Credit: Corporate Bond Markets Recuperate

But investors should brace for another bout of corporate credit spread volatility.

- Despite recent rally in high yield, volatility will re-emerge.

- Recent commodities price bounce shrinks spreads in high-yield debt.

- Negative credit rating trends continue in first quarter.

In our last quarterly outlook, we warned investors that the corporate bond markets would experience a significant bout of volatility during the first quarter. This came to fruition as the average spread of the Morningstar Corporate Bond Index widened significantly over the first six weeks of the year, bottomed out in mid-February, and recovered during the beginning of March.

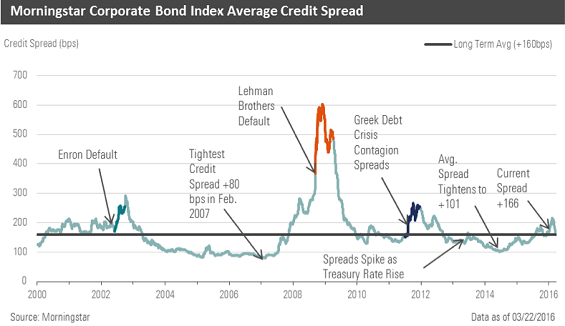

The credit spread reached its highest point since June 2012, when the markets were recovering from the European sovereign debt and banking crisis. A combination of plunging commodity prices and recessionary fears drove the widening among credit spreads early in the quarter. However, at the end of February, we noted that U.S. economic metrics were coming in better than expected and that oil prices had appeared to find a near-term bottom. Considering credit spreads at that time were near levels more consistent with recessionary periods, we opined that with the improvement in the economy and further recovery in oil prices, credit spreads could tighten in a snap-back rally.

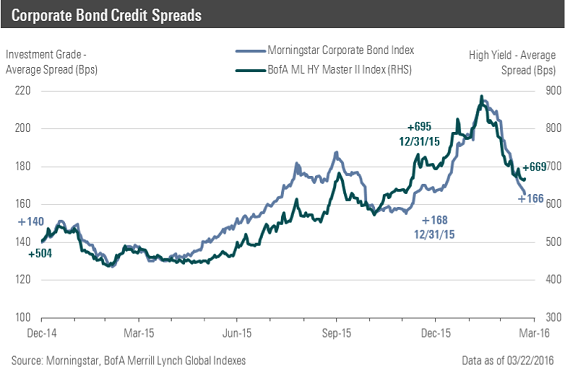

The average spread of the Morningstar Corporate Bond Index began the year at +168, peaked on Feb. 12 at +215, and then tightened to +166 by March 22. In the high-yield market, the average spread of the Bank of America Merrill Lynch High Yield Master II Index began the year at +695, peaked on Feb. 11 at +887, and then tightened to +669 by March 22. Similarly, the S&P 500 dropped as much as 10.51% before recovering its losses and is now essentially unchanged for the year. Oil prices fell as low as $26 per barrel and have since recovered to approximately $40 per barrel. From a longer-term perspective, excluding the depths of the 2008–09 global financial crisis, corporate credit spreads are near their long-term average.

One of the main culprits for the wild swing in credit spreads has been the energy sector. Since the beginning of the year, within the investment-grade index, the energy sector had widened as much as 116 basis points before making a round trip, returning to where it began. In our last quarterly outlook, we recommended that investors stick with more defensive sectors that have held up better in this volatile environment; however, toward the end of February, we revised our opinion in our Credit Weekly Highlights publication. We maintained our forecast that the U.S. economy would maintain its low growth mode, yet noted that credit spreads were near levels more consistent with recessionary periods. With oil prices having stabilized and beginning to move higher, we opined that the burgeoning snap-back rally in credit spreads had further to go. In such an environment, the securities in those sectors that had sold off the most would thus have much greater appreciation potential. Little did we realize at that time how much that statement underestimated the situation.

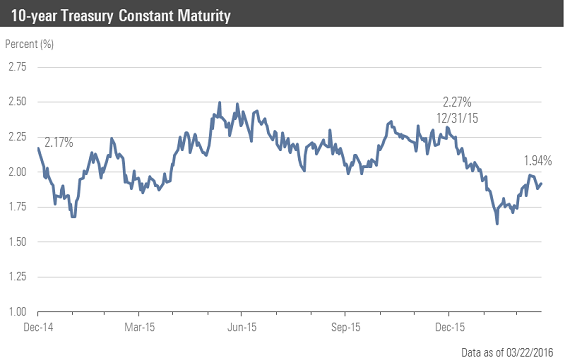

The "risk-off" sentiment that permeated the markets through mid-February drove investors to seek out the safety of U.S. Treasury bonds, driving long-term interest rates back toward their multiyear lows. Since then, the subsequent "risk-on" trade drove a reversal in rates, and yields have climbed as those same investors looked to sell Treasuries to reallocate assets back into corporate bonds. Yet, while interest rates have steadily climbed over the past few weeks, Treasury yields have not yet risen to the same levels as where they began the year. As of March 22, the yield on the 5-year, 10-year, and 30-year Treasury, are 1.41%, 1.94%, and 2.72%, respectively, on average about 30 to 35 basis points below the end of last year.

