Morningstar's Take on the Third Quarter

Our analysis of the third quarter in stocks and funds.

As the third quarter of 2019 comes to a close, Morningstar's analysts have provided in-depth reviews and outlooks across equity sectors and fund categories.

Equities Stock Market Outlook: Energy Sector Again Looks Undervalued U.S. and Canadian stocks are fairly valued overall, with energy offering the most opportunity and utilities the least.

Communication Services: Sector Continues to Outperform We see little strategic reason for AT&T to combine wireless and media businesses.

Industrials: Sector Fairly Valued Overall, but Industrial Distributors Look Compelling Industrials has outperformed despite signs of an economic slowdown and fears over tariffs.

Real Estate: Strong Performance as Investors Seek Income Amid Falling Rates Opportunities in real estate live in the mall and hotel REITs.

Healthcare: Political Uncertainties Have Weighed on the Sector We see opportunities in providers, managed care, drugs, and biotech.

Technology: Sector Looks More Expensive Than at the Beginning of 2019 Opportunities now most common in software and online media.

Utilities: Surging Sector Could Keep Its Rally Going If interest rates keep heading toward zero, utilities could benefit.

Basic Materials: Amid Trade Tensions, We See Several Opportunities Agriculture, uranium, and lithium stocks look particularly appealing.

Consumer Cyclical: Regulatory and Economic Uncertainty Leads to Opportunity For patient investors, an attractive industry is travel and leisure.

Consumer Defensive: Strong Growth Leaves Few Values Shifting consumer health trends are having a big impact on the sector.

Energy: Opportunities Remain Following Saudi-Related Oil Volatility Oilfield-services stocks look particularly attractive, trading at levels we haven't seen in some time.

Financial Services: Best Values in Stocks With Elevated Near-Term Risks Investors have to be pickier with financial-services stocks this quarter.

33 Undervalued Stocks Here are our analysts' top ideas in each sector at the third quarter's end.

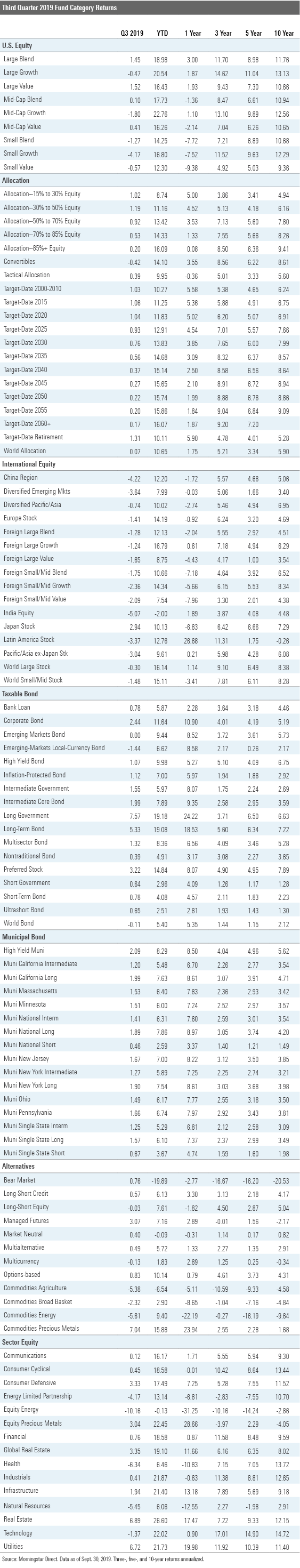

Funds Third Quarter in U.S. Stock Funds--A Mixed Bag Investors remained cautiously optimistic despite looming threats and rocky markets.

A Tepid Third Quarter for Non-U.S. Stock Funds Non-U.S. stocks lagged U.S. equities again.

Third-Quarter Performance in 3 Charts

Bonds Strong Third-Quarter Returns in Fixed-Income Market Dave Sekera explains the quarter in bonds.

Central Banks Had Strong Medicine for Sniffling Markets in the Third Quarter Economic and political uncertainty headlined the fixed-income markets.

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)