How ETFs Are Breathing New Life Into Actively Managed Mutual Funds

Some early success stories have emerged.

The fund landscape has changed dramatically over the past several decades. The development of the index-tracking mutual fund gave investors access to the stock market at a much lower price point than many actively managed funds. In most instances, those lower fees were sufficient, on their own, to deliver better long-term performance. Then the exchange-traded fund came along in the 1990s, a structure that was well-suited to index-tracking funds and that provided additional improvements in tax efficiency.

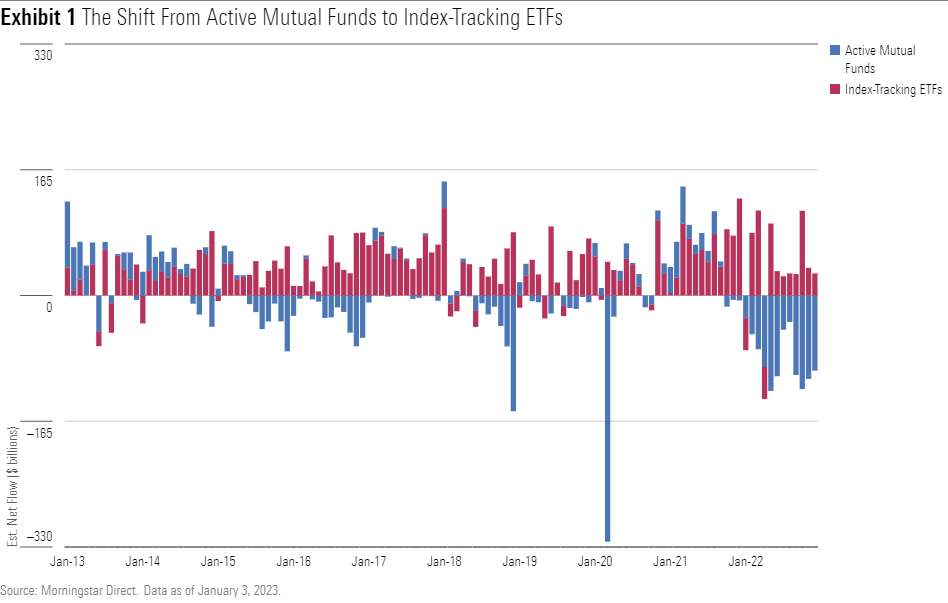

Investors have clearly latched on to those advantages. Index-tracking ETFs exploded in popularity over the past decade, while actively managed mutual funds have languished. The latter have bled money for almost eight straight years, while passively managed ETFs continue to take in record flows.

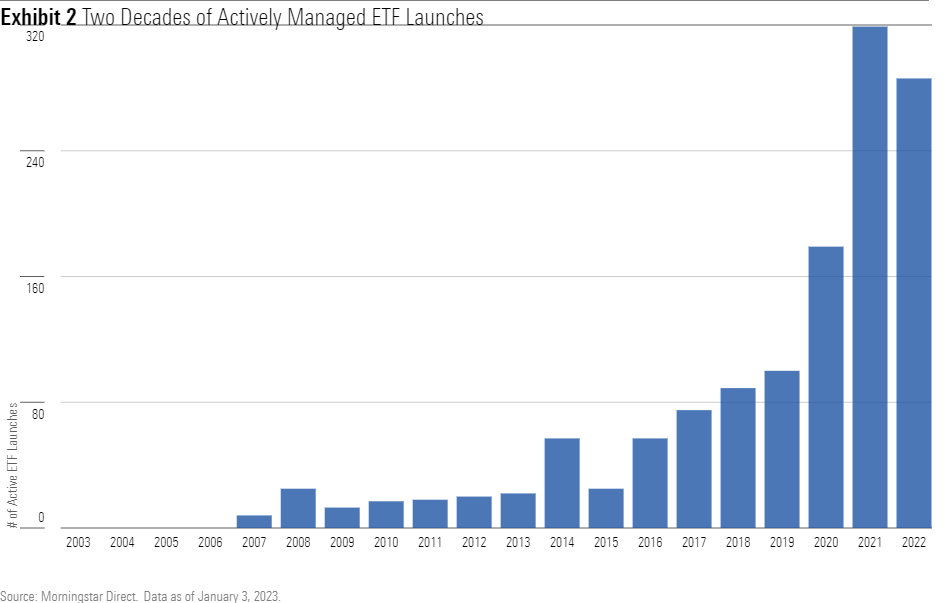

Those developments have essentially strong-armed actively managed funds to cut fees and move into ETFs, a trend that has been more obvious in recent years as fund providers have launched more and more actively managed ETFs.

In many instances, the fees tied to the latest breed of actively managed ETFs are now lower than their mutual fund predecessors, and they possess the same tax efficiency as their index-tracking counterparts, inching them closer to the standard set by index ETFs. In doing so, the lower fees and taxes tied to ETFs are becoming less of the differentiators that they were in the past, meaning the underlying investment process and the people tasked with overseeing it have become more important in selecting great ETFs for the long haul.

The Great Mutual Fund Exodus

The past decade was a gut check for actively managed mutual funds. Exhibit 1 shows that monthly net flows into actively managed mutual funds started to turn negative in mid-2015, and they collectively struggled to return to positive. Between July 2015 and December 2022, almost $2 trillion dollars walked away from actively managed U.S. mutual funds.

