June Cements a Negative Quarter for U.S. Fund Flows

Investors fled bond funds amid market turmoil.

This article is adapted from the Morningstar Direct U.S. Asset Flows Commentary for June 2022. Download the full report here.

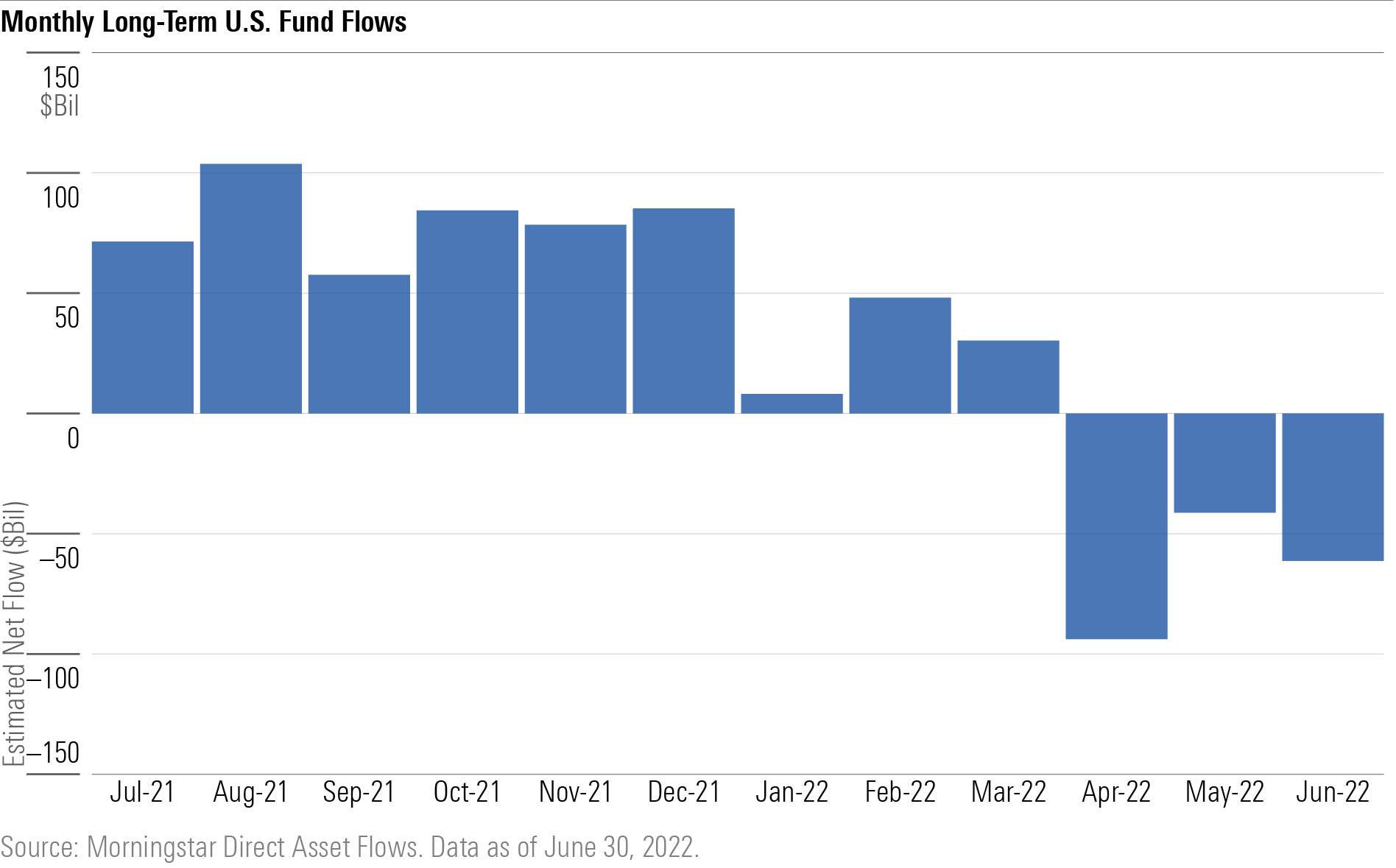

With $61 billion of outflows in June 2022, long-term U.S. mutual funds and exchange-traded funds wrapped up their first quarterly outflows since 2020. June marked the third consecutive month of overall outflows, a stretch that happened just two other times since Morningstar began tracking data in 1993, most recently in 2018′s fourth quarter.

