Overlooked Foreign Stock ETFs

These three options are pretty good.

There are more decisions to make when selecting foreign stock funds than U.S. stock funds, including which markets to focus on and whether to hedge currency risk. The wide range of options can seem overwhelming. But sticking with a broad fund from the foreign large blend Morningstar Category is a great way to start. Many of these funds provide access to a wide pool of foreign stocks, diversify the risks specific to single markets and currencies, and should provide reasonable long-term performance. Here are three funds from that category that haven’t received much attention but are worthy of consideration.

IQ 50 Percent Hedged FTSE International ETF HFXI HFXI is a low-cost, well-diversified foreign stock fund that could be used as a core holding.

Most currency-hedged strategies try to eliminate all of their currency risk. This should help performance when the dollar appreciates but hurt it when the dollar declines. By comparison, an unhedged portfolio will benefit when the dollar declines and suffer when it appreciates. So, choosing one or the other may bring about feelings of regret depending on the direction that exchange rates move.

HFXI tries to reduce that regret by hedging only half of its currency risk. The strategy’s big appeal is that it can be easier to stick with than a fully hedged or unhedged strategy. It should post a better return than an unhedged index when the dollar appreciates, but it won’t suffer as much as a fully hedged strategy when the dollar declines.

Over the long run, currency hedging can eliminate the additional volatility that stems from fluctuating foreign-exchange rates. Since this strategy attempts to erase half of that risk, its standard deviation should land roughly halfway between that of an unhedged and a fully hedged index. Foreign-exchange rates tend to move in cycles, so hedging should have little impact on long-term total returns.

There are some alternatives to this strategy, but they have some unattractive characteristics. Investors could try timing their exposure to unhedged and fully hedged funds, but this can be tricky because foreign-exchange rates are volatile and there is little evidence that most investors can do this effectively. Another option would be to hold equal allocations to an unhedged and fully hedged fund, which requires regular rebalancing to keep allocations on track. However, this method requires discipline, and it can be less tax-efficient because rebalancing often involves selling shares of the fund with greater price appreciation, thus triggering capital gains.

Hedging aside, HFXI has a solid portfolio. It tracks the FTSE Developed ex-North America Index--a broad market-cap-weighted benchmark that targets large- and mid-cap stocks from 23 overseas developed markets. The managers use a sampling strategy that fully replicates the large-cap portion of the index, and they select certain mid-cap stocks based on traits like sector, country, and currency to round out the portfolio. This technique can have cost-savings benefits as it reduces the need to trade smaller stocks that are more expensive to transact. But it sacrifices a small amount of tracking error in the process. The manager’s evaluations are partially tied to the fund’s tracking difference, so deviations from the benchmark should be small.

The managers use forward contracts to hedge half of the portfolio’s foreign-exchange risk. While these contracts are effective, they can reduce the portfolio’s tax efficiency. Gains from these contracts that filter down to investors are taxed through a mix of short- and long-term capital gains tax rates, with 40% of the gains taxed at the short-term rate and 60% at the long-term rate. Therefore, this fund won’t be as tax-efficient as an unhedged index and is best used in a tax-sheltered account like an IRA.

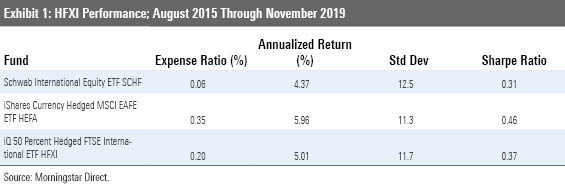

HFXI was launched at the end of July 2015, and so far it has performed as expected. Exhibit 1 shows that its volatility landed between that of an unhedged fund (Schwab International Equity ETF SCHF) and a fully hedged strategy (iShares Currency Hedged MSCI EAFE ETF HEFA). It beat SCHF because the dollar appreciated against foreign currencies between August 2015 and November 2019.

Invesco S&P International Developed Low Volatility ETF IDLV IDLV takes a different approach to dial back risk, and it doesn't suffer from the potential tax consequences that come with hedging.

IDLV directly targets stocks that are more stable than the market. It starts with all companies in the S&P Developed ex-U.S. & South Korea LargeMidCap Index and sorts them by their volatility over the prior 12 months. The index then selects the 200 least volatile names for the portfolio and weights them by the inverse of their volatility. This weighting approach causes the portfolio to emphasize its least-risky names, but it can also lead to higher turnover and trading costs than a market-cap-weighted index.

