How Target-Date Funds Fared Amidst the Coronavirus Sell-Off

Results met expectations and improved since the last bear market, though outcomes diverged for near-retirees.

Editor’s note: Read the latest on how the coronavirus is rattling the markets and what investors can do to navigate it.

Key Takeaways

- Target-date funds performed in line with expectations amidst the coronavirus bear market. While their diversification benefits dissipated, that's not abnormal during extreme sell-offs.

- Target-date funds held up better during the coronavirus drawdown than they did during the global financial crisis, a sign of industry progress.

- Outcomes varied meaningfully for near-retirees, highlighting the importance of knowing your target-date fund's risk profile.

Quick Recap Target-date strategies have become increasingly popular in 401(k) plans, with assets eclipsing $2 trillion as of year-end 2019. Target-date strategies' highly diversified portfolios and systematic reduction in risk as retirement approaches also make them strong options for hands-off investors putting taxable money to work.

Still, the sharp sell-off caused by the global coronavirus pandemic served as a good reminder that, despite extreme diversification, not all target-date funds are created equal. Investors should be especially cognizant of their target-date fund’s risk profile as they approach and enter retirement, when their nest eggs have likely peaked and they begin to rely on those savings to support their lifestyle.

We’ll begin with a broad overview of target-date fund performance amidst the coronavirus sell-off. Then, we’ll dive into specific examples, highlighting strategies that proved resilient, ones that didn’t, and the rationale behind it.

Diversification Benefits Dissipate in Periods of Extreme Panic During the coronavirus meltdown, target-date funds' diversification benefits waned, but results met expectations.

Target-date funds haven’t been immune to the coronavirus meltdown that occurred from Thursday, Feb. 20 through Friday, March 20, which captures most of the market’s drawdown so far this year. Despite extreme diversification, investors expected to retire this year (2020 funds) lost more than 17% on average. Individuals expected to retire in 40 years (2060 funds) lost 31%--a minor improvement versus U.S. equities, which fell 33%, and global equities, which declined 32%.