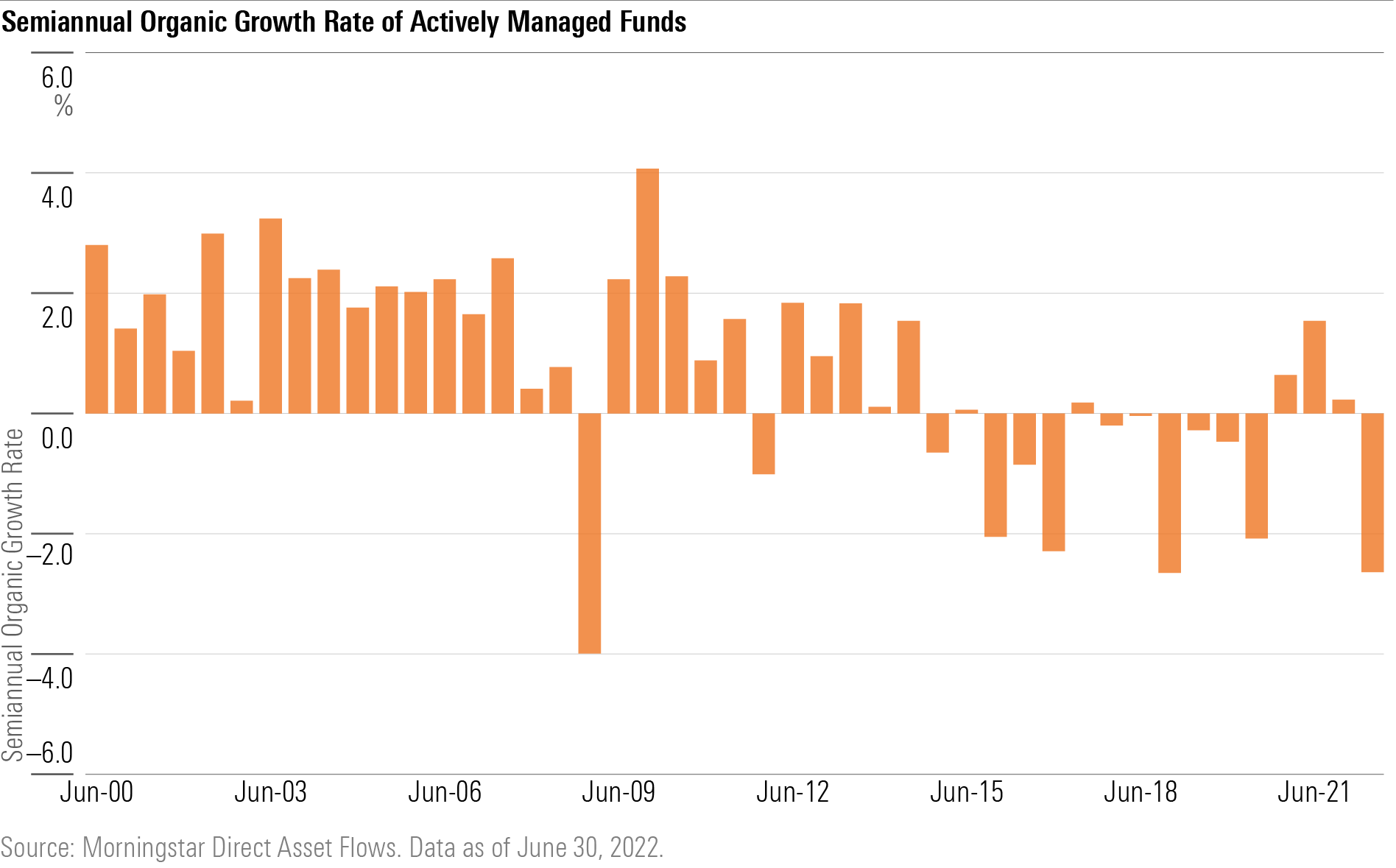

Actively Managed Funds Languish

The first half of 2022 was not kind to active managers. In fact, their negative 2.64% semiannual organic growth rate was their third worst in data beginning in 1993. Active funds shed $91 billion in June and have bled $408 billion for the year to date. A flight from fixed-income funds explains much of the weakness, as those funds skew more heavily to active managers.

