Investors Direct Fund Flows Into Low-Risk Offerings

Investors continued to cut risk in October 2019, despite low yields and strong equity returns.

Note: This is an excerpt from the Morningstar Direct U.S. Asset Flows Commentary for October 2019. Download the full report.

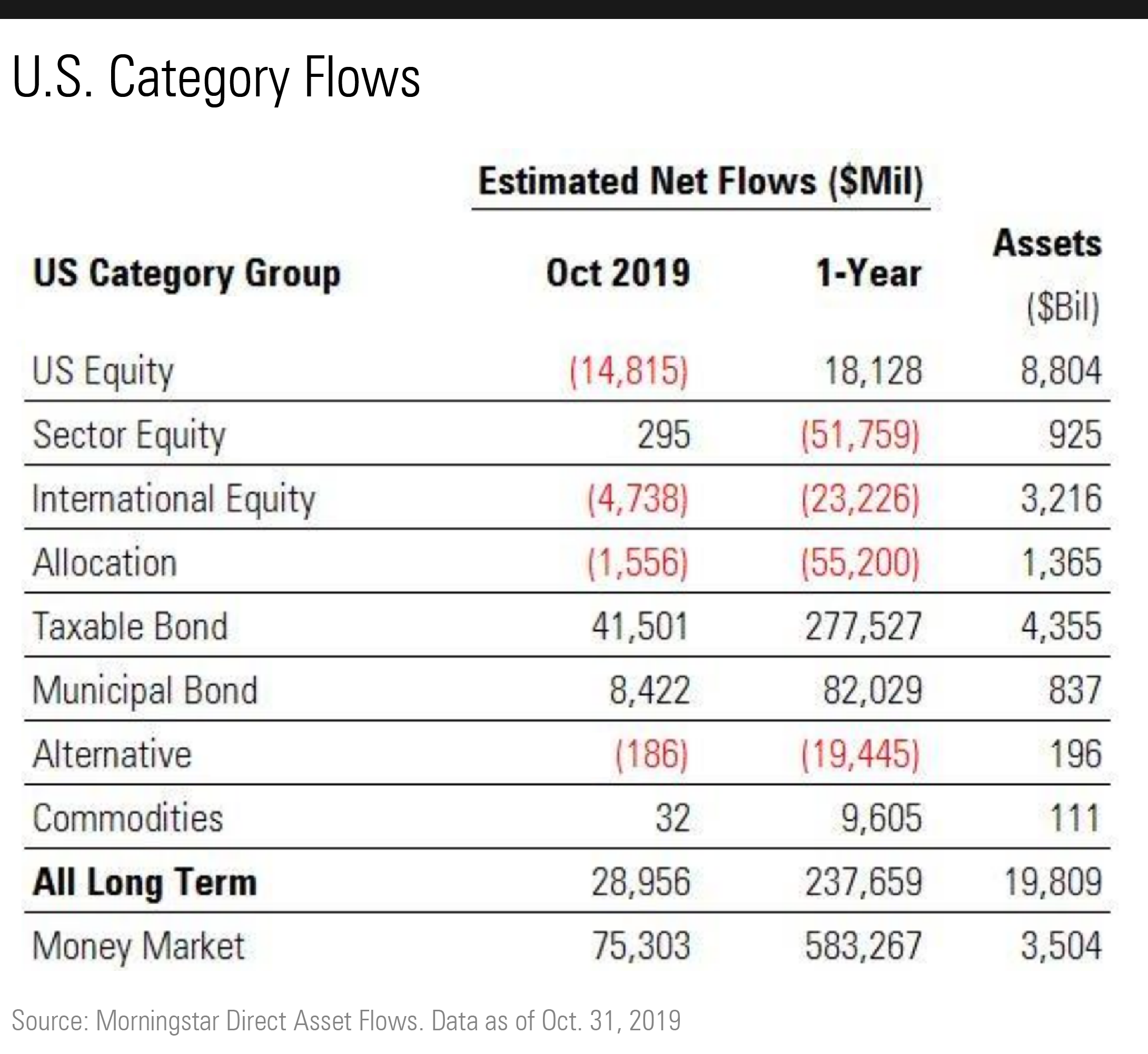

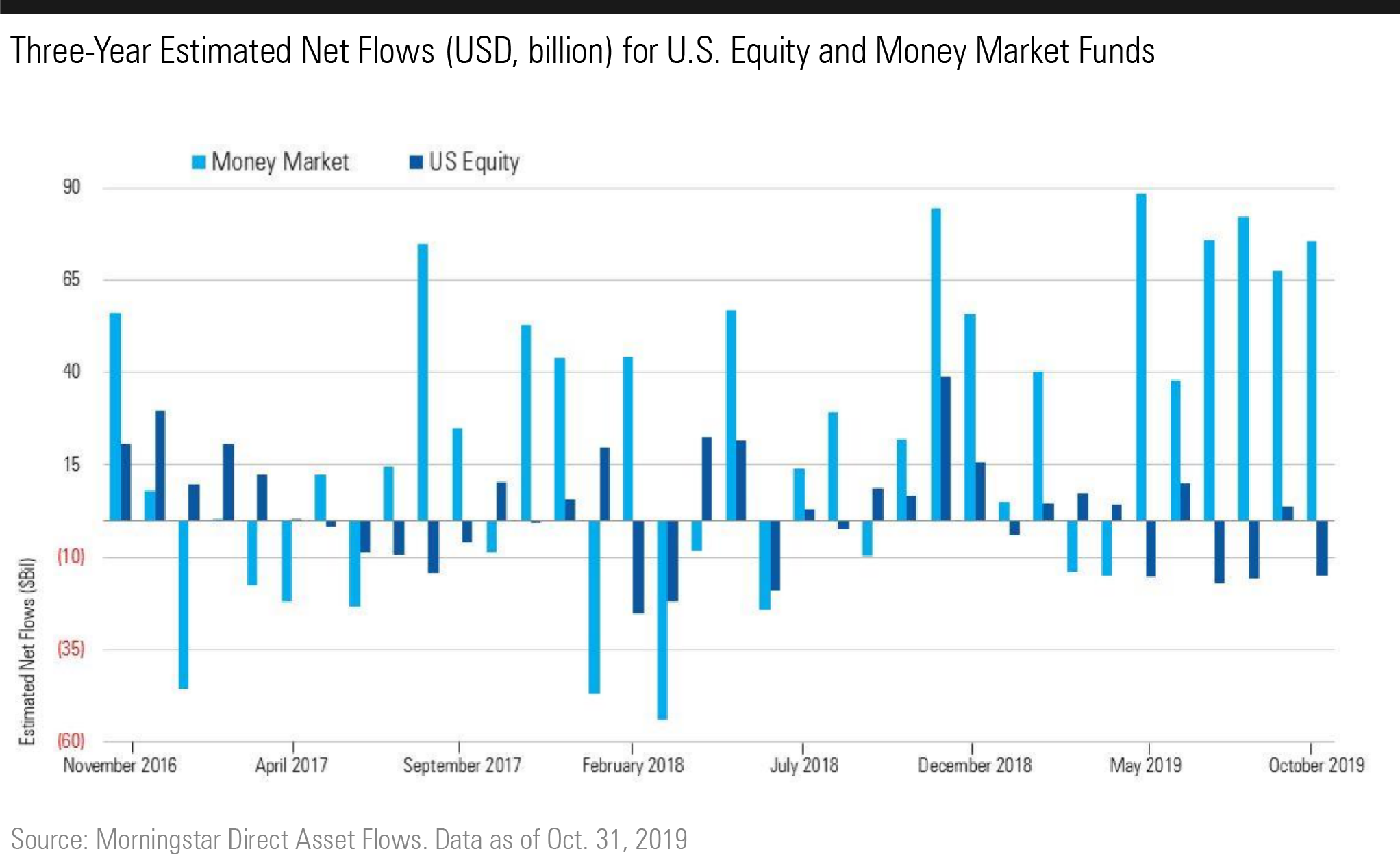

The Federal Reserve cut rates at the end of October for the third time in 2019; and on Oct. 31, the 10-year Treasury bond had a yield of just 1.74%. But despite lower yields, money market inflows still overwhelmed long-term inflows, at $75.3 billion versus $29.0 billion.

Some commentators see these huge money market flows as potential fuel for the U.S. equity bull market. After all, money market assets are the highest they've been in at least 10 years at $3.5 trillion. But a mass move into U.S. equities seems unlikely, at least via open-end funds and exchange-traded funds. That's because, despite one of the longest bull markets in U.S. history and a 13.7% annualized 10-year return for the S&P 500, U.S. equity funds--both active and passive--collected just $59.8 billion during the decade. To put that in perspective, international-equity funds collected $997.3 billion during the same period, although demand for those funds has dropped significantly in recent years.

