Increasing Signs of Gender Diversity on Corporate Boards

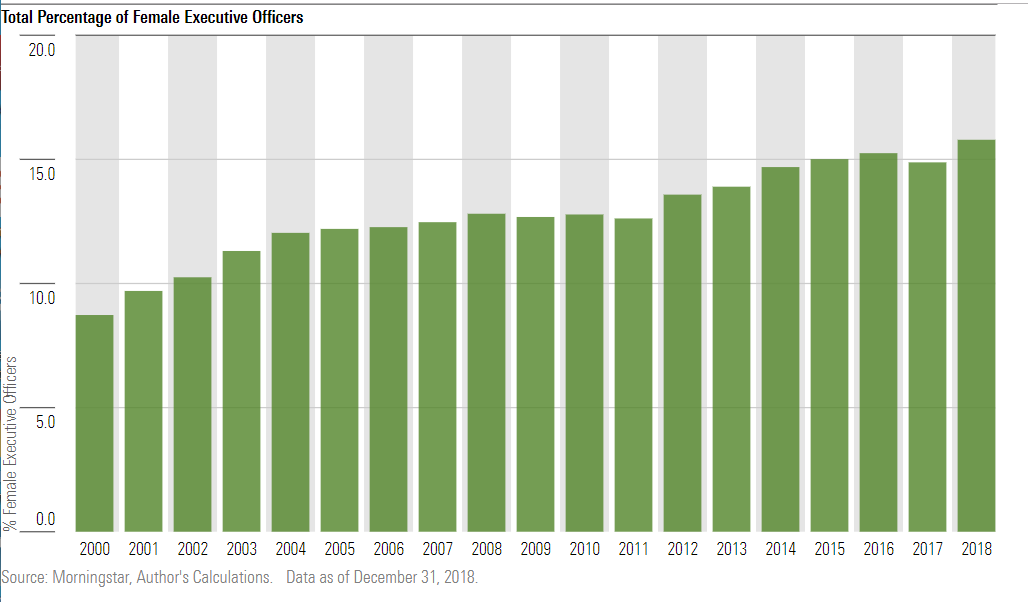

In 2000, women represented 8.7% of executive officer roles for companies in the Morningstar US Market Index. This figure rose to 12.8% in 2010 and 15.8% in 2018.

Editor's note: This article is part of our Women and Investing special report.

Women constitute about half of the U.S. workforce, yet they’re a fraction of members in executive roles and corporate boards. Still, their representation has ticked upward in recent years.

In 2000, women represented 8.7% of executive officer roles for companies in the Morningstar US Market Index. This figure rose to 12.8% in 2010 and 15.8% in 2018.

