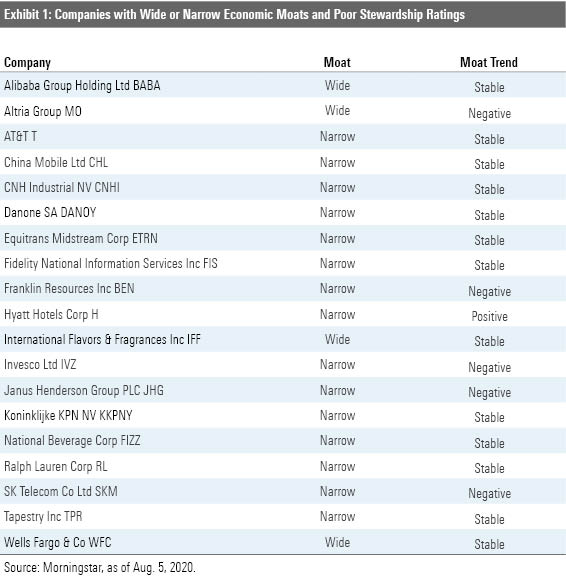

19 Good Companies With Bad Stewardship

These firms all have wide and narrow economic moats but earn poor stewardship ratings.

Life is filled with incongruities. We have, for instance, jumbo shrimp. Working vacations. Old news. Friendly takeovers.

Along those same lines in investing, we have what Morningstar would dub good companies with bad stewardship. These are companies that have carved out significant advantages (or economic moats) and are therefore quite likely to withstand the slings and arrows from competitors, but they've built those moats in spite of what we consider to be poor management.

At Morningstar, we judge stewardship from an equityholder's perspective. Our corporate Stewardship Rating represents our assessment of management's stewardship of shareholder capital, emphasizing capital allocation decisions. Analysts assign each company one of three ratings--Exemplary, Standard, or Poor--based on their assessments of how well a management team protects shareholder interests. Analysts consider a company's financial leverage, investment strategy, investment timing and valuation, dividend and share buyback policies, execution, compensation, related-party transactions, and accounting practices.

Deep Dive: Morningstar's Stewardship Rating for Stocks

Today we’re looking for companies that are competitively sound but not especially shareholder-friendly. Specifically, we screened for wide- and narrow-moat stocks with Poor stewardship ratings. Nineteen stocks made the list.

Here's a closer look at the stewardship of three of the names from the list. Premium Members can research the stewardship ratings for the remaining stocks on each stock’s individual analyst report.

Deep Dive: How to Read a Morningstar Stock Analyst Report

Altria Group MO "Our stewardship rating is Poor in light of the unjustifiable valuation paid for JUUL. The $12.8 billion investment valued the vaping competitor at a whopping $38 billion, or 40 times sales and 150 times EBITDA, according to Pitchbook data, and only several months after a previous capital-raising round had valued the company at less than half this level. Even if management's long-term cash flow targets, largely driven by international expansion, are met, we find it difficult to justify this valuation.

The Juul acquisition is a blot on the copybook of an otherwise strong management team. We applaud the company's focus on maximizing cash flow from the declining cigarette business while maintaining market share and leveraging pricing power. The management team also paid a high price for the U.S. Smokeless Tobacco acquisition in 2009 by issuing $7 billion in noncallable debt at coupon rates close to 10%, but this was executed by a former management team; in the years since, the acquisition has proved to have added some valuable assets to the portfolio. Altria has extracted a strong performance from the brands, particularly Copenhagen, which has grown volume at a high-single-digit rate during the past decade, and won share.

Altria has bought back over $1 billion in shares on average every year since 2012, but has not been particularly opportunistic, with a large buyback program occurring at the peak of the market price in 2017. Dividends are the company's top capital-allocation priority. The stated payout ratio target is 80% on an adjusted basis, which is probably appropriate, given the very few M&A alternatives in the tobacco space. It leaves little room for maneuver, however, if the firm wished to engage in one of the few legitimate targets such as Juul, or to step up its investment in next-generation products.

After two years in the top job, former CEO Howard Willard retired in April 2020, and was replaced by CFO Billy Gifford. We were not at all surprised by the move, given the value destruction of the Juul acquisition, although we were somewhat surprised that the board did not appoint an outsider. Gifford is a 25-year veteran of Altria. The board also split the roles of CEO and chairman for the first time since the separation from Altria, in a move we view favorably." Philip Gorham, director

AT&T T "We believe AT&T's recent capital-allocation decisions have destroyed shareholder value, resulting in our Poor stewardship rating. Since Randall Stephenson took over as CEO in 2007, AT&T's shares have returned about 3.1% annually, with dividends reinvested, trailing Verizon (7.9%), Comcast (10.0%), and the S&P 500 (6.5%) by wide margins. During this period, AT&T has handily outperformed smaller peers like CenturyLink and Frontier, where stewardship has also been lackluster, but we'd argue these firms were dealt weaker hands a decade ago. Stephenson plans to retire at the end of June 2020.