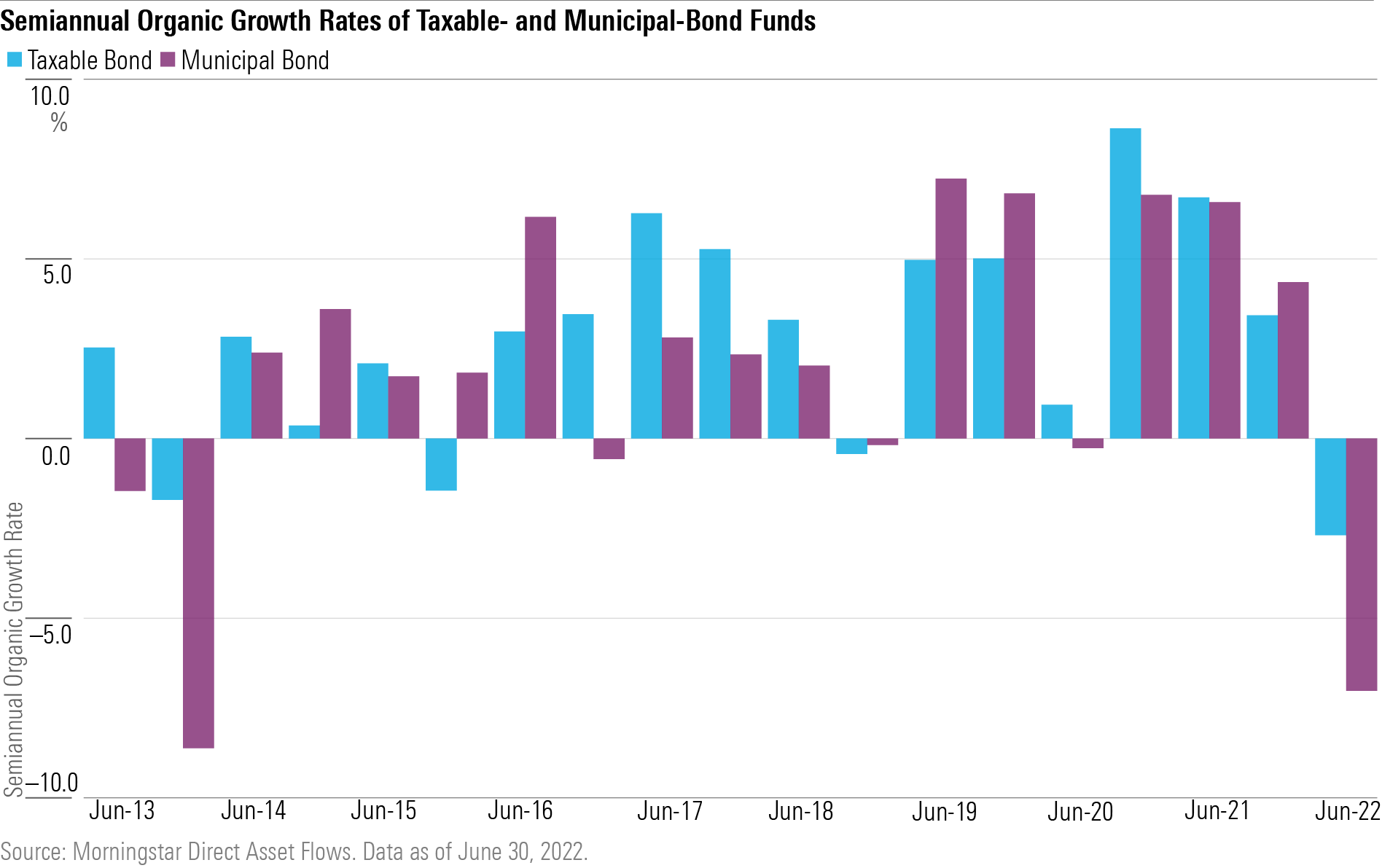

Taxable- and Municipal-Bond Funds See Historic Outflows

Dreadful bond performance sparked a widespread exit from fixed-income funds in 2022′s first half, interrupting years of steady inflows. Muni-bond funds’ negative 7.02% semiannual organic growth rate was their worst in nearly a decade, and taxable-bond funds’ negative 2.69% rate represented their steepest since 2000.

