Economic Outlook: Labor Market to Drive GDP Growth

We look at near-term headwinds, including Ukraine, to understand the U.S. economy's trajectory.

While U.S. economic growth will continue its post-pandemic recovery through the rest of this year even as interest rates increase, Russia’s war with Ukraine is a risk going forward and may fuel a further rise in inflation.

U.S. economic growth accelerated in the fourth quarter due in part to rising inventory levels in the latest sign that problems in the global supply chain are continuing to be resolved. The economy expanded at a 6.9% annualized rate for the three-month period ending in December. That expansion is expected to continue as the post-pandemic economic recovery speeds ahead, with consumer behavior returning to normal levels this year.

What effect Russia’s war on Ukraine will have depends on how the U.S. and its allies respond. Of all the plausible scenarios the one with the largest possible impact is a curtailment of Russian oil and gas exports. We think the risk of a major disruption is low since energy importing countries would face a harsh domestic political backlash from higher prices.

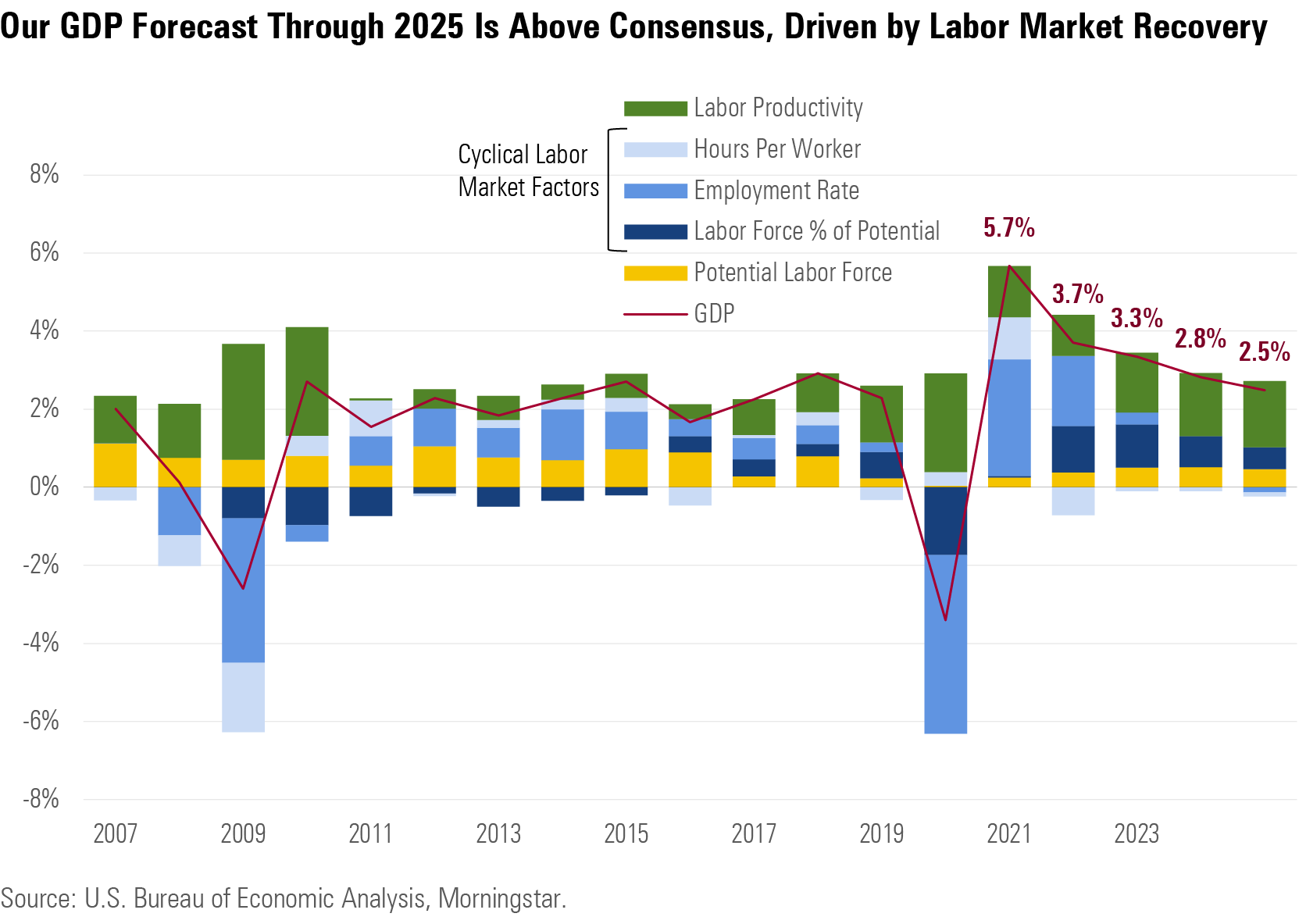

Our GDP Forecast is Above Consensus

Compared with our last forecast, we've slightly lowered our GDP forecast over the next few years by about a combined 0.5% through 2025. This is owing to slightly more conservative expectations surrounding expansion in the labor force over the next several years. This discounts an increased likelihood that near-term signs of labor market tightness (including fast wage growth) are indicative of longer-term constraints.