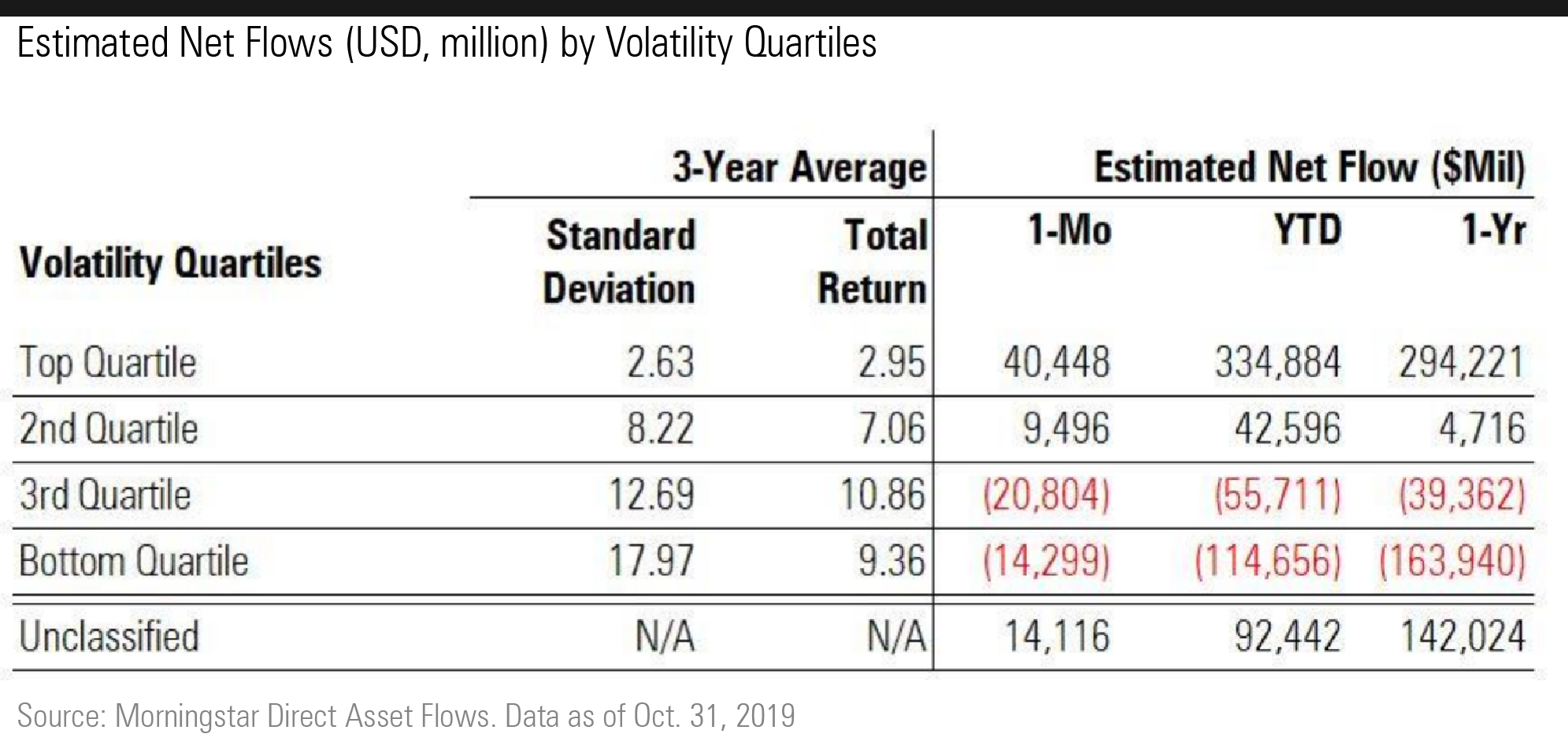

Signs of risk aversion also surfaced in the significant inflows into taxable-bond and municipal-bond funds, at $41.5 billion and $8.4 billion, respectively. This trend aligns with what we observed from a volatility perspective: Investors contributed $40.4 billion to the least-volatile quartile of long-term funds while pulling $14.3 billion from the most-volatile quartile.