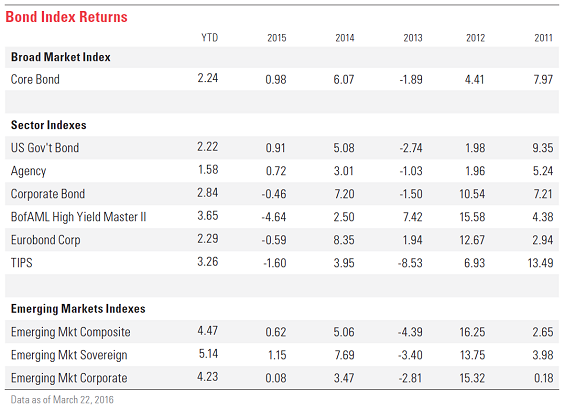

Even though credit spreads are close to unchanged in the investment-grade sector this year, underlying interest rates have declined significantly, and that has been enough to generate a 2.84% gain in the Morningstar Corporate Bond Index thus far this year. The European corporate bond market has experienced a similar return profile this year as the Morningstar Corporate Eurobond Index has risen 2.29%. In the high-yield asset class, the Bank of America Merrill Lynch High Yield Master II Index rose 3.65% year to date. Among other fixed-income asset classes, the U.S. Government Index has returned 2.22% and with core inflation edging over 2%, Treasury Inflation Protected Securities, or TIPS, have risen 3.26%. While the emerging markets have had a rough go at the beginning of the year due to capital flight from China to developed markets, the indexes have rebounded strongly with the Morningstar Emerging Market Composite Index rising 4.47%.

For second-quarter 2016, many of the same dynamics that impacted the first quarter are still in place, and we think investors should brace for another bout of corporate credit spread volatility. In such a volatile environment, investors should look to utilize sell-offs to increase exposures in those sectors whose underlying credit risk dynamics are unaffected by the downturn in commodity prices, but in which credit spreads widen in sympathy with overall market movement.

We expect the volatility to be bounded between by swings in expectations for a relatively stable economic environment in the U.S. as opposed to global economic recessionary fears in conjunction with downward pressures in the commodity sector. From an overall economic outlook, Morningstar director of economic analysis Bob Johnson expects real GDP growth in the U.S. to average between 2.0% and 2.5% in 2016, inflation as measured by the Consumer Price Index will average 2.5%, and the unemployment rate will range between 4.6%–4.8%. Based on these assumptions, he expects the yield on the 10-year Treasury to increase toward 3.00%.

Yet, while the U.S. economy should hold its course, we expect economic growth in China to continue to wane. Even though a very small percentage of U.S. exports are directly tied to China, as the second-largest economy in the world, a slowdown in Chinese economic activity will have ripple effects throughout the world. In addition, credit spread volatility will continue to emanate from the commodity sector, and more specifically, oil prices. Andy O'Conor, Morningstar's credit analyst covering the oil sector, believes that ongoing overproduction in the oil sector could lead oil prices to tumble once more.

With the recent recovery in commodity prices having likely having run most of its course over the past few weeks, prices are poised to either stabilize or reverse from current levels. Even at the current price levels, default rates in the energy and basic materials sectors will continue to climb over course of the year. This will increase the overall default rate; however, continued moderate economic expansion in the U.S. will continue to keep default rates in check among other sectors.

This expectation can be seen in the upgrades/downgrades that occurred during the first quarter. Three of the downgrades occurred in the energy sector (following four downgrades the prior quarter) and one downgrade occurred in the metal and mining sector (following six downgrades the prior quarter). We expect this trend to continue as we have five issuers in these sectors currently under review with negative implications. Further deterioration in credit metrics and subsequent downgrades will limit the amount that credit spreads will be able to tighten past historical averages.

In addition to the economic outlook and volatility in commodity prices, there is a new exogenous variable that will have an impact on the U.S. corporate credit markets. Not only has the ECB continued to expand its easy monetary policy by cutting financing rates further and increasing the negative yield on its deposit facility, but it has also increased the size of its monthly asset purchase program to EUR 80 billion from EUR 60 billion. As part of its quantitative easing program, the ECB has announced that it will begin purchasing nonbank investment-grade corporate bonds by the end of second quarter.

In our view, the ECB will not be a price-sensitive buyer of corporate credit risk as its main goal is to further expand its easy monetary policy in an attempt to bolster economic growth and stoke inflation, as opposed to traditional investors that look to maximize their return for a given level of risk. Toward the end of the second quarter, once the ECB begins this aspect of its purchase program, we expect credit spreads to tighten (or at least restrict the amount credit spreads would widen if global economic fundamentals are deteriorating), as supply is removed from the corporate bond market and those investors that sold their bonds will need to reinvest the proceeds.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)