Real Estate: Firms Sensitive to Interest Rates in Short Term, but Less So in Long Term

No stocks in our real estate coverage are trading at 5 stars.

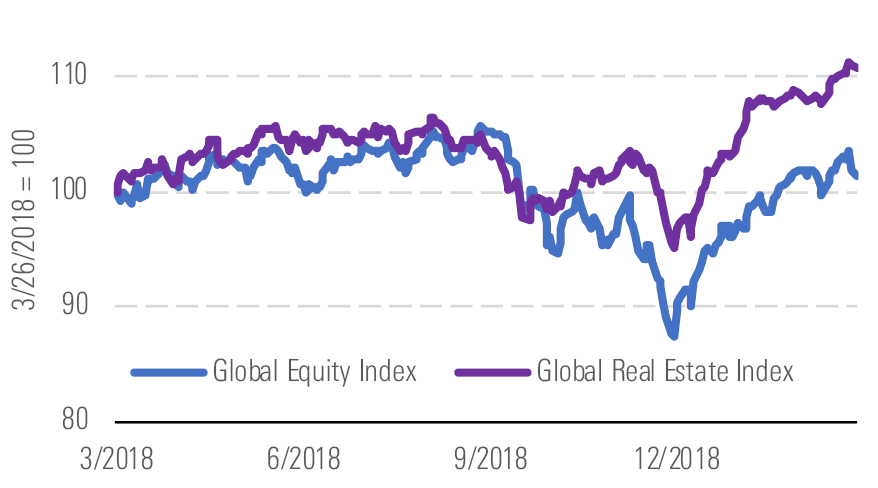

The Morningstar Global Real Estate Index rose 11% over the trailing 12 months, outperforming the broader global equity market (1%) after an interest-rate decline in the middle of the fourth quarter of 2018. Over the last three months, the sector's performance (13%) has been in line with the global equity market (11%).

Real estate is down slightly but is outperforming the Global Equity Index - source: Morningstar Analysts

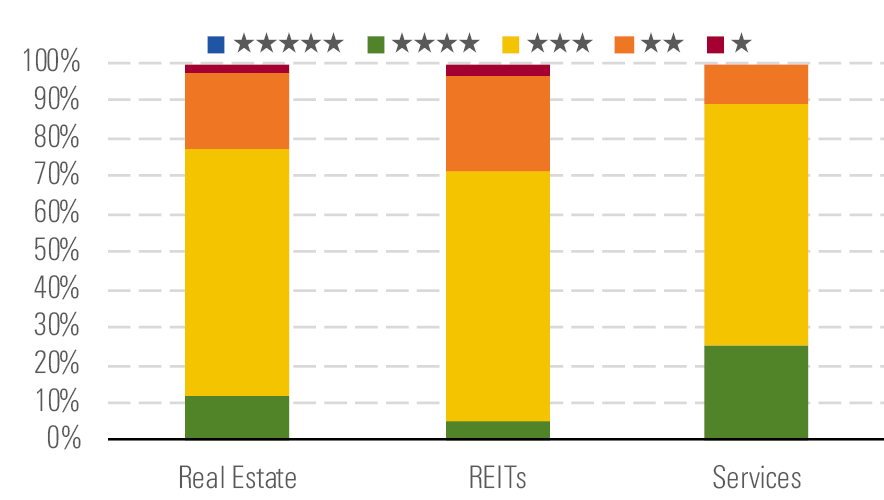

Real estate is one of the most fairly valued sectors, with our coverage trading at a 1% premium to our estimate of intrinsic value compared with a 4% discount at the end of the fourth quarter. Considering most of the names fall in the 3-star range, we see only a few attractively priced real estate companies and none trading at 5 stars.

