REITs Aren't a True Alternative

They're just stocks that look a little different.

A version of this article appeared in the May 2019 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Real estate investment trusts have historically been able to diversify stocks and bonds while providing positive returns. They are also subject to legal constraints distinct from common stocks that dictate their sources of revenue and dividend payments. Those traits may lead some to classify REITs as an alternative investment. Yet, REITs are still subject to the same risks as other businesses, and they have become more closely integrated with the broader market. So, the diversification benefits they have provided in the past may not hold up in the future.

What defines an alternative? To lay the groundwork for this argument, it's helpful to first define what qualifies as an alternative investment. While there's no firm definition, most alternatives share two distinguishing characteristics. They typically promise a combination of positive expected returns, and low correlations to stocks and bonds. That one-two punch is highly coveted because it improves diversification and could lead to better risk-adjusted performance.

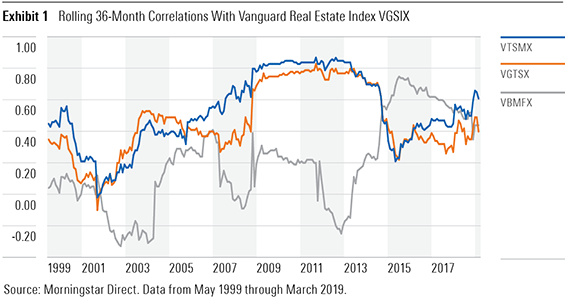

Real estate investment trusts loosely meet these two criteria. Exhibit 1 shows the correlations between Vanguard Real Estate Index Fund VGSIX and Vanguard Total stock Market Index Fund VTSMX, Vanguard Total International Stock Index Fund VGTSX, and Vanguard Total Bond Market Index Fund VBMFX. Over the past two decades, REITs have only been moderately correlated with those traditional investments, indicating that REITs provided a diversification benefit. The 2008 financial crisis was an exception, as correlations spiked.

Real estate investment trusts’ long-term total returns have been on par with the broader U.S. stock market. Between January 1972 and December 2018, the FTSE NAREIT Equity REIT Index returned 11.4% annually, which compares with 10.3% for the CRSP U.S. Total Market Index.

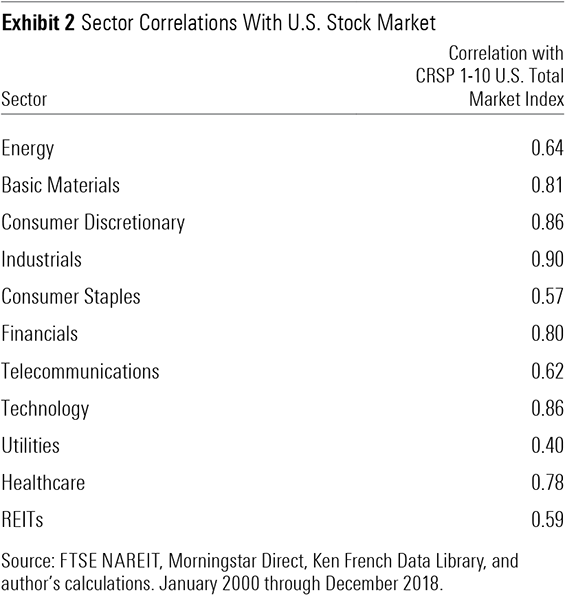

Alternative or Just Different? Real estate investment trusts have historically provided a diversification benefit, but it has not been distinct from other sectors of the U.S. market. The correlation between the CRSP 1-10 U.S. Total Market Index and FTSE NAREIT Equity REIT index was similar to the market's correlation with the energy, consumer staples, and telecommunications sectors, as shown in Exhibit 2.

While publicly traded REITs’ correlations with the broader market don’t stand out, they differ from publicly traded stocks in some important ways.

Unlike most corporations, REITs are legally required to pay out at least 90% of their income as dividends to shareholders. [1] In exchange, they can deduct these distributions from their taxable income, as shareholders will eventually bear the tax burden. This pass-through structure means REITs typically have higher yields than the broader U.S. market, making them attractive to investors searching for income. However, dividends are taxed as ordinary income, so REITs are best held in tax-advantaged accounts like IRAs or 401(k)s.

Another difference between REITs and other publicly traded businesses is their revenue sources. Rather than sell goods or provide services, REITs must derive at least 75% of their gross revenue from dividends, interest, rental agreements, and gains from sales of real property or other REITs. [1]

Rental contracts are an interesting component of these businesses because they have the potential to “lock in” future cash flows (assuming tenants continue to make payments). Yale University’s chief investment officer, David Swensen, suggested that this feature causes REITs to be more stable than the market. [2] But caution is warranted. While rental contracts can provide REITs with more predictable cash flows (relative to other businesses), this does not guarantee that they will be less risky than the market.

Real estate investment trusts often borrow money to finance property acquisitions and growth since almost all of their earnings get distributed to shareholders. That increases volatility and can offset the stability provided from predictable cash flows, though it should also boost expected returns. Additionally, REITs can become highly correlated to the market during stress periods, as shown in Figure 1. So, they aren’t likely to serve as a safe haven when the economy turns south.

