Examining Diversification in the Context of Low-Volatility Funds

Diversification has advantages for low-volatility strategies.

A version of this article was published in the September 2018 issue of Morningstar ETFInvestor. Download a complimentary copy of Morningstar ETFInvestor by visiting the website.

Diversification is an age-old risk-management concept. In its most basic form, it requires an investor to hold multiple assets that are unrelated to each other, thus preventing his portfolio from taking a dive when a single asset is down for the count. In the context of traditional asset classes, this typically means complementing stock investments with other assets like cash or bonds. These assets have low correlations with the stock market. This makes them effective diversifiers, but there is a trade-off, since they typically have lower expected returns.

Low-volatility equity strategies provide an alternative means to reduce risk while potentially improving upon the lower expected rates of return associated with cash or bonds. These strategies explicitly attempt to reduce risk while remaining fully invested in stocks.

There are two main flavors of low-volatility funds currently available on the menu. One approach holds stocks that are less sensitive to market movements, while the other exploits the mathematics of diversification to further cut back on risk. Both methods can lead to portfolios that are less risky than the broader market while looking incredibly different. The former method is simpler to implement but winds up with a portfolio that tends to be concentrated in a few sectors. The latter, more integrated approach taps into how stocks behave relative to one another while spreading its bets more evenly across sectors, offering a more diversified portfolio than the former approach.

Here, I'll briefly review two real-world examples of these construction processes, highlight their differences as they pertain to diversification, and how those differences impact our Morningstar Analyst Rating for each.

A Simple Approach

One way to reduce risk in a stock-only portfolio is to focus on stable companies.

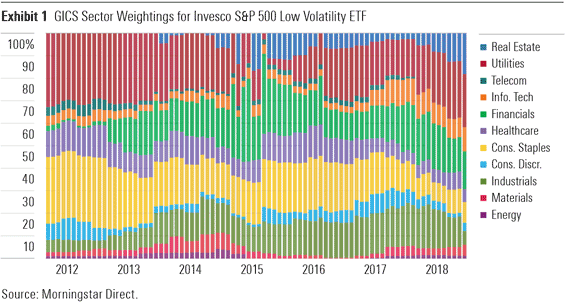

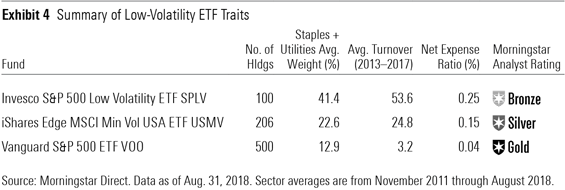

But this approach has some drawbacks. Weighting stocks by the inverse of their volatility breaks the link between their price and weight, causing turnover to run about 10 times that of the cap-weighted S&P 500 and making this strategy more expensive to trade. From a diversification perspective, its methodology does not include any measures to control sector exposure, so the fund has featured a strong, persistent bias toward traditionally stable sectors like utilities and consumer staples. On occasion, it has completely forgone volatile sectors like energy. Exhibit 1 shows the historic sector weightings of SPLV. From May 2011 through August 2018, companies from the consumer staples and utilities sectors accounted for about 40% of the fund, on average, compared with 13% for the S&P 500. For this reason, SPLV can be less diversified than its parent index, making it more exposed to the fates of certain industries.

A Diversification Advantage

The second, more integrated approach is the one followed by

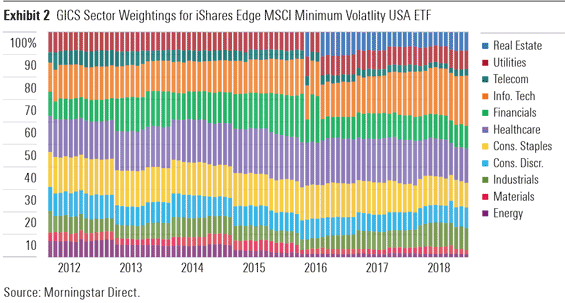

USMV's process also enforces some constraints to maintain diversification. It directly caps the weighting of each stock at 2% of the fund's assets during each semiannual rebalance and keeps sector weightings within 5% of the MSCI USA Index. Consequently, it tilts toward stable sectors, but to a lesser extent than SPLV. It also doesn't restrict the number of holdings in its portfolio, and it has typically held significantly more stocks than SPLV. Thus, it does a better job at spreading its assets over a wider range of stocks and industries. It also limits one-way turnover to 10% at each semiannual rebalance, so it likely incurs fewer trading costs than SPLV.

