If you’re looking for a way to stretch your healthcare dollars, you might consider a health savings account, or HSA.

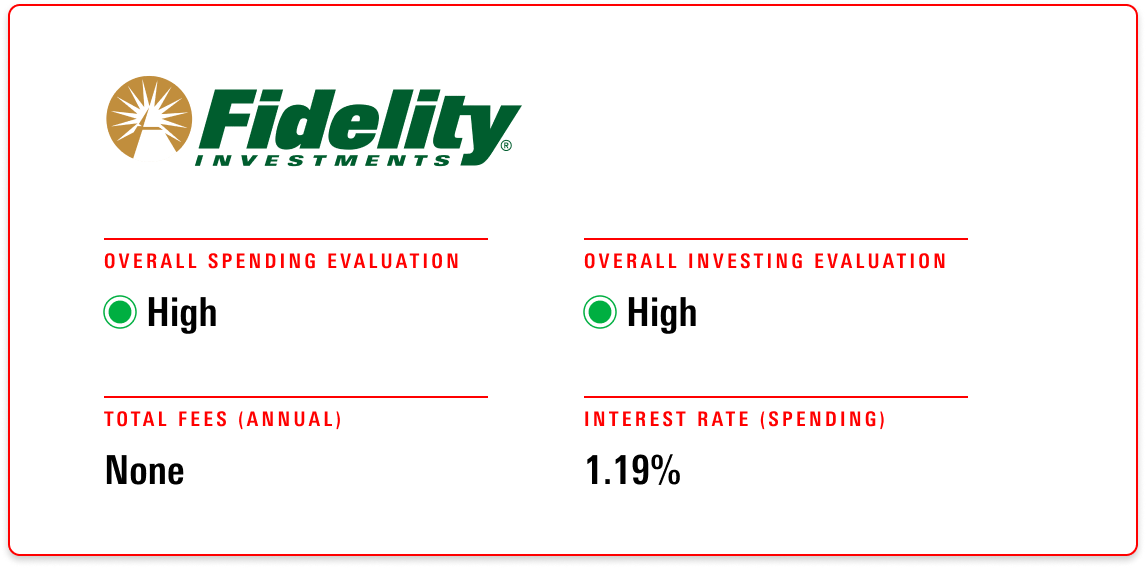

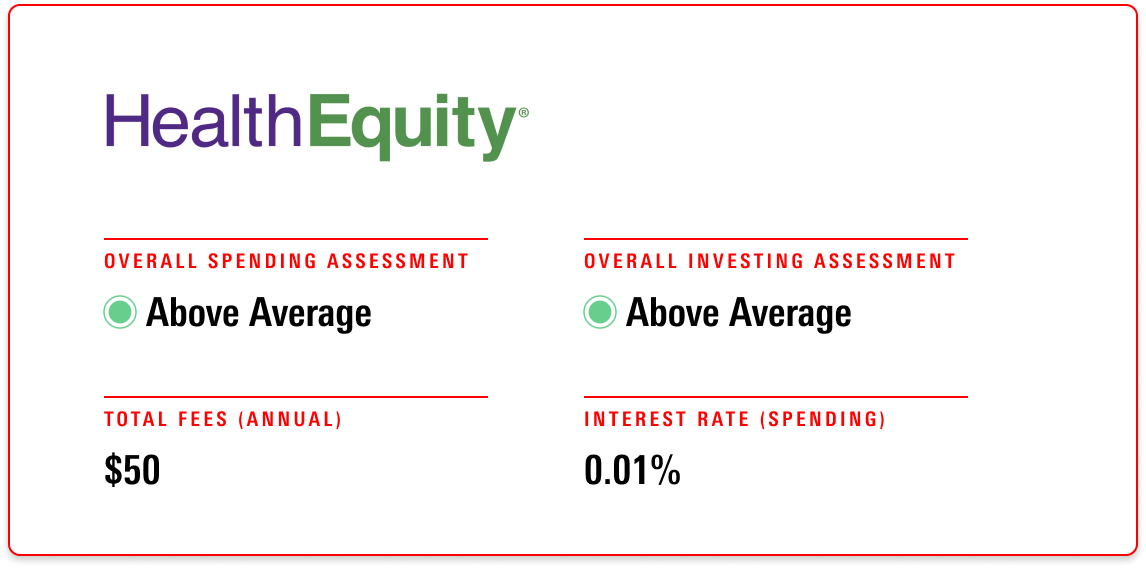

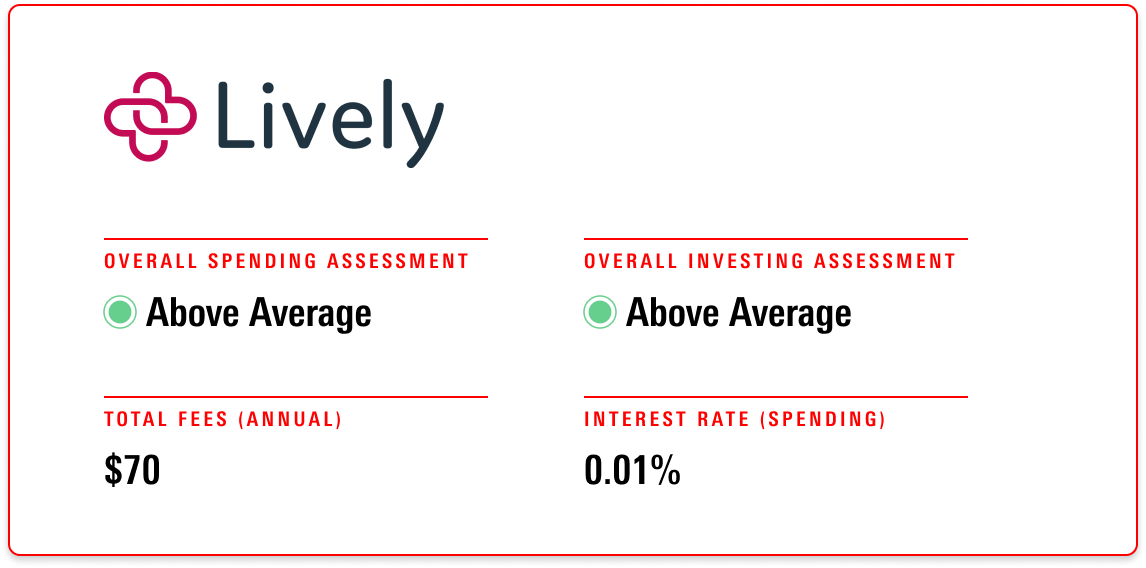

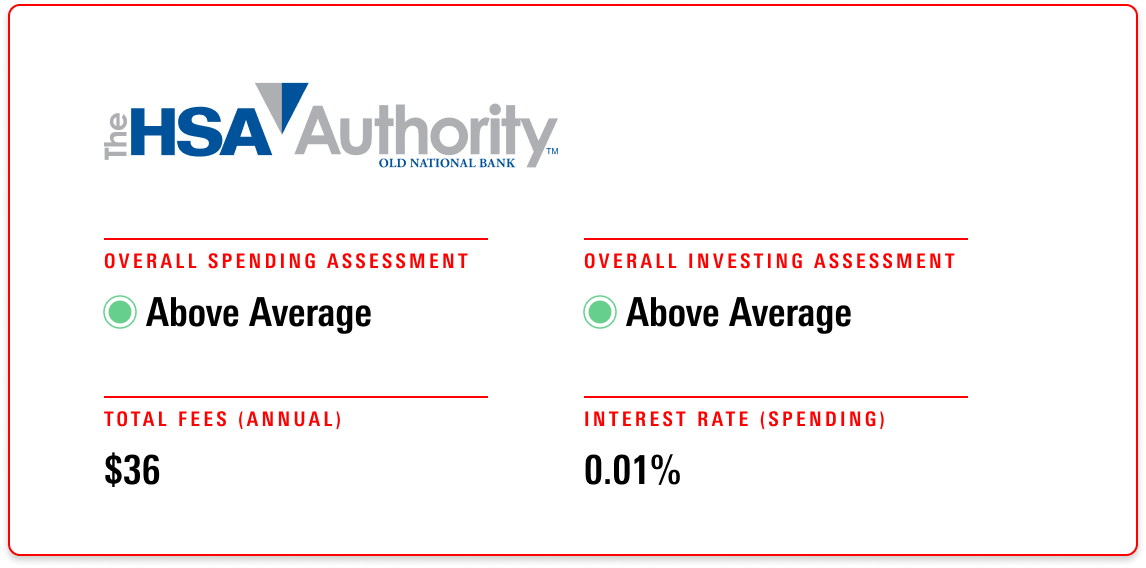