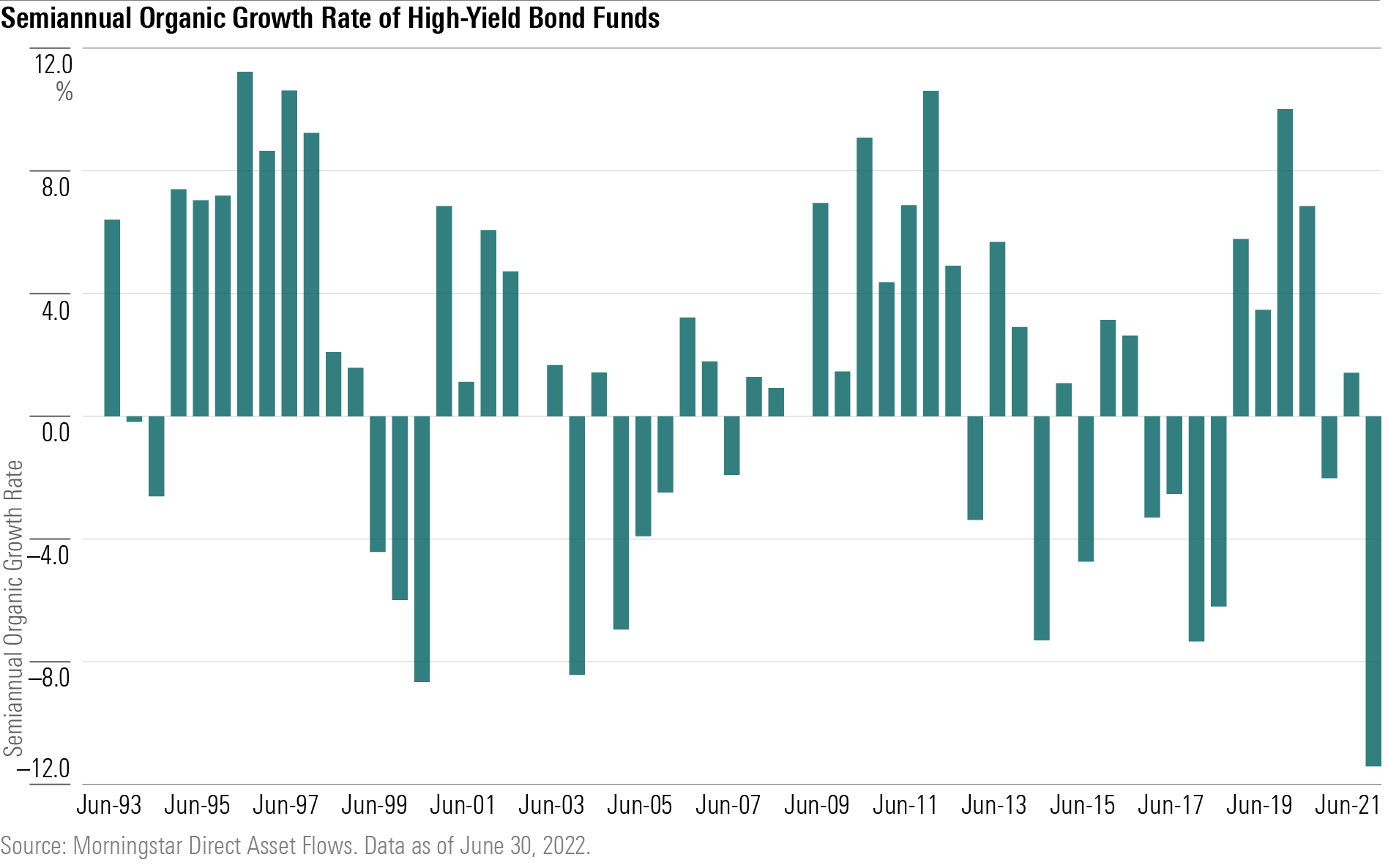

High-Yield Headlines Bond Exodus

High-yield bond funds bore the brunt of the bond-fund pain as investors dialed back credit risk. These funds bled $9.4 billion in June to seal $45.1 billion in first-half outflows—the most among all Morningstar Categories. That translated into a negative 11.4% organic growth rate, high-yield bond funds’ worst-ever semiannual clip.