By comparison, ETFs have continued to consistently haul in new money, with almost all of those flows going into index-tracking ETFs. At least part of the reason rests with the advantages the ETF structure has over mutual funds. All else equal, ETFs typically cost less and make fewer capital gains distributions. Not only are they cheaper, but they’re also more tax-efficient.

ETFs typically charge lower fees in two ways. First, they don’t carry front-end or back-end loads, or fees charged to investors for entering or leaving a mutual fund, respectively. Many mutual funds have done away with these charges in the past few decades, but they are still levied in some instances.

Another layer of mutual fund expenses comes from 12b-1 fees that are largely paid out to middlemen who provide investors with access to those funds. ETFs get around these middlemen by listing on an exchange, which makes them available to any investor with a brokerage account. U.S.-listed ETFs almost never have 12b-1 fees tied to them, so their expense ratios are largely composed of the fees charged for managing the strategy.

All else equal, ETFs also have a built-in tax advantage over mutual funds. The in-kind redemption mechanism that allows ETFs to track their target indexes throughout the day allows ETFs to purge shares with built-up capital gains. Assuming potential capital gains are managed effectively, most ETFs will seldom have to make taxable capital gains distributions; their mutual fund counterparts must distribute those gains in the year they are incurred. ETF investors must still pay taxes when they sell their ETF shares, but they can defer those sales and the associated taxes to a date of their choice.

Those advantages, along with the SEC’s approval of the ETF rule in late 2019, paved the way for actively managed ETFs to become more ubiquitous. The result was a perfect storm of circumstances leading to a sharp increase in the number of active ETF launches over the past few years. Exhibit 2 shows how the number of active ETF launches has increased in the past two decades.

A Flatter Playing Field

The advantages of lower fees and improved tax efficiency are inherently finding their way into a larger number of active strategies as more active managers move into ETFs. Those benefits, once among the primary motivating forces to move into index-tracking ETFs, are on their way to becoming table stakes in an increasingly competitive environment.

As the barriers between index-tracking ETFs and actively managed funds continue to erode, the emphasis should shift to the pillars that differ the most across investment strategies: the process used to select stocks and bonds for a portfolio and the people charged with overseeing the effort. Distinguishing good managers and processes from bad, whether they’re actively managed or index-tracking, has never been more important.

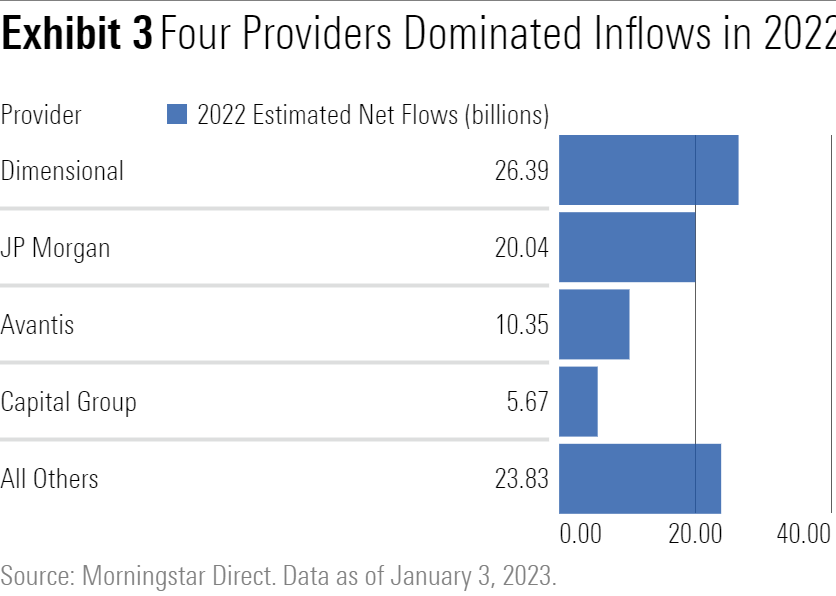

There are some early signs that investors are paying attention and moving their money toward the best of breed. New ETFs backed by firms with solid actively managed mutual funds have represented those with the largest inflows in 2022. For the full year, almost $86.3 billion found its way into actively managed U.S. ETFs. Of that sum, roughly half went into ETFs from Dimensional, Avantis, and Capital Group, as shown in Exhibit 3.

The flows into Avantis’ rules-based funds capture the shift toward ETFs. The firm offers ETF and mutual fund versions of its many strategies, but its ETFs have proved the more popular choice by a long shot. Of the nearly $18.4 billion that Avantis has brought in over the past three-plus years, more than $17 billion went into its ETFs. Likewise, Capital Group rolled out nine ETFs in 2022. Many of them use similar processes and management teams as the firm’s American Funds mutual fund lineup. Those nine ETFs attracted almost $5.7 billion dollars in 2022 despite being less than a year old.

But Dimensional’s move into ETFs looms large over those two. It launched 23 new ETFs and converted an additional seven tax-managed mutual funds to ETFs over the past three years. Dimensional’s ETFs pulled in more than $26 billion of new money in 2022 alone, largely offsetting the money that left its mutual funds.

ETFs for All?

The ETFs from Avantis, Capital Group, and Dimensional have emerged as some of the early success stories in active managers’ move toward ETFs. That’s great for investors as they now have access to a wider range of investments through a cheaper and more tax-efficient vehicle. Great processes and management teams should distinguish the best of breed as fees continue to fall.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)