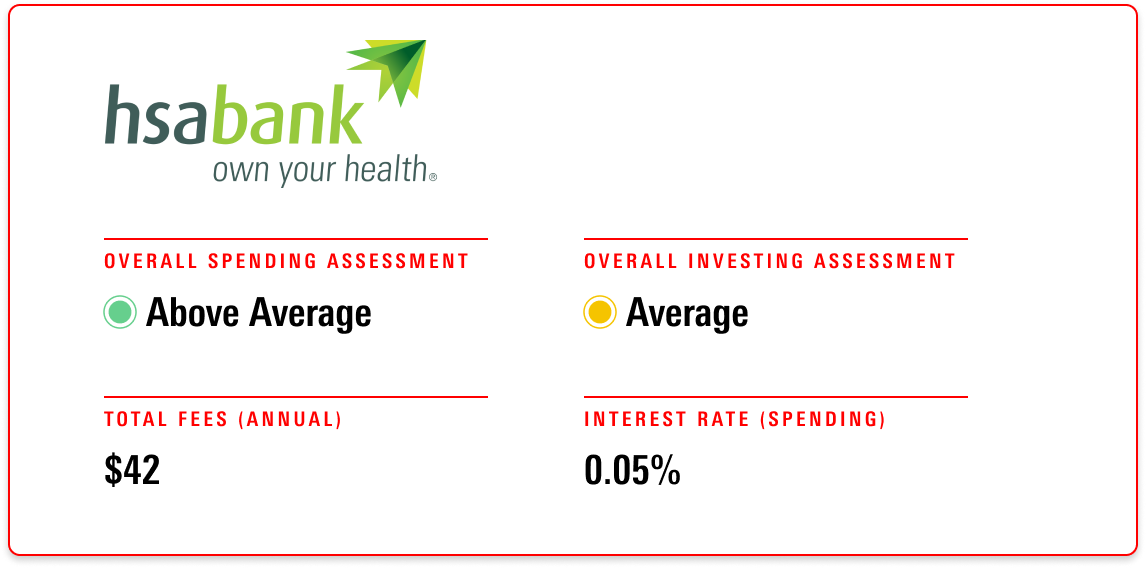

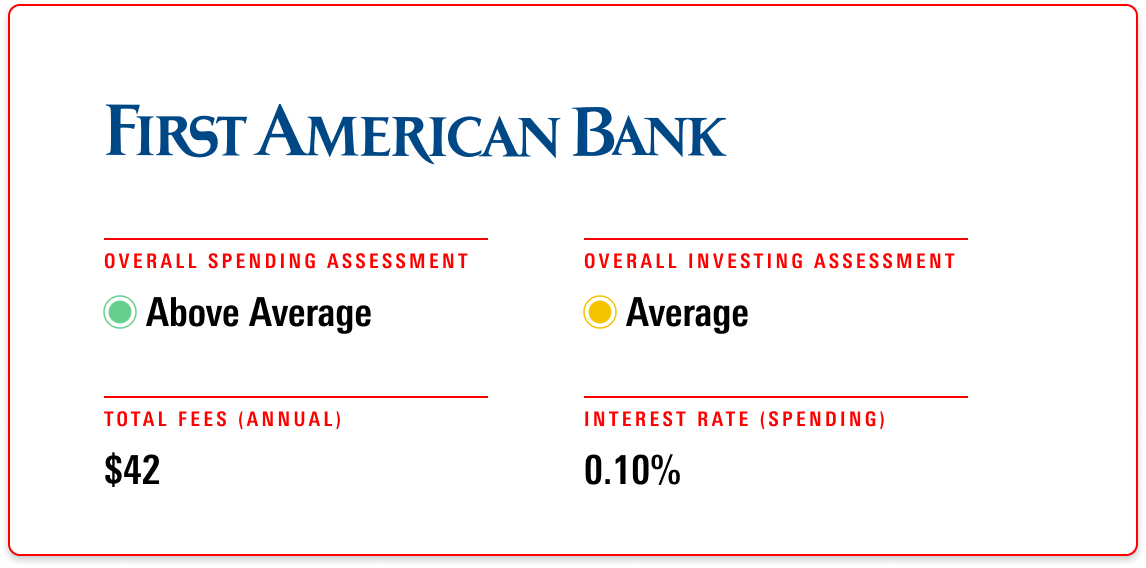

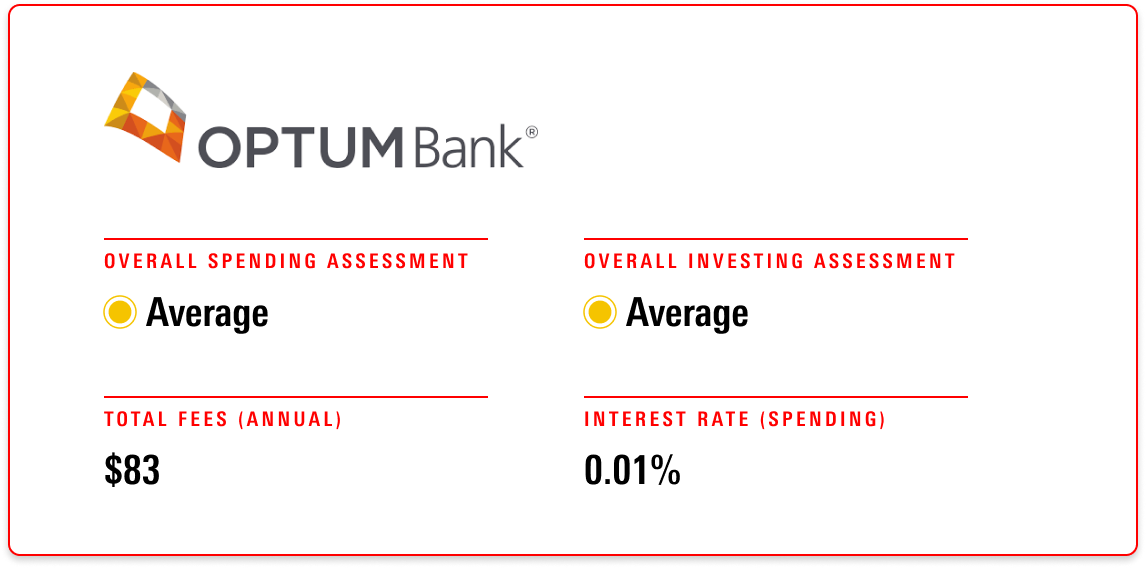

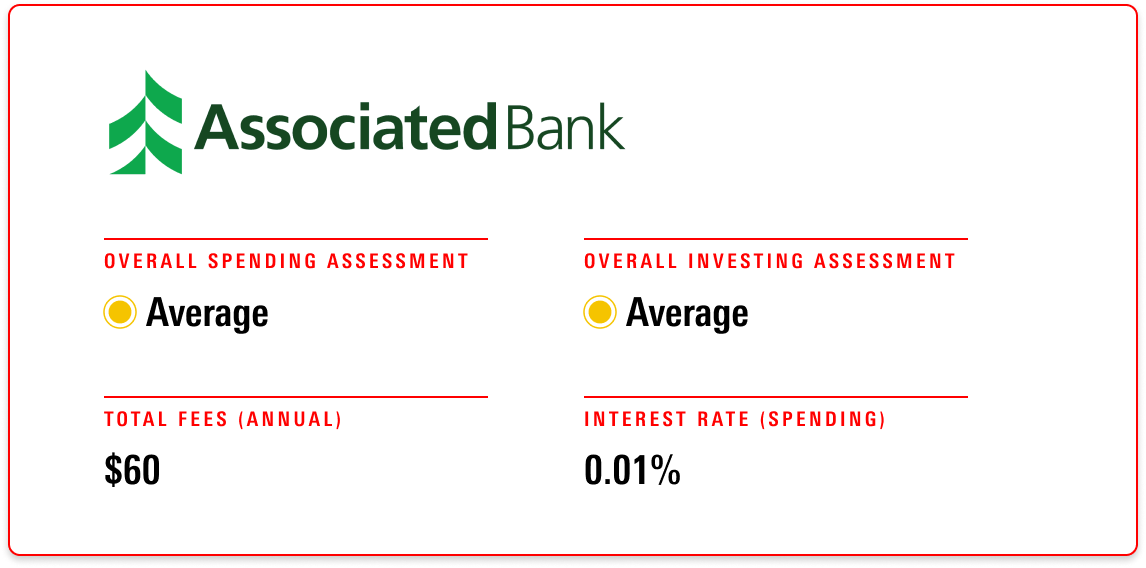

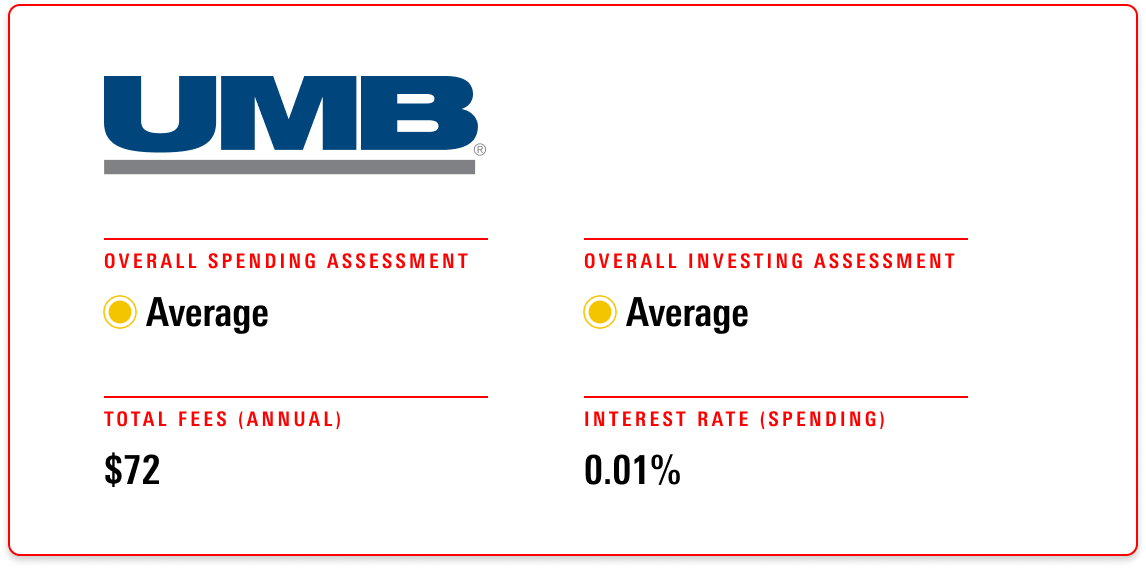

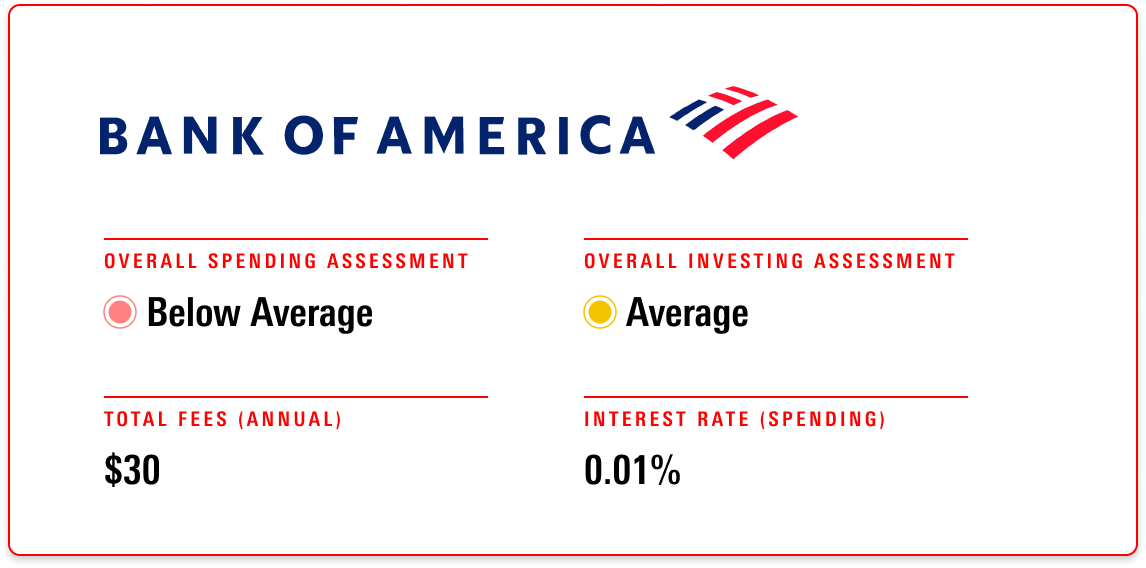

Thanks to its flexible withdrawal rates and powerful tax benefits, an HSA can be a powerful tool. It can be used as a healthcare checking account, or a long-term investment vehicle, and varying degrees in between. But the slew of HSA providers out there, with differing account features and characteristics, can make it a daunting task to sort through all your options. That’s why Morningstar evaluates the top HSA providers that offer retail accounts for those looking to shop around.

Even if you already have access to an HSA provider through your employer, our assessments can help you get the most out of your HSA.

We cover the inner workings of HSAs, address frequently asked questions, and rate HSA providers for different uses. If you decide that an HSA is right for you, or you want to see how your employer-sponsored plan stacks up, consider our list of the best HSA providers for 2022.