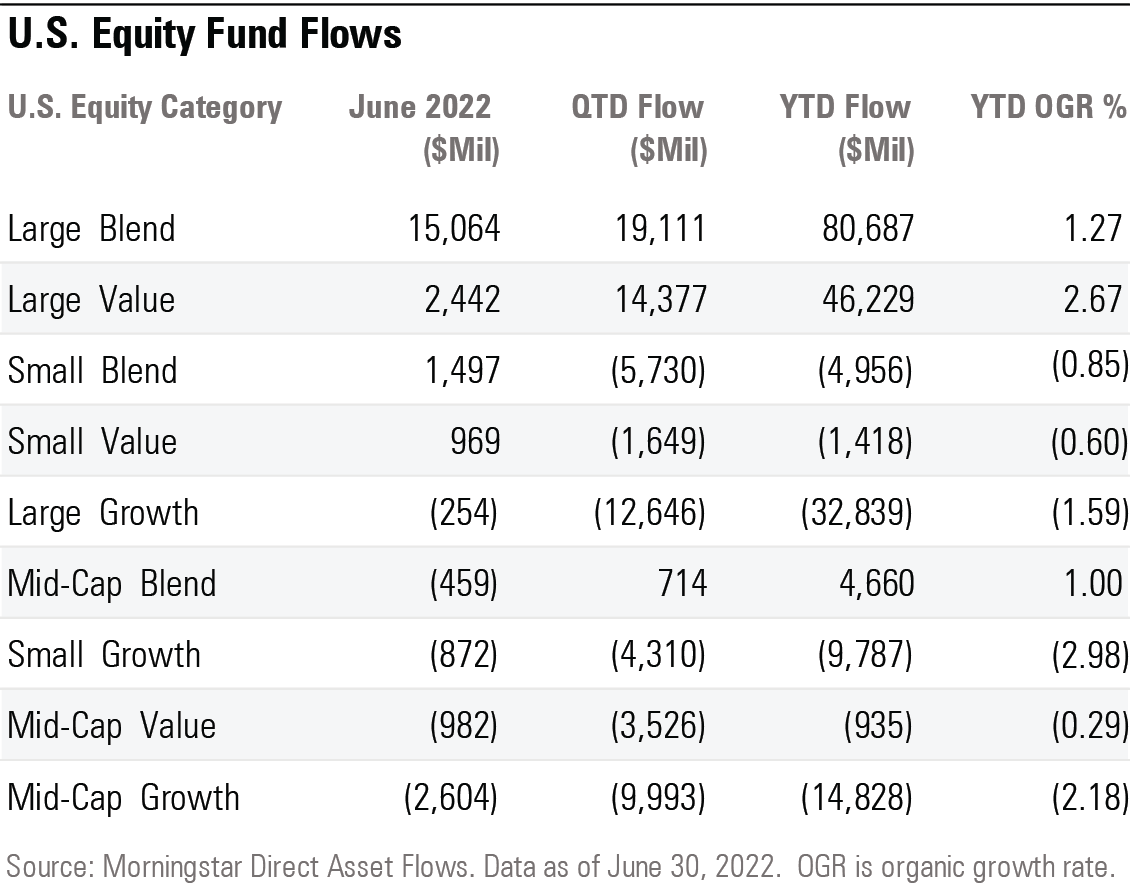

U.S. Equity Funds Stay Afloat

Despite slumping market performance, investors on balance moved into U.S. equity funds in June to the tune of $14.8 billion. The category group enjoyed inflows in four of the year’s first six months. Growth-oriented categories suffered outflows in June and struggled the most for the year to date. Large-blend and large-value funds saw much greater demand.

