June Analyst Ratings Upgrades, Downgrades, and More

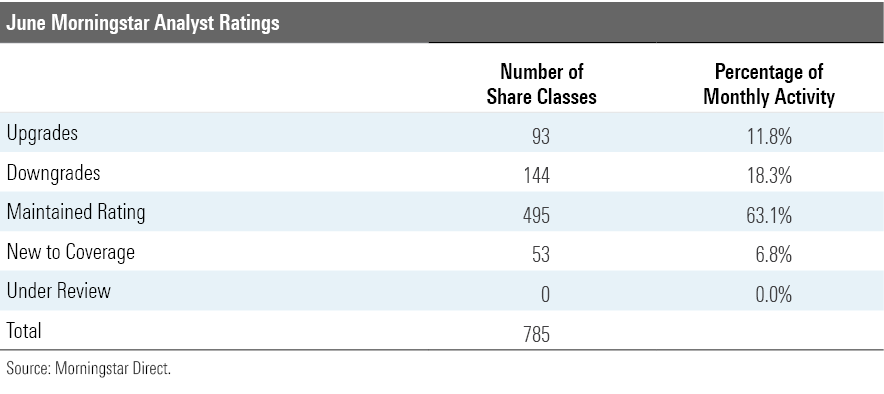

Morningstar analysts rated 785 share classes and vehicles and 187 unique strategies in June 2020.

Morningstar updated Analyst Ratings for 785 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in June 2020. Of these, 495 maintained their previous rating, 144 were downgrades, 93 were upgrades, and 53 were new to coverage.

Sifting out multiple share classes and vehicles, Morningstar rated 187 unique strategies in June 2020. Of these, seven received a rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. A trio of ETFs highlight the upgrades, while two industry stalwarts lead the downgrades.

Upgrades Schwab Fundamental U.S. Large Company ETF's FNDX strengthened equity index team, low fees, and solid investment approach upgraded its Morningstar Analyst Rating to Silver from Bronze. The fund replicates the Russell Fundamental U.S. Large Company Index, which includes most large- and mid-cap U.S Stocks but weights them on fundamental measures of size, including sales (adjusted for leverage), retained operating cash flow, and dividends plus share buybacks. Stocks that trade at low multiples of these metrics receive higher weightings in this portfolio than they would if they were weighted by market cap. When the fund rebalances its holdings back to its target weightings, the fund increases exposure to cheaper firms and trims positions that have become more expensive. This gives the fund a value tilt, though it includes stocks across the entire value-growth spectrum, giving it an edge versus the Russell 1000 Value Index. The strategy's People Pillar rating increased to Above Average to reflect improvements to Schwab's stock index fund management team.

Vanguard International Dividend Appreciation ETF VIGI earns an upgrade under Morningstar’s enhanced methodology to Silver from Bronze because of its low fees. This fund tracks the Nasdaq International Dividend Achievers Select Index, which targets large- and mid-cap stocks from developed and emerging markets that have increased their dividend payments for at least seven years. It also employs filters to eliminate names that may not be able to sustain dividend growth and excludes firms that are working through bankruptcy proceedings. The portfolio tends to favor high-quality stocks from stable sectors like healthcare and consumer staples that tend to be less volatile than the broader market and hold up well in market downturns.

Vanguard Growth ETF VUG moved to Gold from Silver after its first run through Morningstar’s enhanced methodology, which places a greater emphasis on fees. Indeed, its expense ratio is just 4 basis points, making it one of the cheapest funds in the large-growth Morningstar Category. This fund tracks the CRSP U.S. Large Large-Cap Growth Index, which targets the faster-growing half of the U.S. large-cap market weighted by market cap. It yields a broad, well-diversified portfolio with a turnover lower than almost all of its category peers. The fund’s approach leads to concentration among its top holdings, as the top 10 positions represent more than 40% of the portfolio. However, these tend to be highly profitable industry leaders with durable competitive advantages.

New to Coverage DF Dent Midcap Growth Investor DFDMX debuted with a Silver rating. Four experienced managers run the strategy, and all have comanaged the fund since its July 2011 inception. The squad looks for companies with strong management teams and sustainable competitive advantages that have a niche or best-in-class focus. They want to identify firms that can grow earnings per share over time. The collaborative and disciplined team builds a concentrated portfolio of 30-40 stocks of the team's best ideas. While the managers consider valuation, they often pay up for quality, which has helped the fund provide exceptional downside protection to investors since its inception. For example, the portfolio tends to have higher average returns on equity than the mid-cap growth category average and the Russell Midcap Growth Index.

Downgrades Oakmark Global's OAKGX People rating dropped to Above Average, dropping its rating to Silver from Gold. An approaching management transition looms as Clyde McGregor, 67, one of the U.S. equity comanagers, plans to retire by age 70. While David Herro has no plans to retire soon, he has ceded more responsibility to the next generation. Tony Coniaris and Jason Long, the younger cohort, complete the management team. The managers look for global companies with sustainable growth opportunities and stable finances trading around a 30% discount to their intrinsic value. The approach is contrarian and long-term, yielding a compact, conviction-weighted portfolio that often looks out of favor for extended periods. For example, the team has found better valuations abroad for the past several years, which has contributed to its deficit versus the MSCI World Index because U.S stocks have outperformed.

Dodge & Cox Balanced's DODBX flexible blend of equity and fixed-income courts risk lowering its Process rating to Average. That dragged its rating to Silver from Gold. The stock team looks for firms with competitive advantages, solid growth potential, and strong management teams trading at discounted valuations. The fixed-income managers mainly use corporate bonds and aim for a yield above the Bloomberg Barclays U.S. Aggregate Bond Index but also include agency mortgage-backed securities, Treasuries, and taxable municipal bonds. Both approaches are contrarian, often holding names in challenged businesses. However, the strategy’s flexible allocation policy allows for a heavier weighting of stocks beyond the traditional 60%/40% stock/bond balance, and a corporate-heavy bond sleeve has made the fund more vulnerable than most in the coronavirus-driven economic shutdown of early 2020.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)