Go Active in Emerging Markets

Here are a few ways to cope with the risks in emerging markets.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Stock markets around the world have been roiled as the spread of coronavirus has put economies on pause. The tumult has reminded investors of the risks inherent in stocks.

Emerging-markets stocks rank among the world’s riskiest. But they also have greater potential to be mispriced. That creates opportunities for active managers to deliver better performance than a market-cap-weighted index fund.

A stock market’s capacity to accurately price shares relies on a wide range of opinions about an underlying company’s true value. Its participants also require the ability to express those opinions through the price at which they transact. Any restrictions, whether they limit the degree of participation or inhibit trades from occurring, can cause a stock’s price to deviate from the underlying company’s true value.

Major emerging-markets countries like China, Russia, and India impose foreign ownership restrictions on some, or all, of their publicly traded companies. Some segments of these markets may only be available to a select group of foreign investors. For example, Russia’s media companies closely scrutinize and limit foreign investments to prevent outsiders from adversely influencing the country’s communications networks. These policies limit access to certain stocks and can reduce the diversity of opinions that is necessary to arrive at accurate share prices.

In some emerging markets, participants have fewer ways to express their opinions. China only allows certain blue-chip stocks to be sold short, so investors in the Chinese market cannot always bet against stocks they believe to be pricey.

Restrictions aside, emerging-markets indexes possess some risks that are unique to stocks from these regions. Emerging-markets indexes are more regionally concentrated than they have been historically, as Chinese stocks have seen their share of the MSCI Emerging Markets Index swell to about 40% of the benchmark. A number of companies listed in countries like China, Russia, and India are partially owned by their government, which may not always act in the best interest of shareholders.

Well-managed emerging-markets strategies that try to take advantage of mispricings while also tempering their inherit risks are few and far between. And several of Morningstar’s top-rated funds are closed to new investors as their managers are mindful of capacity limits. All of these things considered, here are three actively managed strategies that are up to the task.

New and Promising Rajiv Jain takes a cautious path to emerging-markets stocks with his Silver-rated GQG Partners Emerging Markets Equity Fund GQGPX. He uses a "quality growth" approach in which he looks for companies with little debt, reliable growth, strong profitability, and an ability to weather downturns. These characteristics point to lower-risk stocks because there is less uncertainty associated with their future profits. While this fund is only three years old, Jain's process is mature and has demonstrated its effectiveness. He used the same approach for more than a decade, with great success, to manage foreign and emerging-markets stock funds for Vontobel.

There are two caveats to this strategy. First, the portfolio tends to be more concentrated than other defensive emerging-markets funds. So, Jain’s ability to select and weight stocks will play a more important role in determining this fund’s performance than others. Historically, the portfolio has held around 50 stocks, with its 10 largest names ranging between 35% and 40% of assets. Second, Jain has primarily overseen this fund by himself. He added a comanager in September 2019, but that does little to reduce potential problems should he depart.

A More Diversified Alternative Gold-rated American Funds New World Fund NEWFX is another active strategy that attempts to cut back on the risk typically associated with emerging-markets stocks. The management team has several tools at their disposal to accomplish this feat. This includes investing in emerging-markets debt that can yield stock-like returns but with less volatility. As of December 2019, only 3.5% of the portfolio was parked in fixed-income securities.

The managers also curb risk by focusing on where stocks generate revenue, not just where they are listed. Stocks from developed markets are fair game, so long as these companies derive at least one fifth of their revenue from developing economies and at least 35% of the total portfolio remains dedicated to stocks and bonds from emerging markets. This cuts back on the fund’s risk because developed markets have more stable governments and regulatory systems, so stocks listed on these exchanges don’t have the same political risks that can creep into developing nations.

But accessing emerging markets through developed-markets stocks can actually reduce the fund’s exposure to developing economies because few, if any, multinationals invest exclusively in these regions. As of December 2019, Morningstar’s revenue exposure model indicated the stocks in NEWFX’s portfolio derived about 59% of their revenue from emerging markets, compared with 83% for the MSCI Emerging Markets Index.

American Funds employs a multimanager system that can also contribute to this fund’s stability. In this system, each fund has several managers that independently manage distinct sleeves of a given portfolio. Diversifying across different managers can reduce the consequences of a single manager performing poorly. Ten managers share responsibility for NEWFX, so personnel turnover--when it does occur--should be less concerning than that of GQGPX.

