Ignore Weak Jobs Headline--It's a Solid Report

Here's 5 charts on the November employment report.

The U.S. economy added far fewer jobs in November than forecasters had expected, but it’s likely just a blip given strength elsewhere the monthly report and the volatility seen in the labor market throughout 2021.

For investors, this means that while the labor market still has not fully recovered from the pandemic recession, the outlook for continued economic growth remains intact.

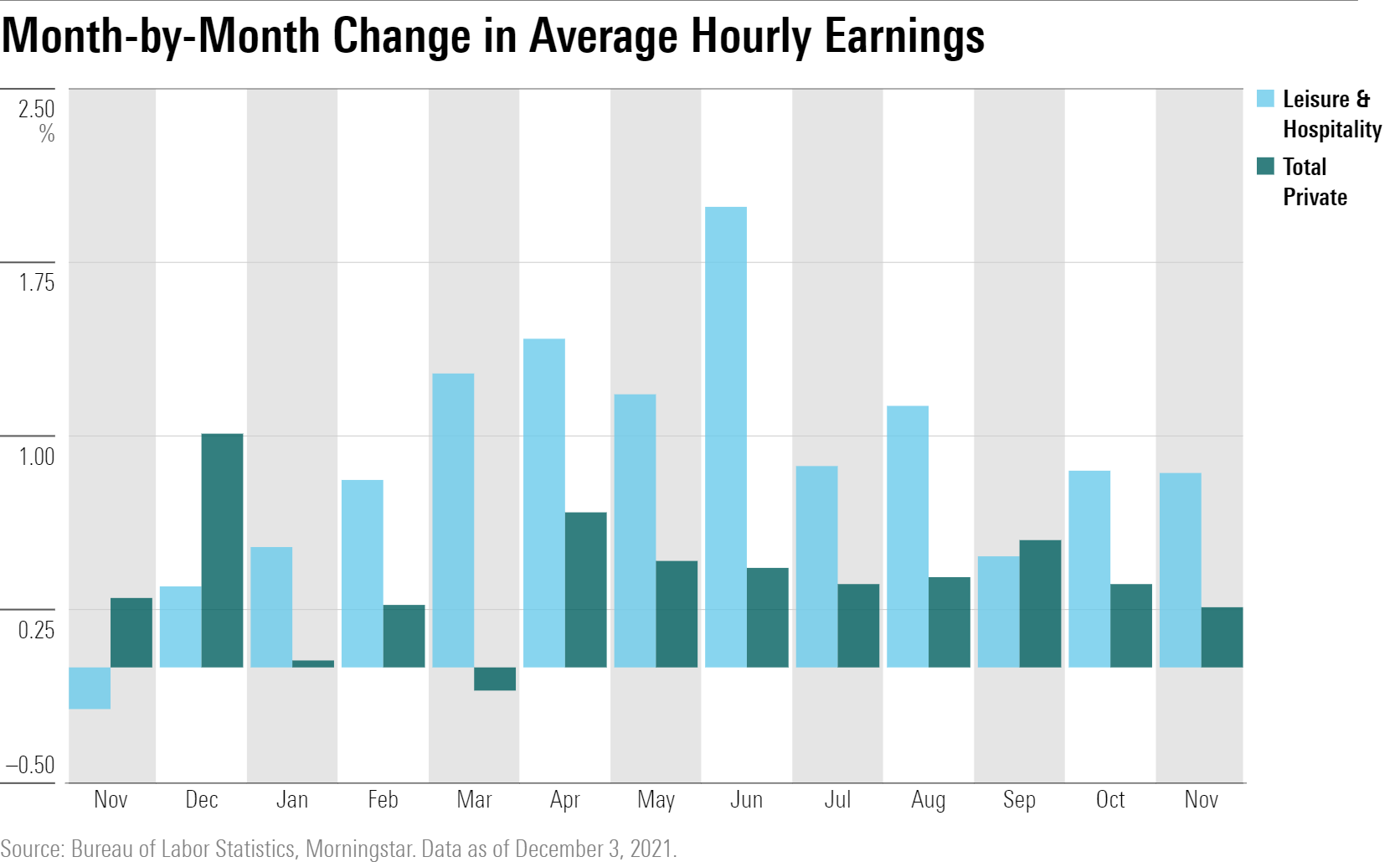

At the same time, wage increases--a metric under the spotlight amid worries about inflation--showed a more-muted increase than has been the case for much of this year.

