Strong-Performing Value Fund's Management Team Resigns

Longtime manager Bill Hench and his team abruptly depart Royce Opportunity.

An abrupt mass resignation of Royce Opportunity's ROFIX management team has left the strong-performing fund in the lurch and its Morningstar Analyst Rating under review.

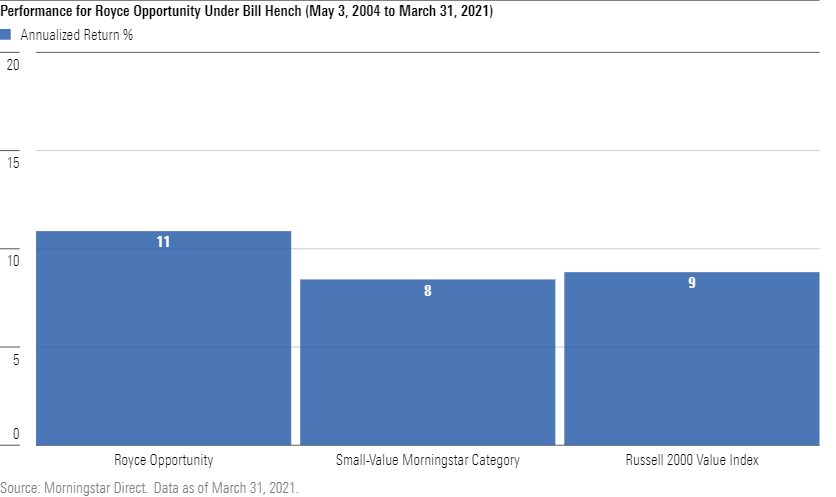

Bill Hench and his three-person team surprised their colleagues at Royce Investment Partners by resigning on April 20, 2021. Hench had served as lead manager since October 2018 and as an assistant or comanager since May 2004, building an excellent track record, first as an understudy and then as successor to Boniface "Buzz" Zaino.

Robert Kosowsky and Suzanne Franks, Hench's assistant managers since 2018, and Adam Mielnik, an analyst for the strategy since 2014, also left. They did not disclose where they were headed but often when entire fund management teams leave at once it is for another firm or to strike out on their own. On April 21, noted value shop First Eagle Investment Management announced that it hired Hench and his team to run a new small-cap strategy for the firm.

Royce scrambled to assemble a contingency plan and quickly settled on recalling Zaino, Hench's predecessor and mentor, to retake the reins on an interim basis. Zaino is the architect of the strategy's quirky, aggressive deep-value process that has produced impressive, albeit volatile, results since he took over from firm founder Chuck Royce in April 1998.

Zaino, who retreated to a senior advisor role in 2018, will run the strategy with Brendan Hartman and James Stoeffel, Royce Micro-Cap's RYOTX comanagers, and James Harvey, an assistant portfolio manager on closed-end fund Royce Global Value Trust RGT, until he can form and train a permanent replacement team. That eventual team may or may not include Zaino's three interim comanagers, of whom only Harvey has experience with the approach. Harvey worked as an analyst on the strategy for about 10 years after joining Royce in 1998.

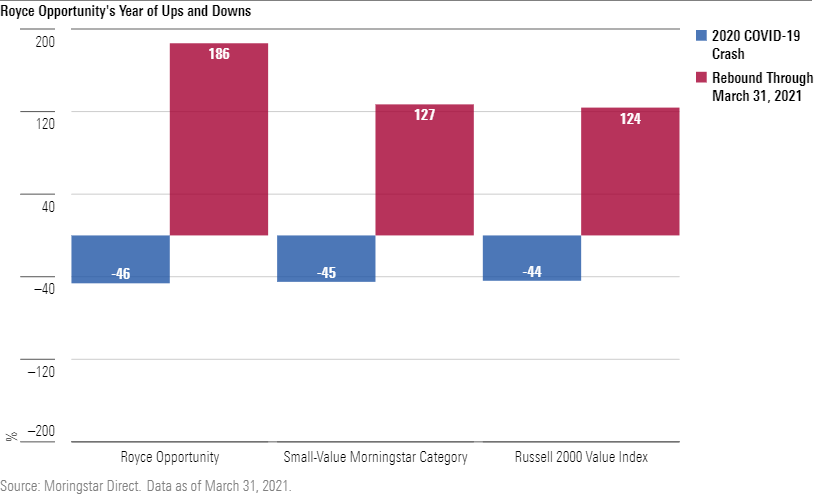

Royce Opportunity, which has always kept a large slug of assets in micro-cap stocks, has some overlap with Hartman and Stoeffel's portfolio, but Zaino and Hench's process, while simple in theory, requires a unique temperament. The strategy looks for statistically cheap small- and micro-cap stocks whose catalysts for improvement may be wallowing under clouds. Turnaround stories and stressed companies have been common in the portfolio, and stock-picking drives sector allocations, which don’t always look like those of a typical value fund. It often, for example, has had big technology and consumer cyclical overweights and financials, consumer discretionary, and energy underweights.

Hench and Zaino, who has continued to participate in team meetings since stepping back, kept the portfolio diversified and controlled position sizes to mitigate the risks of owning stocks that others had kicked to the curb. The strategy has still been among the most volatile small-cap funds, though. It fell harder than its peers and prospectus benchmark in the coronavirus-triggered crash of 2020 but has gained back what it lost and more since.

Zaino, 76, succeeded in inculcating Hench with his philosophy and style after working with him for several years. Doing it again with a team that has less direct, recent experience with the approach will be a challenge.

/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b41a1177-9e6e-486c-bb45-434ac569d47e.jpg)