The Return of the Bond Market

It’s been rough getting here, but the future looks brighter for bonds.

Jeffrey Gundlach, founder and CEO of DoubleLine Capital, said in his November webcast, “The future outlook for bonds has not looked this good in 10 years.”

To be fair, Gundlach is often referred to as “The Bond King,” and investing in bonds is his business, so the comment certainly has an element of the “barber thinks you need a haircut.”

But the point he’s making is that difficult periods usually lay the foundation for better periods to come.

For bonds, that point can’t be understated.

Most investors incorporate bonds into a portfolio to provide diversification. The expectation is that bonds will damp the price volatility of investing in equities, in effect, creating a smoother (but lower) return path for investors.

Unfortunately, a smoother return path has not held true in recent years. The bond market has presented investors with the most difficult period in arguably 100 years.

The 2022 Bond Market in Charts

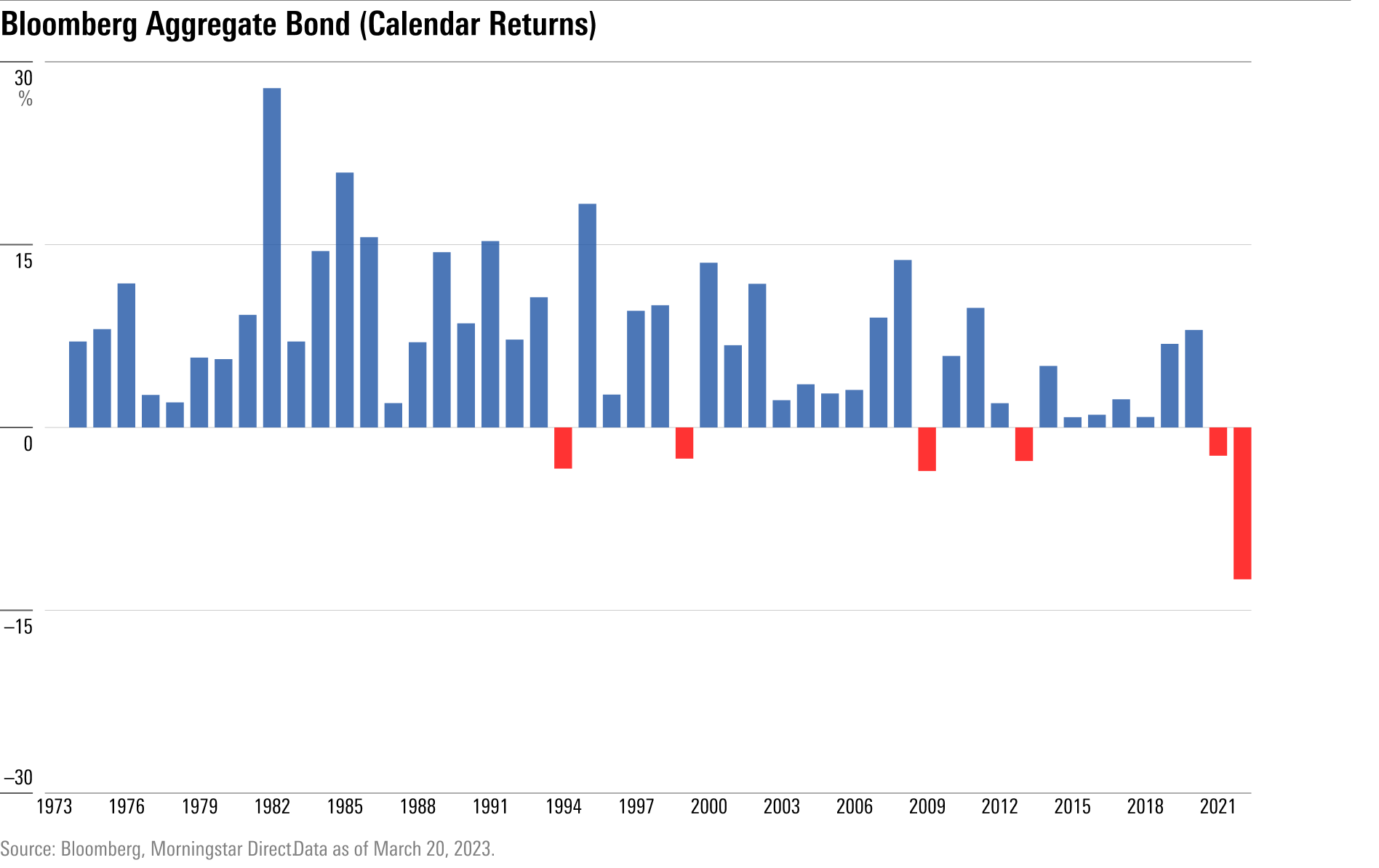

With data going back to 1974, the Bloomberg U.S. Aggregate Bond Index had two consecutive calendar years of negative returns for the first time ever in 2021-22. Before 2021, the index had only been negative four times in 46 years.

