Healthcare Sector Less Appealing After Market Rebound

Changes to U.S. healthcare policy no longer a major fear.

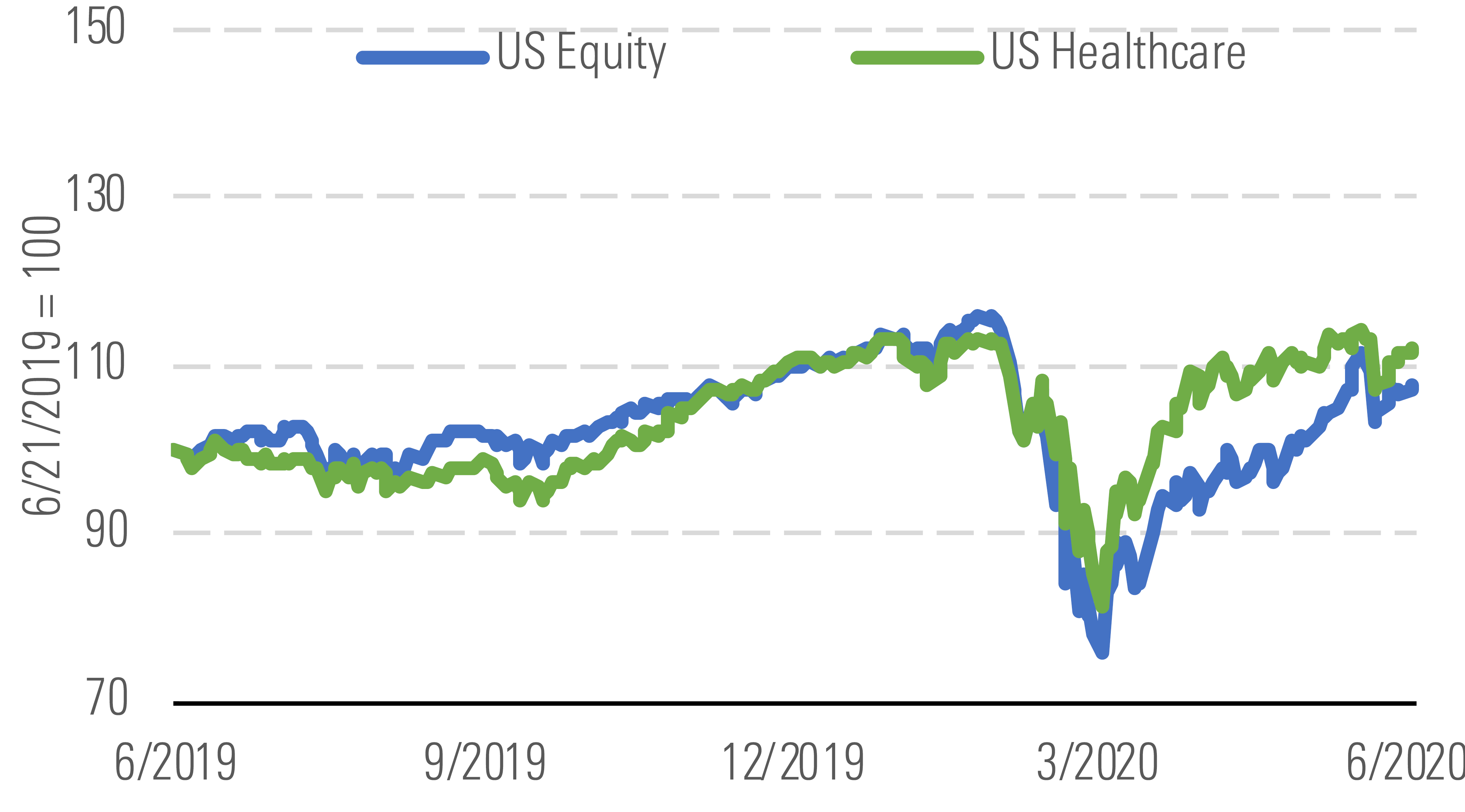

Morningstar's US Healthcare Index has increased 12% over the trailing 12 months, as global concerns regarding the coronavirus eased significantly in the second quarter. Additionally, the returns have outperformed the broader equity market performance of an 8% gain. We believe the solid underlying fundamentals of the healthcare sector are supporting the returns. Also, the defensive nature of healthcare is likely supporting relative returns, as concerns around recessions and other coronavirus impacts weigh more heavily on other sectors. On the policy front, we expect investor attention to return to potential changes in the U.S. with the upcoming elections. However, the fears of major healthcare policy change in the U.S. appear to have faded, with the more moderate Joe Biden the presumptive Democratic nominee for president.

