These T. Rowe Price Funds Find Gold

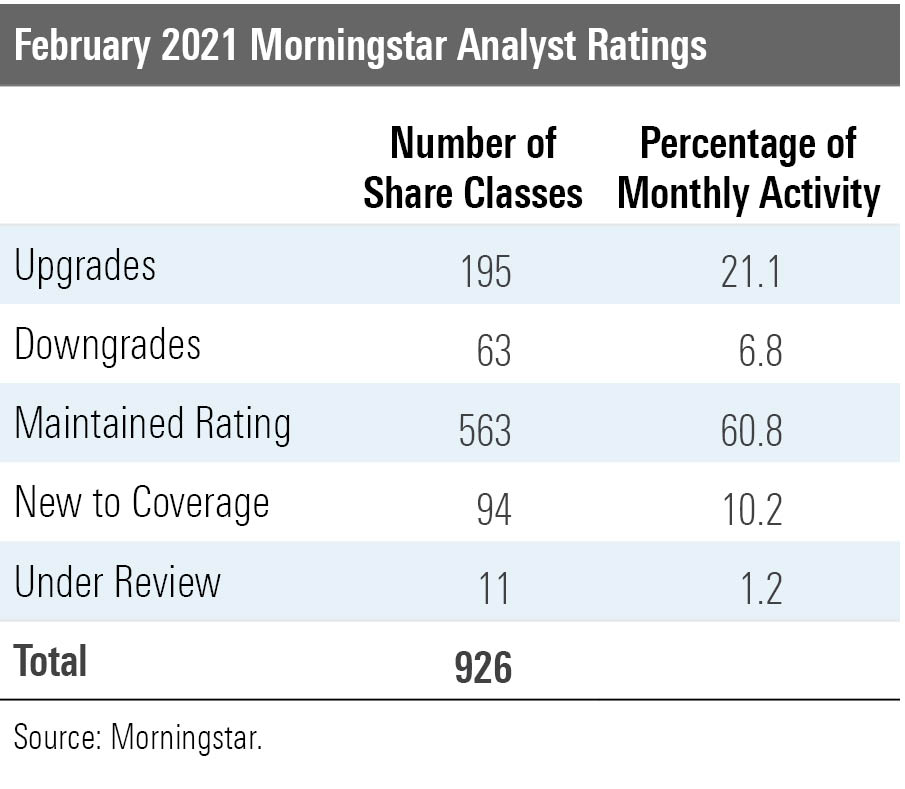

Morningstar analysts rated 926 share classes and vehicles and 246 unique strategies in February.

Morningstar updated Analyst Ratings for 926 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in February 2021. Of these, 563 maintained their previous rating, 63 were downgrades, 195 were upgrades, 94 were new to coverage, and 11 were put under review because of material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 246 unique strategies in February 2021. Of these, 37 received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and new to coverage.

Upgrades

T. Rowe Price Floating Rate's RPIFX robust team earned a People Pillar rating upgrade to High from Above Average, which brought its Morningstar Analyst Rating to Gold for its cheapest share classes. Its more expensive share class earned a Silver. Paul Massaro has served as a portfolio manager on this fund since its 2008 inception. He draws on associate manager Stephen Finamore and a credit research team of 17 dedicated leverage finance analysts. Massaro and the team look for relative value within bank loans, focusing primarily on BB and B rated loans while being more selective within CCC loans. The team's stringent security-selection process has resulted in solid downside protection since its inception, and the fund has landed in the best decile of its bank-loan Morningstar Category peers during that span.

The T. Rowe Price Retirement TRPMX target-date series carefully refined its equity glide path and earned a Process rating upgrade to High from Above Average. This won its two cheapest share classes Analyst Rating upgrades to Gold and its more expensive ones Bronze. In a well-planned transition, Wyatt Lee took over from long-tenured manager Jerome Clark at the start of 2021. Lee has served as a manager on this series for five years, and two comanagers support him. The team spent two-plus years researching updates to its equity glide path and began implementing the changes in April 2020. It maintains that savers' biggest risk is outliving their assets and the best remedy is a bigger equity allocation. It boosted equity exposure at nearly all points on the glide path, making it one of the most equity-heavy around. The series owns some of T. Rowe Price's best funds, with 78% of series assets in Morningstar Medalist funds. This team also manages the MassMutual Select TRP Retirement MMDDX target-date series in the same manner, earning it a Process rating upgrade to High from Above Average this month as well. That drove its rating up to Gold for its cheapest share classes, while the others range from Silver to Neutral.

New to Coverage

Baird Ultra Short Bond BUBIX debuted with an Analyst Rating of Gold for its cheaper share classes while its most expensive got Silver. Lead manager and Baird CIO Mary Ellen Stanek heads a well-tenured, eight-person portfolio management team and draws on a roster of five structured, seven credit, and four risk analysts. The team applies the same controlled and thoughtful process it has used at its other taxable fixed-income funds for two decades. It uses the Bloomberg Barclays Short-Term U.S. Government/Corporate Index as the benchmark for security and sector positioning. The managers keep the strategy duration-neutral and leverage fundamental research to generate a yield advantage. With the help of low fees, the strategy has beaten the benchmark and 65% of distinct rivals since its 2014 inception.

Downgrades

BlackRock Total Factor's BSTIX People rating dropped to Average from Above Average, bringing its Analyst Rating to Neutral from Bronze for all share classes. He Ren replaced Ked Hogan as a manager here in December 2020, as Hogan moved into a broader factor research role. While Phil Hodges has been a manager on this fund since its inception, Ren has only been in the industry for six years. The 12-person analyst team supporting the managers also lost five analysts in 2020. The managers take a unique approach to portfolio construction with about 70% of its risk allocation invested in a market-neutral, factor-oriented sleeve and the rest allocated in a long-only, diversified basket of assets. In the market-neutral sleeve, the managers look to isolate factors with strong value, momentum, interest-rate carry, and low-beta attributes and short those with opposite profiles. The long-only sleeve provides exposure to broad economic themes and generally moves in the same direction as the market.

Owing to an increasingly competitive fee landscape among passive funds, iShares Russell Mid-Cap Value ETF IWS dropped to a Bronze rating from Silver. This fund tracks the Russell Midcap Value Index, which targets the cheaper half of the U.S. mid-cap equity market. Stocks in this index often have dim growth prospects, and their low valuations are often warranted. However, firms that can exceed their modest expectations should reward investors. Five named managers on this fund lead BlackRock's index portfolio team and oversee day-to-day operations. The fund effectively diversifies valuation risk by market-cap-weighting a vast portfolio of 702 holdings. Additionally, while this fund leans into value-friendly sectors like industrials, utilities, and energy, it is diversified across sectors, with the largest stake at 17% of assets.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)