Spot Bitcoin ETFs Inch Closer to Their Debut

Amid flying rumors and fake news, signals are stronger than ever for SEC approval.

Ten years have passed since the first application for a spot bitcoin exchange-traded fund by Tyler and Cameron Winklevoss in 2013, but still no spot bitcoin ETF exists in the U.S. market.

Change may be on the horizon. Cutting through the noise in search of facts is no small task right now. But it’s a worthwhile exercise to parse out which signals indicate the SEC is readying to approve the first spot bitcoin ETF and which are red herrings.

But first, here’s how we reached this point in the spot bitcoin ETF journey.

A Brief History

The SEC rejected the first bitcoin ETF filing in 2017. Of primary concern, the SEC struggled with the lack of regulation in crypto markets. The fact that bitcoin trades on unregulated exchanges makes it nearly impossible for an ETF’s listing exchange to prevent manipulation. In its rejection of this inaugural filing, the SEC stated that the listing exchange must enter into a surveillance-sharing agreement with a regulated bitcoin-related market of significant size.

This significant market test remained an issue for later spot bitcoin ETF filings. Dozens of crypto ETF filings have been rescinded or rejected since the Winklevoss application met its fate. But a crack in the SEC’s hard-line stance on cryptocurrencies appeared with the approval of the first bitcoin futures ETF in 2021—nearly four years after the CME Group launched bitcoin futures. According to the SEC, bitcoin futures were securities traded on a regulated exchange, rendering the significant market test unnecessary.

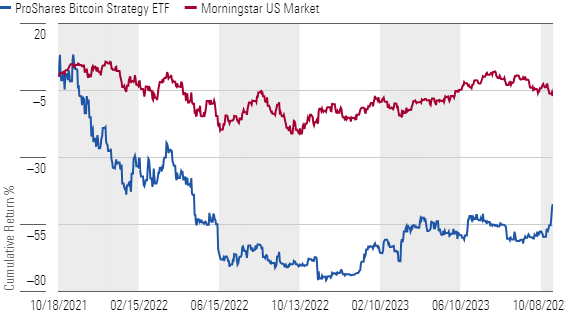

But these were not the bitcoin ETFs investors were looking for. Futures-based bitcoin ETFs come with roll costs, potential for a high amount of taxable distributions, and fund fees that investors could avoid by purchasing bitcoin directly. Still, the first bitcoin futures ETF, ProShares Bitcoin Strategy ETF BITO, became the fastest ETF to top $1 billion in new assets. The initial luster wore off quickly when bitcoin prices tumbled. As of Oct. 24, 2023, the cumulative net assets of bitcoin futures ETFs totaled under $1.2 billion.

In 2023, the SEC approved “ether” futures ETFs and the first leveraged bitcoin futures ETFs. However, investors’ eyes remained on the spot bitcoin ETF prize. These new ETFs combined for just over $100 million in net assets cumulatively, as of Oct. 24.

Calls for a spot bitcoin ETF began again in earnest when BlackRock filed for one for the first time in June 2023. A flurry of filings by other issuers followed suit, each competing to be approved first by the SEC. Meanwhile, one would-be spot bitcoin ETF issuer—Grayscale Investments—sued the SEC, claiming that the SEC’s rejection of its spot bitcoin ETF filing was unlawful. The D.C. Circuit Court of Appeals agreed with Grayscale for a number of reasons but primarily because the SEC failed to explain why spot bitcoin ETFs are exposed to different risks than bitcoin futures ETFs, given that bitcoin futures prices are driven by the same bitcoin markets as a spot bitcoin ETF.

The revival of optimism for a spot bitcoin ETF reached a fever pitch between the court’s decision and the entrance of the world’s largest asset manager into the fray. Crypto fans and investors began to look for any indication that the SEC would finally approve the U.S.’ first spot bitcoin ETF.

Fact or Fiction

As it currently stands, the SEC appears poised to approve the first spot bitcoin ETF. The first hard deadline to approve or deny a filing is in early January 2024. To me, that serves as the base case for when approval would come. The SEC, listing exchanges, and other regulators would need to build new capabilities to ensure adequate regulation of bitcoin the day they start trading on stock exchanges. For this reason, I expect the SEC to take as much time as possible to build out infrastructure before approving any filings.

So, what makes this time different from the other filings from the past 10 years? Let’s parse through a few rumors to see which are fact or fiction:

Fact—The SEC would need a new reason to reject spot bitcoin ETF filings.

The SEC’s use of the significant market test took a significant blow from the federal circuit court’s ruling in favor of Grayscale. The court found that the SEC failed to differentiate its treatment of spot bitcoin ETFs from the bitcoin futures ETFs it had approved, making its rejection of spot bitcoin ETFs “arbitrary and capricious.” The path of least resistance for the SEC is approving a spot bitcoin ETF.

Fact—Increased engagement with issuers by the SEC.

The SEC seems to be more engaged with issuers, opening a line of communication that previously didn’t exist. This rumor appears to be rooted in fact—issuers have corresponded with the SEC about their filings and made several amendments as a result, which indicates a more collaborative approach than in the past.

Fiction—DTCC addition sparks rumor of imminent approval.

X, formerly known as Twitter, was abuzz when a screenshot began to spread of the DTCC website listing iShares Bitcoin Trust with a previously undisclosed ticker. Reuters had the good sense to ask the DTCC what this meant, and apparently the answer is nothing. A DTCC spokesperson stated that appearing on the list was not indicative of approval and that the fund was added in August as standard practice.

Fiction—Cointelegraph tweeted “BREAKING: SEC APPROVES ISHARES BITCOIN SPOT ETF.”

This rumor was promptly debunked, but not before sending the price of bitcoin 7% higher. The price quickly fell back to earth once it became clear that the source of the breaking news was an unattributed message on a Telegram channel.

What Does a Spot Bitcoin ETF Mean for Investors?

With investor attention at all-time highs, one can expect more rumors to break before a final decision is made by the SEC. Don’t be the person who buys bitcoin based on an unsourced tweet. That’s a losing strategy.

More seriously, the fact that rumors create large price swings in bitcoin underlines the extreme volatility and speculative nature of bitcoin as an investment. If a spot bitcoin ETF hits the market, that doesn’t mean everyone needs to go out and buy it.

The risks extend beyond price volatility. It’s extremely difficult to value. Legal and regulatory issues abound in crypto markets. Investors would be wise not to invest in bitcoin anything more than they are willing to lose.

Case in point, bitcoin investors were ecstatic when the first bitcoin futures ETF, BITO, hit the market in October 2021. But it happened to mark the top of bitcoin’s decadelong rally. One year later, it was down over 70%—a hole that it still hasn’t come close to digging itself out of.

BITO Highlights the Risks of Bitcoin

That said, a spot bitcoin ETF would be a better option than any other bitcoin fund currently on the market. Spot bitcoin ETFs should come with cheaper fees, no roll costs (unlike a futures ETF), and tight tracking of the price of bitcoin, unlike grantor trusts such as Grayscale Bitcoin Trust GBTC.

The market is ready for a spot bitcoin ETF, and it would be an upgrade over existing funds. Only time will tell whether bitcoin is a worthy investment.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)