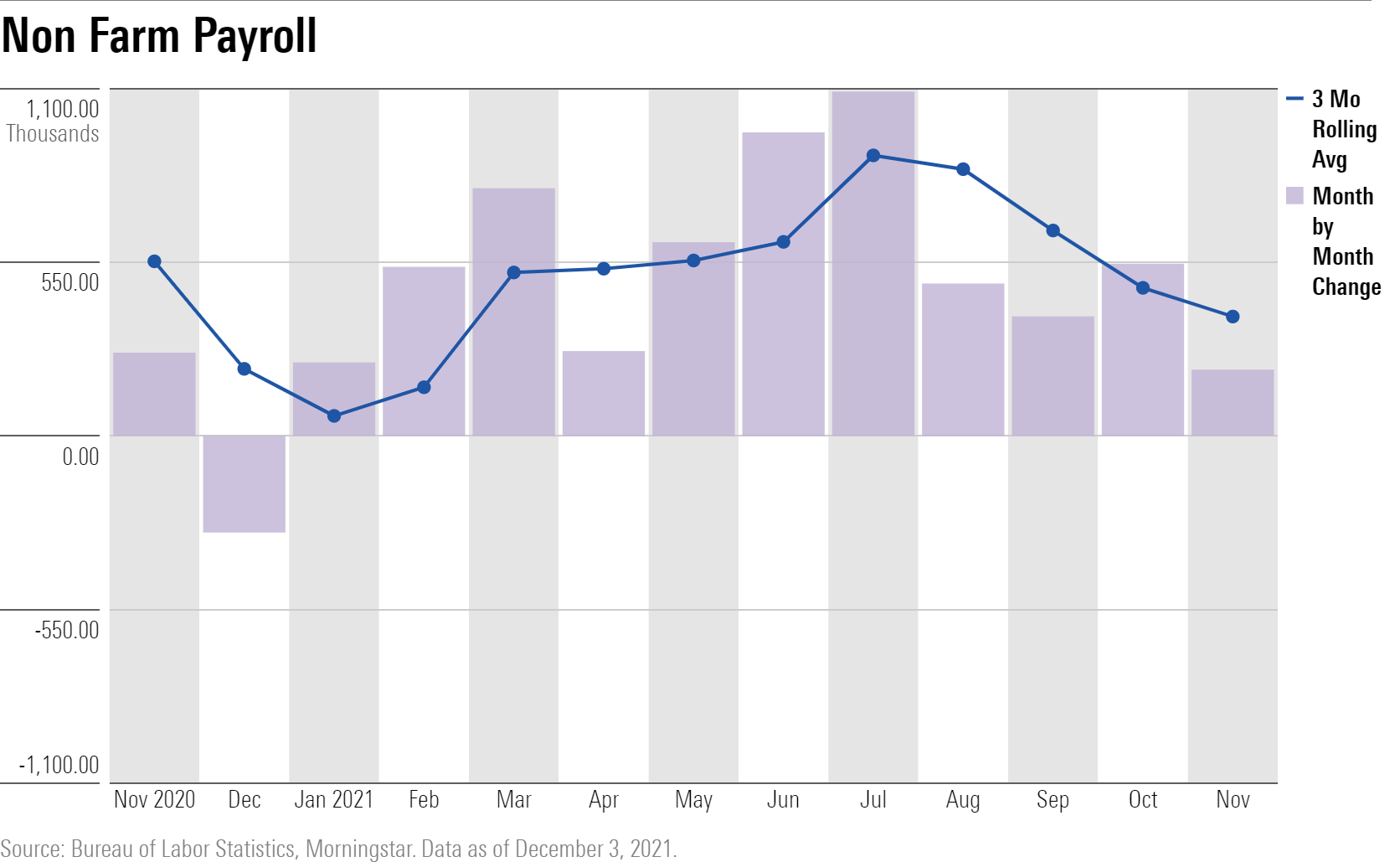

The Labor Department reported Friday that 210,000 net new jobs were created last month and the unemployment rate fell by 0.4 percentage point to 4.2%. That gain of 210,000 nonfarm private jobs was the smallest gain of the year and down from 546,000 in October.

