Morningstar's Take on the Second Quarter

Our analysis of the second quarter in stocks and funds. Also, undervalued stocks and quarter-end index and fund category data.

As the second quarter of 2019 comes to a close, Morningstar's analysts have provided in-depth reviews and outlooks across equity sectors and fund categories.

Equities Stock Market Outlook: Energy Compelling as Oil Ends Quarter Where It Began The energy sector is the most attractive from a valuation perspective, particularly oil-services stocks.

Healthcare: Drugmakers and Providers Look Attractive We're finding some opportunity in a sector that's fairly valued overall.

Energy: Oilfield Services Particularly Compelling The sector overall is cheap, but oilfield-services stocks are at decade lows.

Basic Materials: Opportunities Surface Amid Share Price Declines We're especially keen on the uranium, lithium, and lumber industries.

Communication Services: We Like the Unloved Traditional telecom has lagged, but the rest of the sector has been strong.

Consumer Cyclical: Tariff Uncertainty Leads to Attractive Valuations Brexit and tariffs weighed on the sector last quarter.

Consumer Defensive: Few Values in this Pricey Sector Market continues to underappreciate tobacco stocks.

Technology: Opportunities Pepper Most Subsectors We expect U.S.-China trade talks to lead to greater end product demand down the road.

Real Estate: Few Cheap Stocks Sector is one of the most fairly valued.

Financial Services: Despite Recession Fears, We Find Value in Banks The sector overall is slightly undervalued.

Industrials: Bargains Among Industrial Distributors, Farm & Construction Machinery The stocks in this sector look fairly valued, and tariffs seem to be only a minor threat.

Utilities: Rich Prices Could Limit Defensive Prowess The sector is trading at the largest premium to our fair value estimate since 2017.

6 Midyear Picks for Dividend-Seekers These undervalued stocks all boast generous yields and secure dividends.

32 Undervalued Stocks Here are our analysts' top ideas in each sector as of midyear.

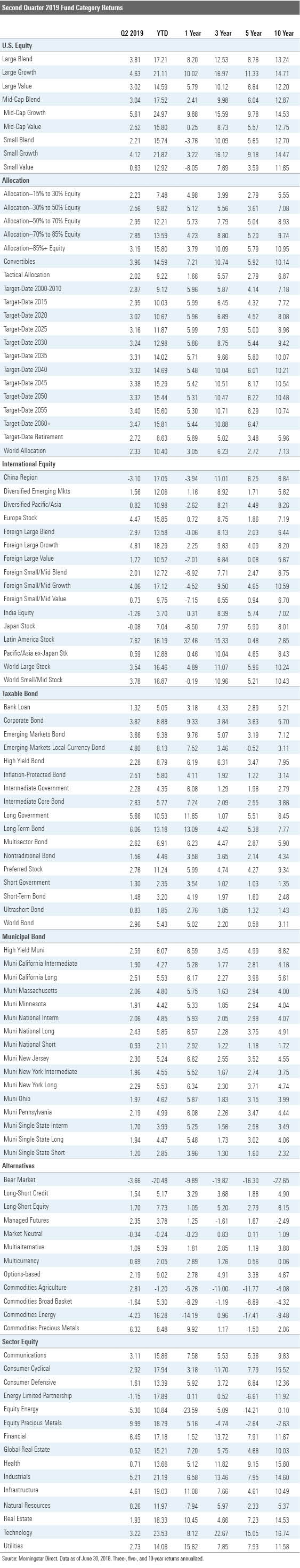

Funds The Second Quarter in U.S. Stock Funds: Settling Down After two volatile quarters, domestic stock funds took a breather.

Second Quarter in Non-U.S. Stock Funds: Uncertainty Abounds Trade drama threatened to derail international stock funds following a strong first quarter.

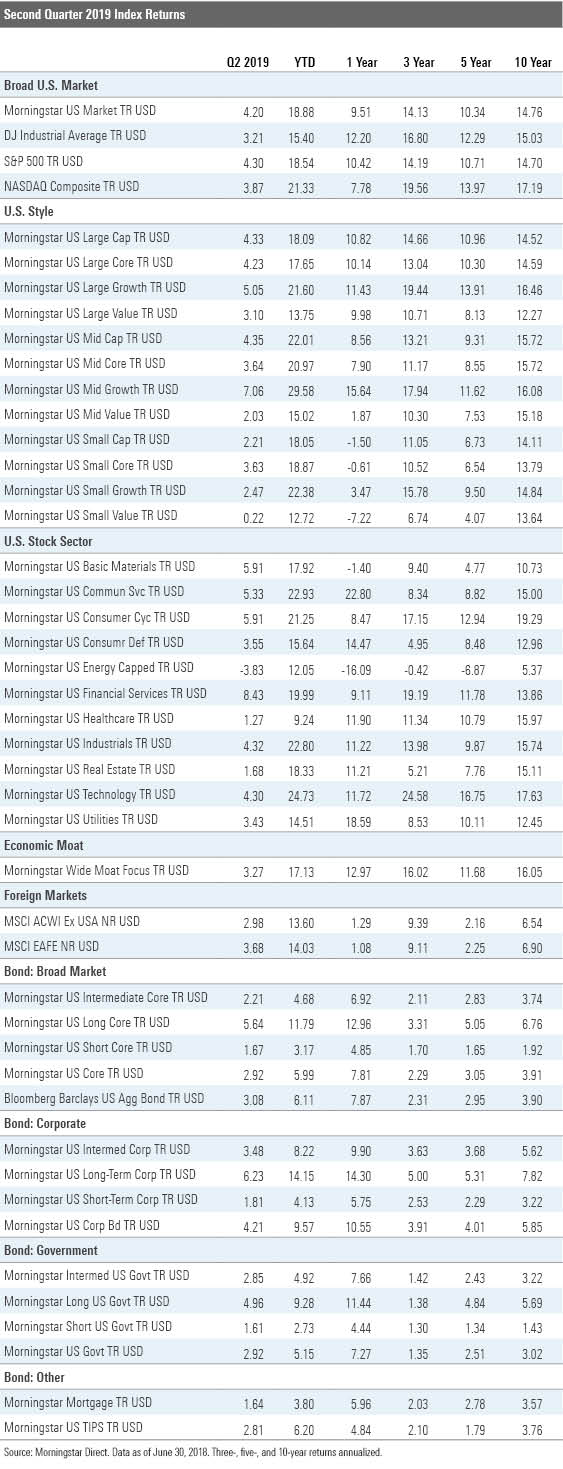

Second-Quarter 2019 Fixed-Income Markets in Review Uncertainty--around actions by the Federal Reserve, trade tensions, and slower global economic growth--contributed to a tense second quarter in fixed-income markets.

Sustainable Funds in the U.S. Saw Record Flows in the First Half With more funds establishing track records, more passive options, and big players getting into the field, the trend seems likely to continue.

Personal Finance A 7-Step Midyear Portfolio Review In a strong year so far for the market, here's how to see if a course correction is in order.

Download data (Excel)

-

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)