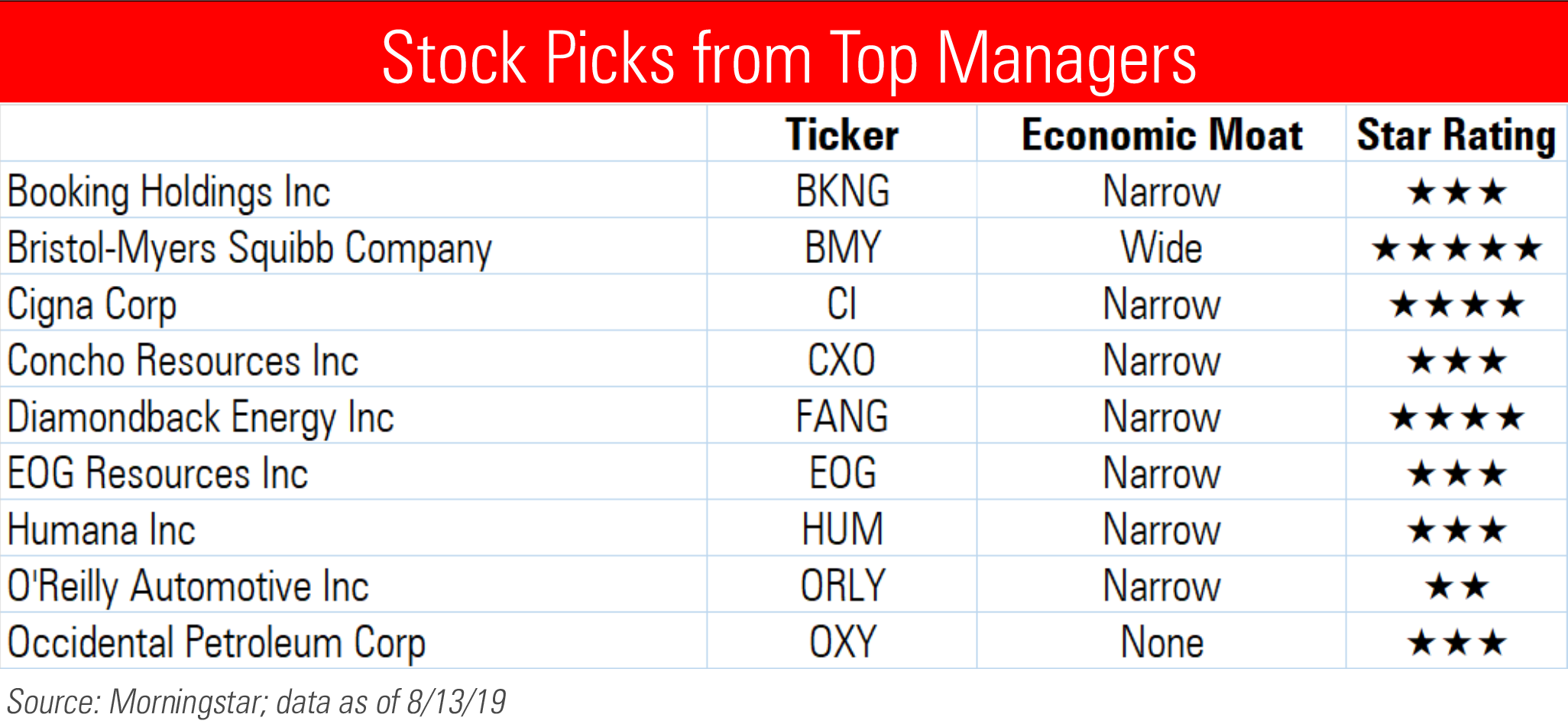

9 Stocks Top Managers Are Buying

Managers from Dodge & Cox, Oakmark, and Diamond Hill have picked up healthcare companies, energy concerns, and an online travel agent.

When our kids were still young, I belonged to a monthly book club with our pediatrician. Several other moms participated, too. Although we talked about what we’d read each time we met, conversation inevitably turned to our kids--and our pediatrician friend patiently granted our thinly veiled requests for free medical advice. Is this year’s FluMist as effective as the standard flu shot? How can I help my bed-wetter to make it through the night? And given X, Y, and Z symptoms, does my kid need an antibiotic?

In a similar vein, we like picking the brains of some of our favorite fund managers for some free stock ideas. Today, we’re sharing some of the latest purchases from a trio of managers of highly rated mutual funds.

The managers of Dodge & Cox Stock DODGX, which earns a Morningstar Analyst Rating of Gold, use a host of metrics to find cheap stocks and are unafraid to build positions in names clouded in bad news or economic weakness. They favor stocks with competitive advantages, growth potential, and solid management.

- Deep Dive: Dodge & Cox Stock: A Contrarian Masterpiece

The team has added to several positions--including Occidental Petroleum OXY, which announced plans to purchase Anadarko Petroleum (also a portfolio holding) earlier this year.