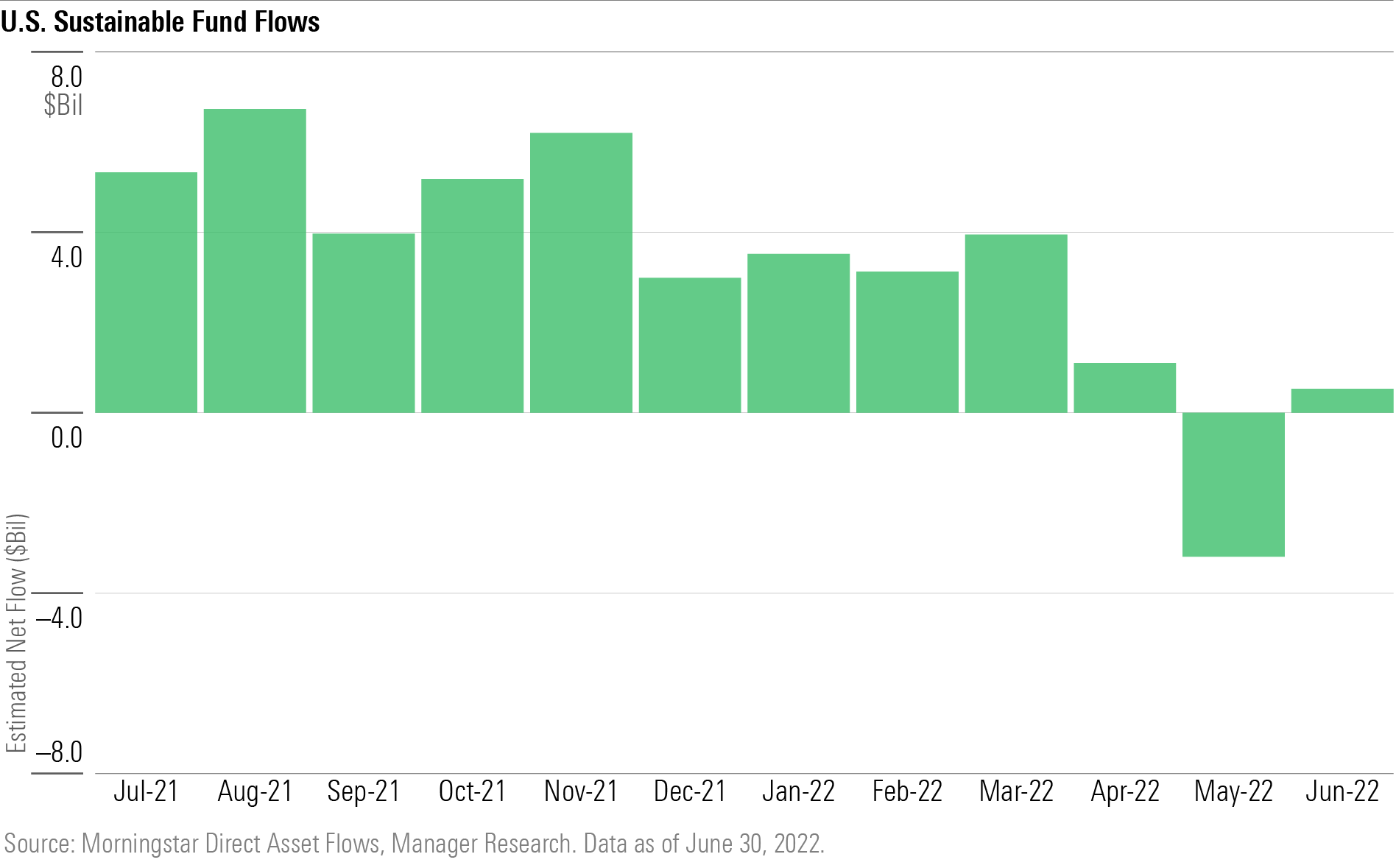

Just a Blip for Sustainable Funds?

Sustainable funds posted rare outflows in May 2022 but bounced back with a modest $528 million of inflows in June. Despite the change in sentiment, June’s flow still pales in comparison to sustainable funds’ multi-billion-dollar hauls in 2021.