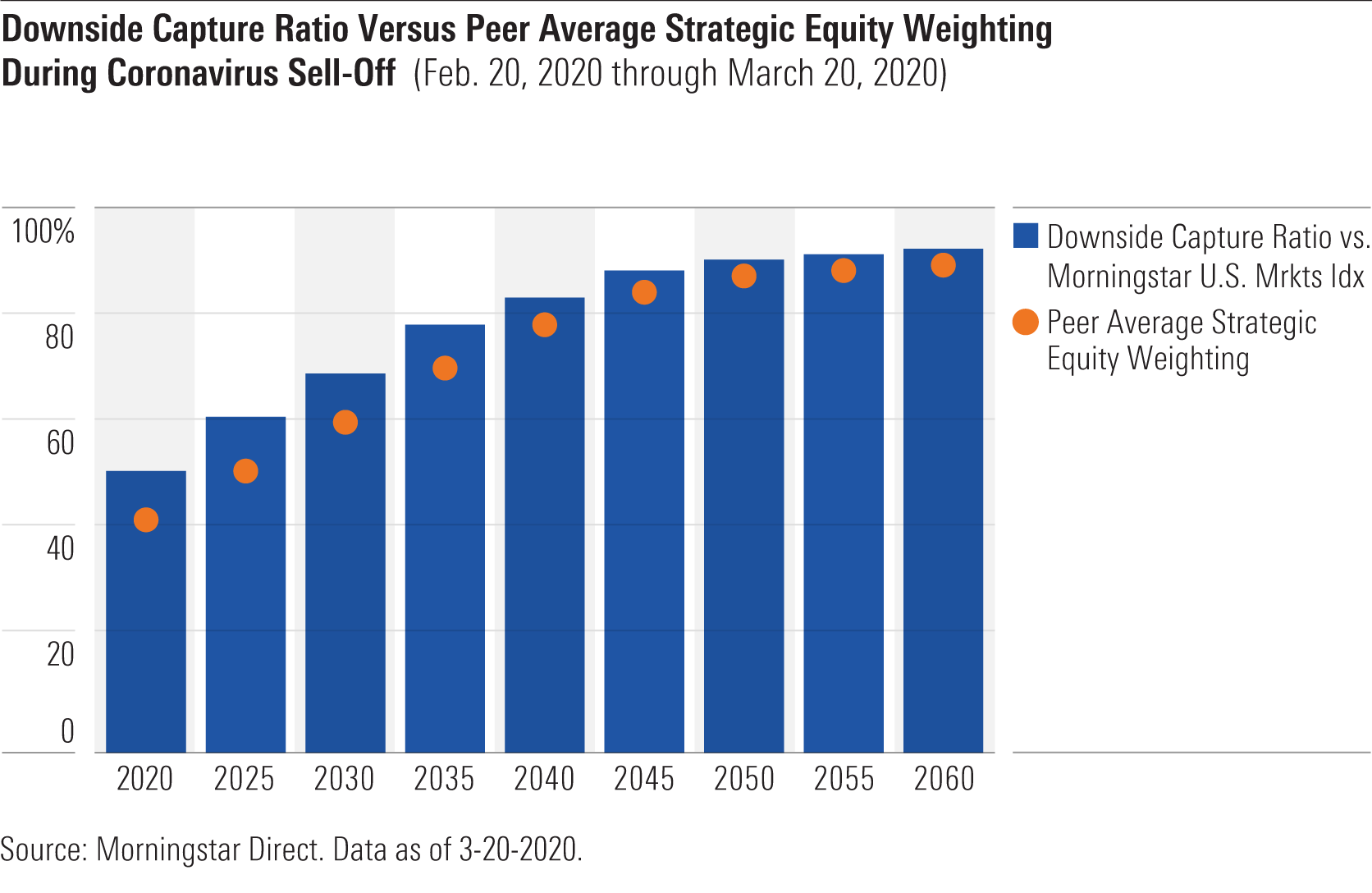

The chart below shows that target-date funds have captured more of the equity market’s downside than would be anticipated from their strategic equity weighting. While seemingly counterintuitive, that aligns with expectations. During more-modest equity sell-offs, bonds typically provide ballast, rising in value as equities fall. But during severe drawdowns, like the ones experienced this year and during the global financial crisis, correlations across asset classes rise, and even investment-grade bonds are susceptible to losses. Indeed, target-date fund bond portfolios declined alongside their stock portfolios, exacerbating losses in the recent meltdown.

Comparing Results During the Coronavirus Bear Market Versus the Global Financial Crisis Target-date funds performed better during the coronavirus meltdown than they did in the last bear market.

