Fees Increasingly Important to Target-Date Fund Performance

Target-date funds are performing more alike before expenses than in the past, making fee differences even more important in separating good and mediocre performers.

Key Takeaways

- Fees to continue to play a meaningful role in the due diligence process of target-date funds as performance becomes more similar among peers.

- Target-date fund fees are falling, but the cheapest funds have fallen at a faster pace than the most expensive over the past 10 years.

- Despite a wide range of investment philosophies, target-date funds' performance is becoming more alike.

- Fees have explained more of the performance difference between target-date funds further from retirement than those closer.

- Over the five years ended Oct. 31, 2018, fee differences accounted for roughly 28% of the performance difference between top-quintile and third-quintile 2040 funds, but only 7% of the same gap in 2020 funds. Both were still higher than the longer-term average, however. This argues for fees to continue to play a meaningful role in the due-diligence process of target-date funds even as performance becomes more similar among peers.

If fee differences narrow, will fees remain a useful predictor of future fund performance, as our research has found to this point? In October, Morningstar tackled the question for U.S. equity funds and found that as the performance of equity funds has become similar, fees have explained more of the difference in funds' afterfee returns than in the past. In this Fund Spy, we'll apply a similar methodology to target-date funds to determine if fee differences still largely explain net-of-fee performance differences among funds.

Methodology To determine how impactful fee differences are to differences in target-date funds' net-of-fee returns, we looked at the rolling five-year returns net of fees for every 2020 and 2040 target-date fund that existed between November 2003 and October 2018, including dead funds, using its cheapest share class at the start of the period. We also looked at how cheap each fund's cheapest share class had gotten over that period. The cheapest share class was chosen so each target-date fund's net-of-fee performance could be compared on equal footing. We chose the 2020 and 2040 vintages to examine any differences between funds nearer the retirement date, which tend to be more bond-heavy, and further out on the glide path, where equities play a larger role.

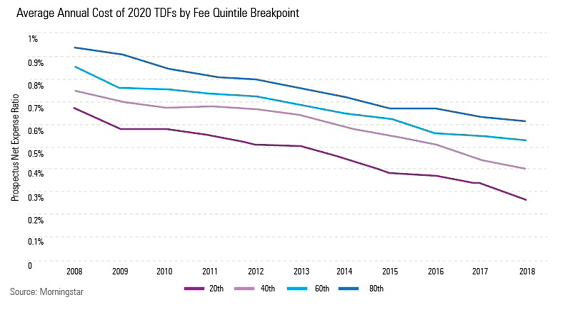

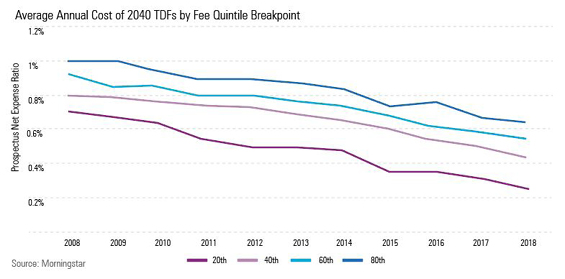

Fees Have Fallen, and Fee Differences Have Widened The cheapest share class of the average for 2020 and 2040 target-date funds has declined significantly since 2008, as shown in the two exhibits below.

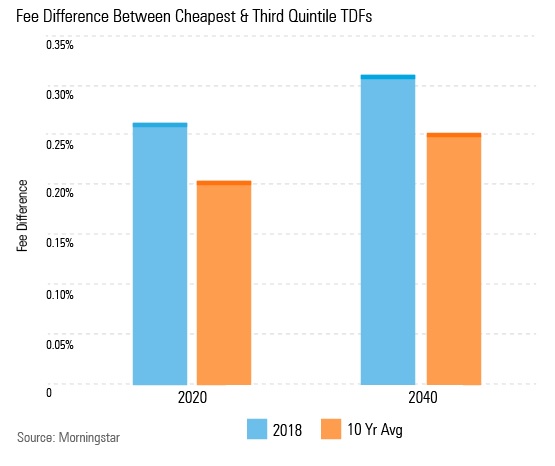

What’s interesting is that over the past decade, the cheapest quintile of funds has seen fees fall at a faster rate than the other quintiles. The exhibit below shows the difference in fees between the 20th percentile and the 60th percentile as of October 2018 and the average difference over the past 10 years.

Target-Date Fund Behavior Is Becoming More Similar Target-date funds have also been performing more alike.