Collectively, NEWFX has a broader and more diversified portfolio than GQGPX. So, its performance should be less dependent on a given stock’s fate. Over the past decade it has held between 200 and 400 names, while its 10 largest typically occupy between 10% and 15% of the fund.

Overall, this is a solid, well-diversified strategy with one of the longest track records in the diversified emerging markets Morningstar Category. It remains open to individual investors.

A Strategic-Beta Option Silver-rated iShares Edge MSCI Min Vol Emerging Markets ETF EEMV is a rules-based active strategy that doesn't rely on manager stock selection. That means it isn't subject to the whims or bad decisions that may befall active managers. However, this strategy primarily aims to reduce volatility, so it doesn't have as much potential to benefit from mispriced stocks as GQGPX and NEWFX.

This fund uses an optimizer to select and weight stocks in a way that minimizes the expected volatility of the overall portfolio. This approach makes it difficult to determine what the fund will hold or how it will weight future holdings. But this is a small price to pay for the advantages that it can provide. It simultaneously considers how a stock’s volatility and its relationship to other stocks in the portfolio will affect the fund’s overall volatility. This integrated approach has the potential to reduce portfolio volatility further than only looking at a stock’s volatility. It also means that volatile stocks can make their way into the portfolio if their correlation with other names is low enough to reduce the fund’s overall volatility.

The optimizer provides additional benefits aside from minimizing potential volatility. It restricts country and sector weights to land within 5% of their weight in the MSCI Emerging Markets Index so the fund doesn’t excessively overweight certain segments of the market. It also limits turnover to 10% at each semiannual rebalance, so the trading costs associated with maintaining this strategy should be relatively low. At each rebalance, the optimizer also restricts the weight of each stock to 2% or less of the portfolio to improve diversification.

EEMV is a great option for investors that want a more active, diversified approach to emerging-markets stocks without the need to evaluate managers.

