Choosing a Top Gold ETF

GLD holds the throne, but these others may prove better options for investors.

Gold has been used as a medium of exchange for thousands of years. Global societies value the commodity, causing its worth to persist and grow over time. Because of its demand throughout the world, gold’s value bypasses many country-specific risks. It can’t go bankrupt or default. It operates as a store of value parked outside of traditional asset classes like stocks, bonds, or foreign exchange, and it marches to the beat of its own drum. It is not a productive asset—instead, gold leans on its scarcity to fuel long-term returns.

Investors include gold in portfolios for a variety of reasons:

- It may provide a diversification benefit to stocks in portfolios and reduce drawdowns.

- It sidesteps country-specific risks, including weakening currencies.

- It can hedge inflation risks (but not always).

- It can act as a safe haven amid global volatility.

- Speculation.

Assessing the Gold ETF Landscape

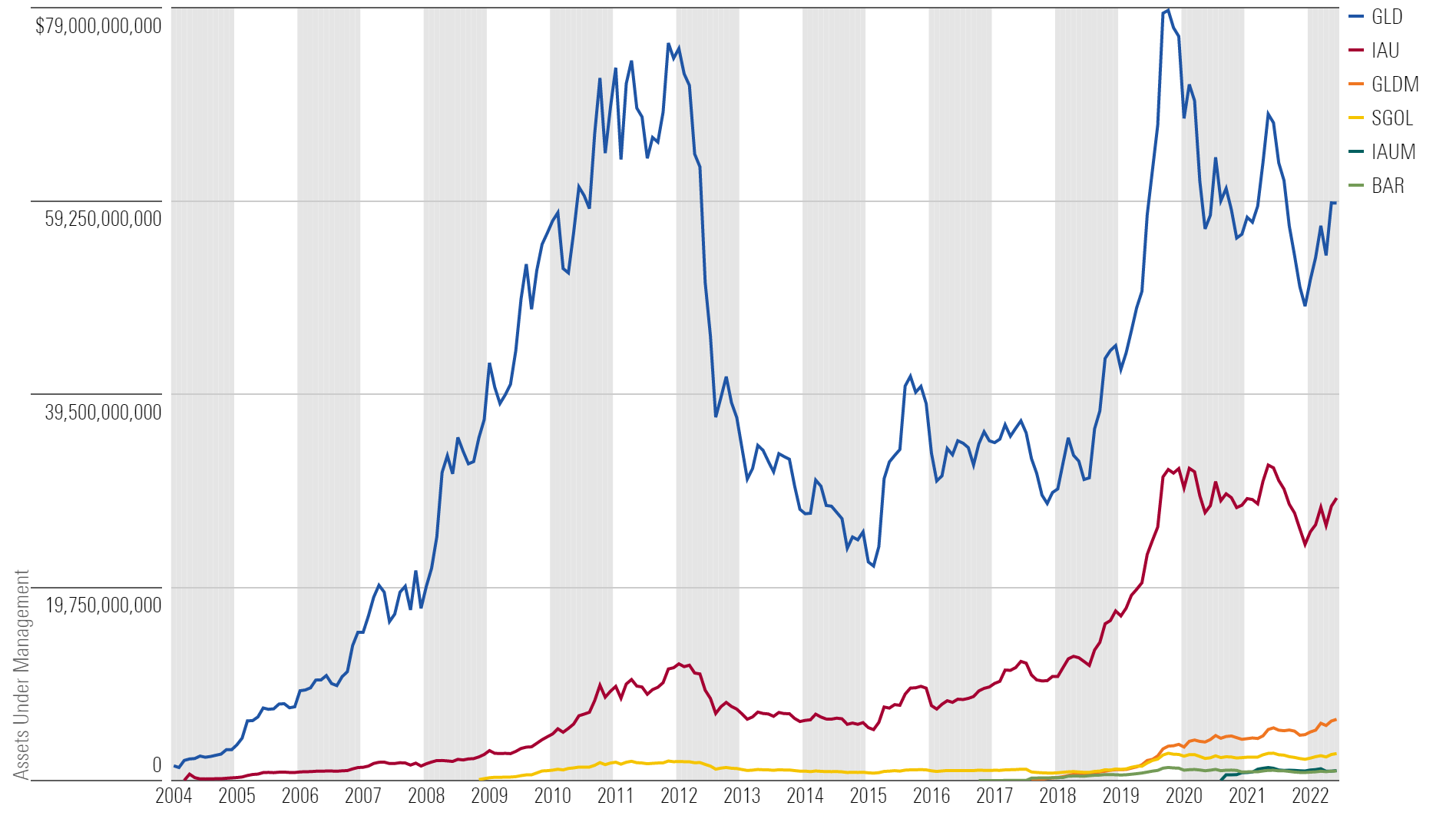

Gold ETFs have played an expanding role in how investors access gold exposure. SPDR Gold Shares GLD was the first exchange-traded fund on the market—an advantage that still benefits the fund today. It held $1.5 billion in assets at the end of its first month in November 2004. Gold ETFs’ assets under management have since grown to $100 billion as of April 2023.