“We shouldn't overreact to one bad month for nonfarm payrolls, especially in light of the volatility in the series and the large revisions we've seen so far in 2021,” says Preston Caldwell, Morningstar’s chief economist. While overall economic growth slowed in the third quarter, Morningstar expects a strong economic recovery to continue mostly by further recovery in the labor market.

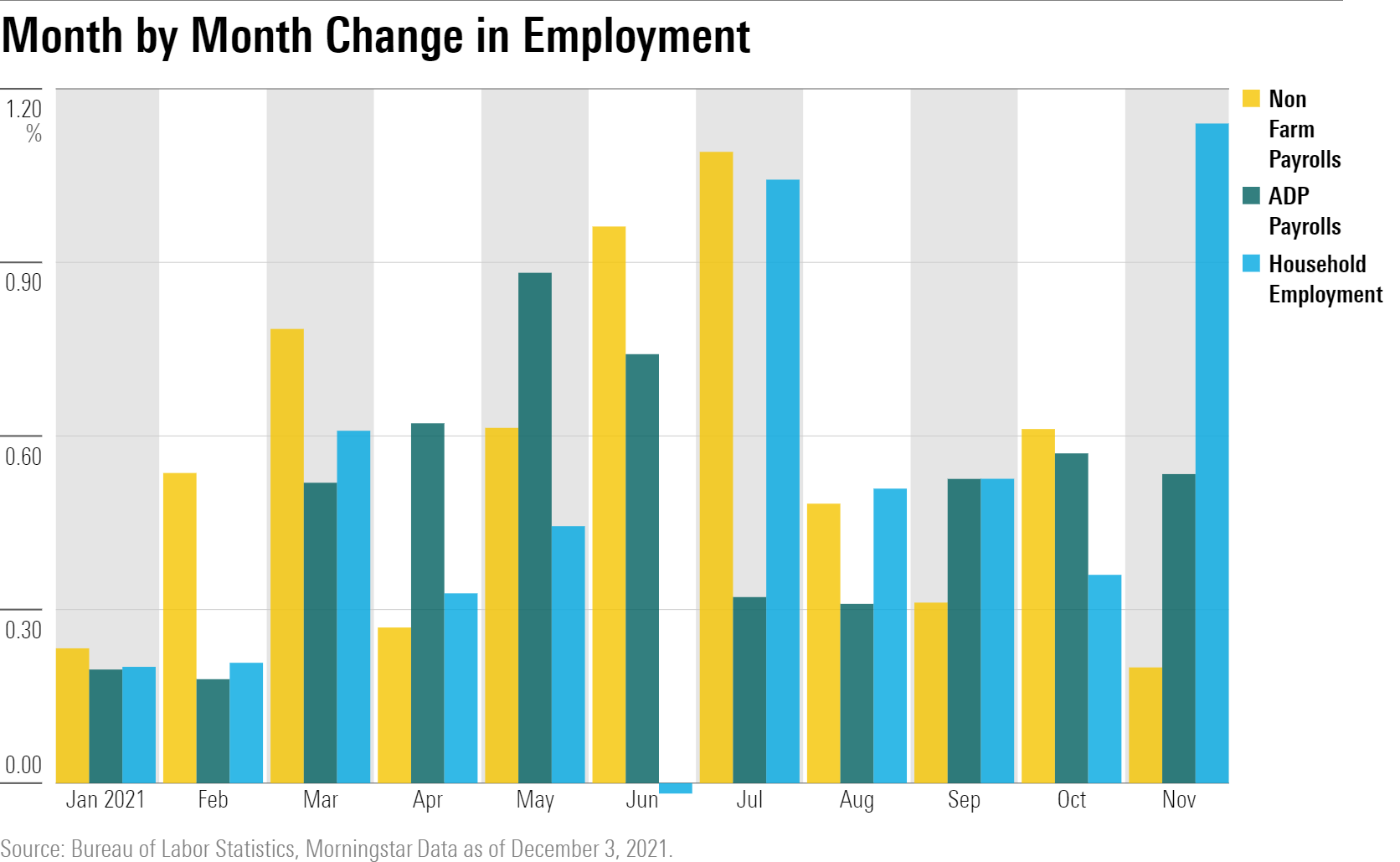

Caldwell notes that other aspects of the jobs report point to November being a much stronger month for job gains. “The ADP payrolls estimate was up 0.5 million and household employment was up by 1.1 million. Therefore, we think it's likely that November's poor showing on nonfarm payrolls will either be revised upward or will be a temporary bump in the road.” Along with the new November data, the Labor Department revised upward its readings for job growth in both September and October.