"While there are concerns about integration risk and the high cost of financing, we believe Occidental's risk-reward profile is compelling due to its attractive valuation, strong operational capabilities, and diversified, free-cash-flow generative upstream portfolio that is supplemented by its midstream and chemicals businesses," they explain in their latest shareholder report. "From our research on Anadarko, we know that Anadarko's asset portfolio has been meaningfully streamlined in recent years and the remaining assets are world class with large reserves and low break-even oil prices. In addition, Occidental aims to achieve $2 billion in cost synergies, and we believe there is a high probability these savings will be realized long term."

In his latest analyst note, Morningstar senior analyst David Meats observes that Occidental’s management spent much of its latest earnings call discussing the deal, assuaging investor concerns.

“In addition to highlighting previously outlined synergies, management emphasized the ability to apply its enhanced oil recovery expertise to Anadarko's unconventional assets, potentially enabling it to squeeze more value out in the latter part of the life cycle than other operators could,” says Meats. “We also noted a robust commitment to protecting and increasing the dividend.”

Shares of Occidental are fairly valued as of this writing, trading at 3-star levels.

The Dodge & Cox team has also added to its stake in Cigna CI. They expect Cigna to achieve significant cost savings from its pickup of Express Scripts in late 2018; the combined company will be generating burly free cash flow that can be used to reduce debt, repurchase shares, and drive earnings growth, they explain. They like management’s solid track record of execution, too.

“In addition, Cigna has proven to be a leading innovator in the midsize employer-based segment where continue to gain share due to their patient centric care model and industry leading cost trend which remains well below industry averages,” they add.

Morningstar assigns Cigna a narrow economic moat rating, stemming from its scale as a stand-alone insurer, says analyst Jake Strole.

“While we believe Cigna is moatworthy in its own right, the strategic addition of Express Scripts should help create synergies and improve the combined firm's selling capability through a more comprehensive, and competitive, product offering,” he argues.

Cigna is undervalued according to our metrics, trading in 4-star range as of this writing.

Dodge & Cox’s managers bulked up their position in Bristol-Myers Squibb BMY, which is acquiring Celgene CELG.

“The combined company will have nine products with more than $1 billion in annual sales and significant growth potential in the core disease areas of oncology, immunology, and inflammation and cardiovascular disease,” they explain.

“We continue to view the firm as undervalued, with the market underappreciating the potential cash flows driven by drugs treating unmet medical needs where pricing power is high,” argues Morningstar sector director Damien Conover. “This strong positioning also reinforces our wide moat rating for the firm.”

Moreover, the Celgene pickup moves Bristol further into the specialty pharmaceutical segment of the market that demands strong pricing power, adds Conover--which will help Bristol in a time when governments and private payers are pushing back on drug costs. Shares are currently a bargain, in our opinion, trading at 5-star levels.

Bill Nygren and Kevin Grant, who helm Gold-rated Oakmark Fund OAKMX, practice a somewhat creative value approach. They favor companies that are mispriced relative to what a rational buyer would pay to own the entire business, unlocking value in ways beyond traditional price multiples.

The pair added three energy names to their portfolio last quarter: Concho Resources CXO, Diamondback Energy FANG, and EOG Resources EOG. They explain in their latest commentary:

“Concho Resources, in our opinion, is one of the highest quality oil and gas producers in the U.S. and it maintains an enormous acreage position in the most attractive parts of the Permian Basin. This large inventory of future drilling locations should allow Concho to invest at high returns for years to come. The market is currently valuing this strategically attractive set of assets at a discount to recent private market transactions and below Permian peers on a per acre basis, despite the company’s superior economics and strong management team. Concho has a long history of creating value for shareholders through both efficient operations and savvy capital allocation. We expect shareholders can once again be rewarded as the company develops and monetizes its acreage footprint.”

A few weeks ago, Concho announced a steep cut in activity during the second half of the year, which sent shares tumbling 24% in one day. That activity slump coupled with a weaker outlook for near-term oil prices led Morningstar to slice its fair value estimate by about 20%, to $71 per share, explains Morningstar senior analyst Dave Meats. As one of the dominant players in the Permian Basin, Concho nevertheless maintains its narrow economic moat rating and stable moat trend. We think shares are fairly valued today.

Regarding Diamondback Energy, the pair notes:

”Diamondback Energy is an oil and gas producer with a high-quality acreage position located entirely in the Permian Basin. CEO Travis Stice and his management team have produced industry-leading returns by focusing on low-cost operations and best execution. We like the management team’s focus on per share value and we believe the market doesn’t appreciate Diamondback’s acreage quality and drilling inventory following the company’s acquisition of Energen. Diamondback is growing production 15% per year with a mid-single digit FCF yield and the business is valued at a significant discount to net asset value and historical per acre multiples.”