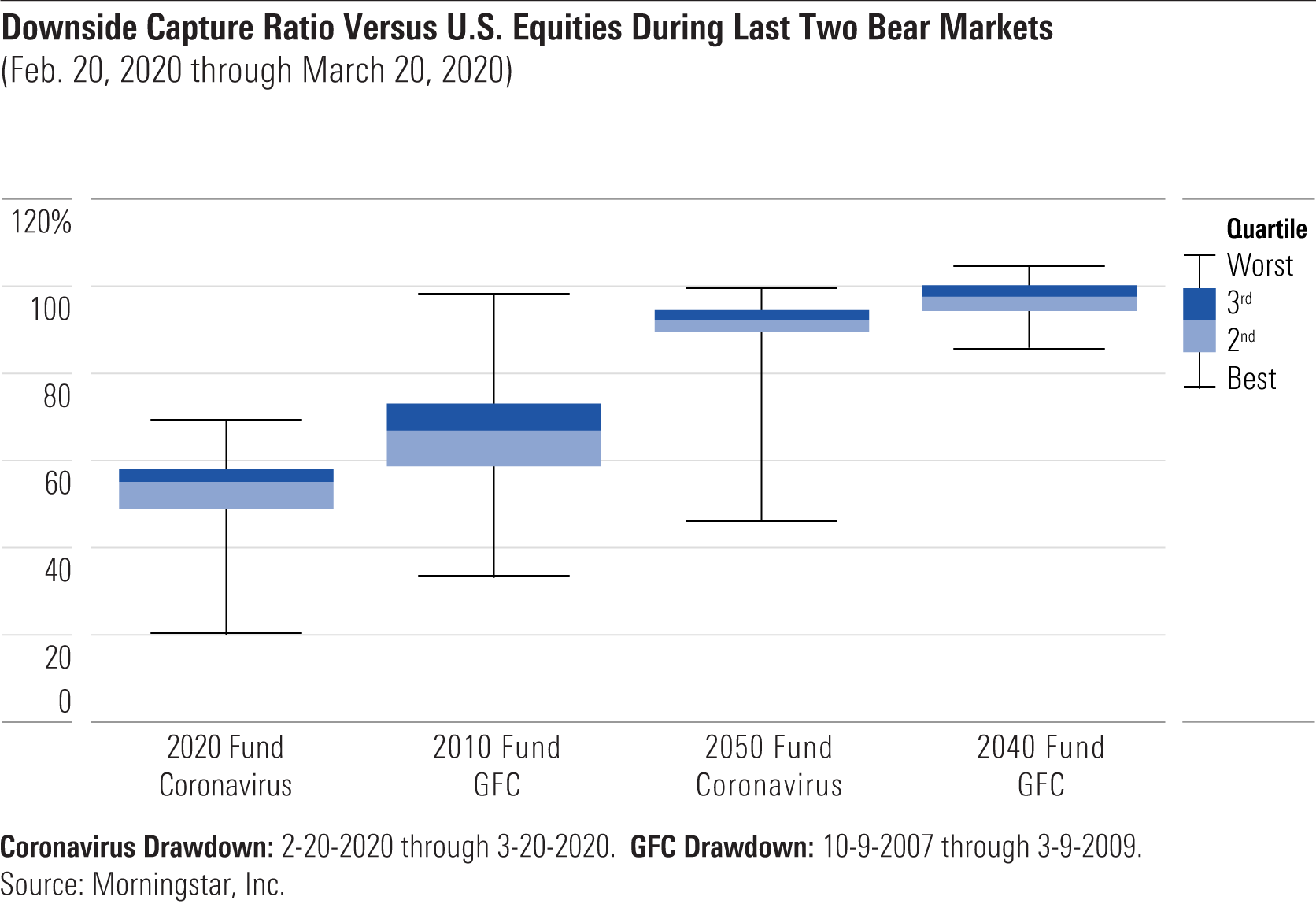

During the global financial crisis, when U.S. equities fell 55% cumulatively from their October 2007 peak to their March 2009 bottom, investors planning to retire in 2010 on average lost 67% as much as U.S. stocks. Investors intending to retire in 2020 fared better amidst the coronavirus sell-off, capturing on average 55% of the U.S. market’s 33% loss.

Younger investors performed better in coronavirus bear market, too. Individuals 30 years from retirement lost 92% as much as U.S. equities during the coronavirus sell-off, versus 98% during the global financial crisis.

The dispersion of outcomes among target-date managers also narrowed during this bear market for both younger and older investors. The chart below illustrates these outcomes. Comparing results versus global stock market indexes revealed similar findings.

Highlighting Divergences in Results Near Retirement Prominent target-date series posted mixed results for near-retirees amidst the recent sell-off owing to differences in risk profiles.

Target-date investors face the most at risk near retirement, as their account balances are likely approaching all-time highs and these individuals will presumably soon forgo their salaries and rely on their savings. Early-in-retirement losses can disrupt retirees’ plans, especially when individuals begin making withdrawals, locking in lower account values.

