An Early Warning on Capital Gains Tax Distributions

Tread carefully at year-end when investing for a taxable account.

In 2017, Hennessy Focus HFCSX paid out half a penny of capital gains per share on a net asset value of $87.76. In 2018, it paid out a huge $14.47 per share on a NAV of $67.71. This despite the fact that the fund returned 19.27% in 2016 and lost 10.47% in 2018. What happened?

Flows tell the story. The fund enjoyed inflows each year from 2013 through 2016, and even in 2017 they were a modest $148 million in outflows. But in 2018, outflows were $792 million from a base that started the year at $2.8 billion. For a fund whose asset base has bounced between $1.5 billion and $3 billion in recent years, that hit in 2018 was big. Inflows are a taxpayer’s friend because it means capital gains will be spread among more shareholders and the managers aren’t forced to sell anything they don’t want to. With outflows, though, a fund has to sell stocks unless they have a cash position larger than outflows. And after a long bull market, many stock funds are sitting on top of a big pile of profitable stock positions. The shift to passive from active means many are in outflows despite those gains. Once those profitable stock positions are sold, the fund makes a capital gains payout and fundholders get taxed. It’s a clumsy system because it doesn’t take into account fundholders’ actual gains in the fund.

As my colleague Christine Benz wrote, it's a kind of madness and it can take a bite out of your portfolio.

The upshot is that you should be careful with your equity fund purchases for taxable accounts in the fourth quarter. Typically, the way it works is funds tally up realized gains and losses, subtract loss carryforwards as of the end of October, and then pay out capital gains in late December. Many of the big firms estimate what those capital gains will be in November.

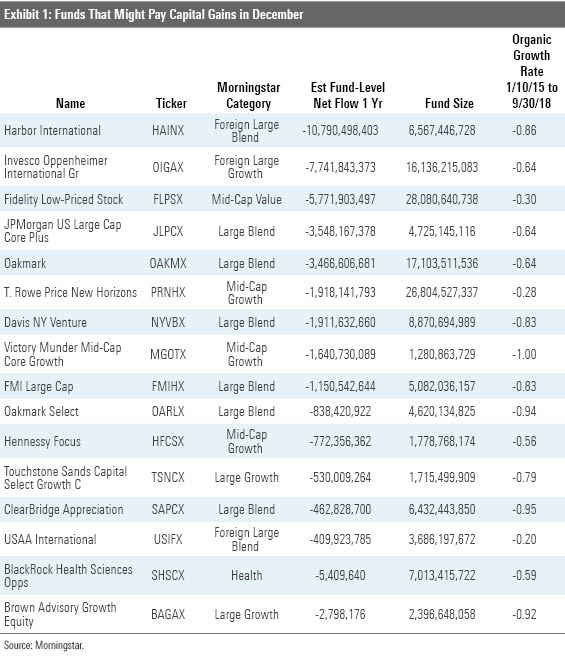

But to give you a head start, I have dug up some potential candidates for big payouts that you might want to avoid in taxable accounts for the rest of the year. From the outside, we can't be sure what gains have been realized. Some firms are very tax-aware in what they sell, and some are less so, but in either case the payout will depend in part on which stocks the managers thought were least attractive and thus the best to sell.

I look for a few different things to figure out if a fund is more likely to have a significant capital gains distribution.

- Outflows--Managers don't have much choice about selling when they face heavy net redemptions.

- A fund's organic growth rate--This is a three-year measure of how much a fund is growing or shrinking based on flows.

- A pattern of rising capital gains payouts--This is pretty straightforward, though I'd say this goes double if a fund is paying out gains twice a year. Turnover is another indicator that capital gains are on the way, though even low turnover funds can make big payouts if they have heavy redemptions or simply choose to move on from a long-held big position.

- Potential capital gains exposure--This is a figure that funds report annually in dollar terms and we then divide by fund assets under management. Obviously, appreciation or depreciation since that time will have an impact.

Who Might Make Big Payouts? Davis New York Venture NYVTX has been in fairly steady outflows for a while now and that has meant steady cap gains payouts. This is an example of a fund making twice-a-year payouts. In June, they distributed $1.12 per share, and last December it was $2.42. The current net asset value is $28.52.

Redemptions and a manager change, plus capital gains, is a combination likely to lead to a big payout. In fact, that's what happened last year at Harbor International HAINX after subadvisor Northern Cross was swapped out for Marathon Asset Management in August 2018. The fund paid out $21.70 on a NAV of $33.78 as the new managers swapped in their holdings. I doubt this year's payout will be anything like that large, but they have seen nearly $11 billion in redemptions, leaving a $6.6 billion asset base.

Victory Munder Mid-Cap Core MGOTX has seen $1.6 billion in redemptions, leaving it with $1.3 billion in assets. The fund has a 12% annualized 10-year return, so it would seem a good candidate for a big payout.

USAA International USIFX was sold to Victory and Victory promptly fired subadvisor MFS, which was running the bulk of the money in the fund. Victory chose in-house (read: more profitable for Victory) subadvisors to replace MFS. So, Victory will make money from this, and USAA made money from the sale, and USAA fundholders will get… a tax bill.

Will these funds and those listed in my table below actually make a big payout? Check their websites in November to see for sure.

Some Good Options for a Taxable Account The short answer here is that index funds (in exchange-traded fund or open-end format) are good bets to avoid big payouts because of their better structure and low turnover. I'll share a few and then some actively managed funds that are Morningstar Medalists.

Vanguard Total Stock Market Index VTSAX VTI is available in open-end and ETF form. It tracks the CRSP U.S. Total Market Index. It's super cheap, tax-efficient, and covers the whole U.S. stock market.

Ishares Core S&P Total US Stock Market ITOT tracks a different total market index, but that's not very important. It's cheap and it's diversified.

Vanguard Total World Stock Index VTWAX VT is even more diversified than the total U.S. market funds. And it's cheap.

Active In general, I sought Morningstar Medalist-rated funds with inflows and low five-year tax-cost ratios. These funds are unlikely to make big payouts this year.

Vanguard Tax-Managed Balanced VTMFX isn't technically an index fund because it doesn't aim to exactly track an index. Its equity sleeve, which is set at 49.9% of assets, tracks a tax-tilted Russell 1000-like benchmark, but it veers away from that slightly in order to minimize taxes. Its bond side is a close match with Vanguard Intermediate Tax-Exempt VWITX. Not many balanced funds use munis instead of taxable bonds, but it is a very sensible approach and quite cheap. In addition, by letting Vanguard rebalance on a security level, it's more tax-efficient than if you rebalanced among mutual funds.

T. Rowe Price Overseas Stock TROSX is in inflows, has a low tax-cost ratio, and doesn't appear to have a big capital gains overhang.

American Funds International Growth & Income IGAAX likewise ticks all the boxes for a positive tax picture. Its Morningstar Analyst Rating of Gold means it also hits all the notes on fundamentals such as management and fees.

DFA Emerging Markets Value DFEVX straddles the active-passive line, and it looks like it has a shot to emulate some of those positive tax characteristics from the passive side.

Parnassus Mid-Cap PARMX has a Silver Analyst Rating, inflows, and a benign tax record.

Fidelity International Growth FIGFX has a modest asset base with significant flows and modest past tax payouts. We rate it Silver.

Diamond Hill Mid Cap DHPAX is a rare thing: a value fund with inflows. The fund took in $93 million in net inflows for the 12 months ended in August on an asset base of $226 million. We rate it Gold.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)