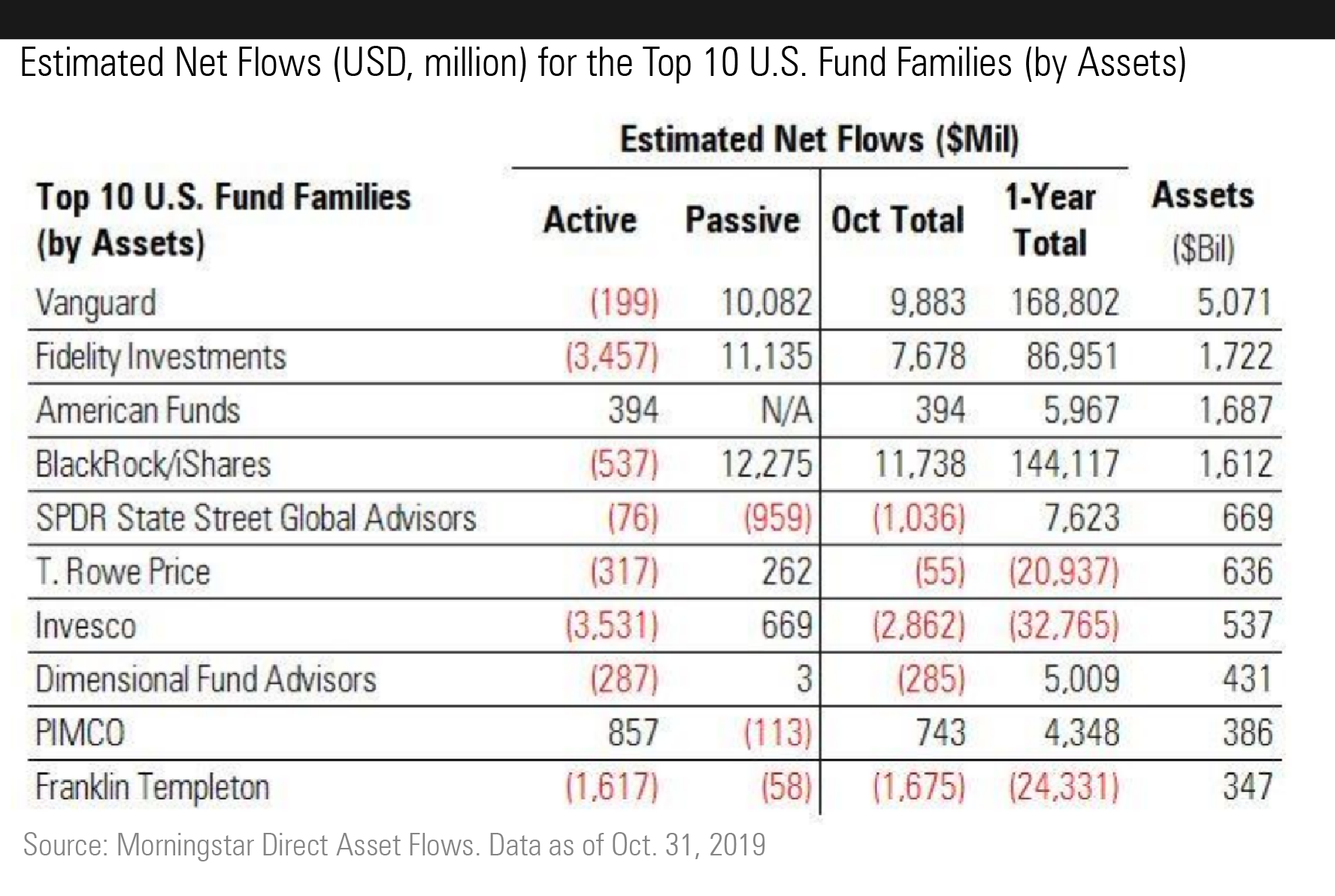

When dissecting fund flows by fund families, although Vanguard had modest inflows of $9.9 billion, it continues to eat up market share. Its total open-end and ETF assets passed $5 trillion in October. Vanguard's 25.6% market share is greater than that of its next three biggest competitors combined.

/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e6b4cff4-0d77-4881-abc5-5b0b34d64bf6.jpg)