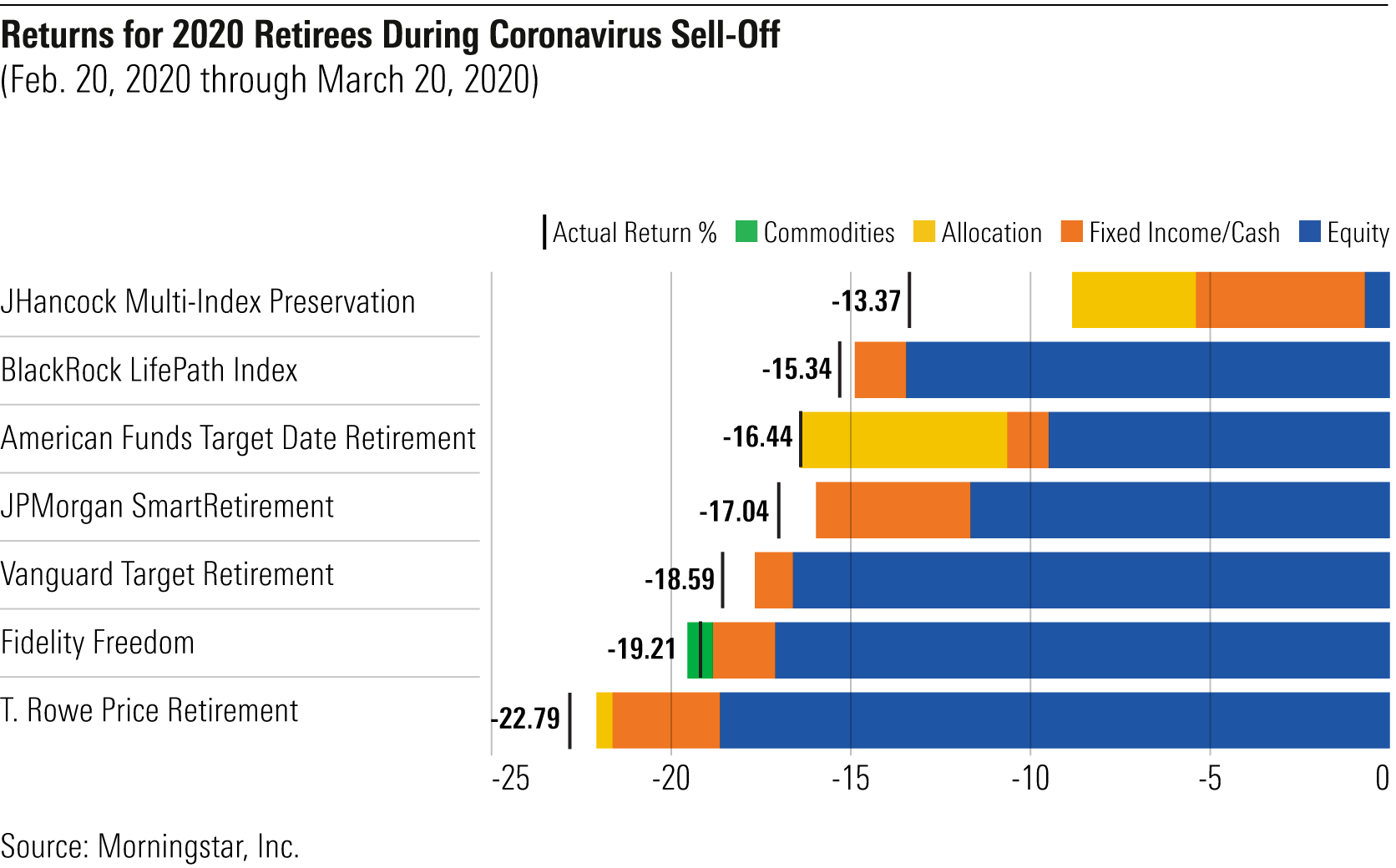

The chart below shows returns experienced during this year’s drawdown by investors planning to retire in 2020 across some of the industry’s most prominent or unique target-date series. It also depicts the contribution of returns by each series’ equity, allocation, fixed income/cash, and commodity underlying fund exposures using holdings as of Dec. 31, 2019. (Actual returns differ from returns estimated by the underlying fund contributions due to changes in portfolios--such as systematic reductions in risk, changes in tactical positioning, and underlying fund changes--that occurred since the start of the year.) Notably, each target-date fund’s fixed-income/cash portfolio lost money in the recent drawdown, declining anywhere from about 1% to 5%.

The variation in outcomes for near-retirees highlights the importance of understanding the risks-and rewards--of your target-date fund’s risk posture as retirement approaches. To that end, let’s explore differences in asset-allocation approaches--and their implications for near-retirees during a sell-off--taken by the target-date series shown above.

Target-date managers construct glide paths with different risks in mind. Two of the most commonly cited risks include longevity risk--the risk of not saving enough or outliving your savings--and market risk--the risk of a material loss in value due to market movements. The former approach typically leads to a more equity-heavy glide path, while the latter results in a more conservative stance.