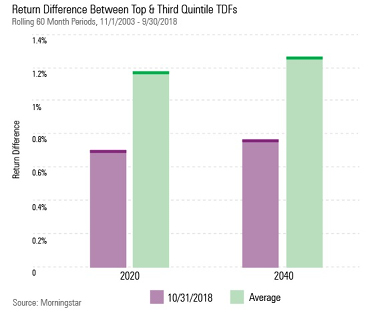

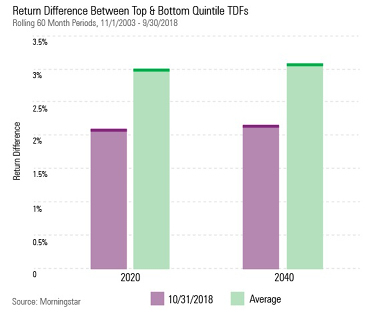

The next exhibit shows the average annual five-year net return difference between good (funds in the top quintile) and mediocre (funds in the third quintile) 2020 and 2040 target-date funds using the cheapest share class over rolling periods from September 2010 through October 2018.

The annual return difference between the average top-quintile and third-quintile fund has shrunk: As of October 2018, 0.71% and 0.75% separated these funds in the target-date 2020 and target-date 2040 categories, respectively. That’s considerably narrower than the annual difference over the full period--1.20% for both categories.

The gap between the best and worst performers (80th percentile) has also shrunk, as shown below.

For the five-year period that ended in October 2018, the average annual net return difference separating top- and bottom-quintile target-date funds was 2.12% and 2.20% for target-date 2020 and target-date 2040 categories, respectively. That’s about 1 percentage point narrower than the average return difference since September 2010.

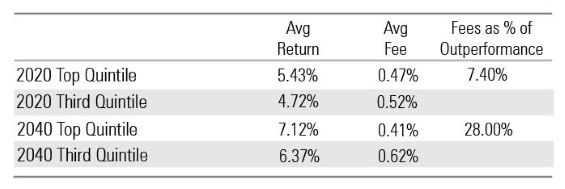

Years From Retirement To quickly recap, the cheapest funds have seen their fee advantage grow while return differences are narrowing. Does that mean fee differences have become more important in explaining target-date funds' return differences? To see the impact of fees in the most recent five-year period, we calculated the average fee charged by funds in each performance quintile over the five-year period then compared the fee difference with the return difference between those quintiles. This gives an estimate of how much of the top performing funds' return advantage was attributable to fees. The following exhibit shows the average return of the top and third quintiles for 2020 and 2040 funds over the most recent five-year period, the average fee charged by funds in those quintiles during the period, and the percentage of the performance difference attributable to the fees.

Percentage of Performance Advantage Attributable to Fee Differences

- source: Morningstar Analysts

Over the most recent five-year period, the average top-quintile 2020 target-date fund had a 0.47% expense ratio--a slight 0.05-percentage-point advantage over the third quintile--and the average top-quintile 2040 fund had a 0.41% expense ratio--a 0.21-percentage-point advantage. The average return in each quintile was narrow as well, with the average top-quintile 2020 fund gaining 5.43%, a 0.71-percentage-point margin over the average third-quintile peer. The average top-quintile 2040 fund beat the average third-quintile fund by a similar margin. The larger fee gap between top- and third-quintile 2040 funds translates to fees having a bigger impact on relative performance.

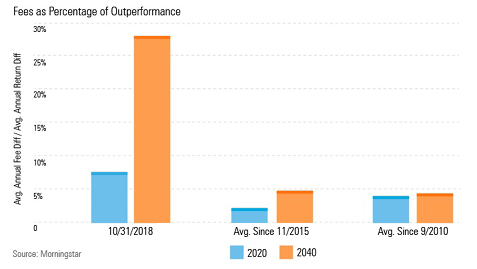

The exhibit below shows how the five-year results from October 2018 compare with the average over longer periods of rolling five-year returns.

The impact of fees on the relative performance of 2040 funds was well above the average impact over the prior three years of rolling five-year returns and the average since late 2010. The impact of fees on 2020 funds was closer to its long-term averages but still slightly higher.

Although the cheapest share class of all target-date funds has declined over the past 10 years, the lowest-cost target-date funds have seen their fee advantage grow over target-date funds with average fees. At the same time, return differences between funds has been narrowing. Taken together, these two trends argue for continuing to put a strong emphasis on fees when evaluating target-date funds as fees are likely to become a bigger edge for the cheapest funds going forward. Indeed, in the five years ended October 2018, fees accounted for a bigger percentage of the performance difference between the top-performing funds and middling performers than they have over the longer term.

Associate analyst Stefan Sayre and data journalist Gabrielle Dibenedetto contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ce4da8a2-a4df-4e55-8388-da69434527e0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/af89071a-fa91-434d-a760-d1277f0432b6.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ce4da8a2-a4df-4e55-8388-da69434527e0.jpg)