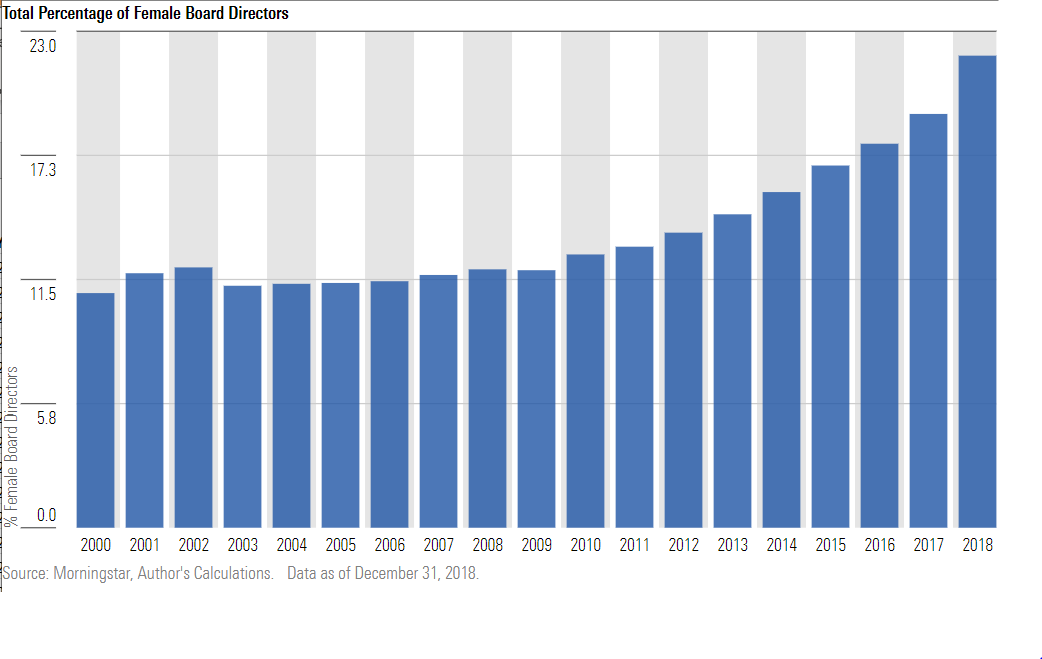

Women’s roles on corporate boards for companies in the index are increasing as well, although remaining more or less stagnant until 2010 and consistently increasing since then. In 2000, women filled 10.9% of board seats, and while they only constituted 12.7% of seats in 2010, they’ve seen a dramatic spike since then--up to 21.9% in 2018.

Policy is a large driver of the most recent uptick of women on boards. In September 2018, California lawmakers passed a bill requiring that all state-headquartered public companies have at least one woman on their boards by 2019. By 2021, California law will require that a board of five directors needs two women and a board of six directors needs three women, so we’ll continue seeing an uptick.

While we see an upward trend in female board members, the trend isn’t as pervasive in small-cap companies. In a previous study, we found that in 2017 the gap between S&P 500 company boards and remaining companies in the Russell 3000 was notable. Twenty-four percent of S&P 500 board members were women, compared with only 14% for the smaller companies.

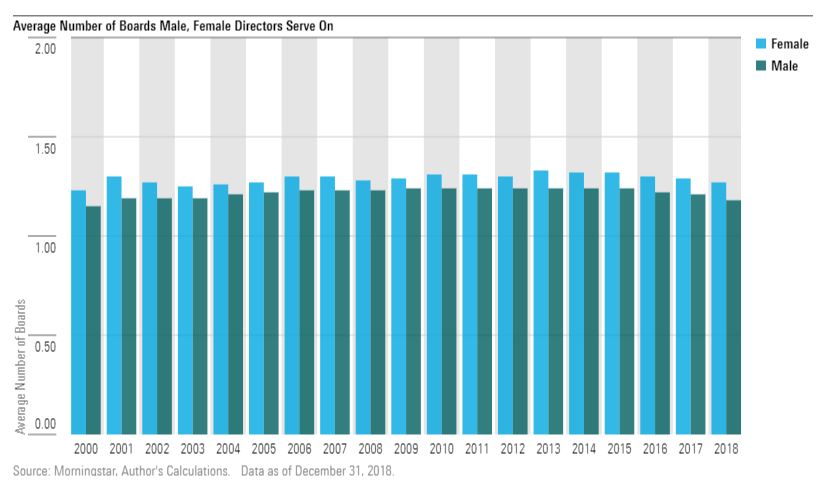

However, for board positions, unlike executive officer roles, there are many women who double, and even a handful who triple, dip. That explains part of the uptick in women on boards--the same talent pool is being tapped to serve on multiple boards. However, there has also been an increase in first-time female directors. Consistently for the past 18 years, the average female board member has sat on more boards than her male counterpart, and the gap between the two has only increased with time. For example, in 2000, the average female board member sat on 1.23 boards, compared with the average male board member with 1.15. In 2018, the difference widened, as the average woman sat on 1.27 to the average man’s 1.18.

Boards typically select experienced female board members, including those with prior board experience, so this data isn’t surprising. However, with so few experienced women, boards have a small pool from which to tap candidates. Twenty-one percent of women board directors sit on multiple boards, compared with 15% for male board members, and 5% of female directors sit on three or more, while only 2% of male directors do. While adding women who have other board experience to a board technically increases its number of female members, this act doesn’t increase the overall number of women on boards and therefore fails to fully add more diversity.

Plus, women with multiple board roles might suffer from a trend that governance advocates call “overboarding”--where the increasing responsibilities of corporate boards lead to potential candidates getting passed over if serving on three on more boards.

Additionally, asset managers are continuing to step in and join the conversation, through funds that invest in companies demonstrating commitment to increasing gender diversity within management or on their boards. To name a few, this includes Glenmede Women in Leadership US Equity GWILX and Fidelity Advisor Women’s Leadership FWOZX, launched this past May; both require 80% of assets to meet this requirement. Top holdings in Fidelity Advisor Women’s Leadership include Microsoft MSFT, Bank of America BAC, and Nasdaq NDAQ, which as of January 2017 is the first global exchange to be led by a woman, with Adena Friedman as CEO.

/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a659ddb3-1d6f-4405-a4c4-9c325330c2da.jpg)