Seeking Financial Information? Keep Your Rules in Mind

Make decisions methodological, instead of attention- and emotion-driven.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

I check the market news far more often than I should, from the latest coronavirus business updates to the wild gyrations of the stock market. It looks like many of you are in the same boat. But are we reading and viewing material that will improve our investment outcomes--or chasing trends? It is perhaps inevitable that dramatic events will catch our eye. The key is to then take a step back and use behavioral techniques to respond mindfully.

Drawing Our Attention According to traffic data for Morningstar.com, many more people are coming to our site to learn about investing and investments: There has been a 40% increase since the crisis began. Not only are more people coming to the site, but visitors are also interacting with more material, as measured by page views--that is, each time visitors click on specific pages on the site.

Other finance-industry websites are also seeing a significant increase in traffic. The online service Alexa.com estimates and ranks the relative number of page views for major sites across the Internet. According to its data, Morningstar, Schwab, Fidelity, TD Ameritrade, and others have all seen a big jump, relative to the rest of the Internet, since mid-February.

In other words, the data suggests we are devoting more time to investing sites at the expense of other online activities. It’s no surprise that more of us are paying more attention to our finances. But where is that attention going?

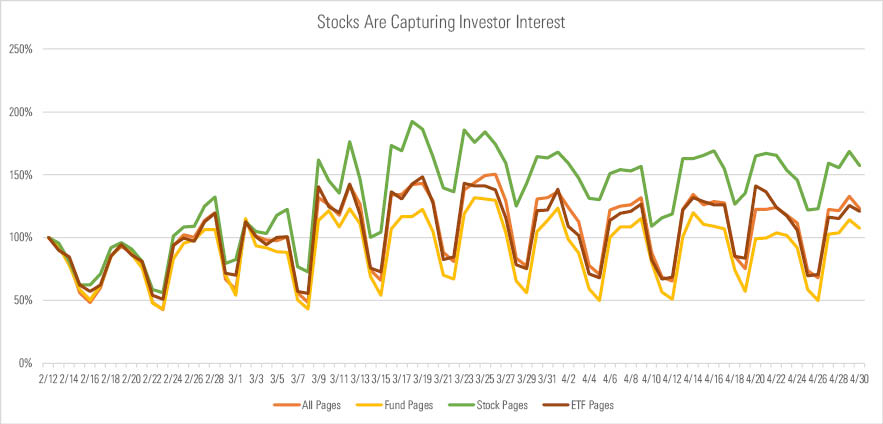

Stocks Tell a Story Visitors to Morningstar.com have been drawn toward individual stocks. As the chart below shows, the increase in visits to stock pages approached 200% some days, outstripping more-moderate increases across the site and visits to both exchange-traded funds and mutual fund pages. This and the exhibits that follow show the increase in page views relative to their values on Feb. 12, 2020, the day the Dow Jones Industrial Average recorded its highest close in history.

Savvy stock investors may stand to benefit from market volatility. But there are real risks here, too: that we will get too excited (or fearful) and react emotionally, or that we are focusing too much on stocks covered in the media and not enough on the broader opportunities.

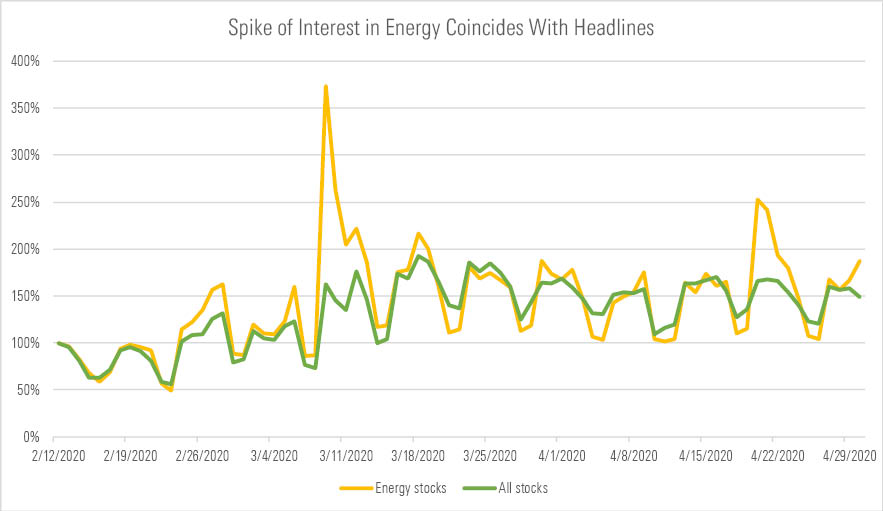

Our data shows that we are seeking more information on stocks that dominate the headlines. The picture below tells the high-level story nicely. The graph shows the number of page views for all stocks, compared with pages specifically on energy-sector stocks, on Morningstar.com. Remember the oil-price war between Saudi Arabia and Russia? The price of oil tumbled on March 9, and that major news story corresponds to a spike of interest--a 350% increase--in energy stocks.