AUM Growth of Gold ETFs

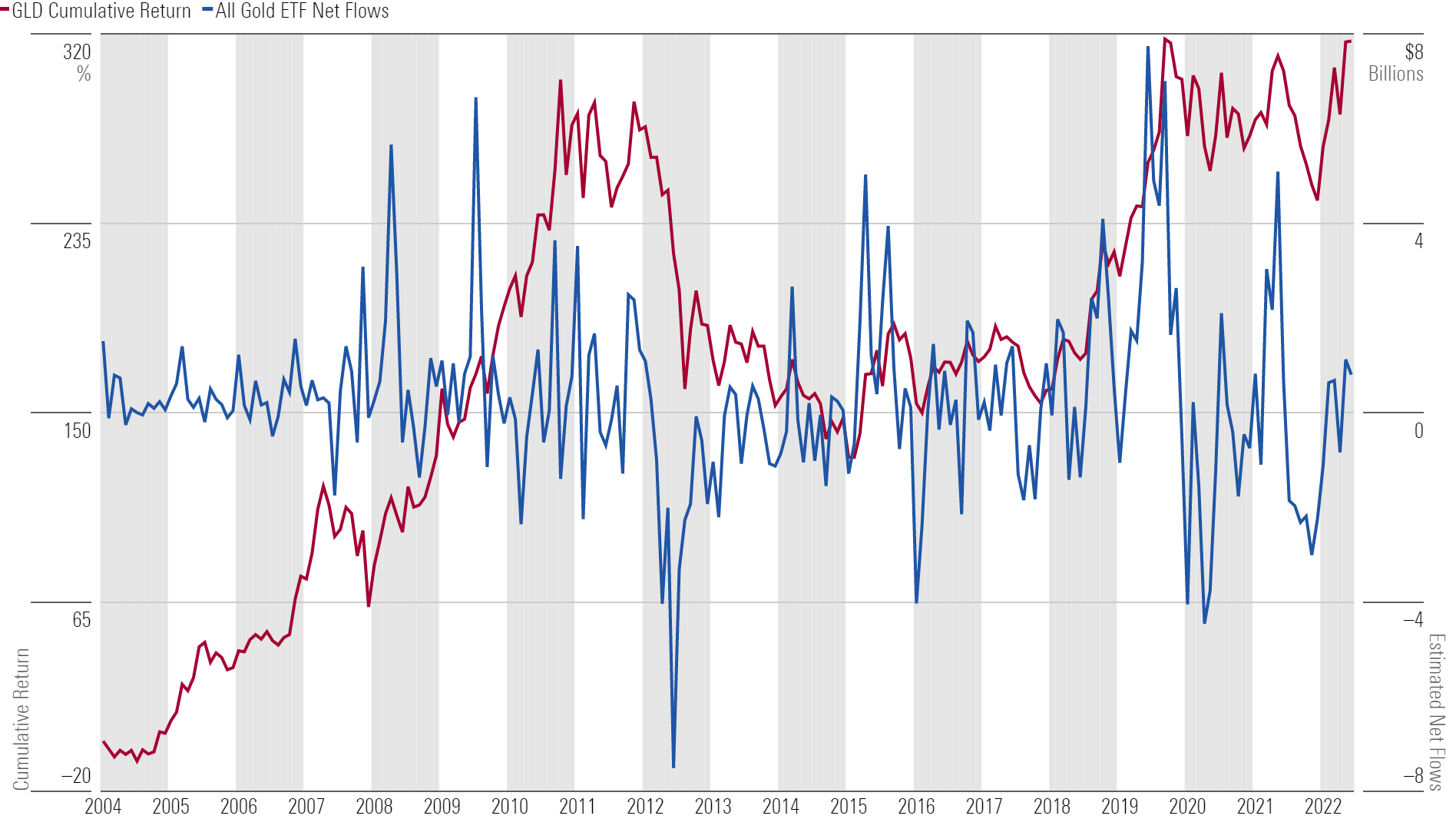

Flows into gold ETFs often accumulate during highly volatile markets, like during the global financial crisis in 2008 and when the coronavirus hit in 2020. Likewise, investors shed gold from their portfolios once those risks were quelled. Gold is a speculative asset that produces no income of its own, so these flows tend to dictate price moves, as seen in the chart below.

