This Globe-Trotting SMID-Cap Fund Earns an Upgrade to Gold

A dive into this rating change and other December highlights.

Increased conviction in American Funds Smallcap World’s RLLGX robust management team drove an upgrade to the fund’s People Pillar rating to High from Above Average. The pillar change resulted in a newly minted Morningstar Analyst Rating of Gold for its seven cheapest share classes and Silver for its pricier shares.

With 18 portfolio managers at the helm, American Funds Smallcap World has a small army guiding its portfolio. And behind it stands a sprawling analyst bench of over 150 professionals split into three teams, unmatched relative to peers in the global small/mid stock Morningstar Category. The fund’s investable universe of the 6,000-stock MSCI All Country World Small Index makes this level of resourcing prudent. The team thoroughly dissects the index constituents, typically investing in 800 to 900 companies it identifies as the best long-term opportunities.

At first glance, one might balk at the size of American Funds Smallcap World. With nearly $60 billion in assets under management, it is safely the largest fund in the global small/mid stock category. Liquidity is often a concern when investing in smaller companies, but the firm’s deep resources and multimanager approach work to suppress these concerns. The portfolio managers split responsibilities by overseeing their own $1 billion to $3 billion sleeves. Each manager can deploy their own styles while staying within the guidelines of the fund, like initially purchasing companies with market caps between $500 million and $6 billion and keeping 80% of the portfolio invested in companies of that size. The strategy can hold stocks up to a market cap of $50 billion, which contributes to its mid-cap growth positioning in the Morningstar Style Box. Having multiple managers delivering their own distinct, but complementary, investing styles at a smaller scale helps surface the group’s best ideas.

While the multimanager approach gives us confidence, so too do the managers themselves. The 18 portfolio managers each have at least 10 years of industry experience, and most have more than 20 years. The longest-tenured manager, Jonathan Knowles, has been named on the fund for 23 years. Additionally, all the managers invest at least $100,000 in the fund, while many have over $1 million invested. This shows the managers’ aligned interests with shareholders and commitment to the strategy.

The fund underperformed its average global small/mid stock category peer by more than 3 percentage points in 2022; this was not unexpected given its tilt to growth stocks, which were out of favor. It has delivered strong results in the long term despite recent headwinds. Over the last 15 years through December 2022, the fund has delivered better results compared with its peers on an absolute and risk-adjusted basis.

This strategy stands as a strong choice for global small- and mid-cap exposure.

Turbulent Times

T. Rowe Price Global Technology’s PGTIX sharp 55% drawdown in 2022 prompted an impending manager change and process shift. These unexpected changes drove a Process Pillar downgrade to Average from Above Average and subsequent Morningstar Analyst Rating decline to Neutral from Silver. While technology stocks had a rough year, the scale of this fund’s underperformance prompted questions of manager Alan Tu’s portfolio construction and risk management approach. The firm ultimately felt analyst Dom Rizzo would be better suited at the helm, driving his addition as comanager in December 2022 alongside Tu. Rizzo will assume sole control on April 1, 2023. The firm also changed the fund’s mandate, placing greater emphasis on diversification, which should help damp the fund’s volatility. However, the transition remains in its infancy and requires more time to decipher whether it can lead to prolonged success.

New to Coverage

Avantis U.S. Large Cap Value ETF AVLV debuted with an Analyst Rating of Bronze. Launched in September 2021, this exchange-traded fund taps companies in the top 90% of the U.S. market by market cap. The strategy’s combination of value and quality risk factors, with profitability at the core, leads to an attractive solution that should provide a long-term edge.

Ratings Roundup

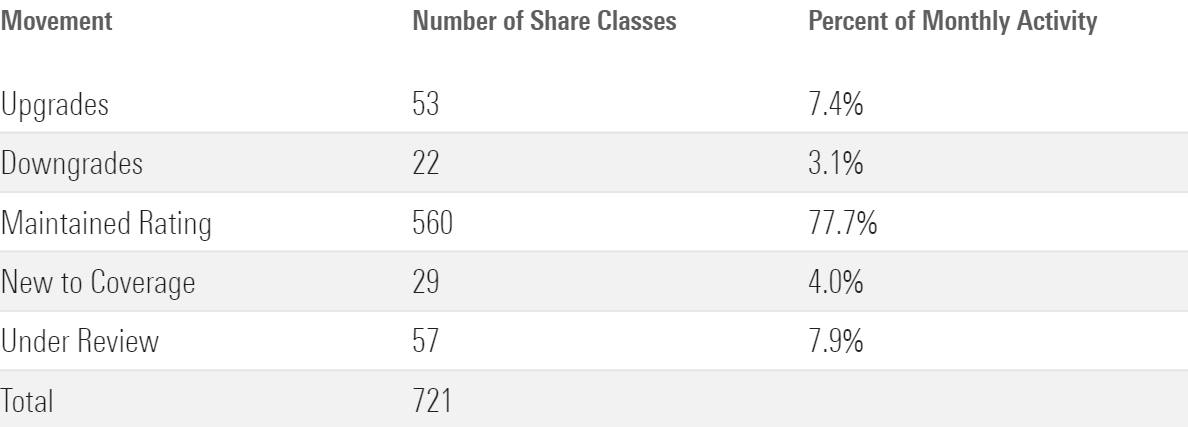

Morningstar updated the Analyst Ratings for 721 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in December 2022. Of these, 560 retained their previous rating, 53 earned upgrades, 22 received downgrades, 29 were new to coverage, and 57 went under review owing to material changes such as manager departures or subadvisor changes. Looking through share classes and vehicles to their underlying strategies, Morningstar issued 178 Analyst Ratings during December. Of these, six were new to coverage and 11 were under review. While eight strategies saw an upgrade and six a downgrade, the majority (147) maintained their previous ratings.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e29c5118-c52b-4431-99f9-23960f2bcb09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e29c5118-c52b-4431-99f9-23960f2bcb09.jpg)