Like Concho, Diamondback’s financial results missed consensus expectations in early August. But production was impressive, says Morningstar’s Meats, and management modestly raised its full-year guidance. The firm maintains its narrow moat and stable moat trend--and its management earns an Exemplary stewardship rating; Meats says the firm is “a lean, efficient operator, with impressively low unit costs.” Shares are undervalued by our metrics, trading in 4-star range.

Rounding out Nygren’s and Grant’s energy pickups is EOG Resources. They say:

”EOG Resources launched the U.S. oil production renaissance by applying fracturing technology to oil basins across North America. Because of this first-mover advantage, the company has typically paid far less than competitors for similar acreage positions. We believe that EOG’s return-focused culture will continue to drive innovation and efficiency. The company expects that over 90% of the wells the company will drill over the next 10-12 years will generate economic returns at a $40 per barrel oil price. This low position on the cost curve makes EOG one of the lowest risk E&Ps, while the company’s continued innovation (experimental plays, enhanced oil recovery and drilling technology investment) provides upside that few competitors can match.”

EOG hit its targets for the quarter, reports Morningstar’s Meats, also maintaining its narrow moat rating and stable moat trend.

“Due to the combination of its size and focus, EOG has significantly more shale wells under its belt than most peers,” says Meats. “This has enabled it to advance more quickly up the learning curve in each play.” Shares are fairly valued as of this writing.

Lead managers Charles Bath and Austin Hawley, who steer Gold-rated Diamond Hill Large Cap DHLCX, buy companies trading below their estimated intrinsic values. The team determines intrinsic value by estimating cash flows on a five-year time horizon, normalized earnings, and an appropriate growth rate.

They initiated several new positions last quarter, including a stake in online travel agent Booking Holdings BKNG.

"Booking benefits from the network economics in its core markets, where a large and growing supply of available accommodation sites is driving demand from consumers looking for choices when they travel," the pair explains in its latest commentary.

“Booking also has good secular growth prospects as travel bookings continue to move online, and it earns high returns on incremental sales. The stock declined due to headwinds from a weak European economy and concerns about increasing customer acquisition costs. We believe these are temporary concerns and that Booking will continue to grow rapidly and earn high returns on capital.”

Morningstar assigns Booking a narrow economic moat, positive moat trend, and an Exemplary stewardship rating.

“We expect Booking Holdings’ global online travel agency leadership position to expand over the next decade, driven by a superior position in China, continued leadership in Europe, and an expanding presence in vacation rentals, restaurant bookings, and attractions, all of which are backed by leading marketing and technology scale,” summarizes senior analyst Dan Wasiolek. Shares are fairly valued by our estimates.

Healthcare insurer Humana HUM--a leader in Medicare Advantage--was another pickup during the quarter.

“The stock has sold off along with the broader group on election fears and the resumption of a health insurer tax; however, we believe the company will have comparably less exposure than commercially focused peers,” they argue. “Humana has long-term exposure to favorable demographic trends via the Boomer retirement wave and remains an attractive acquisition candidate.”

We assign Humana a narrow economic moat and stable moat trend.

“The national dialogue around healthcare reform will likely intensify leading into the 2020 election cycle, but we contend Humana retains a unique position as a premier government contractor in both Medicare Advantage and in the military's TRICARE system,” says Morningstar analyst Jake Strole. “While we think the likelihood of widespread industry disruption is relatively low, Humana is in a position to potentially benefit from more marginal regulatory change. An expansion of Medicare eligibility is likely to benefit the Advantage program, and continued expansion of Medicaid is likely to be of interest to management.”

Shares appear fairly valued to us.

O’Reilly Automotive ORLY also caught Bath and Hawley’s attention last quarter. They note that the top companies in the automotive aftermarket parts retail market produce some of the best margins in all of retail.

“O’Reilly has consistently generated high returns on invested capital in this stable industry by building an excellent distribution network for parts availability and by providing outstanding customer service to both do-it yourselfers and professional installers,” they say. “We believe O’Reilly will benefit from an improving demand cycle over the next 12 to 24 months.”

Indeed, O’Reilly boasts a strong operational track record and national presence, admits Morningstar analyst Zain Akbari. We assign the firm a narrow economic moat, positive moat trend, and Exemplary stewardship.

“While other national chains have attempted to shift toward a similar dual-market approach, we believe O’Reilly’s expertise and customer relationships give it an advantage that will take time for peers to match,” says Akbari. “This should keep O’Reilly’s relative positioning strong among the national retailers as the industry undergoes a wave of consolidation, with large-scale participants like O’Reilly increasingly favored due to their ability to provide hard-to-find parts to commercial (and, to a lesser extent, DIY) customers more quickly, reliably, and efficiently.”

Shares are overvalued today, trading at 2-star levels.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)