Intelligent Indexer: Walking the Reconstitution Tightrope During the Market Meltdown

The timing of the coronavirus outbreak posed unprecedented challenges for index providers. Here’s how Morningstar navigated the turmoil.

With this column, we kick off a new series for asset-management professionals written by Morningstar’s head of index products, Sanjay Arya. This article is adapted from research that was originally published in Morningstar Direct’s Research Portal. If you’re a user, you have access. If not, take a free trial.

The market turmoil that rattled global markets following the outbreak of the coronavirus had a wide-ranging impact on the financial ecosystem. A combination of extreme market volatility in the first quarter of 2020 and loss of liquidity put global asset managers in the eye of the storm. Perhaps less visible were the challenges posed to index fund managers and index providers who support trillions of dollars in passively run strategies.

As a provider of indexes across major asset classes, Morningstar felt the full weight of the events as they unfolded. The timing of market turmoil coincided with index reconstitution and posed unprecedented challenges. Here's a look at what happened and what we've learned.

Cross-Asset Liquidity Crisis Across the industry, March is a significant month for reconstituting and rebalancing index portfolios. Given the short window of time within which index fund managers need to implement additions and deletions, orderly market conditions are vital.

The changes resulting from index reconstitution can lead to price dislocation and tracking error. Hence, reconstitution-related transaction costs can be burdensome for portfolio managers, manifesting as higher-management costs, higher levels of tracking error, or both.

The market correction following the outbreak of COVID-19 earlier this year was unprecedented in speed and scale. The Morningstar US Market Index dropped 35% in 33 days from peak to trough--the fastest bear market in history. The same period was marked by bouts of extreme volatility, which set in motion a global domino effect. Exchanges around the world triggered circuit breakers multiple times to curb panic selling. Restrictions were imposed on short-selling in several markets.

The market correction across other high-quality assets was equally dramatic. The Morningstar US Corporate Bond Index (which tracks investment-grade corporate debt) was down 15.6% over 14 days. The Morningstar Long-Only Commodity Index lost 36% from its high point.

An obvious casualty was market liquidity. To compound matters, the shelter-in-place restrictions and lockdowns across the globe significantly impacted the infrastructure that supports trading activities.

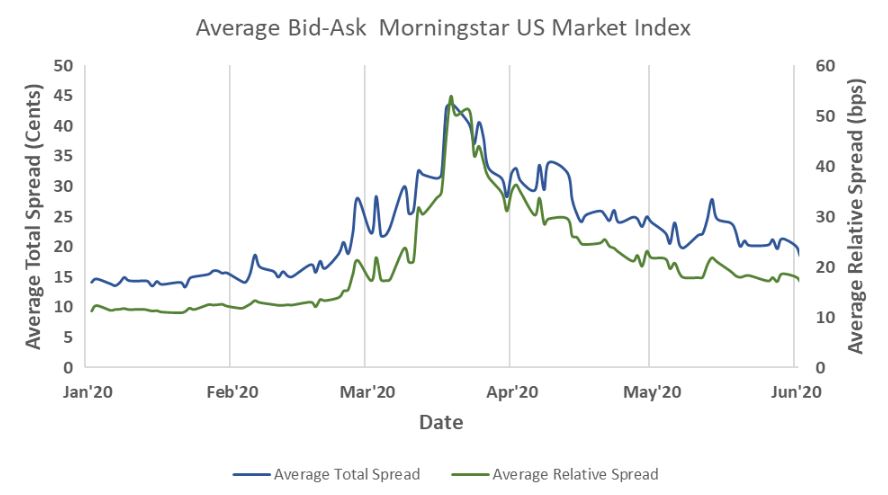

One of the most visible metrics of liquidity--the bid-ask spread--reflected the impact of the market collapse and uncertainty.

Since the last major market collapse during the global financial crisis of 2008, the landscape of liquidity providers has changed. Because of a series of regulations, large banks and securities dealers have been constrained in their ability to serve as market makers. Smaller dealers, hedge funds, and similar firms have picked up some slack as the large dealers have pulled back, but there are real limitations in their ability to do so cost-effectively.