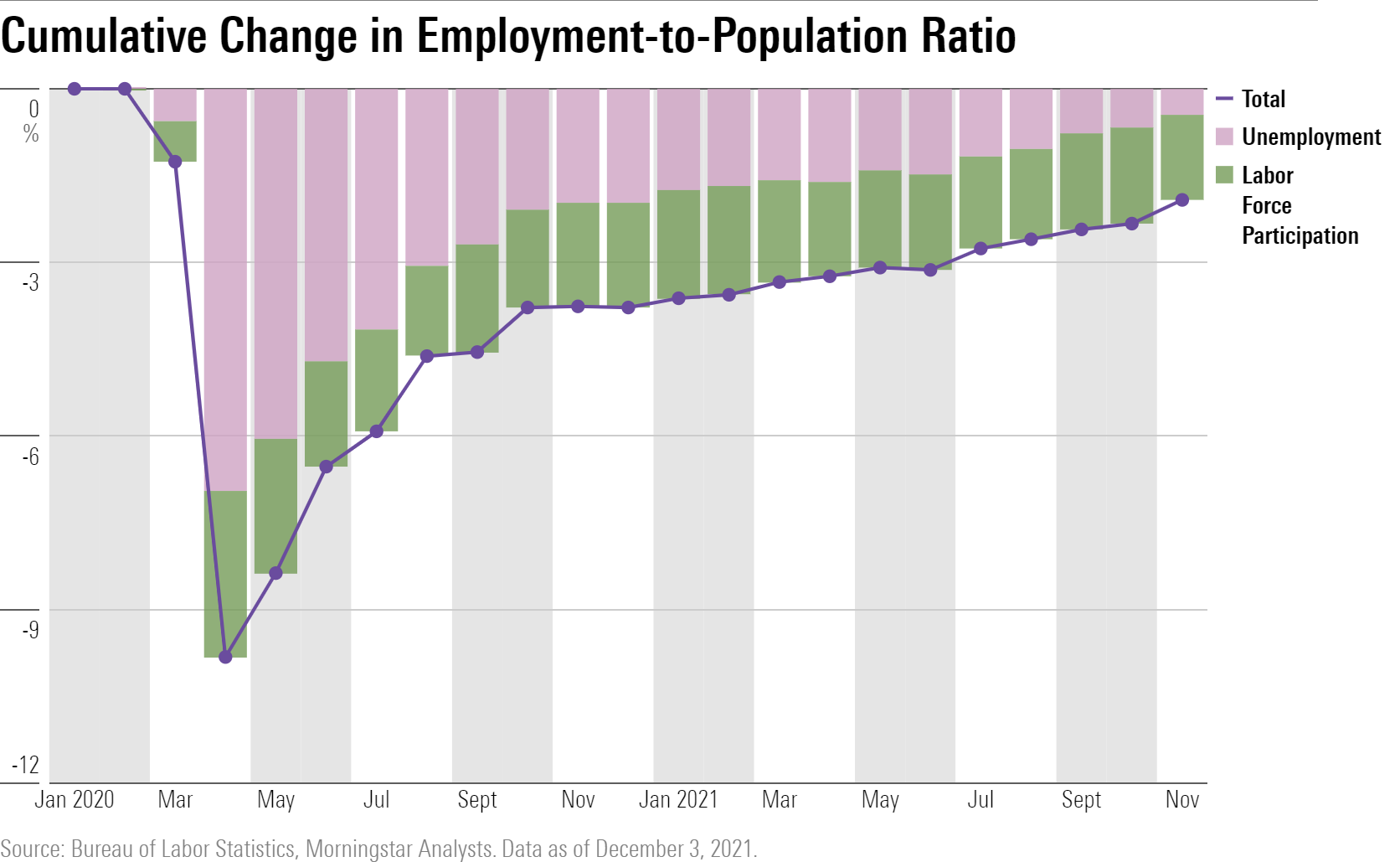

Caldwell notes that large gain in household employment helped lift the adult employment-to-population ratio to 59.2% and is a sign of continued recovery from the pandemic. “This was driven partly by a 0.6 million increase in labor force participation in November--very encouraging given that participation gains had been muted in prior months,” he says.

