Sometimes the Market Is Wrong

But broad-market index funds are still great investments.

A version of this article previously appeared in the September 2019 issue of Morningstar ETFInvestor. Download a copy here.

The efficient-market hypothesis, or EMH, implies that the market quickly and accurately incorporates all information regarding a stock's actual value into its price. Investors can't gain an informational advantage and shouldn't try to beat the market. Instead, they should simply track the market through a broad market index fund.

Critics of the EMH point out that the market can and does make mistakes. Occasionally the market's collective demand can bid share prices well above fair value, creating a bubble that ends with a sharp price decline. This creates a problem for index investors, since they are fully exposed these downfalls in prices.

History has shown that the critics aren't wrong. Digging further into how markets function reveals that the market's judgment isn't always great. But the market doesn't need to be right 100% of the time to make a case for investing in broad-market index funds.

The Sum Is Greater Than Its Parts The EMH is based on the concept of the wisdom of crowds. Most individuals are poor at judging the value of an asset. But a large collection of incorrect estimates can arrive at the correct value as long as they are independent.

This concept is best exemplified in an account from British polymath Sir Francis Galton.[1] Galton was visiting a local fair when he noticed a contest inviting locals to guess the weight of an ox on display. After the contest, Galton analyzed the estimates and made an astonishing discovery. While the individual estimates varied widely, the median of the guesses landed within 1 percentage point of the ox's true weight.

Galton hypothesized that while many individuals made poor judgments (guessing either too high or too low), collectively the low estimates canceled out the high estimates, and the median value of all the guesses landed near the beast's true weight.

It isn't difficult to extrapolate Galton's observation to financial markets. Rather than estimate the weight of an ox, investors exercise their estimates of a company's value through their decisions to buy or sell its shares. Individually, investors can make poor estimates of a stock's true value, causing them to buy too high or sell too low. But the collective trading of thousands, if not millions, of investors means that those willing to buy at a higher price should be balanced by those demanding a lower price, creating a balancing mechanism much like the one Galton documented.

There's a catch. Galton's account teaches us that the market's machinery requires two key components for it to function efficiently. Market participants need access to information, and that information must inform a wide range of opinions regarding a stock's share price. The failure of either part can cause the market to malfunction.

Informed Estimates The fair's patrons didn't have a lot of information, but they did have some. They could see and roughly measure the size of the ox (length, width, and height) through visual inspection. And according to Galton's account, at least some of the participants were farmers or butchers. So, their experience with livestock likely helped improve their guesses.

In the context of the stock market, balance sheets and cash flow statements are the financial equivalents of the ox's rough dimensions. These documents allow investors to size up a company and estimate what its shares are worth. Combine them with a 24-hour news cycle in an increasingly globalized world and investors are left drowning in an ocean of economic and financial information. If the stock market is inefficient, it's not because of a lack of data.

Diversity of Opinions Galton's account also demonstrated that a diverse set of estimates was necessary to ensure the accuracy of the group's collective estimate. Guesses that were too high balanced those that were too low.

The breakdown of diverse opinions in financial markets results in one-way thinking that is consistent with big price changes. In some instances, big price changes are a reflection of the market's efficiency at incorporating new information, such as updated corporate guidance or tax law changes.

But diversity can also fall apart for behavioral reasons. Market participants can collectively get greedy and buy when prices are expensive, or they may get spooked by declining prices and sell when shares are cheap. In these situations, one-way thinking pushes prices further away from an asset's underlying value without justifiable information. Some reasons for this behavior include the herding effect, where investors simply follow the buying patterns of others instead of using available information to make their own decisions. Anchoring to a recent bout of strong performance and continually buying as asset prices rise further away from their intrinsic value is another reason that individual expectations may move in the same direction.

While it is difficult to pinpoint the root cause of behaviorally driven one-way thinking, financial history is wrought with examples of stock prices that grew to expensive levels and crashed. Some of the most prominent cases include Japanese stocks in the 1980s and Internet stocks in the late 1990s. In these circumstances, persistent demand for these stocks caused their prices to grow faster than the value of the underlying businesses, leading to excessively high valuations. Broad market indexes, and funds that track them, weight their holdings by market capitalization. So, they favored the most expensive and overvalued stocks in these markets. When those prices eventually declined, index fund investors were fully exposed to the fallout.

One-way thinking can cause the prices of other assets to deviate from their estimated value. The Treasury market provides a more concrete example. More specifically, the inflation expectations baked into Treasury Inflation-Protected Securities have not always aligned with inflation estimates from the Federal Reserve.

