9 Undervalued Essential Stocks

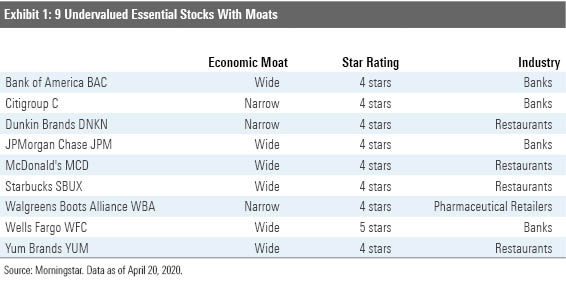

The stocks of these wide- and narrow-moat companies providing “essential” services are trading at discounts to their fair value estimates.

Editor's note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

During the COVID-19 pandemic, state officials have been deciding what businesses are “essential” and can therefore remain open during stay-at-home orders. Healthcare facilities and pharmacies are, of course, necessary. Grocery stores are as well. Gas stations, banks, and restaurants offering take-out make the cut. And in many areas, home improvement and liquor stores do, too.

Controversy erupted last week, however, as Florida officials redefined the term "essential": They deemed World Wrestling Entertainment to be an essential business. The WWE, which maintains a sizable training facility in the state, can now resume broadcasting from that facility as long as its events don't include a live audience. A Stone Cold Stunner, indeed!

Today, we’re steering clear of controversy. Instead, we’re sharing several undervalued stocks with Morningstar Economic Moats of wide or narrow, hailing from industries that most would agree are “essential” today: restaurants offering takeout, banks, and pharmacies. All are trading in 4- and 5-star range as of this writing, suggesting they’re undervalued. Notably, no grocery or home improvement stores look undervalued by our metrics.

We’ve recently published updates on six companies from the list:

Citigroup Prepares for a Tough 2020; ICG Revenue Strong

Bank of America Losses are Manageable

Wells Fargo’s Quarterly Losses Manageable at This Stage

Tough Quarter for JPMorgan; Lowering Fair Value

Starbucks’ Foundation for Future Growth Remains Intact

How We View McDonald’s After COVID-19 Financial Update

Here's our latest thinking on the three other names from the group: Dunkin Brands DNKN "The global food-service industry has come under pressure as several markets have restricted dine-in service in an effort to curtail the coronavirus outbreak. Restrictions vary by geography, but even in markets where carry-out and drive-thru orders are still permitted, we expect severe guest count declines for at least the next two months and an uneven traffic recovery into the back half of 2020. Nevertheless, we believe investors should prioritize those firms that have the scale to be more aggressive on pricing near-term (value-oriented players tend to outperform during economic shocks), developed robust mobile platforms, and possess healthy balance sheets. In our view, Dunkin Brands satisfies the value and mobile technology criteria, and while we believe some franchisees will experience severe distress, we think the company offers a dynamic global consumer growth story.

In our view, Dunkin's long-term cash flow potential is augmented by a strong brand intangible asset and franchisee system, particularly in the Northeast U.S. We believe Dunkin' can extend its brand reach beyond core markets, supported by solid franchise unit economics, national advertising efforts, and more technological-leveraged and drive-thru-focused restaurant formats. Franchisees own all Dunkin' Donuts and Baskin-Robbins locations, providing an annuitylike royalty stream with few capital requirements. This stability, coupled with strong unit growth prospects, inroads into the CPG channel, and supply-chain improvements, could drive ROIC excluding goodwill to the low 30s (from the low- to mid-20s today).

Despite our optimism about Dunkin's asset-light business model and long-term growth potential, we believe the global specialty coffee category will see increased competition from existing players as well as breakfast daypart expansion from QSR chains. However, we're optimistic about "Blueprint for Growth" strategies such as an improved beverage/breakfast sandwich pipeline, expanded espresso capabilities, streamlined menu, targeted value offerings (including the "Go2" breakfast sandwich platform), new store configurations, and DD Perks digital marketing/"On the Go" ordering functionality." R.J. Hottovy, strategist

Dig deeper: What Restaurant Closures Mean for Restaurant Industry

Walgreens Boots Alliance WBA "Founded in 1901, Walgreens Boots Alliance is the leading pharmacy retailer leveraging scale to provide convenience. Currently, the company generates nearly $140 billion in revenue and dispenses over a billion prescriptions annually, representing a quarter of the drug market. The over 10,000 domestic stores are strategically located in high-traffic areas to generate over $13 million per store, which drives scale and helps enable the company to negotiate more effectively with suppliers. Scale remains critical in an increasingly competitive market that has witnessed some rationalization of subscale peers. The core business is centered around the pharmacy which accounts for nearly three fourths of revenue and is the main driver of traffic. Management will need to pull through more volume in the recently acquired Rite Aid locations along with stores abroad as reimbursement stabilizes in Europe.

Narrow-moat Walgreens Boots Alliance reported stronger-than-expected second-quarter results that were ahead of our and CapIQ expectations, largely reflecting strength in wholesale, cost-saving initiatives, and share repurchases. These were offset by continued international weakness and reimbursement pressure. Management noted unprecedented traffic during the first 21 days of March, resulting in a revenue increase of about 30% followed by double-digit declines after hoarding of supplies and prescriptions slowed dramatically. To comply with local and federal travel restrictions, internal resources have been reallocated, which will result in $65 million in incremental expenses that are expected to diminish over time, and internal strategic initiatives have been halted. Also, management pulled fiscal guidance, and we continue to anticipate volatility in the short term. Management will maintain its attractive dividend policy, which will continue to grow with cash flows. We maintain our narrow moat rating, but we have shaved our fair value estimate to $55 to reflect the delayed realization of transformation benefits.”

Soo Romanoff, analyst

Yum Brands YUM "Mirroring steps by its peers, wide-moat Yum Brands announced several measures to better navigate coronavirus-related restaurant operating restrictions and changes in consumer behavior, including a $525 million drawdown on its revolving credit facility and suspension of its $2 billion share repurchase program. Following the $425 million borrowed to complete the acquisition of The Habit Restaurants, the company now has $950 million drawn on its revolving credit facility (in addition to $10.6 billion debt on its balance sheet as of December) and more than $1 billion cash and cash equivalents. The company currently remains in compliance with all credit facility covenants.

Yum also provided additional color regarding the measures it is adopting to aid franchisees who need greater access to capital, including a grace period for certain near-term payments where necessary (both in the United States and internationally) and allowing franchisees to defer 2020 capital obligations for remodels and new unit builds through the end of the year (U.S. only). While Yum will still have distressed franchisee situations to deal with--including NPC International, which operates more than 1,200 Pizza Hut locations and was already exploring restructuring alternatives before coronavirus-related restrictions were implemented--but we believe these measures will help to minimize possible franchisee disruption in 2020.

From a sales standpoint, management disclosed that first-quarter consolidated comps would experience a mid- to high-single-digit decline and that second-quarter comps would likely see a "more significant" decrease than the first quarter. This is consistent with our current model assumptions (updated March 17) which call for a high-single-digit decline in the first quarter and low to midteens decline in the second quarter, and as such, we're not planning a change to our $102 fair value estimate and we see shares as undervalued.”

R.J. Hottovy, strategist

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)