Healthcare sector index versus market index. - source: Morningstar

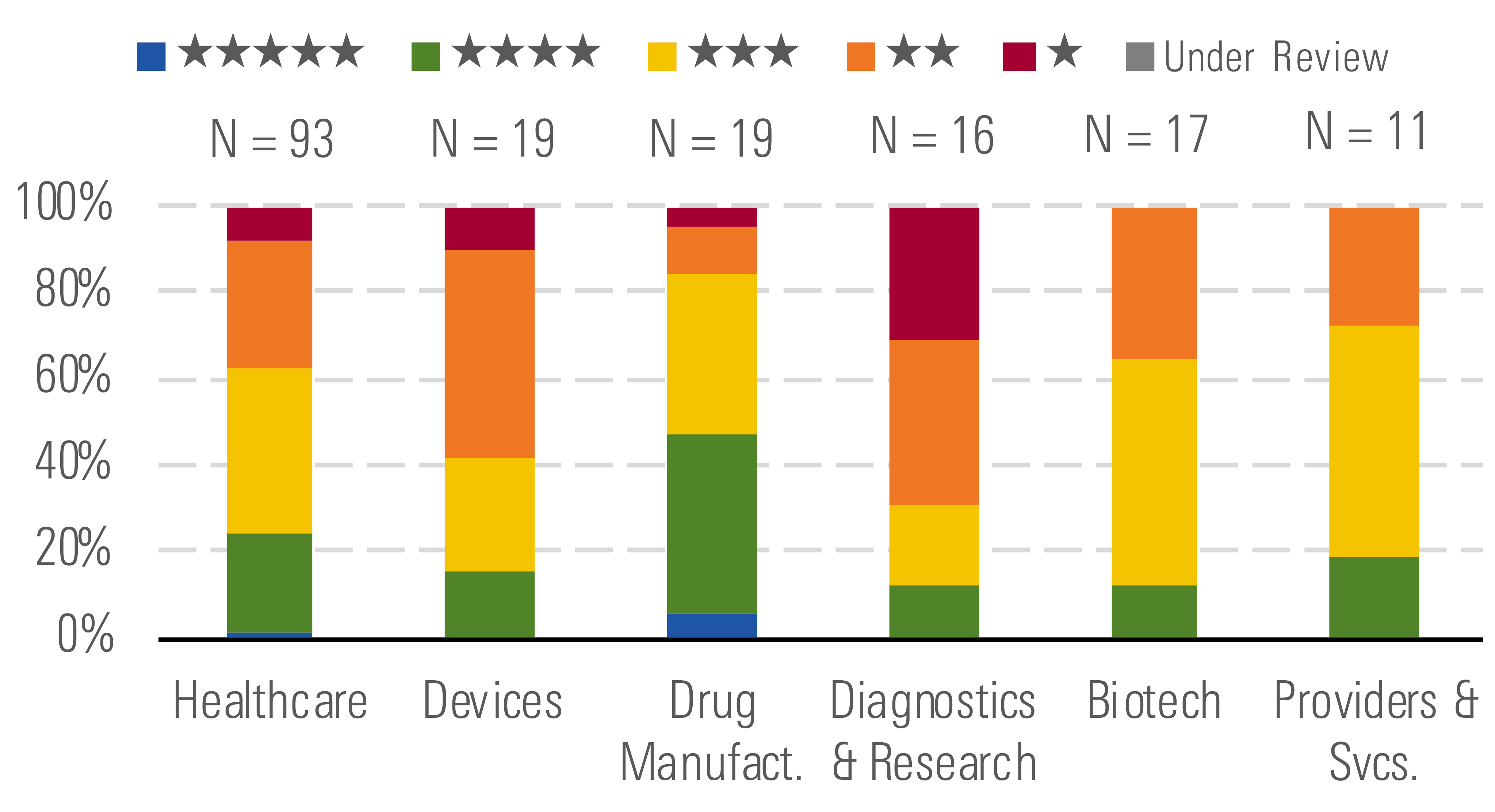

Overall, we view the healthcare sector as slightly overvalued following the recent market rebound. Our coverage trades at a premium to our overall estimate of intrinsic value, with the median price/fair value at 1.06. Given strong recent market gains, we see fewer buys in the sector, with less than a fourth of our coverage rated 4 or 5 stars. However, the most undervalued firms are in the drug manufacturer and managed-care industries.

Star rating distribution and average P/FV for sector and industry groups. - source: Morningstar

On coronavirus impact, we see fewer negative headwinds to the drug and managed-care industries as patients prioritize drug therapy and avoid costly elective surgeries that can weigh on managed-care margins. Conversely, we expect increased negative pressure to the device, dental, life sciences, and hospital industries as patients avoid in-office visits and hospitals reduce capacity to perform high-margin elective procedures.

