5 Sustainable Investing Trends From 2018

Sustainable investing continues to grow in importance.

1. Growing Climate Risk The biggest sustainability challenge the world faces today is global warming, and two reports released this fall underscored its magnitude. The report of the Intergovernmental Panel on Climate Change, written by scientists convened by the United Nations and released in October, finds that the world is currently on a path to warm by 1.5 degrees Celsius above preindustrial levels by about 2040, increasing risks to "health, livelihoods, food security, water supply, human security, and economic growth." The report estimated the global economic impact at $54 trillion, growing worse over the course of the century if warming continues to increase.

The IPCC report was followed in November by Volume 2 of the latest National Climate Assessment focusing on the impacts of global warming in the U.S., which reached similar conclusions: "Climate change creates new risks and exacerbates existing vulnerabilities in communities across the United States, presenting growing challenges to human health and safety, quality of life, and the rate of economic growth."

Climate change topped the list of ESG issues that concern asset managers in the U.S. SIF Foundation's biennial Report on U.S. Sustainable, Responsible, and Impact Investing Trends. Just last week, the Institutional Investors Group on Climate Change, a group of 415 asset managers and pension funds with $32 trillion in assets under management called on governments to do more to combat climate change, including a commitment to accelerate private sector investment into the low carbon transition and to improve climate-related company financial reporting.

Investors need companies to disclose their assessment of the climate-related risks they face and how they plan to mitigate those risks. Many companies face significant carbon risk, which means they are significantly exposed to fossil fuels in their operations or product usage. Investors need to evaluate whether those companies can survive the transition away from a fossil-fuel-based economy and how they plan to do so.

While carbon risk is a material concern for some companies, the growing physical risks of climate change are becoming material concerns for others. These are the impacts on a company's assets, operations, customers, and product use owing to more-extreme and more-frequent extreme weather events and from longer-term climate changes. Schroders estimates the potential costs to some companies of insuring their assets against the physical risks of climate change amounts to more than 4% of their market values.

If you are not sure about why investors ought to be concerned about climate change, I recommend Jeremy Grantham's white paper that is based on his speech at this year's Morningstar Investment Conference. I outlined three ways to follow Grantham's advice on climate-aware investing in this article and explain our Morningstar Carbon Risk Score here. The latter allows you to evaluate the carbon-risk exposure in your portfolio.

2. BlackRock's Commitment to Sustainable Investing The year 2018 kicked off with the head of the world's largest asset manager, Larry Fink, sending an open letter to corporate CEOs, urging them to think long term, act in ways that will benefit all stakeholders, and focus on how their firms make a positive contribution to society.

In response, a few pundits dragged out Milton Friedman's half century-old dictum that the social responsibility of business is to maximize profits. But they missed the point of the letter. Fink was not exhorting CEOs to spend money on corporate feel-good projects. He was urging CEOs to position their businesses for long-term profitability by keeping their focus on a bigger picture, one that recognizes companies focused on minimizing negative environmental and social impacts and accentuating positive ones will be rewarded by increasingly aware customers, protect their brand, and attract top talent, enabling them to better navigate the transition to a low-carbon digital economy.

I don't know of a single corporate CEO who spoke out against Fink's letter. Having more investors focused on sustainability gives them the space they need for bigger-picture thinking.

By August, Fink was telling the Financial Times that "Sustainable investing will be a core component of how everyone invests in the future" and that BlackRock intended to be a leader in the space. The firm had already stepped up its engagement on ESG issues with companies, and during the year it began to share more information with its investors about those efforts.

The firm also rolled out three new iShares exchange-traded funds for U.S. investors: iShares MSCI USA Small-Cap ESG Optimized ETF ESML, iShares ESG U.S. Aggregate Bond ETF EAGG, and iShares Global Green Bond ETF BGRN, bringing the firm's ESG ETF lineup to 13. It is now possible to construct a diversified ESG portfolio for virtually any asset allocation using iShares ESG ETFs.

3. Stewardship The third thing about sustainable investing this year is stewardship: how investors engage with the companies they own and how they vote in the proxy process. It's an element in each of the first two things. First, investors are increasingly engaging with companies, asking them to disclose climate-related risks. Second, BlackRock has ramped up its stewardship activities, arguing that as a permanent owner of capital owing to its size and proportion of passive assets, the only way it can really influence companies--and add long-term value for its investors--is through engagement.

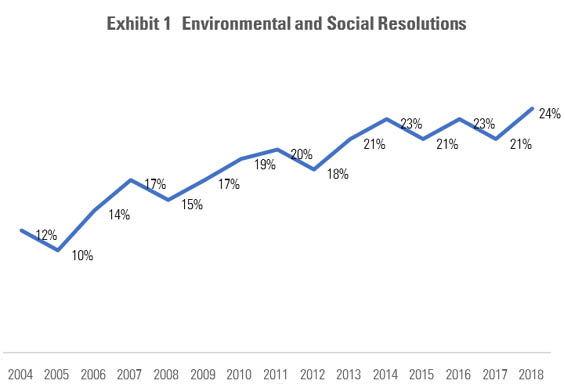

Shareholder resolutions about ESG issues have grown more frequent, and the level of shareholder support has increased, reaching an all-time high in the 2018 proxy season.