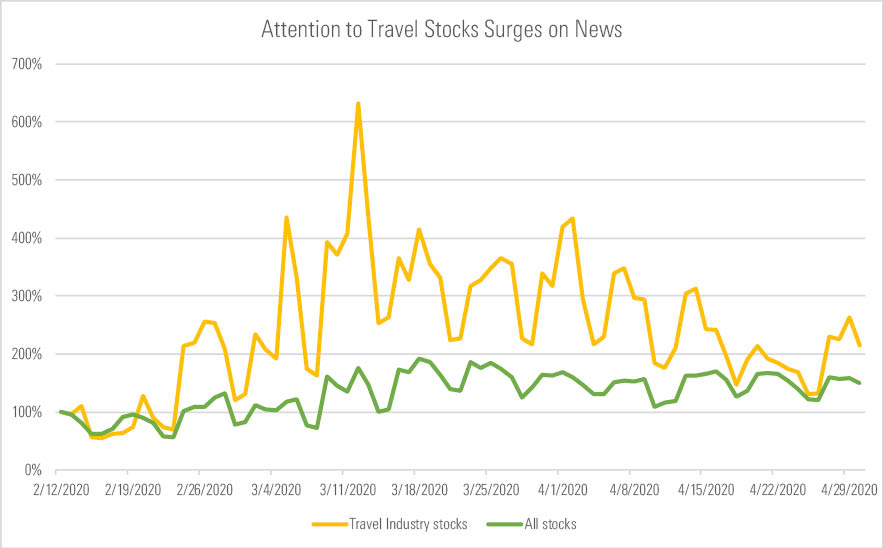

Similarly, interest in

has been consistently higher than that in stocks overall, with surges corresponding to a string of bad news. Traffic notably picked up on Feb. 24, days after the first reported deaths from

. The peak came just after President Donald Trump announced a travel ban from Europe, on March 12.

Together, this data offers some hints about how we as investors are thinking about the global pandemic and its market consequences. We’re devoting more of our overall attention to investing (relative to the rest of the Internet), and that attention is concentrated on individual stocks (relative to funds). We are also responding sharply to news in the media such as the onset of the oil-price war and the travel ban. Those responses are short-lived, however, with sharp peaks of attention for only a day or two.

Does Attention Translate to Action? It's harder to draw broad conclusions about what this behavior suggests about investor outcomes. Is this attention linked to investment behavior--and if so, are we showing collective wisdom or chasing the herd?

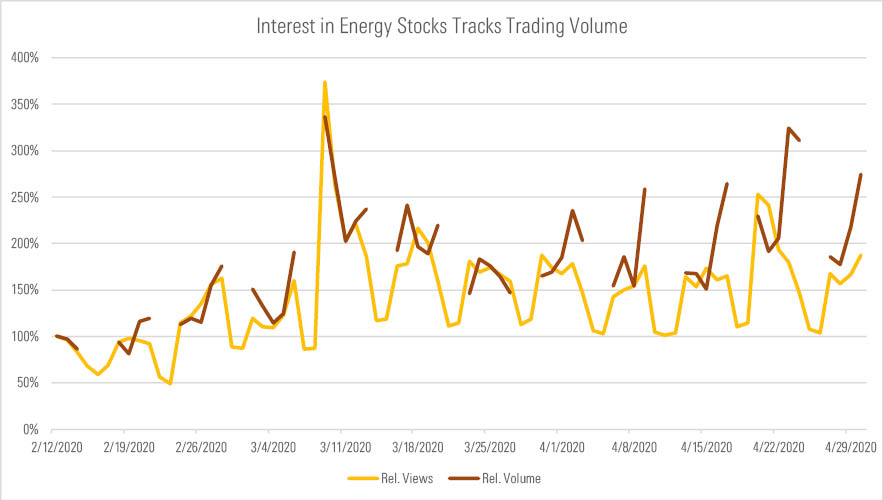

For clues, we can compare attention on Morningstar.com to broader trading behavior. When trading volume for stocks is overlaid on page view data, it is apparent that the two closely track each other. That suggests that investors may be acting on their interests. For example, here’s what it looks like for the energy sector. (We’ve filtered out days on which the market is closed.)

Influential research by Brad Barber and Terry Odean suggests that the buying behavior of individual investors can be driven by news coverage. In a widely cited 2008 paper titled "All that Glitters," they found that individual investors, who have limited time in the face of overwhelming choice, tend to focus on investments that grab their attention. As individual investors, we tend to buy stocks when there are large price gains or drops, or on days when there was a news event that otherwise drove volume.

The data we’ve gathered so far isn’t conclusive, but it is possible that we are engaging in attention-driven buying and perhaps attention-driven selling as well. And it is worth noting that Barber and Odean found that “the attention-driven buying patterns … do not generate superior returns.”

Shaping Our Attention and Behavior Our desire to seek investment information in tumultuous times is understandable. Knowing that, we can direct our attention thoughtfully, while curbing impulsive investor behavior.

One of the most straightforward techniques we can use is to “externalize”: to write out the rules we want to use when investing, and follow those rules instead of reacting in the moment to a news story.

The rules should cover how we select investments. For example, I use a filter based on Morningstar's price/fair value estimate, such as our Morningstar Ratings for stocks. That helps me pay attention to stocks that our analysts say are worth examining--whether or not they are in the news. Similarly, I set rules for trading based on these estimates, among other factors. That's an example of externalizing the investment process to make it more methodological, instead of attention- and emotion-driven.

Morningstar doesn’t have enough data yet on the trading patterns of different types of investors during the current market downturn to know for sure whether people are falling prey to attention-driven buying or selling. But it’s something we’re investigating. And, of course, while we’re doing that, I’ll be checking in on the latest on market headlines: I’m only human.

Steven Berger contributed the research for this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cc15194e-3c37-4548-9ca8-782ff113938c.jpg)