In particular, we disagree with the decision to buy DirecTV at a premium price. With 2015’s DirecTV purchase, AT&T acquired a satellite TV business that was, at best, peaking in maturity. By combining DirecTV with U-verse, AT&T became the largest U.S. pay-TV provider, providing it with content cost leverage. However, we don’t believe this scale advantage, which is rapidly eroding, has delivered significant benefits to AT&T. AT&T’s subsequent acquisition of Time Warner, also at a premium price, looks to us like an admission that the DirecTV deal hasn’t delivered the content advantages AT&T had sought.

AT&T’s pursuit of wireless spectrum has lacked discipline, in our view. In 2015, the firm spent $18 billion at the AWS-3 auction, equating to an unprecedented price/MHz-POP (a common measure of spectrum capacity and usefulness). Dish Network was a heavy bidder in that auction, and AT&T may have pushed prices higher to stall this would-be competitor. However, we don’t believe AT&T has anything to fear from Dish, and we think this capital would have been better spent elsewhere. For context, the AWS-3 purchase equated to nearly $3.50 per share at the time, or about 10% of the stock price. AT&T has only recently put this spectrum to use.

The current period of heavy capital deployment began in 2012 with a massive share-repurchase program that, at the time, was billed as a temporary move away from AT&T’s 1.5 times net debt/EBITDA leverage target. The firm repurchased $27 billion of its shares through 2014, pushing leverage to 1.8 times. That activity reduced balance sheet flexibility as the firm subsequently pursued the AWS-3 auction, the DirecTV deal, expansion into Mexico, and the Time Warner acquisition. With leverage now at around 2.5 times EBITDA, we don’t believe AT&T’s capital structure lines up well with the emphasis that it and its shareholders place on a large dividend payout. Dividend growth will likely remain lackluster for the foreseeable future as a result.

Edward Whitacre served as chairman and CEO of AT&T from 1990 to 2007, transforming the former SBC into a global telecom behemoth through a series of acquisitions, including Ameritech, BellSouth, and the former AT&T. His successor, Randall Stephenson, has been with the company since 1992, previously serving as COO. He was also CFO from 2001 to 2004. Under Whitacre, the firm’s board membership was deeply entrenched and included several overlapping directorships. Membership has since turned over, with the pace of change accelerating sharply in recent years. Eight of AT&T’s 13 board members have been appointed since 2013. New appointees have come from a variety of backgrounds, including private equity and government.

Stephenson's leadership has come into question with the involvement of activist investor Elliott Capital. Elliott chose to go public with its concerns regarding AT&T after longtime Stephenson lieutenant John Stankey was promoted to the role of president and COO, making him heir apparent. AT&T recently made Stankey's promotion official, announcing that he will take the reins on July 1, 2020. With AT&T for more than 30 years, Stankey was tasked with running WarnerMedia after the acquisition. Heavy executive turnover at Warner was among Elliott's concerns." Mike Hodel, director

Wells Fargo WFC "We rate Wells Fargo's stewardship as Poor. The bank has struggled mightily over the past several years, underperforming peers, and based on the details released in the House Financial Services Committee reports, progress has not been good behind the scenes. We originally held off assigning the bank a Poor rating, given all the personnel changes among the board and management (almost all the old management team and board are now gone), as well the internal reforms that were supposed to be occurring; however, the details of the reports suggest that progress has been poor, and even new board members were as bad as the previous ones. Therefore, we believe a Poor rating is now appropriate.

We have not yet come across information that suggests that CEO Charles Scharf is doing a poor job, and he may yet be the one to turn things around at Wells; but, until he and his new slate of managers prove to us that stewardship at Wells Fargo has improved, we will maintain our Poor stewardship rating.

The issues at Wells over the past several years are many. The bank submitted unsatisfactory resolution plans to the Fed multiple times, has been unable to get past its multiple scandals, and is still under an unprecedented asset cap from the Fed. As CEO, John Stumpf did a poor job of maintaining a proper sales culture in the bank, and with a poor performance in front of Congress, it was the right move for him to step down in 2016. Tim Sloan faced a difficult tenure as Stumpf’s successor, and it does not appear he made much progress with cleaning up the bank while he was in charge.

We believe it is fair to place at least some responsibility for the bank's previous sales practices--and living will deficiencies--on Sloan, as he had worked as the bank's COO, CFO, and chief administrative officer during years when sales abuses were occurring on some level. It also appears that little progress was made under Sloan's watch on reforming the bank, with Sloan often presenting a misleading picture to the public about what was actually going on. For example, guiding that the asset cap would probably be removed at the beginning of 2019 now appears laughable.

We hope that Scharf will bring a more realistic and effective tenure of management for Wells, and indeed, Scharf has made a number of notable hires, changing the reporting structure, and has promised that there are many opportunities for cost-cutting. Time will tell if Scharf will be the one to turn Wells around." Eric Compton, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)