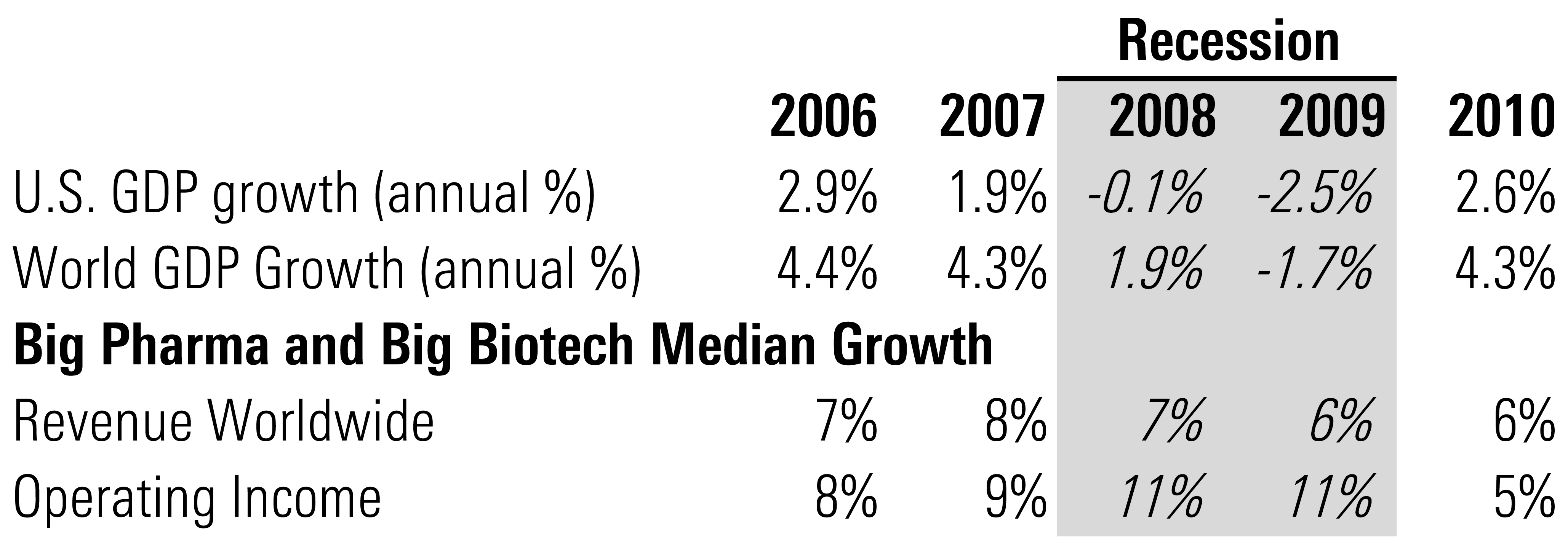

Big Pharma and Biotech revenue and income held up in last recession. - source: Morningstar

We expect the healthcare group to emerge largely unscathed from the recession related to the coronavirus over the long term, as healthcare demand is less sensitive to the economy. In the last recession, the drug and biotech groups held up well. Additionally, we expect the duration of the coronavirus pandemic and related economic pressures to ease by 2021 largely due to the strong progress with vaccine development. However, we don’t expect these vaccines will drive major cash flows for the drug companies due to likely pricing at nonprofit or near nonprofit levels. Nevertheless, we expect the drug industry to use the goodwill generated in creating the vaccines to help in long-term drug pricing negotiations.

Leading coronavirus vaccine candidates and expected timelines. - source: Morningstar

Top Picks

Pfizer PFE Economic Moat Rating: Wide Fair Value Estimate: $42.50 Fair Value Uncertainty: Low

The market is underappreciating Pfizer's next-generation drugs, which should drive strong long-term growth. Further, the pipeline drugs focus on areas of unmet medical need where pricing power is strong. Additionally, the company is facing very few major patent losses over the next five years, which should also support steady growth. Lastly, the divestment of the established products group Upjohn to Mylan creates a new entity with robust cash flows, likely supporting a strong dividend. Also, we expect Pfizer's operations to be more immune to disruptions caused by coronavirus outbreaks.

CVS Health CVS Economic Moat Rating: Narrow Fair Value Estimate: $92 Fair Value Uncertainty: Medium

The firm's combination with Aetna should put the company in a much more attractive competitive position as the industry moves toward a more integrated service offering. Investors should benefit from meaningful cost and selling synergies associated with the combination of a leading medical benefits business with the largest PBM and retail pharmacy network in the country. However, the social distancing period caused by the coronavirus is a concern for the retail business, but we don't forecast this as a long-term headwind.

MORN DODFX VINIX VWILX TSVA EGO WU Brightstart429plan MRO VZ MOAT T NKE CMCSA GOOG

/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90c659a-a3c5-4ebe-9278-1eabaddc376f.jpg)