He also points out that about 50% of the credits in the investment-grade market are BBB rated, the lowest possible rating in the category, and that low-quality credits rarely do well in recessions.

Default Risks Low, but Downgrades Seen Rising

Still, risks of defaults in the investment-grade market shouldn’t be overstated, say money managers, as defaults have historically been low and that is unlikely to change, even given the rise in BBB rated issues.

Says Morningstar’s Bruno: “BBB rated debt has a 1.5% probability of default over a five-year period, and so in essence, it’s rather few and far between that the actual risk of default materializes.”

Financial conditions in the past 10 years also account for the rise in BBB rated issues, say investment managers, noting there wasn’t a significant financial difference between the A and BBB designations, so companies chose to take on more leverage and free up working capital for their businesses.

Moreover, there were changes in insurance regulations that made it less onerous for insurance companies to invest in BBB rated corporate debt while buying A rated became more expensive, says Arvind Narayanan, senior portfolio manager of investment-grade credit at Vanguard.

Narayanan calls Verizon Communications VZ the “poster child” of a company that allowed its ratings to fall to BBB as a calculated business decision to put its capital to better use.

He points out the “vast majority of the BBB rated issues come from noncyclical sectors,” such as telecommunications, pharmaceuticals, and healthcare companies, that are better positioned to ride out a recession, and those are the areas he prefers for their earnings stability.

While he considers the risk of defaults in the investment-grade market to be “remote,” Narayanan expects to see a rise in downgrades in the next 12-18 months amid the likelihood of an economic slowdown.

Short-Term U.S. Treasuries: More Attractive, Less Risk

In this environment, Narayanan favors Treasuries, especially “the front end of the yield curve, five-year Treasuries and under.”

Yields on relatively risk-free short-dated U.S. Treasuries are very competitive with investment-grade bond yields. Six-month U.S. Treasuries yield more than 5.10%, and the one-year U.S. Treasury note is yielding more than 5.0%. Two-year U.S. Treasuries are yielding close to 4.9%, while the three-year is at 4.6%, and the five-year is nearly 4.3%.

“We prefer Treasuries over corporates,” says John Sheehan, a portfolio manager on the team for Osterweis Total Return OSTRX, which has $140.3 million under management. “With the risk of recession, you do need to be careful.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)