Which ETFs Are Making Capital Gains Distributions This Year?

Very few.

For investors, one of the most appealing aspects of exchange-traded funds is their clear tax efficiency.

Most passive ETFs inherently are low-turnover vehicles, with minimal levels of concentrated buying and selling of specific securities. Also, because ETFs have the ability to redeem securities in-kind, their managers often can dodge the capital gains bullet by swapping out low-cost-basis securities without having to realize large amounts of capital gains, if any.

But for a variety of reasons, some ETFs can, on occasion, issue capital gains distributions. As 2015 comes to a close, ETF providers have begun announcing estimated capital gains distributions for the year. Once again, major ETF sponsors anticipate capital gains distributions from just a small minority of funds.

At nine major ETF sponsors that have published estimates thus far--iShares, Vanguard, State Street, PowerShares, PIMCO, Schwab, WisdomTree, First Trust, and Van Eck—just 102 out of 949 ETFs are expected to face capital gains distributions of any kind, whether long-term or short-term. In many cases, the expected distributions are very small--far less than 1% of the affected ETFs' net asset value. That's a far cry from the double-digit capital gains distributions that some actively managed equity mutual funds have announced in recent weeks.

Where Capital Gains Distributions Tend to Occur Most plain-vanilla ETFs that are not in the fixed-income arena and that do not hold derivatives don't pay capital gains distributions. Market-cap-weighted domestic equity ETFs in particular often experience turnover only at the margins and thus keep their trading to a minimum.

It's not always easy to generalize the kinds of ETFs that are prone to issue capital gains distributions. But for the most part, ETFs that could be expected to issue them are ones that trade heavily, use derivatives (such as currency-hedged ETFs, leveraged ETFs, and inverse ETFs), undergo a dramatic change in their underlying indexes, or hold fixed-income securities, as bonds mature regularly and thus must exit a portfolio (stocks, in contrast, have no maturity date). In a falling-interest-rate environment, bonds that reach maturity within a portfolio have done so after appreciating in value, forcing an ETF manager to realize gains. In addition, ETFs in asset classes that have done especially well are sometimes more prone to issuing capital gains distributions.

What's Happening This Year?

This year, several important dynamics have been at work in triggering capital gains distributions for ETF investors. One is in fixed income. As historically has been the case, most large ETFs issuing capital gains distributions of any size are bond ETFs. However, bond ETFs' capital gains distributions are for the most part fairly minimal. For instance, the 2015 capital gains distribution for one of the largest bond ETFs,

Table 1 depicts the 10 largest ETFs that thus far have announced projected capital gains distributions 2015. Seven are fixed-income ETFs. Note that these figures are all estimates; the actual figures may vary.

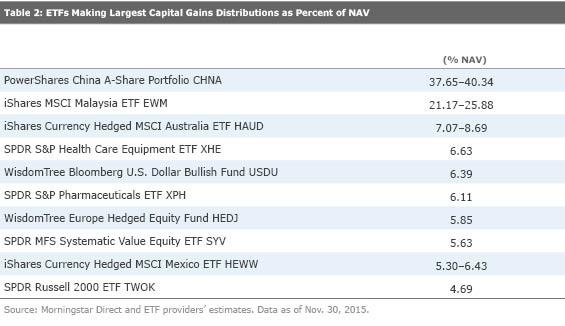

It's Not Just Bond ETFs... ETF investors in several other corners of the market are set to receive capital gains distributions as well. Other notable capital gains include currency-hedged equity ETFs and those investing in Chinese stocks.

Because of a stronger dollar this year relative to some other currencies, several currency-hedged ETFs are expected to generate sizable capital gains distributions. The dollar continued to rally this year, especially relative to the euro and the yen. As a result, during the past year, currency-hedged ETFs' portfolio managers have had to book gains as they have regularly rolled their currency contracts. These hedging instruments cannot be removed from these funds' portfolios on an in-kind basis, which increases the likelihood of capital gains distributions in a strong-dollar environment. In addition, many currency-hedged ETFs are fairly new to market. As such, they tend not to have stores of losses to draw from to offset any realized gains. The bottom line: Currency-hedged ETFs generally are not tax-efficient.

Some other ETFs that issue large capital gains distributions are ones devoted to corners of the market that have done especially well during the past several years, such as small-cap stocks and U.S. healthcare. However, some open-end funds devoted to those areas of the market have projected capital gains distributions that are even higher. For example, funds such as T. Rowe Price Science and Technology PRSCX, T. Rowe Price Health Sciences PRHSX, Silver-rated

Several outliers populate this year's roster of ETFs issuing projected capital gains distributions. One is the tiny PowerShares China A-Share Portfolio CHNA, a $5 million ETF that invests in China's A-Shares market using futures contracts collateralized by money market funds. CHNA, which invests in a market that has experienced significant volatility in 2015, is expected to issue a capital gains distribution amounting to more than 37% of its NAV, owing to a dramatic drop in the fund’s shares outstanding driven by major redemptions this year.

Also,

Table 2 lists the 10 largest projected capital gains distributions (measured as a percentage of funds' NAV) from ETF providers that have published estimates thus far.

Breakdown by Firm At the ETF provider level, the estimated capital gains distribution activity this year is not especially different from past years. Once again, the largest ETF provider, iShares, posted a strong year for tax efficiency, with estimated capital gains distributions on 24 of the firm's roster of 324 ETFs. That's a higher percentage than last year (iShares registered capital gains on just 16 of its roster at that time of 298 ETFs), but it's still very low. And 18 of the 24 iShares ETFs projected to produce capital gains this year are currency-hedged.

Vanguard anticipates a slightly higher percentage of capital gains distributions than iShares relative to its product lineup, projecting capital gains distributions on nine of its 68 ETFs (all nine are bond funds). That's in line with where Vanguard historically has been (last year, for example, Vanguard announced capital gains distributions on nine of its 67 ETFs).

As in the past, State Street is anticipating capital gains distributions for a much higher percentage of its ETFs than other ETF providers. This year, 35 of the firm's 152 ETFs, or 23%, are expected to issue capital gains distributions. That's up from 27 out of State Street's 144 ETFs last year. In addition, many of the same funds that are issuing capital gains distributions, such as

Among other ETF providers, PowerShares is projecting capital gains distributions on 10 of its 138 ETFs, while WisdomTree anticipates distributions on fully 17 of its 83 ETFs. And PIMCO is projecting fairly small capital gains from four of its 14 ETFs, including the firm's largest, PIMCO Enhanced Short Maturity Active ETF MINT.

Several other ETF sponsors are anticipating next to no capital gains distributions. Van Eck forecasts capital gains distributions for just two of its 54 ETFs--one focused on "fallen angel" bonds and one devoted to Chinese stocks--while First Trust projects a small distribution from just one of its 95 ETFs, First Trust Managed Municipal ETF FMB.

Once again, Schwab expects a shutout in 2015, with none of its 21 ETFs projected to issue capital gains distributions. That's in keeping with Schwab's history--the firm hasn't issued capital gains distributions in previous years, either.

Disclosure: Morningstar, Inc.'s Investment Management division licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)