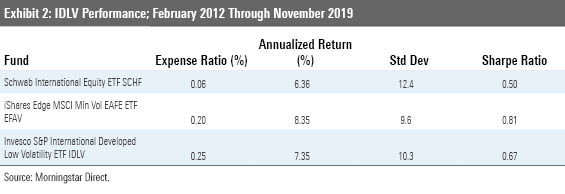

This is a more transparent process than the optimizer-based strategy iShares Edge MSCI Min Vol EAFE ETF EFAV uses, but it still has some weaknesses. Unlike EFAV, IDLV does not control its sector or country weightings, so it tends to be less diversified. Furthermore, IDLV does not consider correlations across stocks. Low correlations can help reduce a portfolio’s overall volatility and provide EFAV with an additional risk-reducing lever that IDLV does not take advantage of.

That said, IDLV should have more potent exposure to the least volatile stocks in the market, which could make it a good choice for harnessing the low-volatility effect documented in the academic papers. Although it isn’t as well diversified as EFAV, IDLV should still exhibit lower volatility, shallower drawdowns, and better risk-adjusted performance than the market over the long term. But like EFAV, it will likely lag in strong market environments.

So far, this strategy has delivered on its low-volatility objective. From its launch in January 2012 through November 2019 its standard deviation has run about 15% lower than the S&P Developed ex-U.S. Broad Market Index. It also held up better during drawdowns. The market index declined by 18.6 percentage points between February and December 2018 while the fund shed only 11.2% over that period. IDLV’s 0.25% fee is lower than most funds in Morningstar’s foreign large blend category.

John Hancock Multifactor Developed International ETF JHMD JHMD uses a multi-factor framework based on Dimensional Fund Advisors' strategies.

This portfolio offers well-diversified exposure to overseas developed markets while targeting factors that have been associated with market-beating returns. The index it tracks uses market-cap multipliers to scale each stock’s weight based on its valuation, market capitalization, and profitability. It assigns larger multipliers to stocks with relatively lower valuations, smaller market capitalizations, and higher profitability than those with the opposite characteristics. This technique provides an effective way to tilt toward these three factors. And it keeps turnover low, as each stock’s weight will float with changes in its price. It’s easier to understand than the complex optimization process employed by iShares Edge MSCI Multifactor International ETF INTF.

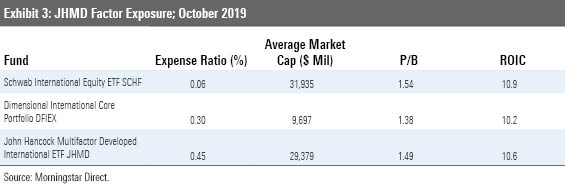

Like Dimensional’s International Core Equity Portfolio DFIEX, this fund has historically emphasized stocks with smaller market capitalizations and those trading at lower valuations. Its tilt toward profitable firms has been less noticeable because its profitability and value exposures tend to offset each other--stocks trading at lower valuations tend to be less profitable. However, the profitability tilt is still at work and should help steer the fund away from the least profitable companies that find their way into the portfolio.

Exhibit 3 shows JHMD’s preference for stocks with lower valuations, based on its average price/book ratio, as compared with a large-cap-focused developed market index-fund, like SCHF. Exhibit 3 also shows that this portfolio’s average market capitalization is substantially higher than DFIEX. While they use similar strategies, JHMD only holds large- and mid-cap firms while DFIEX includes small-caps as well. Thus, DFIEX has a more aggressive small-cap orientation.

Dimensional’s mutual funds don’t explicitly track an index. This freedom provides some flexibility when deciding which stocks to trade and can lead to lower trading costs. This fund’s target index can’t fully capture these benefits, but it does incorporate similar features that can reduce turnover and trading costs. Its rules prevent the fund from making small and insignificant changes to a stock’s weight. Additionally, the fund won’t increase the allocation to stocks with poor momentum because doing so can hurt performance.

Collectively, these features have yet to prove their worth in the fund’s live track record. It lagged the MSCI EAFE Index by 60 basis points annually from its launch in December 2016 through November 2019 with similar risk. But some underperformance is expected because the fund’s tilt toward value stocks has been a disadvantage. Its factor tilts can cause it to underperform the market for short stretches, but they should pay off over the long run.

The fund’s expense ratio is cheaper than the category average, but on its own doesn’t provide much of a competitive advantage. John Hancock charges 0.45% annually for this fund, which is 0.15% more than what Dimensional charges for DFIEX.

Key Takeaways Each of these three funds has a different expected outcome. HFXI provides a well-diversified foreign stock portfolio with only half of the market's currency risk. It should provide a long-term return similar to the market because foreign-exchange rates tend to move in cycles. IDLV should be less risky than the market, but it takes considerable active risk and could underperform in an extended bull market. JHMD offers the potential to beat the market through its factor exposures, though as any value investor can attest, those don't always pay off.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/05-07-2024/t_9dca62d6f7b3444d90619b3637ec379b_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)