However, we think the near-term signs are mostly misleading, and that there's room for much more labor market expansion compared with current levels, mainly driven by the participation rate. We expect labor force participation (demographically adjusted) to surpass pre-pandemic levels. Because of this, we remain above consensus on real GDP growth through 2025, expecting about 2% more cumulative growth than consensus.

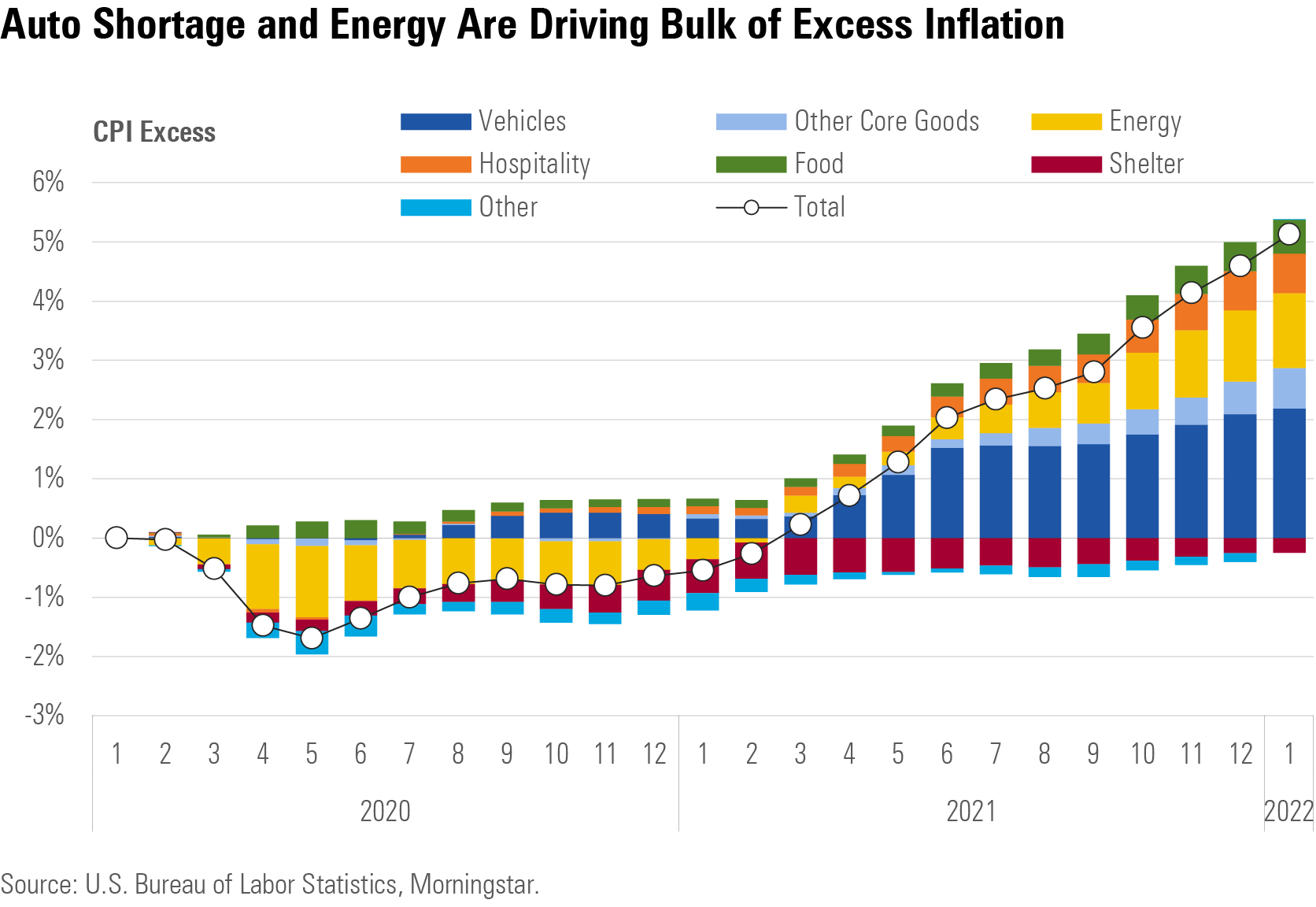

Temporary Factors Drive Inflation

We've hiked our inflation forecast for 2022 again (by 0.4%) due to higher near-term energy prices, which have been driven up by Russia's invasion of Ukraine, though we've reduced our later forecasts by an essentially offsetting amount. We continue to think that temporary factors, which will reverse in coming years, are the main drivers of inflation. Most of the excess inflation since the start of the pandemic is attributable to autos and energy, where we can identify short-term supply constraints that should be resolved eventually. Our inflation forecasts are about 0.4% annually below the bond market over the next five years.

