A Painful 2018 So Far for Prominent Long-Short and Market-Neutral Funds

Some of our Morningstar Medalist alternative funds have struggled so far this year, but we remain confident in their long-term prospects.

It has been a tough year for market-neutral and long-short equity funds (including some large hedge funds). As the equity market entered a more volatile period with rising interest rates and tightening monetary policy, many investors shifted their attention to alternative investments, but many prominent and fast-growing alternative products offered by AQR and Boston Partners have struggled in 2018. While the year-to-date performances have been disappointing, these Morningstar Medalists stay the course and stick to their knitting.

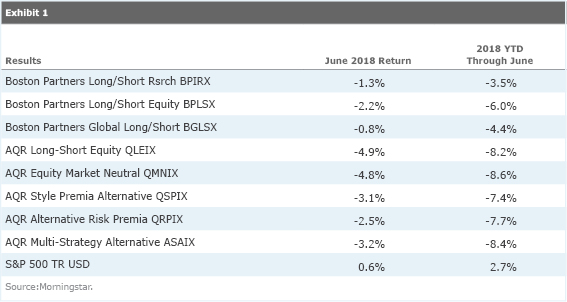

Exhibit 1 shows some selected funds’ year-to-date returns through June 2018.

The funds in the table use a range of strategies; the first five funds are purely equity-based strategies with a short component, the next two target factors and/or alternative risk premiums, and the final fund invests in a mix of alternative strategies. Despite their differences in approach, all eight funds suffered from a similar problem: underperformance of the value factor (and exuberantly rallying growth stocks on the other side of the coin). Some AQR funds use leverage to amplify returns, so an adverse market move can result in larger losses when compared with unleveraged funds.

If we look under the microscope, we see a number of patterns in the market that explain the performance struggles here. This analysis is not intended to precisely explain what happened in these portfolios for the year to date, but it sheds some light on why things turned out this way.

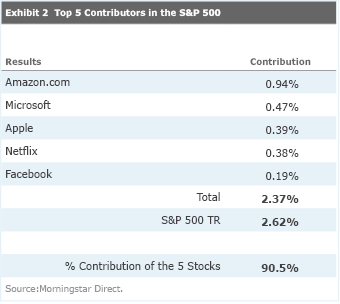

Exhibit 2 shows the top five contributors to the S&P 500’s return over the year to date through June.

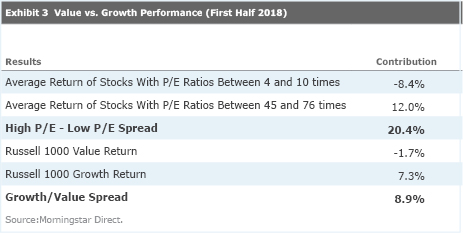

And Exhibit 3 shows the performance of value and growth stocks.

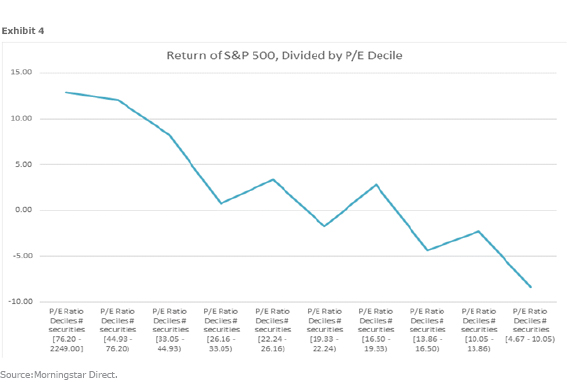

Exhibit 4 breaks down the performance of the S&P 500 with respect to P/E ratio deciles over the first half of 2018.

Exhibit 2 makes it clear that a handful of mega-cap technology stocks have driven returns so far this year. Exhibit 3 highlights that low P/E stocks in the S&P 500 have significantly underperformed stocks with high P/E ratios. In addition, the 8.9% performance differential between the Russell 1000 Growth and Value indexes confirm the market’s strong preference for growth. These differentials were major headwinds for the funds mentioned above, as all bet on that value factor implicitly or explicitly. Finally, Exhibit 4 provides a striking perspective on how the market rewarded high P/E stocks and punished the low P/E stocks on a year-to-date basis.

But this was only half the story. The short side of these portfolios can take a larger loss on high-flying growth stocks, which are not necessarily attractive to a fundamental stock-picker like Boston Partners. This also applies to AQR as a fundamental quant shop, even though the firm may define value differently from Boston Partners through its factor research. At the core, though, both firms have a strong focus on fundamental data and valuation. Exhibit 3 makes it clear that going short the Russell 1000 Growth Index (which gained 7.3%) would hurt much more than being long the Russell 1000 Value Index (which lost 1.7%). However, both these firms run large (and growing) short portfolios, which could make them less nimble and prone to occasional short squeezes.

For a purely market-neutral strategy (such as

In summary, having a value bias on the long side and shorting high-flying expensive stocks (that rely more on credit markets with little to no free cash flow generation) is a sensible approach, and it should produce good results in the long run. (Note that the funds on perspective are not always positioned this way.) This, however, can take some patience to be realized, as results can suffer in the short run when certain factors may not behave as expected. Additionally, investors should beware that episodic short squeezes can get especially ugly for investment shops with large short portfolios (and the use of leverage can exacerbate that effect, more relevant for AQR). Although AQR and Boston Partners have very big short portfolios, we think their disciplined investment processes and deep resources offset those concerns, and we remain confident in the above-referenced funds.

Financial professionals are accessing this research in our investment analysis platform, Morningstar Cloud. Try it today.

/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5ff7a7e7-10d3-4880-b243-dff72384e635.jpg)