The rising labor participation rate--a statistic that reflects the number of people actively working or looking for jobs--could act as a relief valve for building inflation pressures. As more people enter the job market, the upward pressure on wages could cool down.

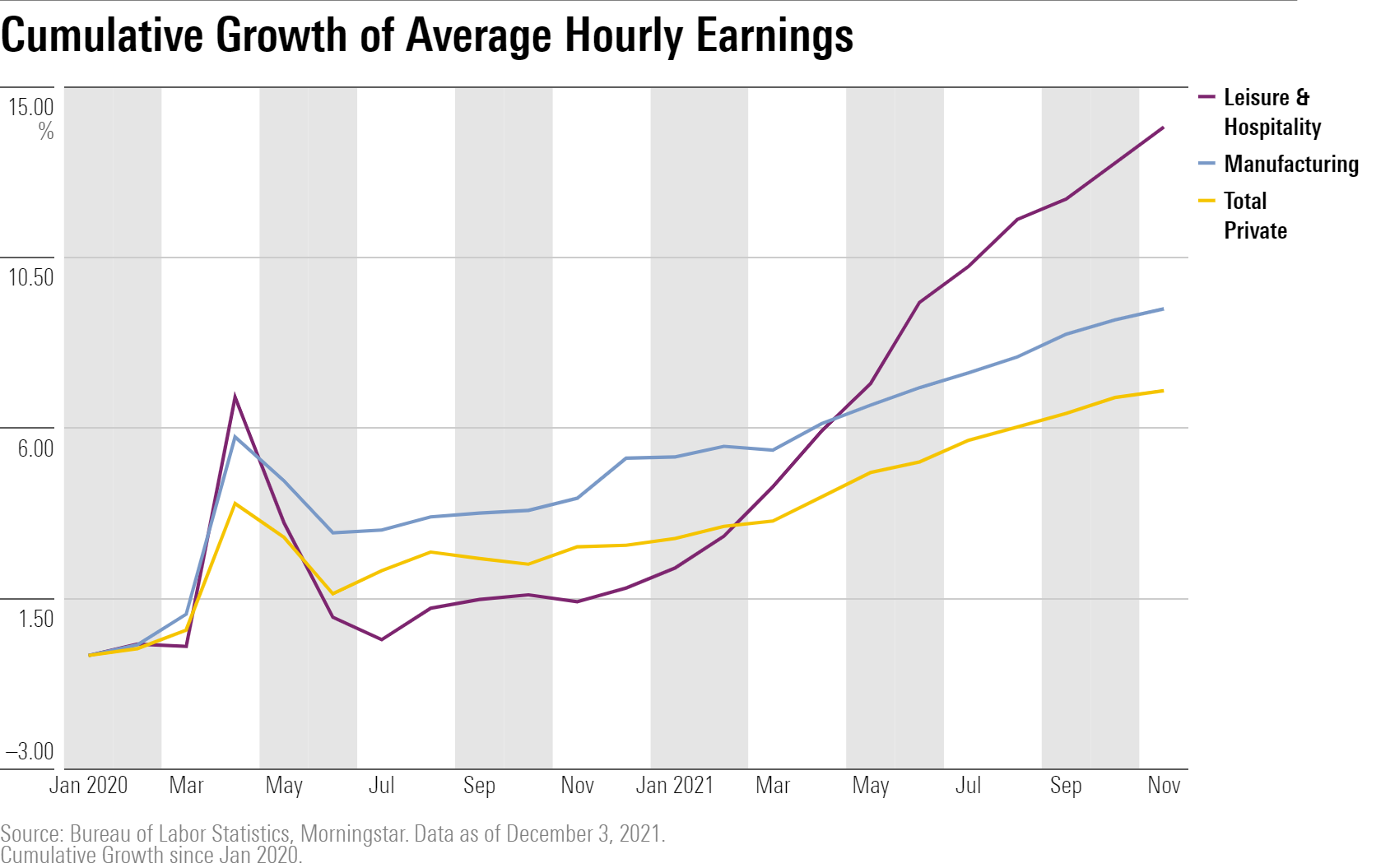

There was some evidence of a cooling trend for wages in November. Last month, average hourly wages rose 0.3%, down from a 0.4% increase in October and 0.5% in September.

Since the start of the pandemic, however, wages have steadily increased overall, led by outsize earnings growth in hospitality as well as manufacturing, areas where job shortages have led to employers having to lift pay to attract new employees.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)