Where Have New Managers Taken These Funds?

Looking at key manager changes to see what we've learned along the way.

A version of this article first appeared in the March 2020 issue of Morningstar FundInvestor. Performance figures have been updated. Download a complimentary copy of FundInvestor by visiting the website.

Sammy Simnegar recently took the helm at Fidelity Magellan FMAGX after a transition period in which he worked alongside the retiring Jeff Feingold. Simnegar has produced solid results at previous charges Fidelity International Capital Appreciation FIVFX and Fidelity Emerging Markets FEMKX.

As a result of the change, we've upgraded the fund to a Morningstar Analyst Rating of Bronze--Magellan's first ever Morningstar Medalist rating. I'm sure that caused some eye rolls, as Fidelity Magellan has long struggled since Peter Lynch stepped down in 1990. Only Jeff Vinik had a good run at the fund since then. The fund's huge asset base and the spotlight it attracted may have contributed to some of the past disappointments.

Yet should that past really matter? The fund doesn't get much attention anymore, and at $18 billion, it's not all that big for a large-growth fund. Simnegar's record at his other funds is what matters to us, and so our first take is that this should be a solid fund. The biggest unknown is how his strategy will translate from foreign equities to domestic. He chooses to modestly overweight names he likes relative to the index and not own those he doesn't like. It's kind of unusual to have such modest bets on favorite names, but it has worked for him.

I thought I'd take a second look at manager changes announced between one and five years ago to see what we've learned along the way. I'll start with changes five years ago and work my way forward. In cases where a fund changed strategies, I've dropped in a style trail. This traces the portfolio's movement across the Morningstar Style Box, with the smallest dots representing the oldest portfolios and the largest the newest.

I have also included a rundown of performance since the change through March 26, 2020. Keep in mind these are still fairly short time periods by which to judge the managers.

Alger Small Cap Focus AOFAX, February 2015 Manager: Amy Zhang. Performance from start date through March 26, 2020: 12.3% annualized versus 4.5% for the Morningstar Category and 3.8% for the index. Verdict: Morningstar Analyst Rating of Silver.

We liked the fund as a Bronze with our first rating a year after the change had taken place. At that point, it was clear that Zhang was applying a similar process as at her previous fund, Gold-rated Brown Capital Management Small Company BCSIX. Our only real uncertainty was that she was part of a team at Brown but lead manager at this fund, and it's not easy to know how much her former team members contributed. But it quickly became clear that Alger had made an astute hire, and the initially small asset base helped Zhang make the most of her style. We raised the fund to Silver in 2018, and now it's a $4.4 billion fund closed to new investors.

Columbia Acorn ACRNX, January 2016 Manager: Matt Litfin (Richard Watson and Erika Maschmeyer were named comanagers in May 2019). Performance: Since January 2016, the fund returned an annualized 6.64% compared with 6.6% for peers and 8.7% for the benchmark. Verdict: Neutral.

The fund was rated Neutral prior to Litfin's arrival, and it has stayed Neutral since then. To appreciate the story at Acorn, you need to look at all the departures rather than focusing on this one in particular. Litfin is an experienced manager who came over from William Blair. So, his arrival wasn't a negative. Rather, the problem was that four comanagers had departed in the five years prior to his arrival, and two more left after. In addition, four analysts have left since Liftin joined. Litfin made the process more disciplined and a touch more growth-leaning. Those changes are fine, but the real issue is a steady outflow of investment professionals and shareholders.

