Index Funds’ True Advantages

They reduce both tax bills and bad investment decisions.

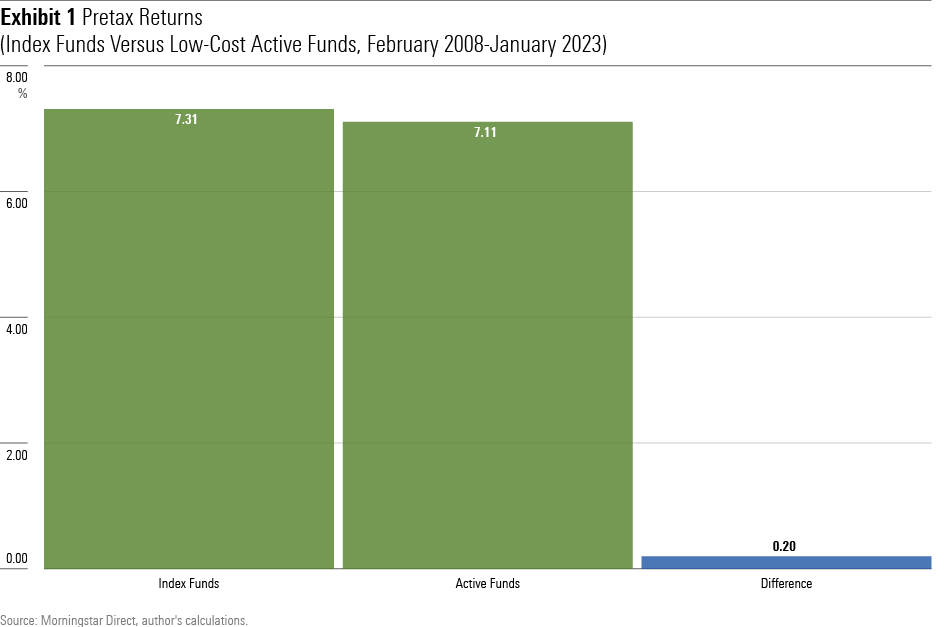

Pretax Returns

Most investors now buy index funds rather than actively managed offerings. The primary reason is because the public has grown to believe that index funds will post superior returns. Also, they rarely disappoint. While active funds can surprise even the most knowledgeable buyers, index funds do what the label promises.

True enough. However, as with sports teams, index funds score most of their victories against mediocre opponents. When assessed against the thriftiest actively run funds, index funds don’t look so remarkable. They are slightly better than the competition—but only slightly.

To demonstrate, I compared the trailing 15-year performances of three Vanguard index funds (admiral share classes) against the cheapest active funds that share their Morningstar Categories. The funds were Total Stock Market VTSAX, Total Bond Market VBTLX, and Small Cap Index VSMAX, with the categories being large-blend, small-blend, and intermediate core bond.

With the active funds, I selected only funds that had expense ratios below 0.5% in 2007 (that is, the year before the study began), aside from small-blend funds, which had a limit of 0.75%. I then further narrowed down the study group by eliminating all equity funds that possessed less than 90% of their assets, on average, in U.S. stocks. Such funds occupy those categories because they must go somewhere, but they are not true index fund rivals.

Here were the results of those calculations, presented as the average of the three index funds versus the average of the three categories. As usual, all returns exclude front-end loads (which have pretty much become obsolete) but include the effect of ongoing expenses.

The index funds’ annualized edge of 20 basis points comes entirely from expenses, which were 23 basis points below the active funds that I selected. In short, active funds that cost the same as index funds wind up performing the same.

About Risk

Two objections arise. First, this test ignores volatility. I had intended to chart the funds’ risks along with their returns, but when the volatilities of the three index funds (as measured by monthly standard deviations) almost exactly matched the active fund averages, I did not bother. Suffice it to say that they are the same.

Second, just because the average active fund only slightly lagged the indexes, that does not mean that all of them did. Perhaps some active funds posted excellent 15-year returns, while others lagged severely. Unless one can identify the winners and losers in advance, one should index, to avoid buying a dud.

This is indeed a powerful argument for indexing—but it does not apply to the stingy active funds. As with index funds, they possess a cost advantage, which their portfolio managers use accordingly. They seek to nurse small opportunities rather than make large bets that, if unsuccessful, would squander their leads. Consequently, the active funds behaved very much as a group. For example, nine of the 11 large-blend funds gained between 9% and 10% annualized for the period.

Incorporating Taxes

For those with tax-sheltered accounts who are unaffected by investment emotions, my analysis is complete. For core investments—speculative purchases being a different topic—choose either a major index fund or a dirt-cheap active fund that follows a mainstream strategy. Six of one, half a dozen of the other.

The biggest advantages for index funds are implied by the two caveats. Their tax benefit has long been known. Forty years ago, when Jack Bogle preached the gospel of indexing to the early few, he lauded index funds’ ability to dodge taxes along with their lower costs. Technically, index funds can make capital gains distributions, even exchange-traded funds. In practice, though, they rarely do.