Flows Dictate Returns for Gold

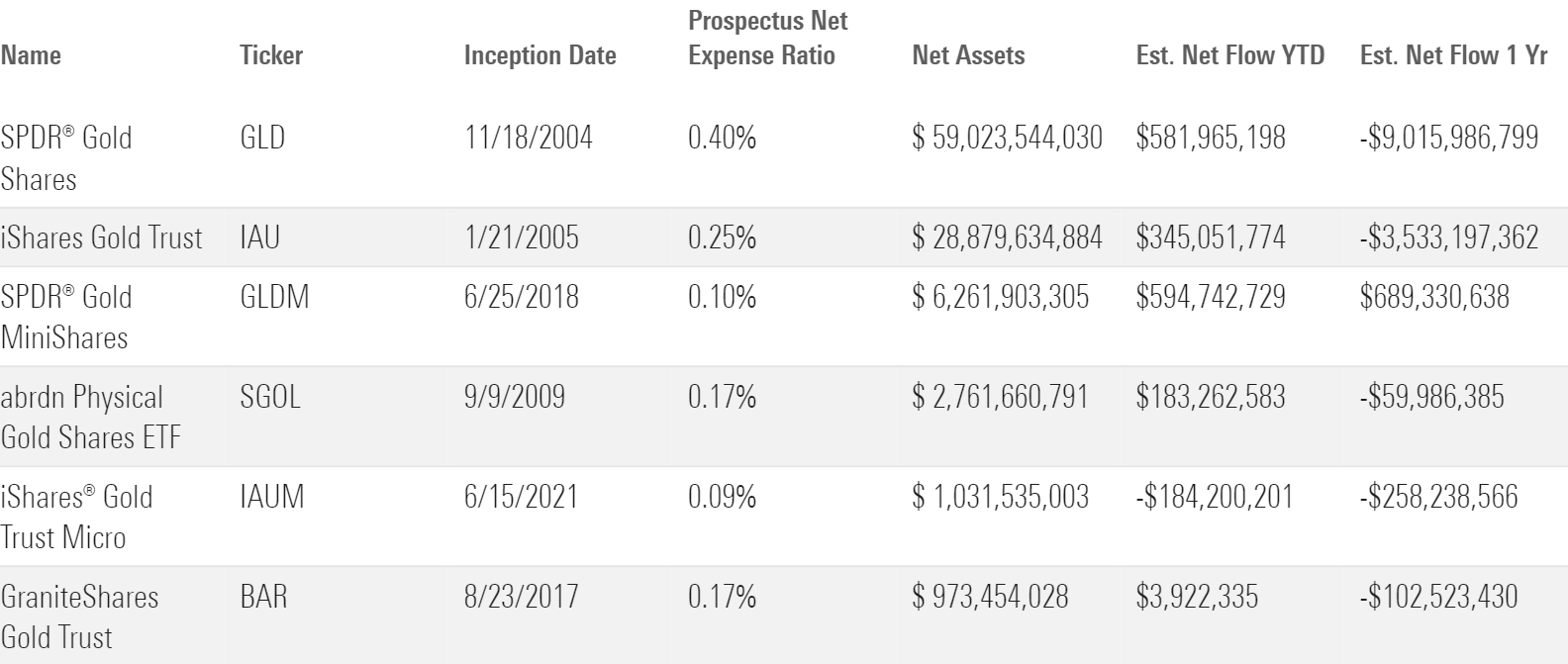

At the end of April 2023, six gold ETFs had about $1 billion or more in AUM. GLD has topped the list since its inception. IShares Gold Trust IAU launched a couple of months after GLD and holds firm control over second place among gold ETFs by AUM. But being the second gold ETF to market has kept it playing catch-up to GLD for over 18 years.

Top 6 Gold ETFs

GLD and IAU Have Dominated AUM

All six ETFs are structured as grantor trusts and hold physical gold. Worth noting: The IRS treats physical gold as “collectibles,” meaning long-term capital gains are taxed at a maximum rate of 28% instead of the 20% used for stocks and bonds.

Finding an Edge for Investors

Investors interested in gold ETFs may struggle to differentiate between these six funds. Investors get the same thing from each ETF: Gold is gold. There is no way for portfolio managers to carve out a meaningful edge—gold just sits in a vault.