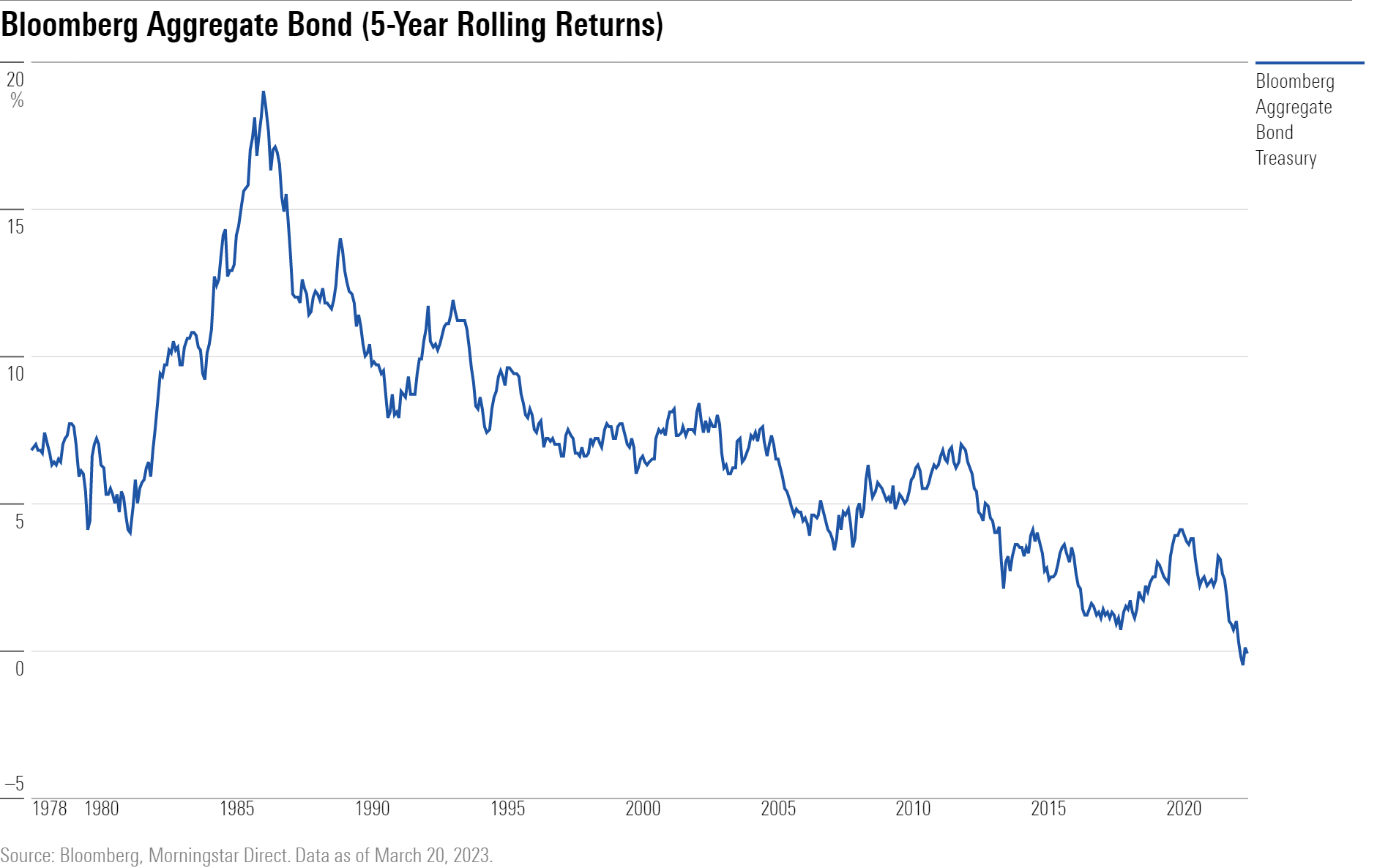

And with how bad things have been, the Aggregate Index now has an annualized return of negative 0.10% over the past five years; 2022 was the first calendar year ever to end with a negative five-year annualized return.