This too has also been an effective risk-reducing strategy. The fund's volatility was 1.6 percentage points less than the MSCI USA Index from November 2011 through August 2018. It also took on less exposure to market risk over this stretch, with a beta of 0.69. Its caps on sector weightings have kept its exposure to consumer staples and utilities more in line with the S&P 500. Collectively, these two sectors took up about 22.6% of the index, on average, between November 2011 and August 2018. This compares with 12.9% for the S&P 500 over the same period.

Odd Lots

Despite their seemingly similar objectives, the difference in methodologies used by these two funds can lead to very distinct portfolios. Specifically, USMV's inclusion of each stock's correlation with others can cause it to hold some unusual stocks for a strategy with a minimum-volatility label.

Let's first take a quick look at Newmont's business. The company's core operations are the extraction and processing of precious metals like gold and silver. Its exposure to volatile commodity prices and the relatively higher fixed costs needed to conduct these operations can cause its earnings to fluctuate in a manic fashion, making Newmont a risky holding. Over the trailing 10 years through August 2018, the stock's standard deviation was 39.6%, compared with 14.7% for the S&P 500. Based on its volatile nature, Newmont never found its way into SPLV's portfolio, nor should it have.

Newmont doesn't meet SPLV's criteria, but it does have another feature that can make it an attractive holding for USMV--its behavior greatly diverges from many other large U.S. stocks. Its correlation with the S&P 500 ran at just 0.13 over the 10 years through August 2018. In other words, though Newmont was a crummy stock to own over the past decade, it was an excellent diversifier. Therefore, Newmont plays into USMV's strategy, since its low correlation can help reduce the portfolio's overall volatility despite being a risky business.

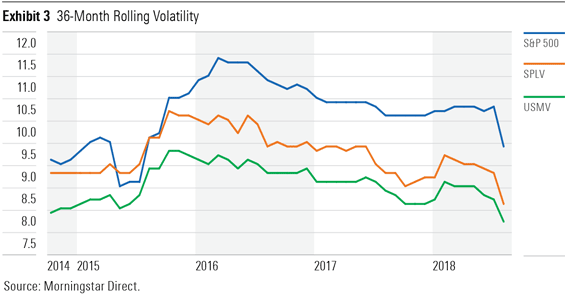

Including stocks with low correlations and using an optimizer to construct the least-volatile portfolio possible while maintaining diversification has been an advantage for USMV. Its volatility over the past several years has run modestly lower than SPLV's. Exhibit 3 shows the rolling 36-month standard deviation of USMV, SPLV, and the S&P 500 over the past several years.

Both of these funds have been effective at cutting back on risk relative to the S&P 500. USMV can occasionally hold risky stocks like Newmont that appear out of place in a low-volatility strategy. But USMV is justified in holding these types of companies because of their low correlations with other index constituents, which can be an advantage for a strategy that seeks to reduce volatility. USMV also controls its sector weightings and typically holds more stocks than SPLV. Both of these characteristics cause USMV's portfolio to be more diversified than SPLV's. USMV's cost profile is also more favorable. It directly takes steps to control turnover, which has run at about half that of SPLV, indicating that it incurs fewer trading costs. Additionally, its expense ratio is 0.10% lower than SPLV's. Overall, both strategies should do well. But better diversification and a lower cost of ownership should give USMV an advantage over the long run. For these reasons, we have assigned USMV an Analyst Rating of Silver and SPLV a Bronze rating.

/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/78665e5a-2da4-4dff-bdfd-3d8248d5ae4d.jpg)