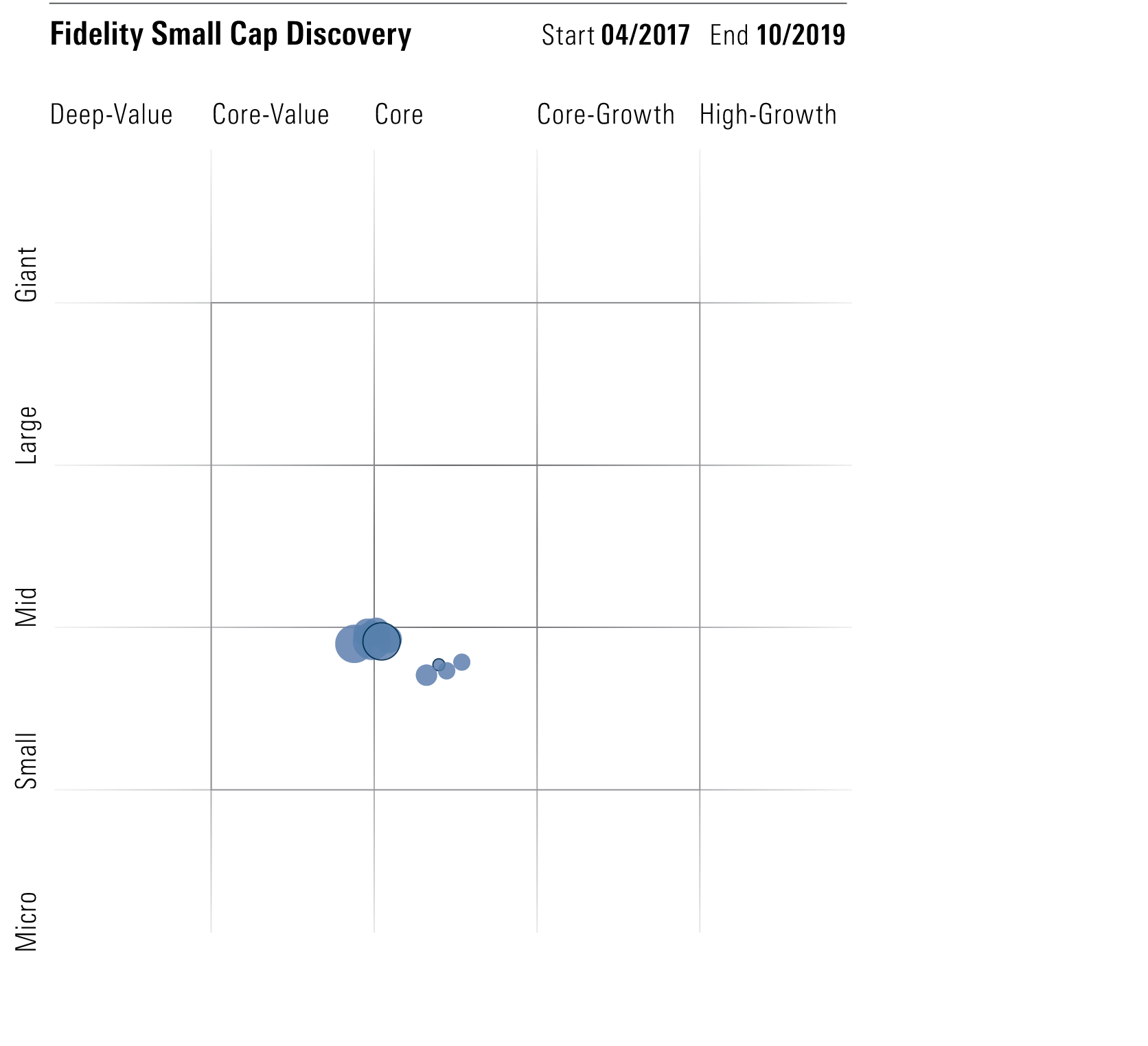

Fidelity Small Cap Discovery FSCRX, March 2016 Manager: Derek Janssen. Performance: 4.5% from March 2016 versus 6.8% for the category and 9.3% for the index. Janssen wasn't lead until Jan. 1, 2018. His record from that point has been negative 13.9% annualized versus negative 12.5% for the small-blend category and negative 9.9% for the index. Verdict: Silver.

We cut the fund to Bronze from Gold when the change was announced and then raised it to Silver in 2018. Janssen moved the fund to the value/blend border, whereas previous manager Chuck Myers had it in the middle of the style box. That move has hurt so far given growth's recent dominance. Janssen has maintained Myers' Buffett-influenced strategy but clearly has placed greater emphasis on valuations.

Source: Morningstar.

T. Rowe Price Small-Cap Stock OTCFX, October 2016 Manager: Frank Alonso. Performance: The fund returned an annualized 5.3% since October 2016 compared with 4.4% for the category and 3.2% for the Russell 2000 Growth Index. That's impressive because the fund's benchmark is the Russell 2000, and the fund has more of a core orientation than some of its peers. Verdict: Silver.

Alonso had no mutual fund track record when he took the helm in 2016. He was an associate manager under predecessor Greg McCrickard for three years prior, but that wasn't much to go on, so we cut the fund to Neutral. But we’ve warmed up to the fund and upgraded it to Silver on Feb. 4, 2020. We’ve seen that Alonso has maintained the fund's mild-mannered profile with a wide-ranging portfolio focus on stock selection. Sector weights are kept roughly in line with the Russell 2000 so that stock selection drives performance. And so far Alonso has delivered solid stock-picking.