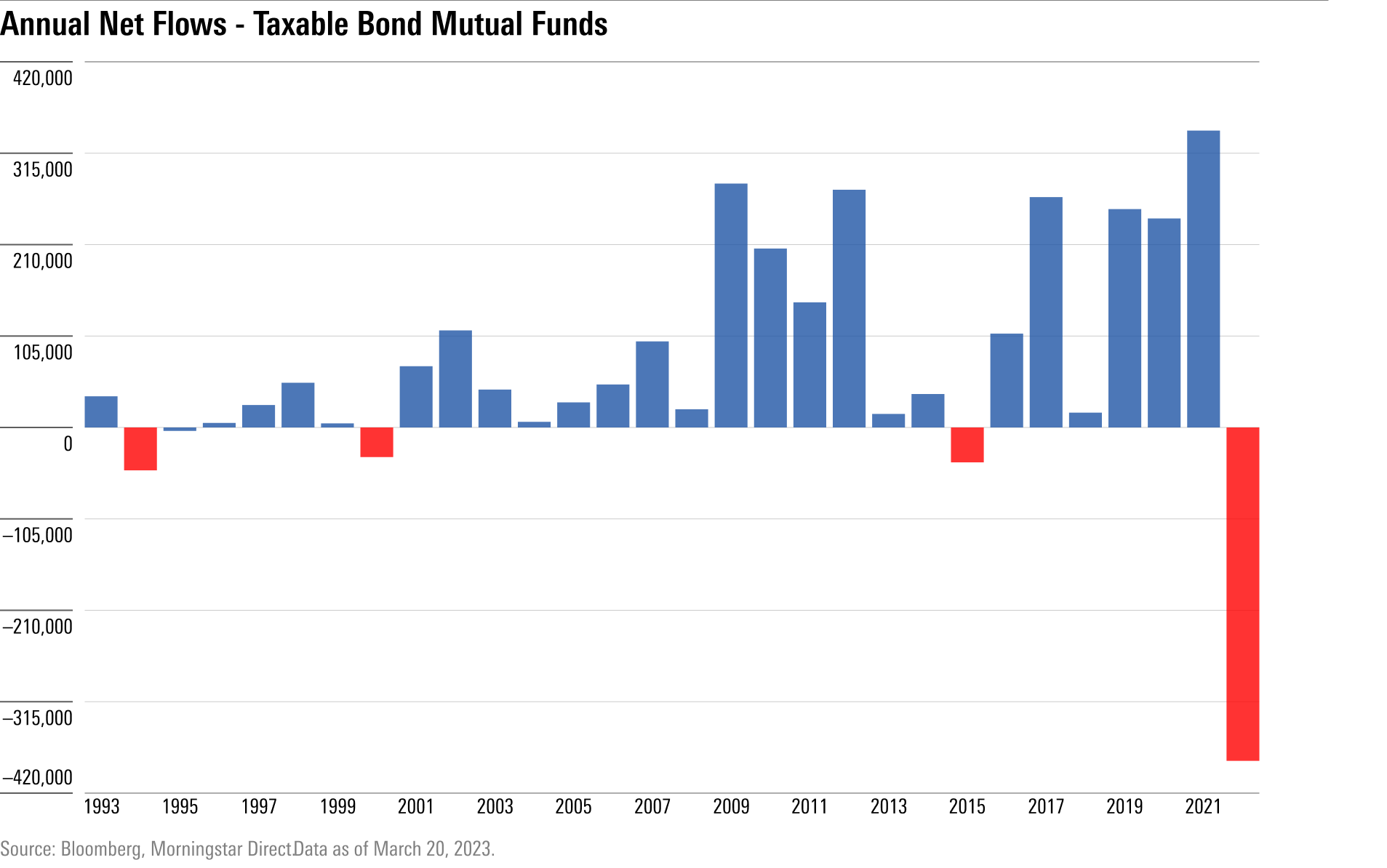

Taxable-bond mutual funds suffered $383 billion in outflows last year. Since 1993, these funds have only seen annual outflows three times. The single-year taxable-bond outflows in 2022 more than tripled the three previous years of outflows combined.

We often hear about performance-chasing, where investors pile into the asset that is going up the most. Last year’s bond market was an example of “performance un-chasing.” Many investors have capitulated on the asset class.

It would be fair to ask, could the bond market pain have been predicted in advance?

After all, we know bond returns are mostly a function of starting yield. Using the 10-year Treasury as an example, the yield was 0.50% in July 2020 when the bond market peaked. Effectively, there was no cushion for yields to buffer any pain from rising rates.