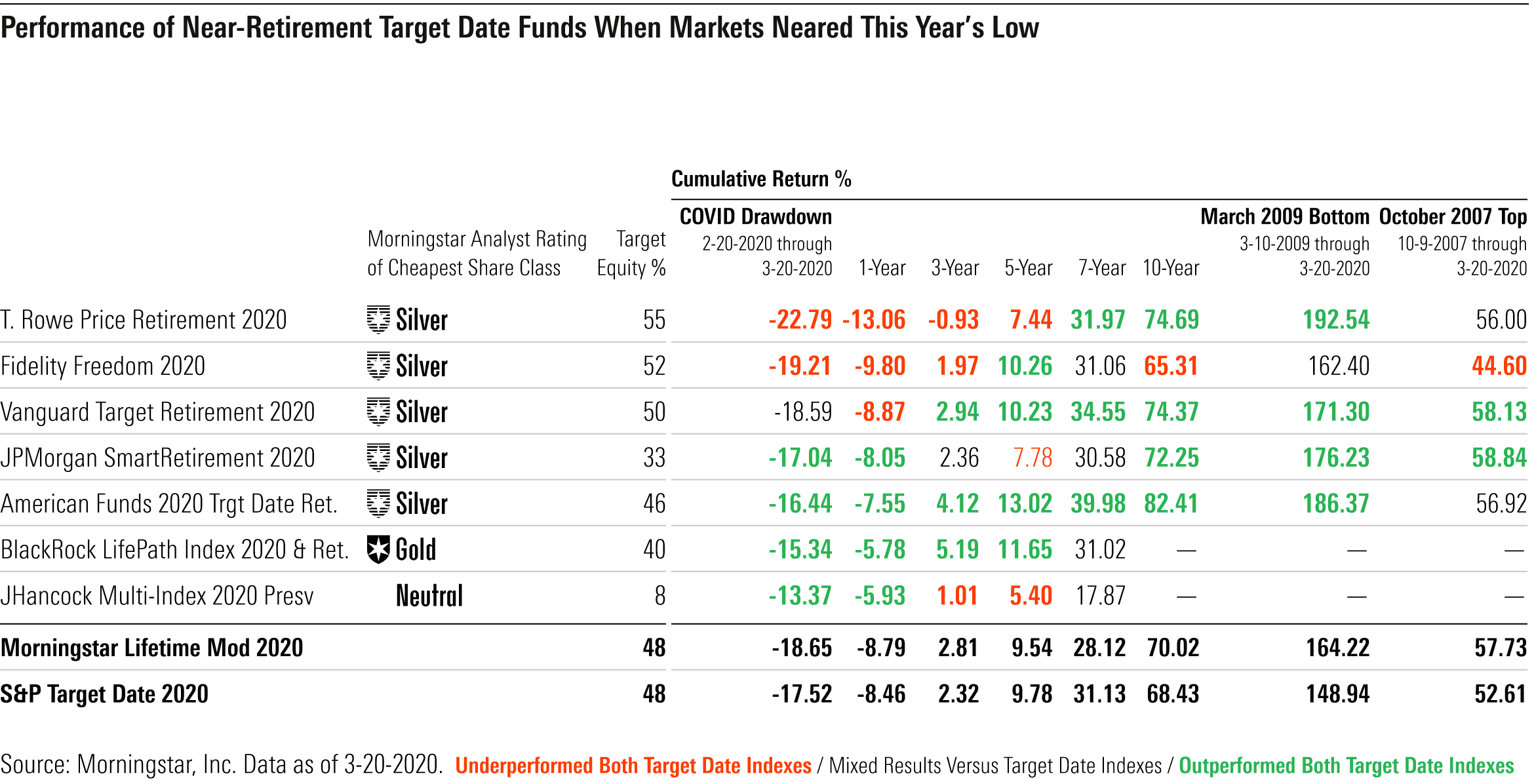

Focusing on Longevity Risk Has Led to Long-Term Gain but Near-Term Pain T. Rowe Price has long stood by its commitment to minimize longevity risk via a heavy equity weighting in its Retirement series. It targets 55% in equities at retirement, versus 43% for the norm. Its bond portfolio also courted more risk than most in the recent sell-off, contributing an estimated 3% loss in the 2020 fund. That led to one of the industry's worst outcomes for near-retirees during the drawdown, when its 2020 fund declined almost 23%, lagging relevant target-date indexes shown in the table below by about 4 to 5 percentage points. As of March 20, that largely wiped out the fund's excess returns it had earned over the past five years. The fund's higher risk profile has paid off over the long term--since the market bottomed on March 9, 2009, through March 20, 2020, it gained 192%, outpacing all its competitors. The series remains an excellent choice--its cheapest share class earns a Morningstar Analyst Rating of Silver--but investors should prepare for a bumpy ride.

Fidelity’s Freedom Funds also emphasize longevity risk, though to a lesser degree than T. Rowe Price. It’s above-average targeted equity stake of 52% at retirement contributed to its 2020 fund’s below-average 19.2% loss during the coronavirus sell-off. Investors in its 2020 fund have reaped the benefits of an overweight stake in equities during the past five years, but when stocks neared their trough this year, the 2020 fund’s one- and three-year returns came up short. The series remains a strong option; it improved its approach in late 2013 amid lackluster results and now earns a Silver rating on its cheapest share class.