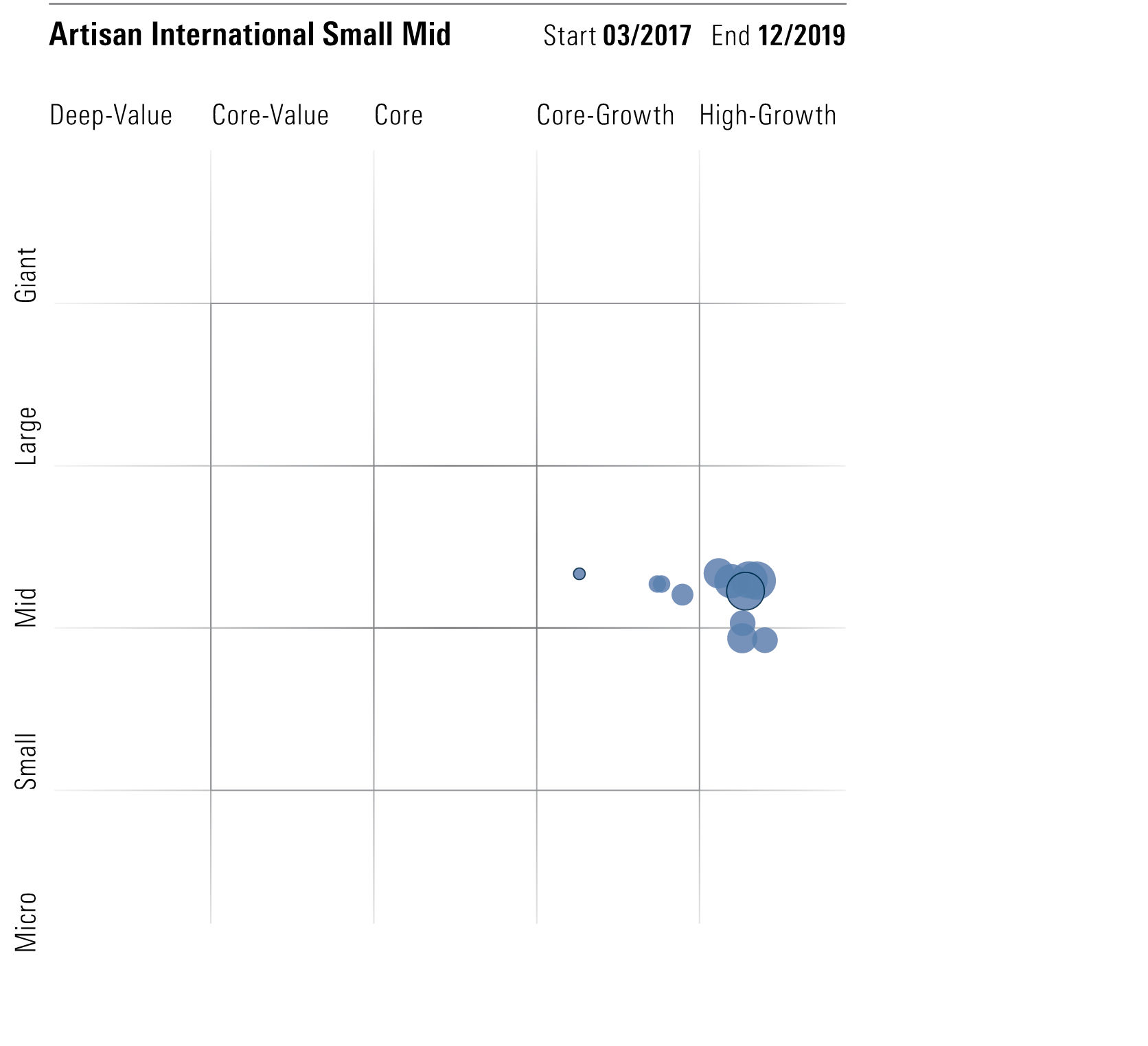

Artisan International Small-Mid ARTJX, October 2018 Manager: Rezo Kanovich. Performance: The fund lost 8.1% annualized versus 14.3% for the category and 16.7% for the index. Verdict: Bronze.

Hiring Kanovich was quite a coup for Artisan, as he had put up strong performance using a very aggressive style at Oppenheimer. The strategy change was quite clear from the beginning, as Artisan changed the name from Small to Small-Mid, and Kanovich completely overhauled the portfolio to move up and to the right in the style box. Kanovich aims to find companies set to benefit from structural growth themes such as biotherapeutics. Investors took note of Kanovich's arrival, and the then-$400 million fund took in $1 billion in new flows in 2019.

We maintained our Bronze rating when Kanovich took over. The fund now has greater return potential but also greater downside, and fees are a bit pricey.

Source: Morningstar.