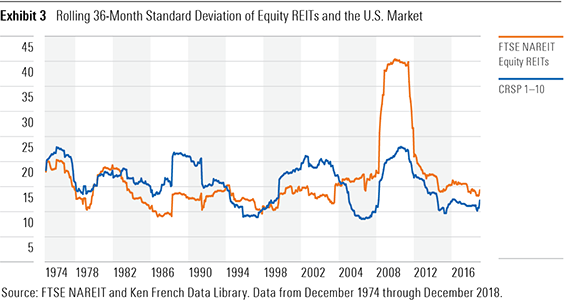

Real estate investment trusts have gone through several periods where they have been more volatile than the broader market, as illustrated in Exhibit 3. This chart shows the rolling 36-month standard deviation of the CRSP 1-10 U.S. Total Market Index and the FTSE NAREIT Equity REIT Index.

Over the long term, REITs have exhibited a similar level of risk to the broader market. Between January 1972 and December 2018, the standard deviation of the FTSE NAREIT Index was 16.9%--a little higher than 15.5% for the CRSP 1-10 U.S. Total Market Index over the same period.

Swensen also helped popularize the notion that REITs have characteristics of real assets. In other words, their direct connection to physical property should help them maintain their value and perform well during short periods of unexpected inflation.

There is some historical evidence to support this idea. Between January 1975 and December 1984, the FTSE NAREIT Equity REIT Index outperformed the CRSP 1-10 U.S. Total Market Index by 7.1 percentage points annually--a period when inflation in the U.S. averaged 10% per year. But the U.S. has not experienced this sort of inflation since then, making it difficult to further test this hypothesis.

It’s important to remember that publicly traded REITs are still publicly traded stocks. Over long periods of time they should outpace inflation in much the same way as the broader market. Changes in market conditions and investor sentiment can cause prices to deviate from the value of the underlying businesses and add to volatility. Real estate investment trusts are also exposed to the same economic risks faced by all businesses. Declines in wages or slowing economic growth not only dent demand for goods and services, but also demand for rental housing, office space, and commercial property.

This tends to make property values (and REITs) somewhat cyclical. However, the sector’s sensitivity to interest rates can partially offset the impact. Interest rates tend to move countercyclically--declining when the economy heads south--which can boost property values by making purchases cheaper to finance. Rising rates have the opposite effect.

Differences in business structure, while notable, aren’t sufficient to classify publicly traded REITs as an alternative asset. They’re essentially businesses that are subject to some unique legal constraints regarding their operations and taxes. And they’re exposed to many of the same risks other publicly traded companies face.

From Exclusive to Mainstream Another difference between publicly traded REITs and other alternative investments, like long-short strategies, has been their ease of access and integration with the broader markets. This doesn't impart an advantage or disadvantage on REITs, but increased acceptance means they have become less alternative in a more subjective way.

Real estate investments were once limited to wealthy individuals and large institutions. They became available to a much wider investor base in 1960, when the Eisenhower Administration signed legislation that created the legal structure for REITs. Since then, retail investors have been able to access businesses tied to real estate activities by owning shares of publicly traded REITs.

The growth and spread of REITs has not been limited to the U.S. Other countries have adopted a similar legal structure for firms operating in the real estate industry. As of March 2019, U.S. REITs represented almost two thirds of the global REIT market, with those listed in Japan, Australia, and the United Kingdom accounting for sizable portions of the overseas market.

While the legal structure and tax requirements have remained largely consistent over the past 50 years, the industries that REITs occupy have grown. The earliest REITS focused on shopping malls, railroads, and residential housing. Modern-day REITs span a much wider array of sub-industries, including casinos, movie theaters, farmland, and communication towers.

REITs have evolved from a nascent segment of the financial sector into their own stand-alone sector. In August 2016, the Global Industry Classification Standard formally separated REITs from the financial services sector, placing them in a separate real estate sector.

Historically speaking, REITs have gone through periods where they provided some advantages. They have occasionally diversified stocks and bonds, exhibited periods of lower volatility than the market, and provided market-like returns. But REITs have also expanded into a wider range of sub-industries and are now recognized as a separate sector of the market.

Investments in real estate firms are no longer as exclusive as they were in the past. Real estate investment trusts are included in most broad stock index funds, like Vanguard Total Stock Market ETF VTI, where they represent 4% of the portfolio. They may provide a modest diversification benefit, but it probably won’t be much better than what other sectors of the market provide. And they may not hold up better than the market during downturns. Publicly traded REITs are best seen as publicly traded companies, and therefore subject to the same economic and market risks as other publicly traded firms.

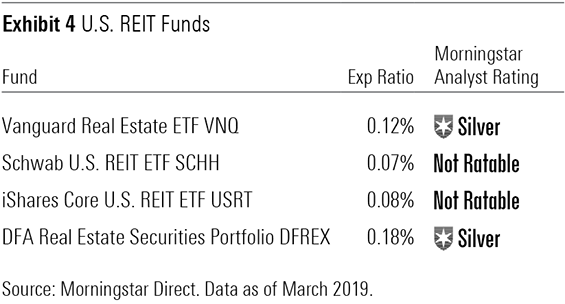

For those interested in overweighting REITs, the easiest and most cost-effective way to do so is through a market-cap-weighted index fund. Exhibit 4 lists four funds that are competitively priced in the real estate Morningstar Category.

References:

1. Cigar Excise Tax Extension of 1960. https://www.govinfo.gov/content/pkg/STATUTE-74/pdf/STATUTE-74-Pg998.pdf.

2. Swensen, David F. 2005. “Unconventional Success.” (New York: Free Press). P. 67.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)