What differentiates these six ETFs is costs. And those costs are expressed in two ways:

- Fees

- Trading costs

Fees

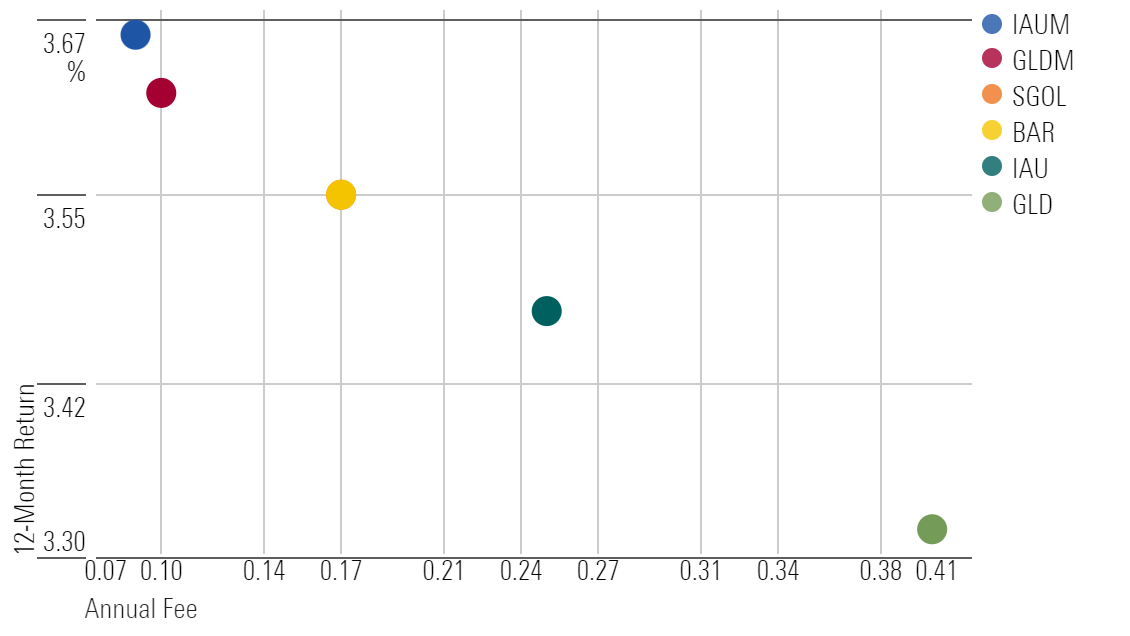

Investors can easily boost returns by choosing low-fee options. For the 12 months through April 2023, investors returned 3.72% before fees for each ETF (the lone exception being iShares Gold Trust Micro IAUM, which earned 3.75%). When holding these ETFs, the one with the lowest fee will win in the long run.

Fees Dictate Returns

Trading Costs

(Note: Costs can add up with frequent trading and larger orders that may execute outside the best bid or offer. This is not typically the case for most buy-and-hold investors.)

Trading costs are more complicated than fees. They can vary drastically depending on the type of investor. Buy-and-hold investors that would trade infrequently are far less exposed to the liquidity risk of these ETFs than a daily trader. For the market makers and proprietary trading firms trading millions of dollars worth of gold ETFs each day, trading costs add up quickly.

When it comes to limiting trading costs, GLD reigns supreme. On average over the four months through May 18, 2023, the ratio between GLD’s daily average bid-ask spread to its price was 0.0065%, making the price of crossing the bid-ask spread in GLD virtually nothing. IAUM clocked in with the highest spread/price ratio of 0.05%, or about 8 times higher than GLD.

In theory, fair value exists somewhere in the middle of a given bid-ask spread. Investors could expect fair value to be the midpoint. The trading cost incurred by an investor buying IAUM, for example, would be 0.05% divided by 2, or 0.025%, since that is the price paid beyond fair value to cross the spread. An investor trading once a year would happily eat IAUM’s 0.025% liquidity premium instead of GLD’s given the 0.31% advantage on fees. But traders active in gold ETFs each day benefit from lower trading costs more than they would gain from a lower annual fee.

The other cost consideration when trading ETFs is the liquidity pool an investor can execute against. I previously assumed crossing the spread would result in a fully executed order at that single price, but that may not be the case when placing an order for a substantial number of shares. Still, paying more on trading costs for lower-cost ETFs is worthwhile for buy-and-hold investors (assuming they follow best trading practices) given the annual fee advantage.

The Verdict

Most investors benefit from low-cost gold ETFs like GLDM and IAUM. Traders and those trading substantial volumes may need to take a closer look at the liquidity benefits of ETFs like GLD and IAU.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)