At the same time, central banks have stepped in to play an increasingly bigger role as providers of market liquidity by exercising different levers at their disposal. First, by loosening monetary policy and easing the flow of capital, central banks around the world appear to have provided considerable support for market liquidity. And second, they offer direct support through various quantitative easing programs that purchase securities in the open market in order to shore up the markets.

Against that backdrop, when the COVID-19 crisis hit markets with full force in the third week of March, the average bid-ask spread on securities in the Morningstar US Market Index was 3 times the average seen over the past six months (see the exhibit below). And as turmoil hit global markets, the same theme played out across bond, commodity, and foreign-exchange markets. The ease of buying and selling even the safest, most high-quality assets deteriorated rapidly.

Source: Morningstar.

In Index Providers We Trust At Morningstar, we oversee indexes across major asset classes--equities, fixed income, and commodities as well as multi-asset indexes. As the markets were moving fast and furious in the lead up to the March index reconstitutions, there were concerns about the ability of asset managers to ensure orderly portfolio transitions. We were actively communicating with our clients in the days leading up to the reconstitution, and it was clear without any exception that clients would follow the index and have their products mirror our index makeup.

But on our end, what were we to do? We considered three different options and the risks associated with each:

1) Stay the course and follow the rules. Predictability and consistency are the hallmarks of indexing. Following published rules takes any uncertainty or ambiguity out of the process. And that's what our clients expect us to do. Deviating from the published rules, without a clear standard to lean on, would create implementation and governance issues. More importantly, though, it would put the credibility of the index provider into question.

2) Postpone or suspend reconstitution. If markets are truly frozen, this would be the prudent approach. However, we were wading into uncharted waters, and this option was beset with challenges. Since this would be a departure from our standard operating procedure, market participants would need adequate lead time to recalibrate their processes. Information would need to be shared with all market participants as early as possible. There also would be legal and governance issues to be considered if we were to depart from index rules.

3) Apply partial reconstitution. In the case of multi-asset indexes, we would move ahead with reconstitution for asset classes where market conditions supported an orderly portfolio transition. Conversely, for asset classes where market liquidity was scarce, we would postpone reconstitution. Hypothetically speaking, if we felt that the liquidity in the bond markets was too low to enable orderly trades, we would postpone the reconstitution of the fixed-income allocation in the index but move ahead with the reconstitution of the equity allocation. However, in the case of multi-asset indexes, in addition to the intra-asset-class reconstitutions, there is also rebalancing that takes place between asset-class weights to bring the index in line with its investment policy mandate. Inevitably, the portfolio manager would be forced to trade the fixed-income portion of multi-asset-class indexes, and there would be no way to avoid trading the fixed-income portfolios. While this option has some merit, it wouldn't preclude the problem.

As we wrestled with managing an orderly reconstitution, we had numerous conversations with our clients. Some were struggling with finding enough market liquidity to implement portfolio changes. Ultimately, though, our response was shaped by Morningstar's core value of acting in the best interests of end investors. In every instance, we decided to stay the course, leaning on the published rules without changes. Predictability and clarity for investors won out. To quote a large client: "Notwithstanding the volatility in the markets, the markets were orderly, and reconstitutions went without a hitch."

Indexing as Art and Science Indexing has been at the heart of shifting the investment profession from art to science. But the recent crisis is a reminder that rules are only as good as their impact on the investor experience during times of market stress. The broader industry response was mixed--there were some index providers who suspended their reconstitution; while others, including us, stayed the course.

Recognizing that financial markets are shaped by dynamic factors is important. The industry would do well to adopt a model that strikes the right balance between preserving the best practices in index construction and allowing providers to be nimble in responding to the needs of changing financial markets. Index rules could make allowances for extreme circumstances and give providers flexibility on the timing of reconstitutions and rebalancing in times of volatility and illiquidity. Recognizing that indexing is both art and science will improve investors' odds of success.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)