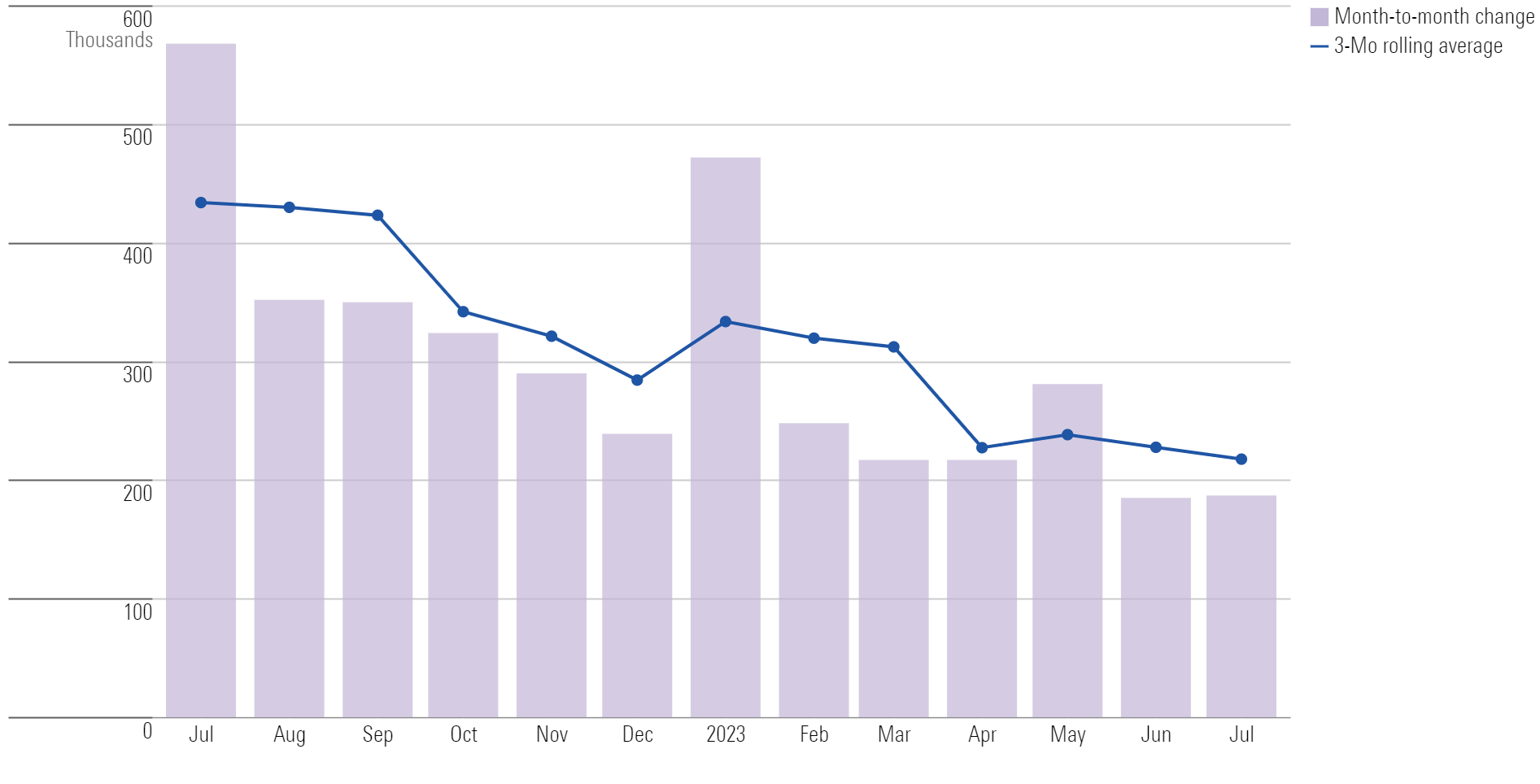

August Jobs Report Forecasts Predict Strong but Cooling Growth

Moderating hiring gains should allow the Fed to keep rates steady in September.

Forecasts call for the August jobs report to show another month of strong hiring, though at a slower pace than what’s been seen over the past few months. That would be a positive sign for the economy and the Federal Reserve, which will be closely watching labor data as it attempts to bring down inflation without damaging a jobs market that’s still in danger of overheating.

For the month of August, nonfarm payroll employment is expected to rise by 170,000, according to FactSet’s consensus estimate. That’s slightly below the 187,000 jobs added in July and the 185,000 in June.

A headline increase in nonfarm payroll employment in the 150,000-200,000 range would be a “great number for the economy” according to Eric Merlis, managing director and co-head of global markets at Citizens Bank. He says it “[would indicate] the economy generally is growing,” but not at a pace that’s too far above the trend. That suggests the Fed could keep interest rates steady in September, rather than hike them again.

Amid the threat of a recession, “a robust labor market is preventing any more rapid slowdown in economic activity and consumer spending,” says Gregory Daco, chief economist at EY. Merlis adds that numbers in that range also tend to be associated with healthy salary inflation readings.

