April Ratings in Full Bloom

Eight upgrades, 10 downgrades, and 146 affirmed ratings of funds and target-date series.

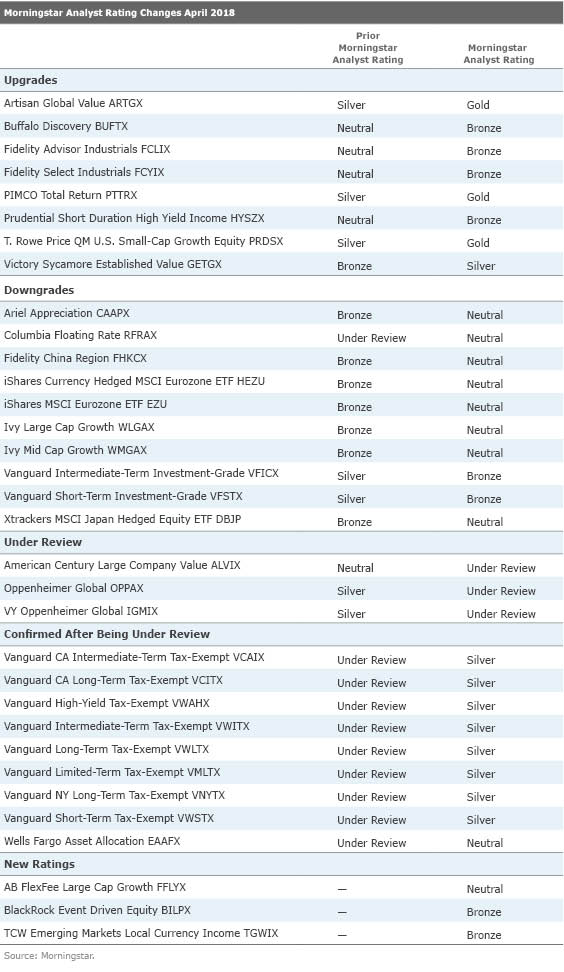

In April, Morningstar Manager Research analysts affirmed the Morningstar Analyst Ratings of 143 funds and three target-date series, upgraded the ratings of eight funds, downgraded the ratings of 10 funds, placed three funds’ ratings under review, and assigned new ratings to three funds. Below are some of April’s highlights, followed by the full list of ratings changes.

Upgrades

PIMCO Total Return

PTTRX was raised to Gold from Silver on renewed confidence in its leadership. The departure of the fund’s legendary manager Bill Gross in 2014 set off massive outflows and left doubts as to the firm’s ability to maintain talent and focus. But PIMCO has managed outflows well. The fund’s leaders--Scott Mather, Mihir Worah, and Mark Kiesel (Morningstar Fixed-Income Fund Manager of 2012)--have found their groove as a team, and PIMCO’s world-class research staff has been augmented, in some cases by senior-level alumni returning to the firm. While the fund had some hiccups under its current team in 2015, it has done well since, benefiting from well-timed interest-rate calls and a continued bet on nonagency mortgages. Since the current team took over through March 2018, the fund has landed in the best third of its peers in the intermediate-term bond Morningstar Category. This reasonably priced offering, backed by a strong asset manager, continues to deserve plenty of investor confidence.

Increased conviction in

T. Rowe Price QM U.S. Small-Cap Growth Equity

’s PRDSX disciplined process and well-resourced team drove an upgrade in its rating to Gold from Silver. Manager Sudhir Nanda has been a member of T. Rowe’s quantitative equity group since 2000. He is supported by nine quant analysts and a five-member dedicated IT team, and resources have scaled well in response to a growing product lineup for this team. The fund buys about 300 stocks based on a combined score from three broad metrics: valuation, profitability coupled with capital allocation and earnings quality, and momentum. Valuation accounts the most for a stock’s ranking, followed by quality, and momentum comprises 15%-20%. Given the relatively low emphasis on momentum, the fund’s turnover is well below the small-growth peer average. That, coupled with a broadly diverse portfolio, also afford the strategy greater capacity than its typical peer. The fund is an excellent, low-priced option that should deliver long-term outperformance against its MSCI U.S. Small Cap Growth Index benchmark with less risk.

Victory Sycamore Established Value

GETGX was bumped to Silver from Bronze thanks to its stable approach and consistent results under lead manager Gary Miller. Head of subadvisor Sycamore Capital Management, Miller assumed the lead role on this closed fund in 2002 and has since expanded the research team to six fundamental analysts and portfolio managers, each of whom in turn heads a sector-specific research team that sources ideas for Miller. They ply a straightforward process that focuses on cash-generative businesses poised for future growth and valued with a margin of safety. Quantifying downside risk is particularly important, so careful consideration is given to company balance sheets and management’s allocation of capital. Indeed, on Miller’s watch, the fund has beaten its Russell Mid Cap Value benchmark largely by losing less in down markets. New money has flooded in at a fast clip in 2016-17, but the team has shown prudence here and in the past handling capacity, and this strategy has largely retained its composition. Low fees relative to peers further boost the fund’s appeal.

Downgrades

Vanguard Intermediate-Term Investment-Grade

VFICX and

Vanguard Short-Term Investment-Grade

VFSTX were dropped to Bronze from Silver following the departure of lead manager Greg Nassour, co-head of Vanguard’s U.S. corporate bond desk. Until Vanguard finds a replacement as co-head, Samuel Martinez and Daniel Shaykevich will comanage the two funds. The comanagers have ascended Vanguard’s ranks over time, though neither had more than two years of lead manager experience when they took over here. This sudden transition also raises concerns about the firm’s succession planning. On the bright side, the funds are still supported by a deep research team and are unlikely to see dramatic changes to a rigorous process. Top-down themes such as yield-curve positioning come from a hub of senior fixed-income leaders, while satellite managers (Martinez and Shaykevich here) oversee their assigned sectors. Relative to peers, the two funds have had a higher-quality profile and less credit and interest-rate risk, thanks to a smattering of securitized and sovereign debt. This risk-conscious mindset, a team-oriented approach, and the advantage of a cheap price tag should keep the funds on a steady course.

New Ratings

Despite high fees,

TCW Emerging Markets Local Currency Income

's TGWIX experienced team and risk-conscious approach lead to an inaugural rating of Bronze. Managers Penny Foley and David Robbins have decades of experience in emerging-markets bond trading and research. They’ve brought experienced hires into the mix, including promoting a longtime trader to comanager in mid-2017, though a couple of analysts have left in recent years. The team evaluates interest rates and currencies on a country-by-country basis. Given the small number of names (under 20) in the JPMorgan GBI-EM Global Diversified Index, it makes sense that the fund is mindful of its bogy, sticking close to the benchmark’s position sizes and taking a small bet on a benchmark country even if the team has less conviction in it. But Foley and Robbins can increase or hedge the fund’s exposure to a country’s currency based on valuation; that tactic has helped the fund navigate tough stretches in 2013 and 2015. The fund is further diversified by off-index plays, such as frontier- and developed-markets names.

For a list of the open-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e1746d1f-b066-4c24-a3bb-b037eb26aeac.jpg)