One important distinction to make is that rates didn’t have to stop at zero, and nobody rings a bell at market peaks. Nearly 80% of the European bond market had negative yields in July 2020. The possibility certainly existed that the same thing could have happened in the United States. While it may seem obvious now, it wasn’t then.

None of this is an attempt to bury the lede. Bonds have been painful and frustrating and have required a ton of patience.

But now the market has recalibrated, and yields have reset higher. Higher yields mean higher future returns. And for the first time in a while, you can make the argument that bonds provide true competition to stocks.

Put simply, most investment dollars go where they are treated best.

The 10-year Treasury yield went north of 4% late last year for the first time since 2010. Essentially, you can buy a near-riskless security (the U.S. government would have to fail) and earn 4%. It’s been a long time since you could say that.

Agency debt—bonds issued by U.S. government-sponsored agencies—yield around 5% in certain cases. A year ago, you would’ve needed to leverage the high-yield market to get that type of yield. Now you can get it backed by the U.S. government with minimal credit risk.

Keep going out on the credit spectrum and you can find parts of the bond market yielding high single digits to low double digits. Risk will be significantly higher in these types of bonds, but to some investors, these yields could draw in money that previously would’ve been invested in stocks. It’s been a long time since bonds have competed with stocks for investor dollars.

Extremely low rates also provided a major benefit to companies in recent years. Any business worth its salt took the opportunity to refinance and pushed debt maturities into the future.

For those reasons, evidence is mounting that bonds should provide more competition to stocks going forward.

The Opportunity in Bonds

No bell rang to signal a top, and no bell will ring to alert us about a bottom. Given where yields sit today, it’s not unreasonable to believe the worst could be behind us. To be fair, the range of outcomes remains wide. While inflation appears to be cooling off and the Fed appears set to slow down the pace of rate hikes, the future is never certain, and there could be a course correction.

Like most asset classes, as bond prices moved lower, the expected future returns rose, making them more attractive as investments. However, we remain cognizant that a “discount” to a prior price is not necessarily the same as a “bargain,” which is a discount to a fair price. As experienced Black Friday shoppers know, failing to differentiate between the two can be an expensive mistake.

But a key aspect of the bond market is interest rates adjusting higher from zero, hurting most at the beginning. An increase in rates from 4% to 5% will be much less dramatic than the move from 1% to 2%, for the simple fact that if you’re getting paid a coupon of 4% to 5% and you reinvest, it has a tremendous compounding effect that isn’t replicated with 1%–2% yields.

For bond investors, particularly those in retirement, this should be front of mind as you evaluate your portfolio. Capitulating on bonds now is akin to driving forward while looking through the rearview mirror.

A secondary consideration also looms, which is the possibility of a recession. Bonds possess a strong track record during economic downturns. Historically, the first half of a recession is typically marked by a decline in economic activity from a late-cycle peak. During this phase, U.S. Treasuries and investment-grade bonds have historically been positive, while returns for high-yield bonds, equities, and commodities have typically been negative.

It’s never guaranteed that past recessions will look like the next one, but a diversified approach to investing is likely the best way through. Most investors tend to understand diversification through an equity lens, but the same concept holds true in bonds.

Short-term bond yields currently offer their most attractive coupons in over a decade without taking on the greater interest-rate risk subject to long-term bonds. U.S. Treasury Inflation-Protected Securities also offer a means of hedging against unexpected inflation risks. High-yield bonds, in some cases, offer yields that are competitive to historical equity returns, though they come with higher volatility than other sectors of the bond market.

A Multi-Asset Approach

In short, there’s an opportunity for a multi-asset approach to the bond market. Investors can find attractive yields in today’s bond market that weren’t attainable in the recent past. Much of the past decade was defined by “TINA” (there is no alternative), but we are moving into a period of “TARA” (there are reasonable alternatives.)

While it was uncomfortable getting here, the future could be much brighter for bonds than the recent past. That’s the unfortunate feature of markets—things often get very ugly before they get pretty.

To state the obvious, things have been very ugly. Hopefully, the stage is set for better things to come.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3442650a-fd51-42c1-863b-733b24b6b6b8.jpg)

/s3.amazonaws.com/arc-authors/morningstar/4c343f77-c00a-4f59-9d1e-6d0de5e5a86f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3442650a-fd51-42c1-863b-733b24b6b6b8.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4c343f77-c00a-4f59-9d1e-6d0de5e5a86f.jpg)