With More Rate Hikes On the Table, All Eyes On Jobs Numbers

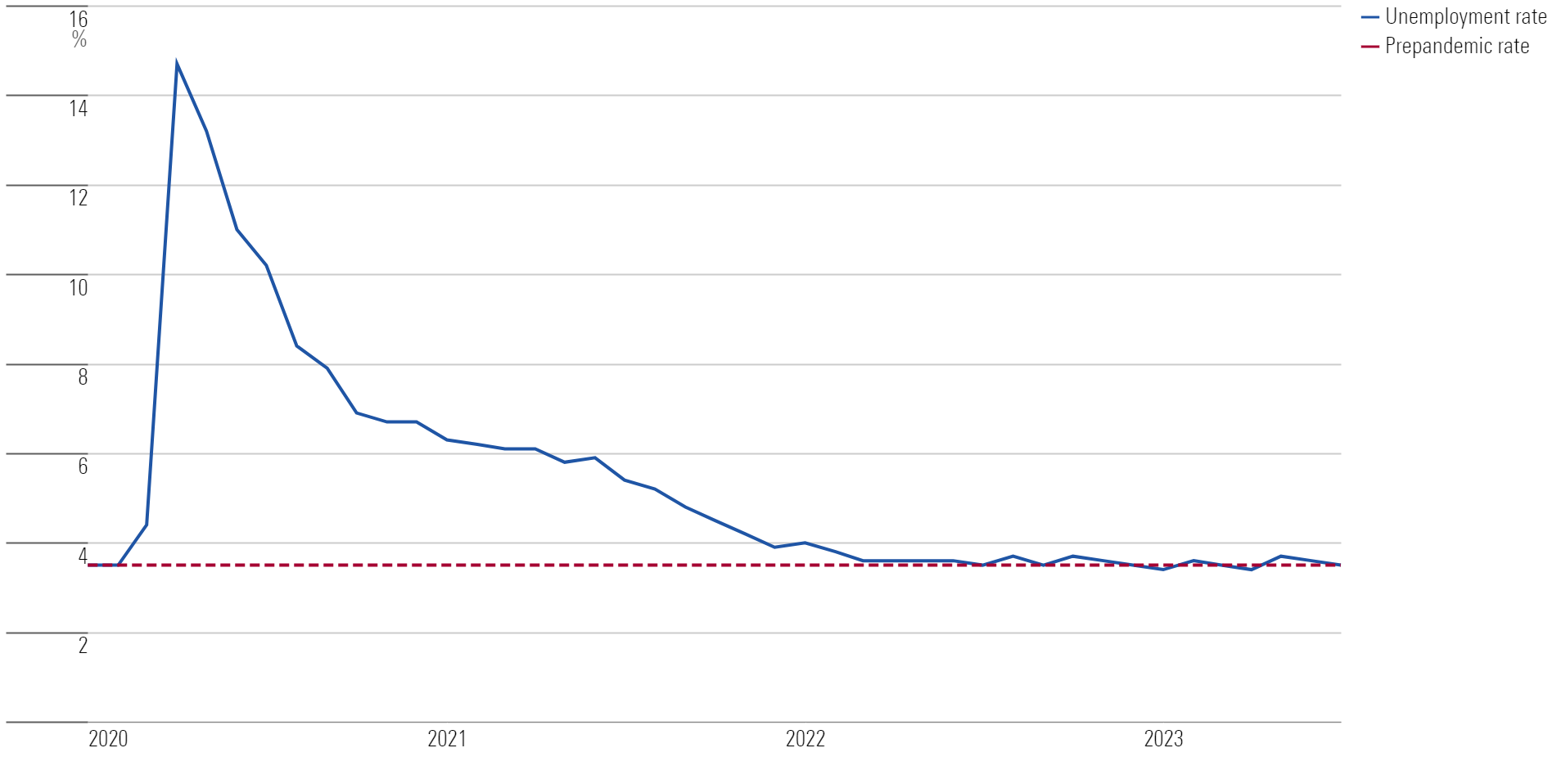

In a closely watched speech last week at the economic policy symposium in Jackson Hole, Fed chair Jerome Powell emphasized that while the labor market is showing signs of rebalancing to more sustainable levels, the process “remains incomplete.” He reiterated that if signs show that tightness in the labor is no longer easing, additional interest-rate hikes may be necessary.

Of course, it’s worth remembering that the Fed isn’t focused on the headline jobs figure alone. “[The Fed] will be looking at the broad signs of rebalancing in the labor market,” says Daco. Such indicators include payroll growth, labor force participation, and hours worked. He says that one “telltale sign” the labor market is loosening would be wage growth rising too high and too quickly.

Monthly Payroll Change

August Jobs Report Consensus Estimates

- Nonfarm payroll employment to rise 170,000 versus the 187,000 increase in July.

- Unemployment rate to remain steady at 3.5%.

- Hourly earnings to rise 0.3%—a modest slowdown from 0.4% in July.

In August, Daco expects to see positive momentum in hiring in the construction sector, which would likely offset some weakness in the manufacturing sector. A meaningful drop in construction jobs would be cause for concern, Merlis adds, because it would signal that investment in the goods sector is starting to decline, which is an indicator of a recession.

Daco also anticipates a softening in the positive momentum for the leisure and accommodations sectors. He notes that there could be some abnormalities in the data as a result of the ongoing writer and actor strikes in the entertainment industry, but he doesn’t expect them to significantly alter the character of the report.

The recent bankruptcy of trucking company Yellow could also drag employment numbers lower, according to Merlis.

Unemployment Rate

Employers Eager to Retain Workers

While an hourly earnings increase of 0.3% in August would still point to ongoing inflationary pressures, Daco says he expects that number to moderate in the coming months. “We’re in this unique environment where employers value their talent,” he says. “They’re a little bit more reticent to let go their talent because they’ve struggled so hard to acquire it and train it and maintain it.”

In other words, firms might be more likely to pump the brakes on salary increases rather than eliminate jobs to save money over the next few months. Merlis agrees: “Companies are really going to think twice about laying off quality employees.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)