A Balanced Approach to Risk Management Contained Losses Vanguard's 2020 fund targets a 50% weighting in stocks at retirement, which largely drove its subpar 18.6% decline in the drawdown. However, its conservative bond portfolio, which lost just about 1% in the sell-off, lessens its risk profile. The series' two share classes receive Silver ratings; its consistent and highly diversified approach has delivered over time and it remains a top pick for investors.

JPMorgan’s SmartRetirement series takes meaningfully less equity risk than the average peer for near-retirees, targeting 33% in stocks at retirement. However, its bond portfolio, which includes high-yield bonds, emerging-markets debt, and bank loans, courts more risk than most, leading to an overall moderate risk profile. The 2020 fund’s bond sleeve lost about 4% in the drawdown. Still, with a 17% loss, the 2020 fund held up modestly better than peers and target-date indexes. (The series merges its target-date vintages into a retirement income fund at retirement, but it hasn’t yet merged its 2020 fund--a move that would have reduced losses by about 1 percentage point during this year’s drawdown.) Despite a few missteps during the past five years, the 2020 fund’s long-term returns rank among the industry’s best, owing to the team’s thoughtful approach to strategic asset allocation, tactical tilts, and manager selection. The series’ cheapest share class earns a Silver rating, highlighting our conviction in its long-term prospects.

American Funds’ 2020 fund pulled off an impressive feat. Despite an above-average 46% equity weighting, it lost 16.4% amidst the sell-off--that’s still painful, but it’s better than about 70% of peers. The series’ bias toward giant caps with strong fundamentals, safe bond portfolios, and large cash balances held by its underlying funds offset its overweighting in stocks. Strong security selection by the series’ underlying managers has helped most of this series’ funds rank among the industry’s best over most trailing periods, supporting its cheapest share class’ Silver rating.

BlackRock LifePath Index, which receives a Gold rating on its cheaper share classes, has the industry’s most aggressive equity glide path for young investors, who hold 99% in stocks. However, the series de-risks at a faster pace than most, landing with a below-average equity weighting of 40% at retirement. The firm merged its 2020 fund into its Retirement fund in November 2019, a move that proved beneficial as the latter’s conservative stance held up well during the coronavirus meltdown. Investors retiring in 2020 lost 15.3% during that period, meaningfully outpacing relevant target-date indexes and landing in the peer group’s top quintile. The series’ timely merger of the 2020 fund and its more aggressive equity stance versus the norm up until just a few years before retirement has led to strong results over the past five years, when the series revamped its glide path. (The series’ return stream in the table above blends the 2020 fund’s performance up until November 2019 with the Retirement fund’s performance thereafter).

Cautious Glide Paths Shone Recently but Have Taken a Toll Over Time John Hancock's Multi-Index Preservation has the most conservative glide path among series we cover, aiming to guard against market risk. Investors 40 years from retirement begin with just 82% in stocks, and equities drop to 8% of assets at retirement. That positioning helped this series' 2020 fund outperform about 90% of rivals and both target-date indexes amidst the sell-off, when it declined 13.4%. However, the series' overly conservative stance has weighed on returns over time. The 2020 fund posted subpar results over the trailing three-, five-, and seven-year periods. The series earns a Neutral rating on its cheapest share class. The firm offers other target-date series with more equity-heavy glide paths that have fared better over time.

As an aside, during the coronavirus sell-off, the series' 2020 fund performed much worse than would be anticipated by its underlying fund holdings as of year-end 2019. That unwelcome outcome appears to be attributable to the combined effect of changes in underlying fund changes and asset-allocation shifts.

Conclusion Although target-date funds in aggregate performed in line with expectations, investors should expect their diversification benefits to wane during periods of extreme stress. Better results during the recent bear market as compared with the global financial crisis indicate industry progress. Still, investors should remain cognizant of their target-date fund's risk profile, especially as retirement approaches, when results can diverge meaningfully from one series to the next.

/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/07-25-2024/t_56eea4e8bb7d4b4fab9986001d5da1b6_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BU6RVFENPMQF4EOJ6ONIPW5W5Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/41940ba6-d0f1-493c-af96-52ad9419064e.jpg)