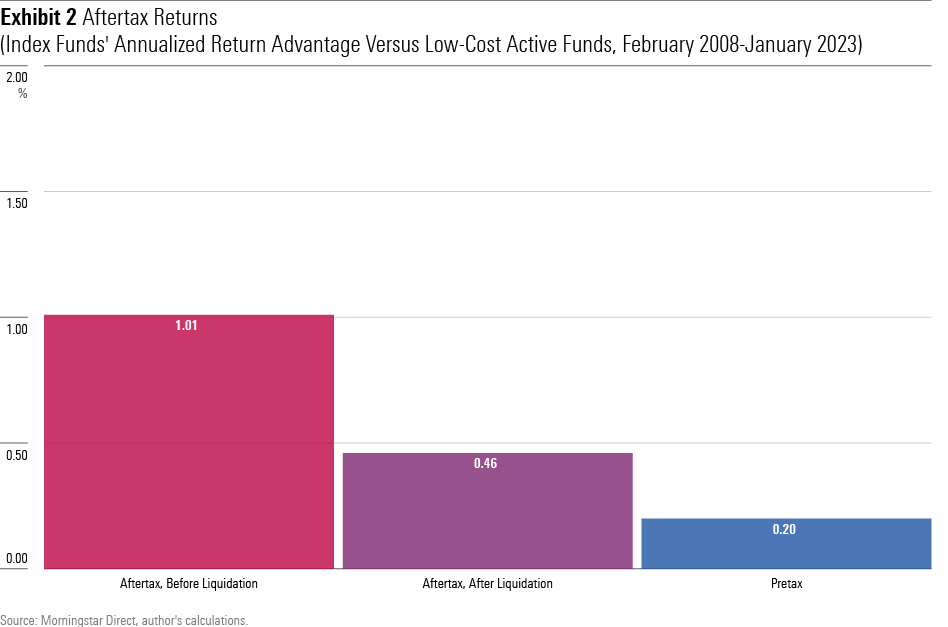

And that attribute is critical for aftertax returns. The next exhibit illustrates how the first chart’s finding, shown in the blue bar, changes if the funds are held in taxable accounts. It evaluates two tax conditions: 1) after liquidation, meaning that the funds were bought entering the 15-year period and sold exiting it, and 2) before liquidation, meaning they were retained through the study’s conclusion.

The index funds have a large lead before liquidation. Their victory margin shrinks after liquidation but still more than doubles their pretax margin. The moral of the story is obvious: Rare is the active fund that can beat index funds within taxable accounts. (Admittedly, this calculation assumes the maximum tax rate, but the overall lesson also applies to lower tax brackets.) That said, I should note that this precept primarily holds for equity funds, as bond funds pay few capital gains.

Avoiding Emotions

The less-discussed benefit of index funds is that they are dull. If one sat at your right at a lunch table, you would turn and talk to the person on the left. That doesn’t prevent index fund shareholders from becoming overenthusiastic, but it unquestionably minimizes the danger. It’s much harder to convince oneself that an index fund is an investment miracle run by an investment genius than to do so with an actively managed fund, particularly when successful portfolio managers will loudly and eagerly tout their talents.

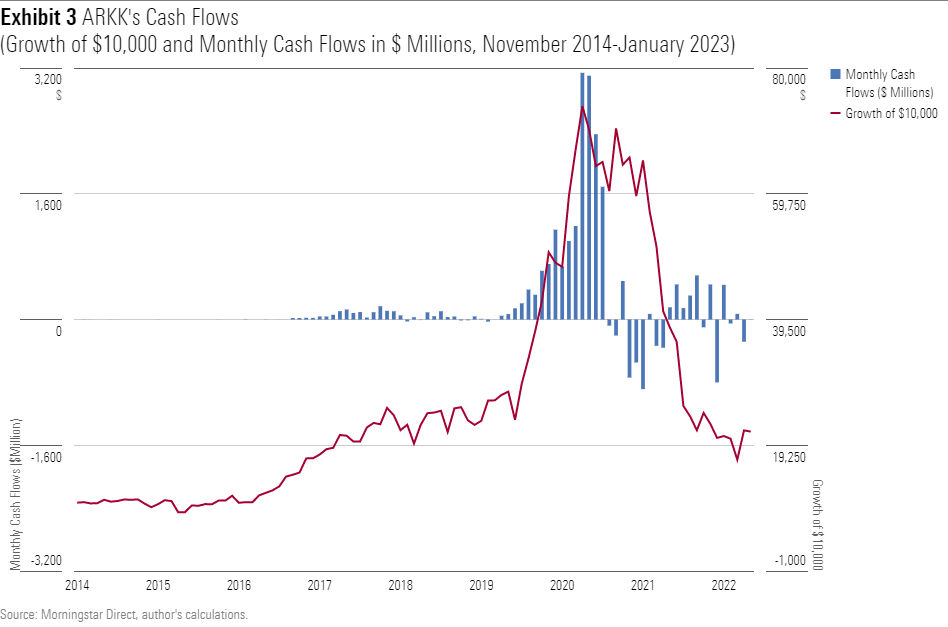

A case in point is here:

Although ARK Innovation ETF ARKK has more than doubled its value on paper, growing a $10,000 initial investment to $21,000 today, essentially every ARK Innovation shareholder is in the red, as evidenced by when its assets arrived (the blue bars) and the fund’s subsequent performance (the red line). Such results do not occur with index funds—not to that extent. For example, the cash flows for Invesco QQQ Trust QQQ, also a highly volatile technology fund, have been far less volatile.

To be sure, chasing performance can work in shareholders’ favor, should the fund continue to rise. Not every impassioned action leads to bad outcomes. But the odds do not favor decisions that arise from investment excitement.

Summary

Index fund proponents sometimes overstate their argument. I have read claims that owning active funds “endangers investors’ financial health.” Balderdash. Within tax-sheltered accounts, a low-cost active fund is a perfectly sound choice. If taxes or emotional responses are possibilities, though, then index funds are clearly the superior option.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)