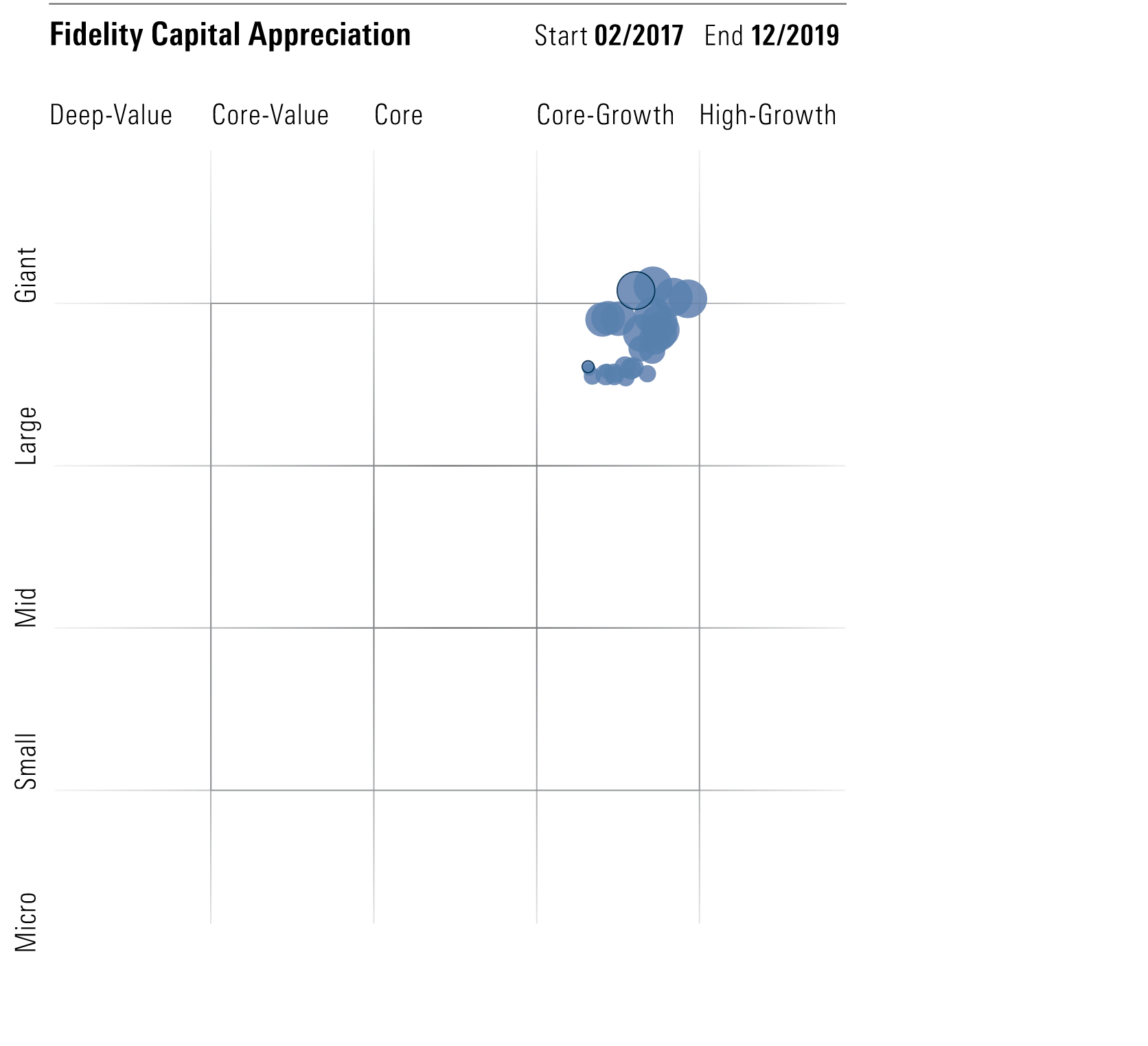

Fidelity Capital Appreciation FDCAX, October 2018 Managers: Asher Anolic and Jason Weiner. Performance: Since October 2018, the fund lost 8.0% annualized compared with peers' negative 4.2% return and 0.1% for the benchmark. Verdict: Neutral.

We rated the fund Neutral when Anolic and Weiner took the helm in 2018, and we just confirmed that rating. The fund represents something of an experiment at Fidelity. Both managers are equals who work together on the portfolio. That's a rarity at Fidelity, where one manager is usually in charge, or two if one is clearly a junior role with modest responsibilities.

Anolic and Weiner moved the fund up in the style box with a bias toward software giants like Microsoft MSFT and Adobe ADBE. Overall, though, they've reined in stock bets relative to the index. The process and returns aren't distinctive enough for a medal.

