Is Lululemon Stock a Buy, Sell, or Fairly Valued After Earnings?

With stellar Q1 earnings and solid sales growth, here’s what we think of Lululemon’s stock.

Lululemon Athletica LULU released its first-quarter earnings report on June 1, 2023. Here’s Morningstar’s take on what to think of Lululemon’s earnings and stock.

Lululemon Stock at A Glance

- Fair Value Estimate: $259

- Morningstar Rating: 2 stars

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Narrow

What We Thought of Lululemon Q1 Earnings

Lululemon posted typically stellar results in its first quarter, as 24% sales growth soared past our 19% estimate. Unlike many other apparel retailers and manufacturers, it did not report any concerns about slowing consumer spending. Lululemon’s sales growth, margins, and earnings per share were above our estimates as well, and the company issued a generally positive outlook. This is not unusual for Lululemon, which has consistently beaten expectations over the past five years.

Lululemon’s first-quarter sales outperformance was mainly due to its store operations (comparable sales were up 13%). The company received a boost from the end of coronavirus restrictions in China (12% of the quarter’s sales), where its sales rose 79%. Lululemon has added about 30 stores in China over the past year, bringing its total to about 120 in the country, and we forecast it can reach 400 stores within 10 years. However, there is a risk to this, given the company’s limited history in the region and rising competition. Lululemon has targeted a fourfold increase in international sales between 2021 and 2026, but we model such sales to roughly triple.

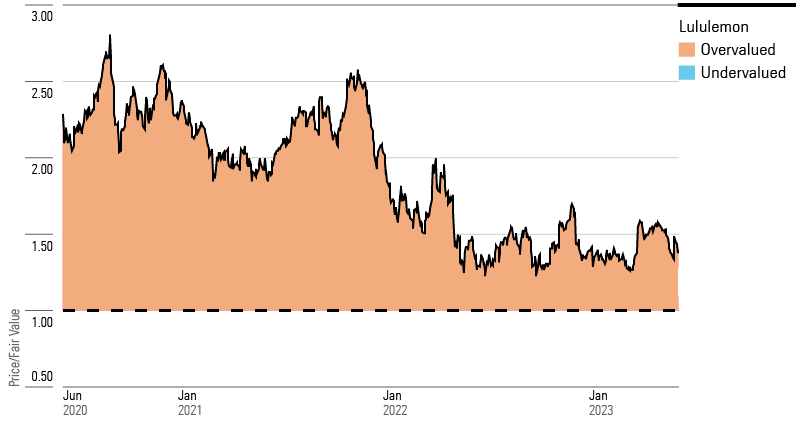

The earnings report was strong. Our view that Lululemon’s stock is overvalued is based on its current valuation (a price/earnings ratio of about 30) and concerns about the competitiveness of the industry. Lululemon’s success has attracted many competitors, many of which are selling similar products.

Lululemon Stock Price

Fair Value Estimate for Lululemon Stock

We are raising our fair value estimate on Lululemon to $259 per share from $247 per share. In the first quarter, the firm recorded 24% sales growth (above our 19% forecast) and a 20.1% operating margin (140 basis points above our estimate). In the long run, we believe Lululemon’s sales growth rates will decline to the high single digits as the recent surge in demand moderates and competition takes a toll.

Boosted by the pandemic, Lululemon’s e-commerce grew to 46% of 2022 sales from just 8% of sales in 2010. We forecast its e-commerce revenue will rise to nearly $14.0 billion in 2032 from $3.7 billion in 2022—a compound average annual growth rate of about 9%. Overall we forecast compound average revenue growth of 11% over the next decade as sales rise to $23.0 billion in 2032 from $8.1 billion in 2022.

We believe Lululemon can increase its gross margins on premium pricing and lower costs. The company has made improvements to its supply chain, and we think it can achieve cost efficiencies as its men’s and international businesses expand. We forecast its gross margins will stabilize at 58% in the long run. We also forecast Lululemon’s average annual operating margins over the next 10 years will rise to 25% from 22% (on an adjusted basis) in both 2021 and 2022.

Read more about Lululemon’s fair value estimate.