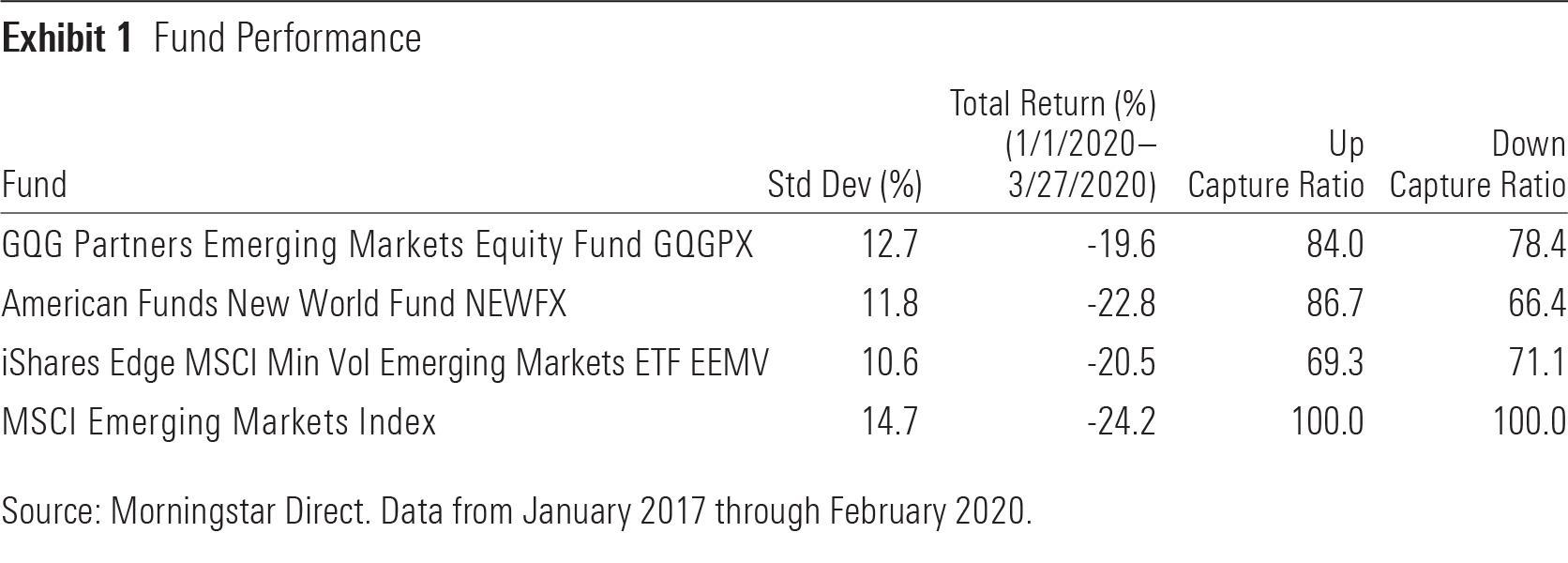

Different Roads, Same Destination Each of these funds uses a different process to cut back on risk. But there are some similarities in how they have performed. Each has delivered a less volatile record than the MSCI Emerging Markets Index. GQGPX was launched at the end of December 2016, so there is only about three years of data to demonstrate and compare their results. Exhibit 1 shows that all three funds experienced less volatility than the MSCI Emerging Markets Index. They also had shallower drawdowns in the first quarter of 2020.

These funds also all sacrificed some upside to curb their downside, as the up and down capture ratios show. These numbers indicate, on average, what percentage of the MSCI Emerging Market Index’s upside and downside each strategy captured.

Up and down capture ratios also indicate that these funds behave differently than the market. These defensive funds should continue to lag the index during strong bull markets but hold up better than the market during drawdowns or stretches of lackluster performance.

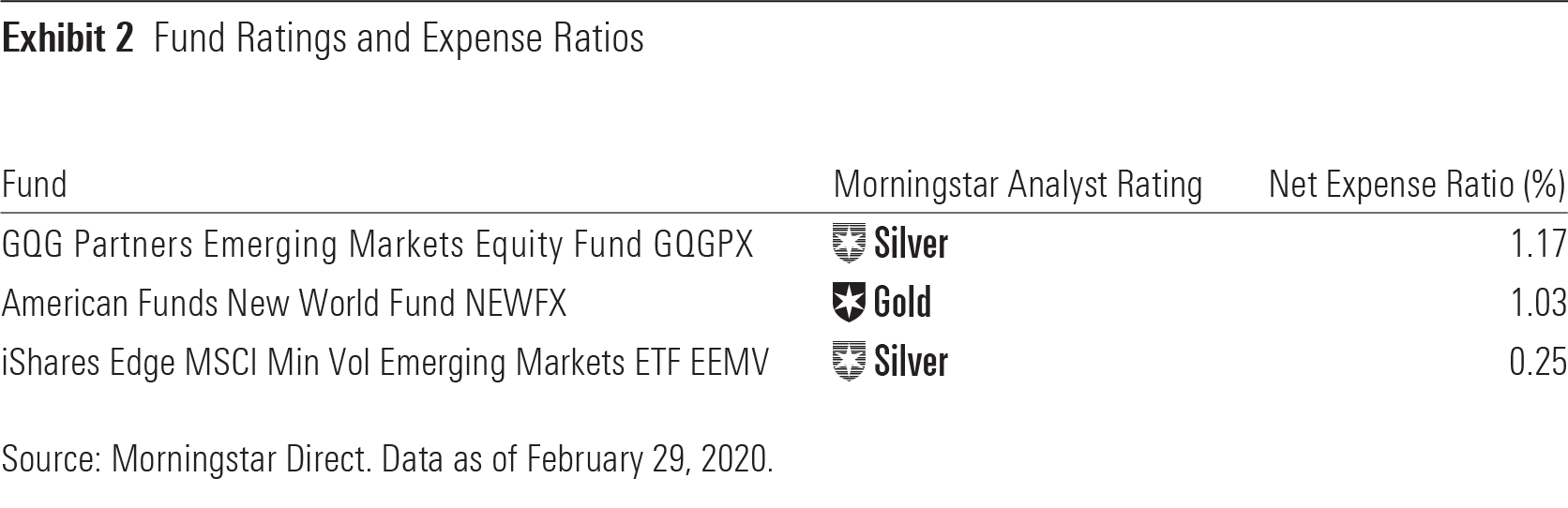

The fees that each fund charges is one area where these funds differ from each other. GQGPX and NEWFX are less expensive than a typical fund in the category, but both levy a considerably larger expense ratio than EEMV. Investors considering one of these three funds should keep in mind that fees are one of the most important predictors of future performance. Our ratings indicate that NEWFX and GQGPX are worth the expense. EEMV is more appropriate for investors that are more sensitive to fees or those that don’t want to evaluate active managers.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)