10 Fund Rating Upgrades

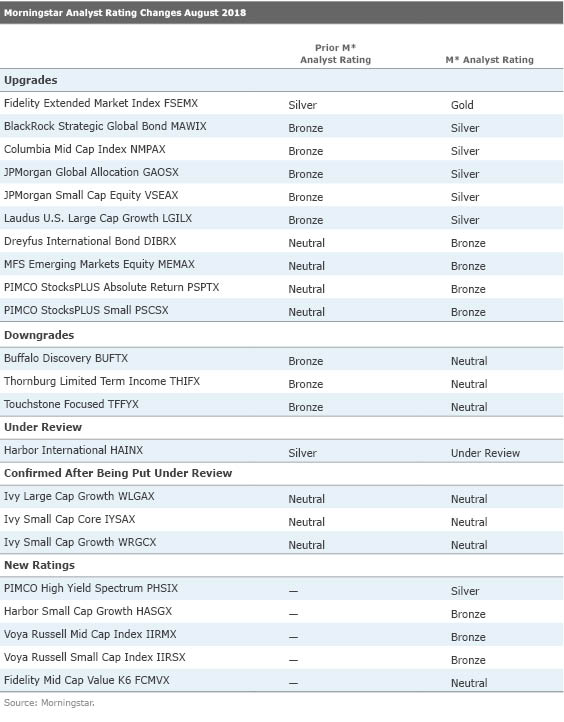

The month featured 10 upgrades, three downgrades, and 114 affirmed ratings of funds.

In August 2018, Morningstar manager research analysts affirmed the Morningstar Analyst Ratings of 112 funds and two target-date series, upgraded the ratings of 10 funds, downgraded the ratings of three funds, placed one fund's rating under review, and assigned new ratings to five funds. Below are some of August's highlights, followed by the full list of ratings changes.

Upgrades

Downgrades

Comanager Elizabeth Jones' departure in August 2018 was a blow to

New Ratings

Investors should be aware that

/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)