Lululemon Price/Fair Value Ratios

Economic Moat Rating

We assign a narrow moat rating to Lululemon based on its intangible brand asset. The company holds a market-leading position in yoga and workout clothing for women in the United States and Canada. It is often credited as the originator of the athleisure apparel trend. Despite significant competition, Lululemon has experienced double-digit sales growth every year since 2003. Its revenue increased an astounding 20,000% over the past 18 years (to $8.1 billion in 2022 from $41 million in 2004).

We think Lululemon’s significant control over its sales process provides an advantage. Unlike many competitors, the company does not have a significant wholesale business. Indeed, its “other” category (which includes wholesale sales, outlets, and its connected fitness offerings) generates less than 10% of its revenue. Lululemon mainly sells its product through company-owned, full-price physical stores (45% of 2022 revenue) and e-commerce (46% of 2022 revenue). This model allows for control over pricing, discounting, expenses, product assortment, and marketing. Competitors who sell through partners lack this level of control and must share margins with retailers. Moreover, competing brands may lose their integrity if their product is discounted or sold through unpopular retailers. We believe Lululemon’s model helps preserve its status as a premium brand and supports our view that it has a narrow moat.

Lululemon achieves market-leading prices in its key categories. Its women’s leggings typically retail for between $89 and $128. Premium yoga clothing competitor Athleta, owned by no-moat Gap GPS, sells similar leggings for about 20% less. On its website, Lululemon lists leggings that cost as much as $168 (as of June 2023). Most competitors do not list any leggings at such a high price.

We do not believe Lululemon has any moat sources besides its intangible brand asset. The company lacks efficient scale or cost advantage, as its production and distribution systems are like those of most apparel companies. Lululemon does not own any production facilities; rather, its products are sourced from about 45 manufacturers and 60 fabric suppliers, nearly all of which are in Asia and also supply competitors. Furthermore, there are no switching costs or network effects in play.

Read more about Lululemon’s moat rating.

Risk and Uncertainty

We assign Lululemon a High Uncertainty Rating. Like many others, the firm has faced supply issues and elevated inventories in recent quarters. It also faces the risk of reduced consumer spending on apparel owing to widespread inflation. However, we think the effects on its long-term business will be limited.

Women’s bottoms are the highest sales and profit products for Lululemon and attract most of its new customers. The firm achieves premium pricing on women’s leggings, with many styles priced above $100 per unit. Thus, Lululemon is dependent on the continuation of the athleisure trend it helped create. While we believe athleisure is not a fad, fashion trends can change quickly. Also, many firms, from multinationals to tiny startups, sell low-priced leggings.

We expect Lululemon will generate significant growth in territories where it has limited history and brand recognition, such as China and Europe. In 2022, Lululemon generated just 16% of its sales outside of North America.

We do not believe Lululemon has any material environmental, social, or governance risks. However, like its peers, it is subject to controversies related to the treatment of workers in the international clothing supply chain.

Read more about Lululemon’s risk and uncertainty.

LULU Stock Bulls Say

- Lululemon’s online sales increased to $3.7 billion in 2022 from less than $100 million in 2010. We believe its e-commerce operating margins can hold around 42% to 43%—about 17% better than its store margins.

- Lululemon has a big opportunity in greater China, which currently accounts for just over 10% of its total sales. China is already the second-largest sportswear market in the world.

- Lululemon is often credited with the development of athleisure, which we believe is a major change in how people dress and has an increasingly broad appeal.

LULU Stock Bears Say

- Leggings—Lululemon’s primary category—are now offered by everyone from low-priced fast fashion to luxury apparel brands. The competition in this lucrative category is unrelenting.

- As Lululemon expands beyond yoga into categories like running and training and offers footwear, it competes directly with established athletic apparel firms like Nike NKE.

- The only acquisition in Lululemon’s history, Mirror, largely failed as a stand-alone product. Lululemon is now trying to make it part of a connected fitness strategy, but this plan is unproven.

This article was compiled by Muskaan Hemrajani.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-06-2024/t_bd32499d257a40fe9a757102874ba6c4_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35cad34a-5a55-4541-88e4-5464951e9ae1.jpg)