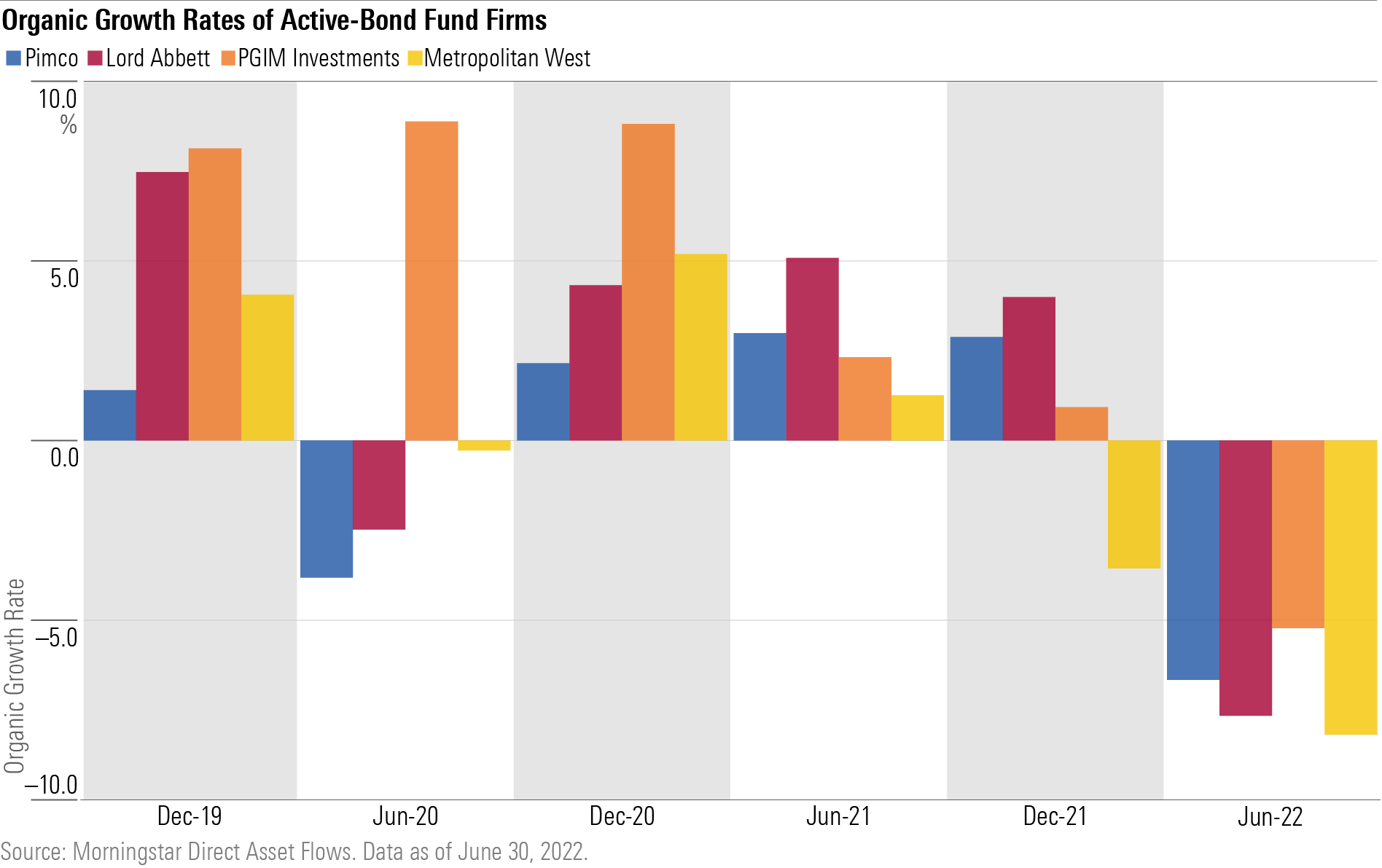

A Bad Half for Active Bond Behemoths

Investors’ diminished appetite for fixed-income and active management has caused acute pain for firms whose products combine the two. Firms like Pimco, Lord Abbett, PGIM, and Metropolitan West—each of which stashes at least three fourths of assets in active bond funds — endured their most pronounced semiannual outflows in years.

Note: The figures in this report were compiled on July 13, 2022, and reflect only the funds that had reported net assets by that date. Artisan had not reported, and Matthews had not fully reported.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/96a2625e-83c2-4fdb-9fd7-0efcd07c88bb.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)