The value of a Treasury bond is simply the net present value of its principal and coupon payments, discounted by the bond's interest rate or yield to maturity. TIPS have this same trait, but the principal value of a TIPS is adjusted to account for inflation. So, its discount rate equals the yield to maturity of a Treasury bond of the same maturity, less the market's collective opinion of the expected rate of inflation.

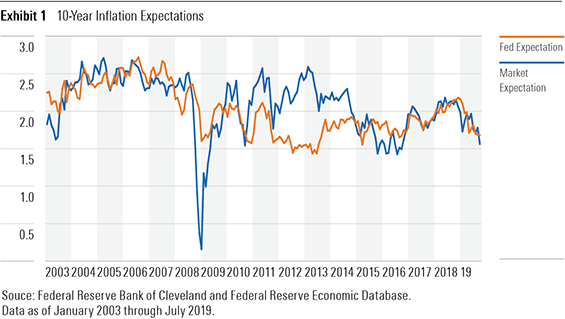

Therefore, subtracting the yield to maturity of a 10-year TIPS from the yield to maturity of a 10-year Treasury bond equals the market’s inflation rate expectation for the next decade. Exhibit 1 shows the inflation expectation from this calculation and the estimated 10-year rate of inflation from the Federal Reserve Bank of Cleveland, which is based on a combination of current inflation rates, inflation swaps, and surveyed data.[2]

For the most part, the Treasury market has closely reflected the Fed's inflation expectation. But it got off track between 2011 and 2013, when the Federal Reserve was taking drastic actions to stimulate the U.S. economy out of a recession. The Treasury market expected that the stimulus effort would push inflation higher than the Federal Reserve's estimate, pricing in an additional percentage point over the next 10 years from January 2013.

In this instance, the market's expectations have yet to materialize, as inflation ran at a 1.7% annualized clip from January 2013 through July 2019--not too far from the Fed's 1.5% expectation in January 2013. But 3.5 years remain until December 2022, so it is too early to say that the market's collective expectation failed to appear. Examples like this demonstrate that prices contain a collective opinion about what the market expects to happen in the future. Events often don't unfold in line with expectations because no one has perfect information about the future.

Advantage: Index Funds Markets don't need to be accurate all the time to justify investing in broad-market index funds. While markets can make mistakes, actively managed alternatives typically don't fare much better.

A Vanguard paper addressed the notion that active managers have the opportunity to protect their shareholders during market drawdowns by tactically shifting to safe assets like cash or more-defensive stocks. [3] The researchers found that there were some bear markets where most active managers were able to provide this benefit. However, the actively managed funds that delivered superior performance varied from one drawdown to the next. That led the researchers to conclude that active managers could not consistently provide a cushion when the market declined, meaning index-fund investors were not necessarily disadvantaged by staying fully invested over multiple market cycles. That long-term performance advantage only builds on the low-cost and tax efficiency advantages that broad-market index funds provide.

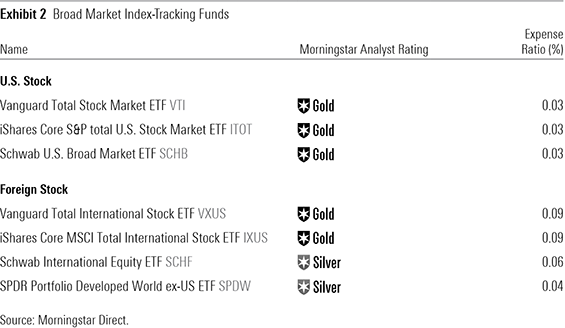

Jack Bogle summed it up best with his Cost Matters Hypothesis: "No matter how efficient or inefficient markets may be, the returns earned by investors as a group must fall short of the market returns by precisely the amount of the aggregate costs they incur. It is the central fact of investing." [4] Costs matter a lot more than a market’s ability to accurately price its assets. Exhibit 2 lists some of our top-rated low-cost index funds that should deliver solid performance for decades to come.

References:

[1] "The Wisdom of Crowds (Vox Populi)." All About Psychology. https://www.all-about-psychology.com/the-wisdom-of-crowds.html.

[2] Federal Reserve Bank of Cleveland. 2019. Inflation Expectations. Aug. 13, 2019. https://www.clevelandfed.org/our-research/indicators-and-data/inflation-expectations.aspx.

[3] Philips, C. B. 2009. "The Active-Passive Debate: Bear Market Performance." Vanguard. http://www.rrcapital.com/files/Vanguard%20Active%20vs%20Passive%20-%20Bear%20Markets.pdf.

[4] Bogle, J. C. 2005. "The Relentless Rules of Humble Arithmetic." Financial Analysts Journal. Vol 61, No. 6, P. 22.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/05-07-2024/t_9dca62d6f7b3444d90619b3637ec379b_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)