Source: Morningstar

While the average level of support for ESG-related shareholder resolutions may seem low, keep in mind that these advisory votes are always opposed by management and investors generally don't vote against management unless they feel strongly about an issue, or unless direct dialogue with the company has failed to produce the desired results. Against that backdrop, the growing support of ESG-related shareholder resolutions signals to companies that a significant proportion of shareholders cares about these issues. Many times, a proposed shareholder resolution doesn't make it to a vote because it prompts management and investors to discuss the issue in direct dialogue, resulting in management taking action to address investor concerns. In 2018, more shareholder proposals were withdrawn (212) than came to a vote (177), according to the Sustainable Investment Institute.

But the increasing successes on the stewardship front have drawn out-and-out attacks from business lobby groups like the National Association of Manufacturers, which claim that ESG issues like climate change are political and that the BlackRocks of the world undertake engagement activities without considering the views of the everyday investors whose assets they invest. NAM is leading an effort to encourage the SEC to adopt rules that would limit the ability of shareholders to get proposals onto a company's proxy by increasing the required number or value of shares held and the holding period. This would leave only a few large shareholders eligible to put proposals on a company's proxy. And while the BlackRocks of the world often engage with companies on ESG issues, they generally avoid sponsoring shareholder proposals.

Raising the bar for shareholders who wish to file shareholder proposals would be a step in the wrong direction. Such proposals facilitate the dialogue between shareholders and companies and provide early warning signals to companies about emerging issues that may affect them materially. As for the political argument that NAM makes, shareholder proposals must establish that they are financially material to a company in order to make it onto a proxy ballot. NAM would like for climate change to be defined as a political issue. But the genie is out of the bottle on that. It is clearly a material risk for many companies, and the shareholder proposal process is helping investors and companies better understand that risk.

4. The Sustainable Funds Universe Keeps Growing The fourth thing about sustainable investing in 2018 is that the sustainable funds universe in the U.S. has continued to expand. A total of 31 new funds were launched (17 open-end funds and 14 ETFs), and 55 existing funds added ESG or impact criteria to their investment processes, as described in their prospectuses. By contrast, in 2017, 27 funds were launched and 17 existing funds added ESG or impact criteria. By my count, there are now 341 sustainable open-end funds and ETFs available to U.S. investors. To make my list, a fund must make clear in its prospectus that it uses sustainability or ESG criteria and/or seeks to deliver measurable impact alongside financial returns. Funds that focus only on values-based exclusions are not included.

The level of commitment to ESG within the universe varies. Some funds have simply added a reference to ESG in their prospectuses, an indicator to investors that ESG is a material factor for the fund but not necessarily the determining factor for security selection or portfolio construction. Among the 55 existing funds that added ESG criteria to their prospectuses, nearly all of them fall into this group. Others clearly use ESG criteria as key factors in both security selection and portfolio construction. Still others include impact beyond financial return as an investment objective. Of the 31 funds newly launched in 2018, 13 have an impact focus.

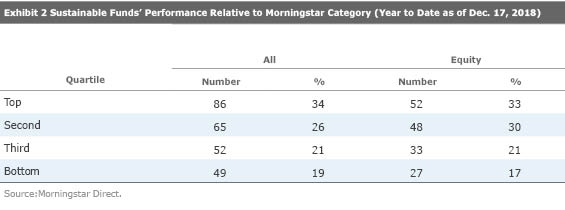

5. Sustainable Funds Performed Well in 2018 For the year to date through Dec. 17, sustainable funds have performed well this year relative to peers. I considered the 252 funds that have been around and defined themselves as sustainable investments since the first of the year and used the returns of the funds' oldest share classes as designated in the Morningstar database. So far in 2018, the returns of 34% of sustainable funds placed in the top quartile of their respective Morningstar Categories, and 60% finish in the top half. By contrast, the returns of only 19% place in the bottom quartile. Significantly in a year when equities have struggled, the pattern for sustainable equity funds is similar, with the returns of nearly twice as many (33%) placing in the top quartile as those placing in the bottom quartile (17%).

Because sustainable funds today pursue a range of investment strategies from a style and market-cap perspective, their collective returns are not driven by unique sector weightings. They do share in common the consideration of ESG factors, which leads them to companies that are managing environmental and social issues effectively and that have strong corporate governance practices. These tend to be lower-volatility companies that hold up better during downturns. I'll have more to say about sustainable funds in my next Sustainable Funds U.S. Landscape Report, coming out in January.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)