Sector has mostly 3-star names, but there are some bargains in services - source: Morningstar Analysts

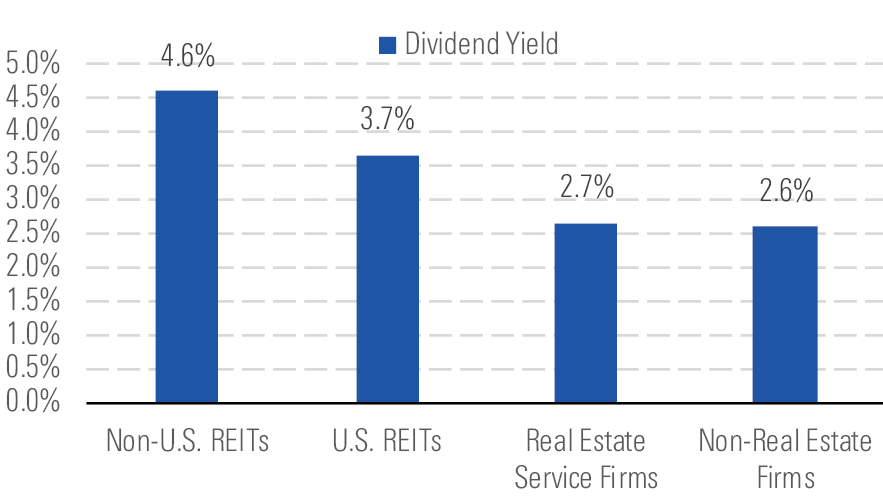

The average dividend for real estate firms is higher than the rest of our coverage. To receive tax-free status, REITs are required to pay out most of their net income as dividends to shareholders. International REITs on average have higher dividend yields than U.S. REITs, but both offer regular income payments higher than most equities. These companies are frequently included in portfolios of income-oriented investors. As a result, the yields of REITs are often compared with government bond yields.

Real estate firms have higher dividend yields than other sectors - source: Morningstar Analysts

The high dividend payouts make REITs sensitive to changes to interest rates. When the yields of risk-free government bonds rise, REITs' yield spread falls and many income portfolios move from holding REIT positions to holding government bonds. As a result, real estate firms, REITs in particular, will see the relative performance of their stock correlate with movements in the risk-free rate.

Movements in the 10-year U.S. government bond have corresponded with periods of real estate outperformance and underperformance. When the interest rate rose 40 basis points in September/October, real estate underperformed by 4%. However, when interest rates dropped almost 70 basis points between November and December, real estate firms outperformed by 5%. However, the relative performance of real estate often mean-reverts when interest rates are stable. For example, interest rates rapidly rose in January and February of 2018, but the following six-month period of stable interest rates saw real estate firms make up the lost ground. While real estate trades in the short term on interest-rate movements, the long-term impact isn't as strong.

Top Picks Macerich MAC

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $57

Fair Value Uncertainty: High

Class A malls continue to outperform other forms of brick-and-mortar retail. Over the past 12 months, Macerich's tenants have produced 10% sales per square foot growth and occupancy costs dropped to 12.4%, the lowest point in six years. This has let Macerich continue to push double-digit re-leasing spreads and generate net operating income growth above 4%. The stock has underperformed recently because of several tenant closures that will negatively affect cash flows in 2019. However, we view these as opportunities to redevelop the assets and replace out-of-favor tenants, which should yield significant returns over the next few years.

Sun Hung Kai Properties 00016

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: HKD 158

Fair Value Uncertainty: Medium

The sentiment in the Hong Kong residential property market has rebounded after the Fed turned dovish in early January and paused the rate hike in late January. The company is expected to achieve strong contract sales in 2019. It has also been more active in the land auction market, replenishing its project pipeline. Riding on the back of the city’s retail sector recovery, the company’s quality portfolio of retail assets performed well, with midteen rental reversion during second half of 2018. For the city as a whole, retail sales grew nearly 9% in 2018 compared with 2% in 2017, after declining 4% and 8% in the prior two years.

CK Asset Holdings 1113

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: HKD 81

Fair Value Uncertainty: Medium

A potential decline in the Hong Kong residential market has weighed on the stock price, but with Hong Kong residential sales only projected to be around 30% of the company's earnings we believe it is well-diversified, with earnings coming from investment properties, interests in REITs, hotels, and non-real-estate activities accounting for the rest. The company also holds a large agriculture land bank that can be used for development. Proceeds from noncore asset disposals in Hong Kong and its strong balance sheet have been tapped to acquire higher-yielding infrastructure and utility businesses as well as real estate assets overseas.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)