Rate Hikes Won’t Stop the Economic Recovery

Financial markets are pricing in seven hikes in the federal-funds rate by the end of 2022 (or 1.75% cumulatively). The impact of this should begin filtering into the real economy shortly, given that bond yields that drive household and business borrowing rates are incorporating the hikes.

We think the sensitivity of GDP to rate hikes in the next one to two years is likely to be smaller than usual. The most important way that monetary policy affects the economy is via housing demand, but the pace of homebuilding is currently constrained by supply, not demand.

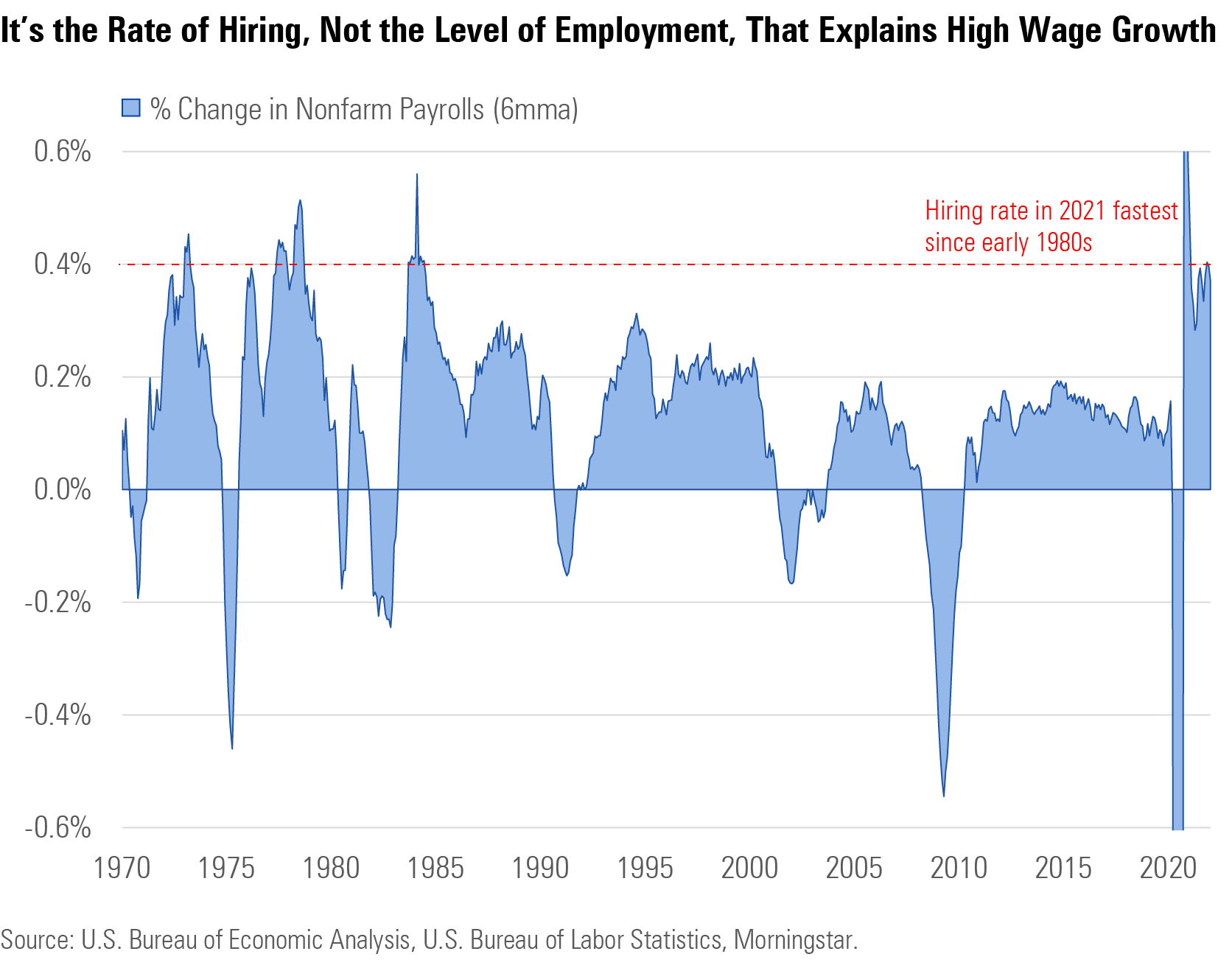

The “Great Resignation” Isn’t the Best Characterization of the Labor Market

Labor markets are continuing to show signs of strong tightness, with high wage growth starting to broaden out into more industries. However, we think this mainly reflects the rate of change in employment (the fast pace of hiring), rather than signaling that the level of employment is getting too high. This means that wage growth should moderate through the end of 2022 as the pace of hiring slackens.

Despite widespread media attention, the term "Great Resignation'' is a complete misnomer—the more accurate characterization is the "Great Reshuffling.’’ Workers aren't leaving the labor market in droves; instead, they're trading up for better jobs. This process is adding to the logjam of labor markets currently, but it could ultimately help boost productivity growth by moving workers into higher-quality jobs.

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)