Source: Morningstar.

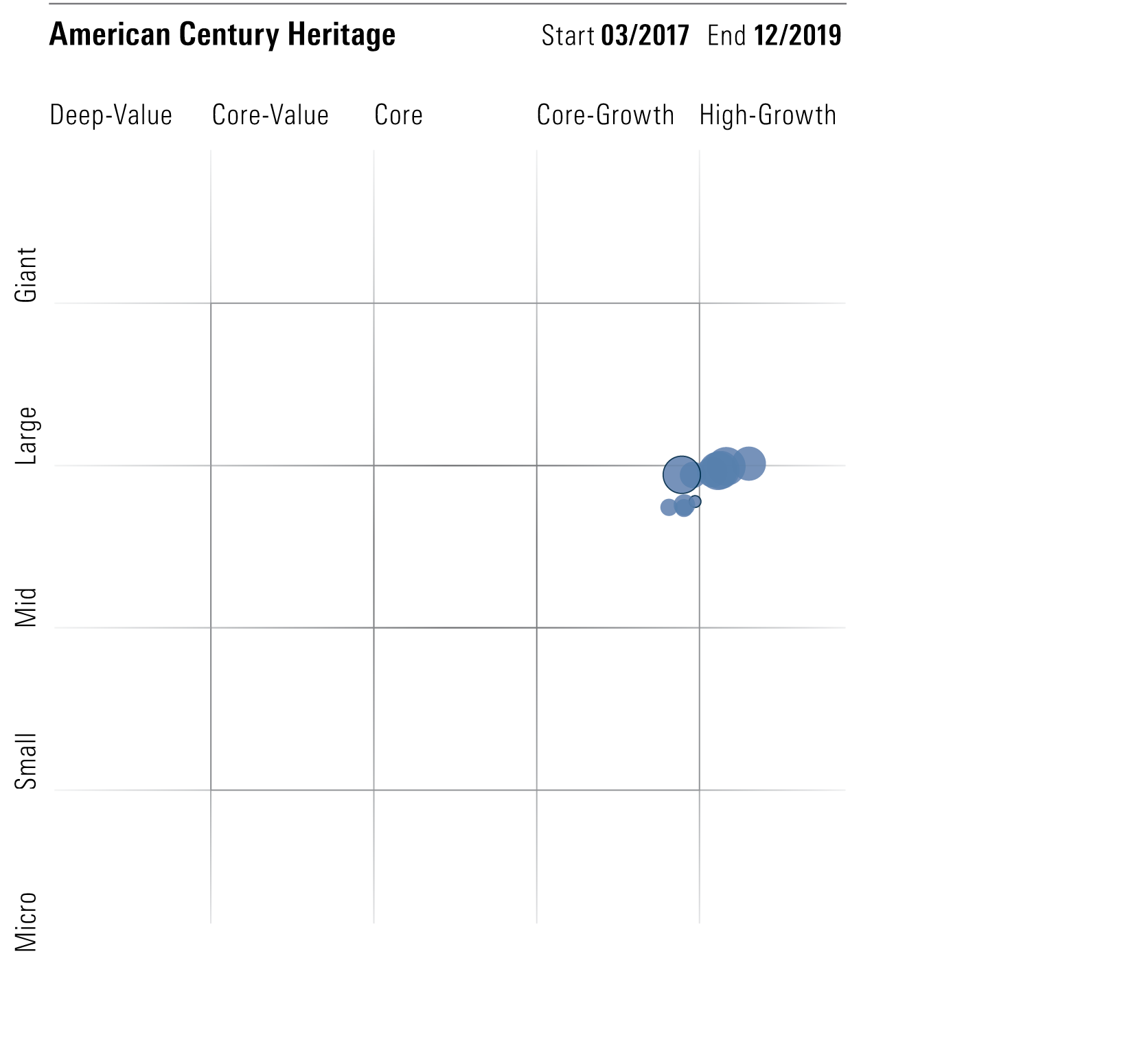

American Century Heritage TWHIX, October 2018 Managers: Lead manager Rob Brookby (February 2018) and comanager Nalin Yogasundram (March 2016). Performance: From March 2016, the fund returned an annualized 9.7% versus 9.2% for the category and 10.8% for the benchmark. Verdict: Neutral.

We lowered the fund to Neutral from Bronze in 2017 when manager Dave Hollond left, and we've kept it there since. The fund's three analysts are rather new to the team, having joined in 2016, 2018, and 2019.

The fund has moved up a bit in market cap but otherwise has not done much to set itself apart. The high turnover in recent years among investment professionals is holding us to a Neutral in the meantime.

Source: Morningstar.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)