Key Takeaways From Our 2018 Checkup on HSA Plans

We assessed 10 of the largest HSA plans; a few are healthy, but most need attention.

Editor's note: We have published new research and enhanced our methodology. Read our evaluation of the best HSA providers of 2022.

Health savings accounts, or HSAs, have become more popular thanks to their unrivaled tax advantages and increased adoption in health benefit plans. But choosing an HSA can be difficult given the industry's immaturity and the opaque, frequently changing availability of the information. What's more, investors have few resources to help them navigate the hundreds of HSA options that exist. For these reasons, we released our first-ever evaluation of HSAs in June 2017. Today, we published a report, building upon last year's research, that evaluates and ranks 10 of the largest HSAs available to individuals and articulates what we consider industry best practices. This is a summary of the report's key takeaways.

How We Evaluated HSAs We evaluated the plans assuming two distinct use cases: HSAs as a spending vehicle to cover current medical costs, and HSAs as an investment vehicle to save for future medical expenses. The spending account is typically used by individuals who have high healthcare costs and want to take advantage of HSA tax benefits today. The investment account appeals to individuals who will pay for medical costs out of pocket and intend to invest their HSA contributions to achieve long-term growth and supplement healthcare costs in the future. Investing HSA dollars allows individuals to maximize the unrivaled tax benefits offered by HSAs. Often known as the triple tax advantage, contributions into HSAs are tax-deductible, investment growth and interest are tax-exempt, and withdrawals avoid taxes as long as they're spent on qualified medical expenditures. The tax benefits even outweigh what's offered by a 401(k), a Traditional IRA, a Roth IRA, or a 529 college-savings plan.

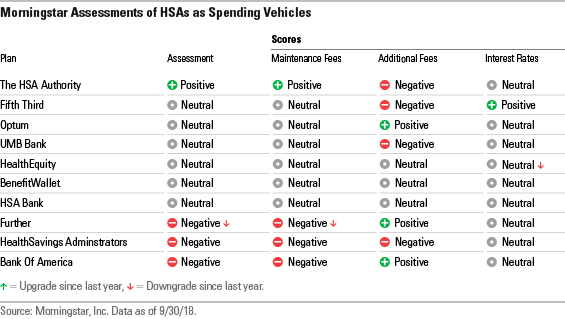

Spending Account Assessments When evaluating HSAs as a spending vehicle, we focused on three main components: maintenance fees, additional fees, and the interest rates offered by their checking accounts. We believe maintenance fees represent the most important consideration when choosing an account. As such, scores for maintenance fees are the only criterion that earns points toward the overall assessment.

A couple of HSA plans offer multiple checking accounts to participants. This year, our spending account analysis focused only on each plan's account that offers FDIC insurance. The HSA industry remains young, and FDIC insurance gives us—and participants—confidence that healthcare spending dollars are protected from a catastrophic event at the provider.

Below are our spending account assessments.

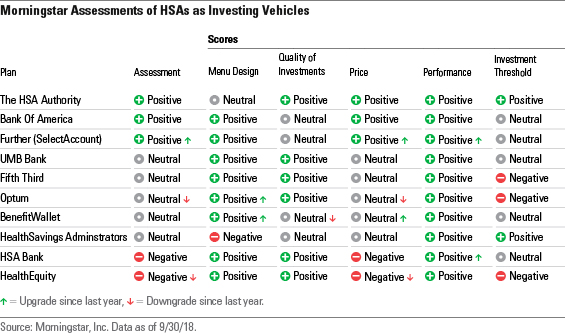

Investing Account Assessments We considered five components of HSA plans in assessing their merits as investment vehicles: investment menu design, quality of investments, price, investment threshold (the amount investors must keep in the checking account before they can invest), and performance. We consider price to be the most important component in evaluating HSAs as investing vehicles, as it's the most significant differentiator among plans.

Our investing account assessments are shown below.

Key Takeaways Overall, while some of the HSA plans that we evaluated last year have improved their quality of investments and investment menu designs, there's still much room for continued progress. Fees vary significantly across plans, and most require individuals to keep money in the checking account before they can invest. Below are some of our key takeaways from this year's HSA Landscape Report:

Best Practices

- HSAs as spending vehicles should avoid account maintenance fees, limit additional fees, offer reasonable interest on deposits, and provide FDIC insurance.

- HSAs as investing vehicles should charge low fees for both active and passive exposure, offer strong investment strategies in all core asset classes while limiting overlap among options, and allow first dollar investing (by not requiring money to remain in the checking account before investing).

The Best HSA Plans

- We consider The HSA Authority the best HSA plan for spenders and investors.

- Fifth Third's spending account is compelling for individuals able to keep more than $4,000 in the checking account.

- Further and Bank of America are solid choices for HSA investors, though neither plan quite stacks up to The HSA Authority primarily because of higher fees.

Upgrades

- Further's investing account assessment increased to Positive, because it offers very low fees for passive exposure, though its active funds aren't a bargain.

Downgrades

- Further's spending account assessment fell to Negative because its FDIC-insured checking account charges maintenance fees that can't be waived; in addition, the firm will stop offering its free checking account to newcomers in 2019.

- HealthEquity's investing account assessment decreased to Negative, because it charges very high fees for passive exposure.

- Optum's investing account assessment fell to Neutral after learning that the firm charges higher investment fees than what it disclosed to us in 2017.

Signs of Progress

- The quality of investments across HSA plans remains strong and has improved since last year; at least 50% of the investment options available in the 10 plans we evaluated boasted Morningstar Analyst Ratings of Gold, Silver, or Bronze.

- Investment menu designs have improved, with several plans addressing shortcomings that we identified last year by reducing investment menu overlap or adding core investment options.

Room for Improvement

- Transparency remains poor. Only four of the 10 plans we evaluated disclose relevant fees, interest rates, and investment lineups on their websites, and call centers often struggle to provide this basic information.

- No plan earns Positive marks across the board as either spending or investment vehicles, indicating ample room for improvement.

- Fees vary across HSA plans but remain elevated. Across the 10 plans, the average cost for passive funds ranges from roughly 0.30% to 0.75% per year, and the average for active funds from about 0.80% to 1.20%.

- Eight of the 10 plans require investors to keep $1,000 or $2,000 in a checking account before they can invest, which can create an opportunity cost.

Next week, we’ll take a closer look at our assessments of HSAs as spending vehicles.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OSPGGQHXJVCGLBHR5CUUQWH3NQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AGAGH4NDF5FCRKXQANXPYS6TBQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)