This article was originally published on northerntrust.com by Carl Tannenbaum.

I am dating myself by sharing with you that my first mortgage carried an interest rate of 12%. Our hands were shaking when we signed the loan documents; my wife and I both hated being in debt, and the monthly payments were not going to be easy to keep up with. Anxiety was high; fortunately, falling interest rates eventually allowed us to refinance our loan and keep our budget in balance.

Today, many homeowners around the world are enduring high anxiety. Interest rates are going up, making home loan payments harder to handle. The impact that this could have on consumers and the real estate sector could be enough to get central banks to slow down or stop their tightening campaigns.

Home ownership is both a symbol of and a contributor to economic success. Families who reach that stage have worked hard, and take pride in having a place of their own. And as any homeowner knows, furnishing, maintaining and occasionally remodeling a home is a major element of consumer spending. High levels of home ownership are also associated with a range of positive social outcomes.

Houses are expensive, though, meaning that most purchasers have to borrow a substantial fraction of the purchase price. The lower the interest rate, the easier it is for a borrower to handle the payments. Prior to this year, a long interval of very low interest rates had spurred demand for houses, generating outsized increases in their values.

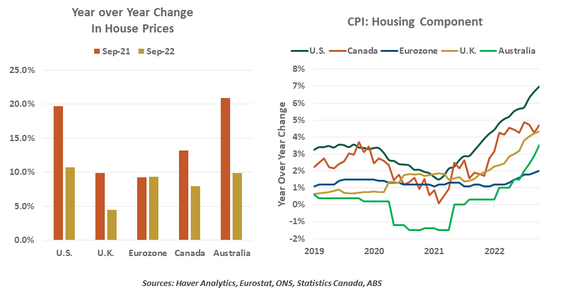

The cost of shelter is a substantial portion of consumer price indexes around the world. Calculations of this component vary from place to place, but all are keyed off rents, mortgage payments, or some combination of the two. Rising house prices lift both of these elements, and have therefore become one of the largest contributors to recent inflation.

Interest rates have risen steadily since the spring. This has had a dramatic impact on the affordability of housing, taking scores of prospective buyers out of the market. The slump in demand has initiated retreats in house prices, which will eventually take the edge off of inflation.

But the residential real estate sector is now struggling with a paucity of demand, which is depressing new construction. It is fair to say that the housing industry is in recession in most major markets, and may remain there for some time. Further, rising interest rates are taking a toll on household finances around the world. The magnitude of this impairment depends critically on where one lives.

Mortgages outside of the U.S. reset often, and payments are set to rise dramatically.

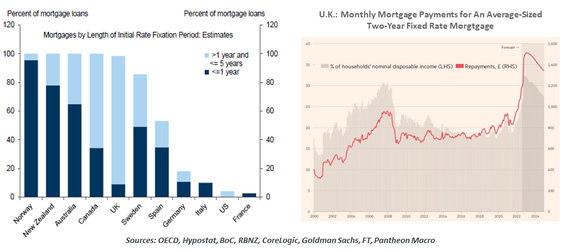

Mortgage markets vary importantly across nations. The United States is the only country in the world with 30-year, fixed rate home loans that can be refinanced without penalty. This design dates back to the Great Depression; federal authorities, looking to rejuvenate the real estate industry, promoted this long-term form of financing as a way of spreading out monthly payments and insulating borrowers against interest rate risk.

To assist further, the first U.S. mortgage agency was founded in the 1930s to facilitate flows of credit to the housing sector. The securitization of mortgages in recent decades has brought investor capital into the housing market, something seen much less frequently outside of America.

Pandemic-era monetary policy allowed many American homeowners the opportunity to fix their loan rates at low levels for long periods. For many, then, rising interest rates have made little difference in their monthly loan payments.

In other countries, however, home mortgage rates typically float or reset at fairly regular intervals. The recent escalation in interest rates will squeeze household budgets; some homeowners in the United Kingdom, for example, could see their payments more than double. Movements of this magnitude could go well beyond dampening consumer spending; they could raise the risk of defaults. Outside of the U.S., banks own the lion’s share of mortgage debt, so a surge in loan losses could become a systemic problem.

Policymakers in the affected countries have considered offering relief. But these programs would add to fiscal deficits at a time that fixed income markets are growing more impatient with levels of government debt. And supporting demand could perpetuate the inflation that central banks are trying desperately to contain.

Economists and investors have been wondering what it will take for central banks to end their tightening cycles. Markets have been rallying on the barest of indications that a pivot may be near. But there have been instances when monetary authorities took their foot off the brake too soon, inviting renewed inflation that became even harder to combat. The current crowd of central bankers seems intent on avoiding that fate.

The risk to household solvency may lead some central banks to stand down sooner.

The damage that rising mortgage payments are inflicting on household finances in some countries could easily carry over into trouble for other economic and market sectors. The risk of financial instability may be one of the reasons why interest rate hikes have been reduced in places like Canada and Australia; Britain may soon have to follow suit.

The influence of housing will likely mean that American interest rates will peak at a higher level than they will in other developed countries. And that will likely mean that the U.S. dollar will continue its strong run.

Our home has been paid off for some time, so I no longer have to worry about mortgage rates. But I can certainly empathize with what others are going through, and with the policy makers who have to decide what to do about it.