10 Scary Stocks

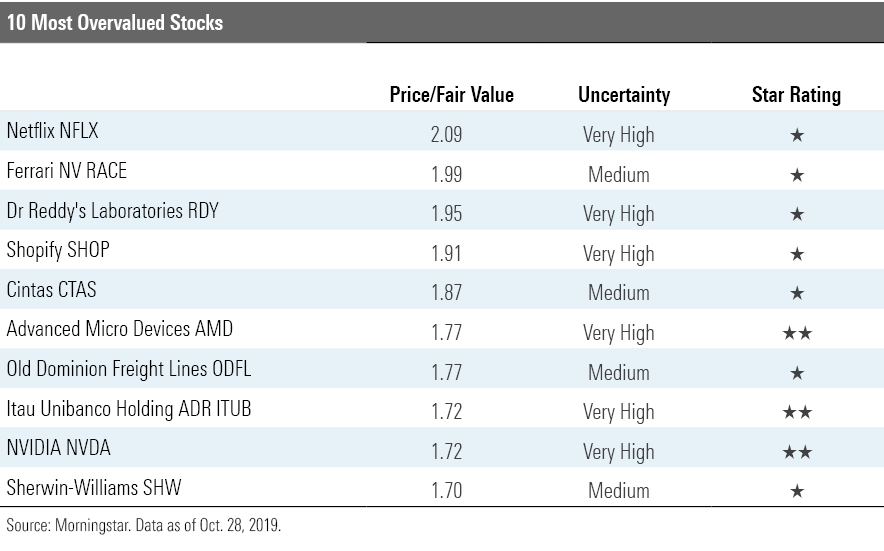

These are the most overpriced stocks in our coverage universe today.

In what is becoming a Halloween tradition, today we're profiling spooky-expensive stocks. Specifically, we've uncovered the 10 most overvalued names in our coverage based on their price/fair value ratios. (We excluded extreme uncertainty stocks.) The valuations on these names are as frightening as Jack Torrance wielding an ax.

It’s an eclectic bunch. Three of the stocks appearing on this year’s roster are apparently perennially overpriced: Netflix NFLX, Ferrari RACE, and Itau Unibanco Holding ITUB appeared on our overvalued list one year ago, as well. Moreover, this isn’t a collection of stocks all flying high on a wing and a prayer. To wit: Six of the stocks--Netflix, Ferrari, Shopify SHOP, Cintas CTAS, NVIDIA NVDA, and Sherwin-Williams SHW--have carved out economic moats.

Six stocks on the list carry very high uncertainty ratings. The uncertainty rating represents the predictability of the company's future cash flows and, therefore, the level of certainty we have in our fair value estimate of that company. Some types of companies have less predictable cash flows than others and carry higher uncertainty ratings. Firms in more economically sensitive industries, including auto manufacturers, retailers, and restaurants, generally carry higher uncertainty ratings. So, too, do companies in highly disruptive sectors such as technology and communication services.

Given the uncertainty around the future cash flows of many of the companies listed here, there's a chance that our fair value estimates may be overly modest. But even once you take into account uncertainty--as the Morningstar Rating for stocks does--these names are still overpriced. In fact, seven of the stocks are trading at Morningstar Ratings of 1 star as of this writing.

Here’s our take on three of the fiendishly priced names.

Netflix The most overpriced name on our list was also the priciest name one year ago, trading at a breathtaking 109% premium to our fair value estimate--even after the stock lost about 6% during the past 12 months.

Morningstar assigns the largest online video provider in the United States a narrow moat, based on the firm's intangible assets and a network effect derived from its massive worldwide subscriber base, explains senior analyst Neil Macker. The company’s streaming subscriber base continues to grow, but it’s slowing. We think that adding and maintaining the marginal subscriber is becoming increasingly challenging, argues Macker, though the core user base is less price-sensitive.

“However, we still expect that coming competition with lower-price plans will test the price sensitivity for these core users--both Apple TV+ and Disney+ will launch in November, with HBO Max and Peacock from NBCUniversal following next spring,” adds Macker. “Feeding these services has also driven up content costs, as management indicated that the cost to develop premium content has increased about 30% over the past year.”

Finally, Netflix continues to burn cash, to the tune of $551 million during the latest quarter. Although management insists that the cash burn will decrease next year, it also admits that the firm will move “slowly” toward positive free cash flow, says Macker.

{Deeper dive: Netflix Reports Mixed Subscriber Growth}

Dr Reddy's Laboratories RDY In September, we axed our fair value estimate on the generic drug maker by 43%. Why the cut? We're expecting slower growth because of the company's limited pipeline and its inability to differentiate itself in an increasingly competitive market, explains analyst Soo Romanoff.

“Market share gains of commodity generics through acquisitions in the large U.S. and European regions have provided historical top-line growth for Dr Reddy, but this has been tempered recently by intense pricing pressure with the consolidation of the sourcing entities,” she continues. “The company has completed numerous successful drug launches, but its manufacturing scale, research capabilities, distribution networks, and legal acumen still lag those of larger competitors, in our view. While we do expect that its low-cost operating structure may sustain its current market share gains, Dr Reddy's focus on the more commodified developed markets has started to erode the firm’s returns on capital.”

Moreover, the drugmaker hasn’t carved out an economic moat.

“We view the generic drug industry as predominantly a no-moat industry with low barriers to entry and commoditylike products,” says Romanoff. “With increasing competition in the subsegment, especially in the U.S., the key differentiator is pipeline (and ability to replenish), significant legal and administrative scale, and the ability to manufacture relatively more complex drugs. Dr Reddy manufactures the least complex generics with no product differentiation, which are highly commoditized.”

The stock is trading at a 95% premium to our fair value estimate.

Cintas The largest provider in the route-based uniform solutions industry, Cintas is "firing on all cylinders," says analyst Matthew Young. The firm boasts market share around 35%, an immense distribution network, industry-leading efficiency, and top-tier operating margins, he explains. We've awarded Cintas with a Morningstar Economic Moat Rating of wide, stemming from its scale-based cost advantages.

“Providers can’t differentiate much from a product standpoint since uniforms are essentially commodified apparel products,” notes Young. “However, scale matters in this route-based service business, as it provides greater leverage over a vast fixed-cost base, relative to smaller peers. It also generates barriers to entry. It would be quite difficult for a new entrant or small provider to replicate Cintas’s broad network reach--an operation would incur significant losses until building sufficient route density, particularly given the need to run scheduled routes while investing in delivery trucks and rental processing facilities.”

Although Cintas' performance is cyclical--its operations are tied to U.S. employment trends--the firm adeptly navigated the 2009 downturn by curbing excess labor and inefficient routes.

There’s much to like about the company--we only quibble with its outlandish share price, which is 87% above our fair value estimate.

A previous version of this article originally appeared on Oct. 31, 2018.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)