Don’t Ignore the World’s Second-Largest Economy

7 reasons China’s GDP growth is slowing—and what it means for investors.

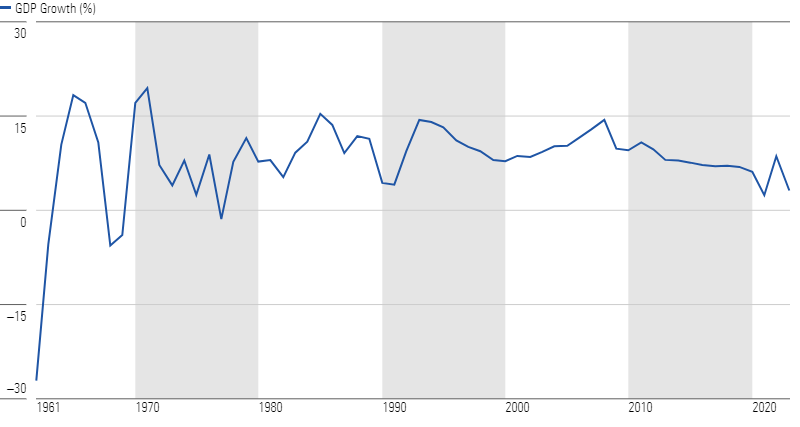

Today, China is the world’s second-largest economy. As you can see in the chart below, the Chinese economic miracle began in December 1978 when Deng Xiaoping launched a series of economic reforms. From the early 1980s through 2010, China’s gross domestic product grew 9% per year, and there were 15 years when it grew at double-digit rates.

Growth of China GDP

However, the chart also shows that the rate of economic growth has been decelerating for more than a decade. Given its importance as the world’s second-largest economy, I thought it worthwhile to discuss the reasons behind the trend, consider whether it will continue, and examine the investment implications.

Early-Stage Advantages of a Centralized Economy

China is a centralized economy in which the government controls the means of production and allocation of resources. Those controls can provide advantages in the early stages of economic development, as Russia demonstrated after World War II.

The Soviet economy grew at a rate of 5.7% per year from 1950 to 1960 and 5.2% per year from 1960 to 1970, becoming the second-largest economy in the world. In a 1959 speech at the United Nations, Premier Nikita Khrushchev stated that the Soviet Union would “bury” (economically) the United States. Russia had benefited from the advantage of centralized economies (over capitalist ones) to harness resources to develop infrastructure. In terms of economic growth, the advantages include the efficient allocation of resources in a way that maximizes social welfare (rather than profit), and these economies can sometimes grow rapidly in the early stages of development by directing resources to strategic industries and projects.

The Soviet economy did grow more rapidly than the U.S. in the years after Khrushchev’s speech. However, the negatives of a centralized economy eventually led to the stagnation of the Soviet economy in the 1970s and 1980s and the eventual breakup of the Soviet Union. Those negatives include the lack of market pricing signals that help to efficiently allocate capital, the lack of incentives for innovation, and inefficiency in allocating resources owing to waste and corruption.

Causes of China’s Slowdown

The same effects are playing out today in China. Keeping in mind that demographics and productivity are the two main drivers of economic growth, there are other trends that are leading to this slowdown:

1) Aging Population

A significant part of China’s economic growth was fueled by a quickly increasing population. China’s population is now aging rapidly: There will be fewer workers to support the growing number of retirees, placing a strain on the economy and leading to slower growth. China’s population, which now stands at about 1.4 billion, will drop below 1 billion by 2080 and 800 million by 2100. China’s working-age population, which peaked in 2011, is projected to decline by nearly a fourth by 2050. Meanwhile, the number of elderly Chinese will rise to 500 million at midcentury from 200 million, and providing for their needs will be a mounting challenge for China’s workers and policymakers.

2) Slowing Productivity

The Chinese migration from farms to cities helped fuel rapid increases in productivity. That era is basically over. As a result, China’s productivity has slowed in recent years, another contributing factor.

3) Deglobalization

China benefited from the era of globalization, which is now reversing for national security reasons and to reduce supply chain risks, with negative implications for growth.

4) Rising Debt Levels

China’s debt levels are high and rising, and research shows a negative relationship between economic growth and debt once the government debt/GDP ratio reaches about 100%. According to the IMF, China’s government debt/GDP rose to 76.9% in 2022 from 71.5% in 2021. In 2013, it was 37%.

5) Trade Tensions

Trade tensions, including the imposition of tariffs, between China and the United States have led to slower growth in exports, which has been a drag on China’s overall growth.

6) Distressed Property Sector

Because Chinese investors have a higher percentage of their net worth invested in real estate, the negative impact of distress in that sector could be as dramatic as it was in the U.S. during the Great Recession, or even worse.

7) High Unemployment

The unemployment rate among Chinese youths aged 16–24 in urban areas reached a record high of 21.3% in June 2023, the highest since reporting began in 2008.

The distress in the property sector, the high unemployment among youths, and the declining trust in financial institutions are negatives for consumer confidence.

Implications for Investors

Investors should be aware that slower growth in the world’s second-largest economy has negative implications for global economic growth.

With that said, it is possible that India could replace China as an engine of global growth. In its favor are a democratic and capitalist system, favorable demographics, the population moving from farms to cities (increasing productivity), and surging infrastructure spending (on roads, power generation, airports, and so forth), which enhances productivity.

However, the research on the relationship between economic growth and stock returns—including the 2016 paper from Dimensional Fund Advisors, “Economic Growth and Equity Returns,” the 2015 study “What’s Growth Got to Do With It? Equity Returns and Economic Growth,” and the 2012 study “Is Economic Growth Good for Investors?”—has found that there not is a significant link.

The lack of relationship is evident in comparing the returns against those of SPDR S&P China ETF GXC and the S&P 500. Over the period from April 2007 to August 2023, GXC returned 3.86% per year, underperforming Vanguard 500 Index’s VFIAX return of 9.45% per year. While China’s economy grew at a much faster pace than the U.S. economy, U.S. stocks dramatically outperformed. One reason could be that while the Chinese economy grew rapidly, perhaps it did not grow as fast as investors anticipated, which had a negative impact on valuations. That can be seen today: As of Aug. 31, 2023, while the P/E ratio of Vanguard 500 Index was 20, the P/E ratio of GXC was just 11.2. Another explanation is that the benefits of economic growth went to Chinese citizens and not investors.

Investor Takeaways

While it seems likely that the rate of economic growth in China will continue to decline, that doesn’t mean investors should ignore China or even underweight it any more than the expected rapid growth of the Chinese economy should have caused investors to overweight China in 2007.

The key takeaway is that investors should not make the mistake of confusing information with value-added information (or wisdom), which can be used to generate excess risk-adjusted returns (alpha). Because the information we discussed is well-known by the sophisticated institutional investors that dominate trading, it is already embedded in prices. Thus, it is unlikely that it can be used to generate excess returns.

With that understanding, investors should not overweight India because they believe it will have faster economic growth, and they should not underweight China because its growth rate is likely to decline. Instead, the starting point for allocation to international markets is the global markets capital allocation.

The views here are the author’s. Larry Swedroe is head of financial and economic research with Buckingham Strategic Wealth. The opinions expressed here are their own and may not accurately reflect those of Buckingham Wealth Partners, collectively Buckingham Strategic Wealth and Buckingham Strategic Partners.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements, or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability, or privacy policies of these sites and shall not be responsible or liable for any information, opinions, advice, products, or services available on or through them. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this article. LSR-23-541

Larry Swedroe is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8c5d95ea-6364-418e-82fc-473134024ece.jpg)