Brighter Future for FirstEnergy

We think the shares still have room to run following the FES resolution.

The recent agreement with FirstEnergy Solutions allows

Because of these factors, we think FirstEnergy should trade more in line with its regulated utility peers with economic moats. At 14.6 times our 2019 EPS estimate, FirstEnergy’s shares trade meaningfully below this peer group. In our U.S. utilities coverage (excluding FirstEnergy), the median forward price/earnings multiple of utilities with narrow or wide moats is currently 18.5 times. We believe solid earnings growth and a growing dividend will be the catalysts for the market valuing FirstEnergy’s shares more in line with this peer group.

Our $41 fair value estimate, based on a discounted cash flow model, implies a P/E ratio of approximately 16 times our 2019 EPS estimate, closer to the peer group, but still more than 2 turns below that median. If we strip FirstEnergy of the valuation benefits that come with our narrow moat rating, our fair value estimate falls to $39 per share, still above the current trading price. We believe strongly that FirstEnergy has a narrow moat following the separation from FES.

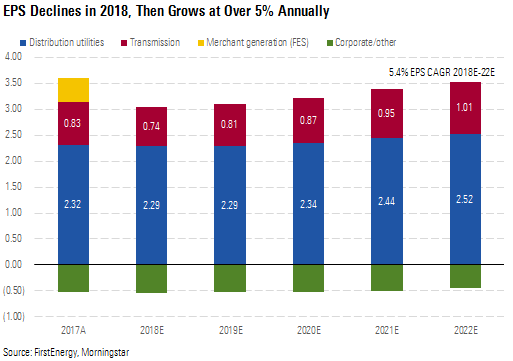

Lower EPS in 2018, but 5%-Plus Growth on Horizon We expect 2018 consolidated earnings per share to decline almost 20% versus 2017 to $2.50, due in large part to the loss of FES earnings and approximately $2.75 billion of additional equity. The equity was needed to strengthen the balance sheet following FES write-offs and settlement payments to its creditors after the separation. The bulk of this equity ($850 million of common equity and $1.62 billion of mandatory convertible preferred equity with conversion in 2019) was issued to a group of prominent investors in January 2018.

After the decline in 2018, we estimate that a fully regulated FirstEnergy will have annual operating EPS growth of approximately 5.4% after 2019, driven by the transmission businesses’ EPS growing 8% annually. Transmission growth will be partially offset by the regulated distribution segment EPS growing at only 2.4% annually, as we assume the Ohio distribution modernization rider is not fully renewed in late 2019. We expect corporate and other to decline as the company rationalizes the parent support of a smaller business at roughly $250 million per year. Thus, once FirstEnergy gets past the headwinds of the FES separation and the expiration of the Ohio DMR, we believe over 5% EPS growth is on the horizon.

FirstEnergy cut its dividend 35% in 2014, and shareholders have not seen an increase since then. We believe dividend increases in line with EPS growth are likely, possibly beginning in 2020.

FirstEnergy's Moat Sources We believe a regulated utility can establish a narrow economic moat if the majority of its operations are in jurisdictions with constructive regulatory environments. Following the separation from bankrupt no-moat merchant business FES, we estimate wide- and narrow-moat businesses will represent 89% of FirstEnergy's 2018 operating earnings, up from 76% in 2017.

FirstEnergy is accelerating investment in its wide-moat transmission business and, combined with the favorable Federal Energy Regulatory Commission regulatory framework, we estimate transmission operating earnings will increase 8.7% annually over the next five years. We expect wide-moat transmission to contribute 25% of operating earnings following the FES separation, climbing to almost 30% by 2022.

Narrow-moat utilities in Ohio, Pennsylvania, and West Virginia will represent about 64% of estimated operating earnings in 2018 following the separation, up from 53% in 2017. Partially offsetting these narrow-moat utilities is Jersey Central Power & Light, a regulated utility in New Jersey that struggles to earn its cost of capital, largely because of a poor regulatory framework. The good news for shareholders is that JCP&L will represent only about 11% of operating earnings in 2018, and regulation could be improving in the state.

Wide-Moat FERC-Regulated Transmission In 2017 and before the separation of FES, FirstEnergy derived approximately 23% of its operating earnings before parent company expenses from three stand-alone FERC-regulated transmission companies and FERC-regulated transmission owned by its distribution companies. The transmission system has over 24,500 circuit miles and is one of the largest in the PJM Interconnection, which covers the Mid-Atlantic region from Chicago to New Jersey. We expect FirstEnergy to invest almost $6 billion over the next five years in its transmission business, resulting in 8.7% average annual earnings growth. Due to the acceleration of transmission investments, we estimate that wide-moat transmission will represent approximately 29% of consolidated operating earnings before corporate and other in 2022.

We believe electric transmission is a wide-moat business due to its efficient scale competitive advantage. Once a transmission line is serving a region, there is little incentive for a competitor to enter a market. Capital costs for new transmission lines are too high and incremental revenue too low to offer sufficient returns on invested capital for two competing transmission owners. In addition, FERC prevents new transmission lines from being built unless there is a demonstrated economic need to do so. If there is a need, many times it is more economical to increase the capacity of an existing transmission line than to build one in a new right of way.

Electric transmission also has a favorable regulatory framework under FERC. Rates are based on a formula that allows FirstEnergy’s transmission businesses to recover expenses and earn a return on investment. The formula rate mechanism considers forecast expenses, investment base, revenue, and network load each year, then adjusts annually to true up returns. Thus, regulatory lag--the difference between allowed return and actual returns--is close to zero. In other words, a transmission owner is virtually assured of earning the FERC-allowed return on its investment. This formula-based rate-setting framework is more investor-friendly than typical state regulation, which requires a utility to invest capital before adjusting customer rates to collect a return on and return of that capital.

FirstEnergy spent approximately $4.2 billion over 2014-17 completing the first phase of its Energizing the Future strategy. The majority of the investments were in smaller-scale projects replacing older equipment with updated technology in the ATSI system serving northern Ohio and western Pennsylvania. FirstEnergy is now targeting annual investments of about $1.2 billion between 2018 and 2021 as it continues Energizing the Future to its transmission systems in central and eastern Pennsylvania, West Virginia, and New Jersey.

We assume total transmission capital expenditures of $5.95 billion over 2018-22, driving annual transmission rate base growth of about 11%. We estimate that this will result in annual operating earnings growth of 8.7%, less than rate base growth due to declining average allowed returns on equity as the investment mix shifts to jurisdictions with lower allowed ROEs and equity ratios. In addition, approximately 20% of the transmission system, although regulated by FERC, receives revenue from retail customer rates and is subject to regulatory lag. However, we still expect the weighted average allowed ROE to equal 10.4% in 2022, well above our estimate of the cost of equity for these businesses, and 80% of the rates are in the FERC forward-looking framework with no lag. We are confident that realized returns will be higher than the average cost of capital for at least 20 years, supporting our view that interstate electric transmission is a wide-moat business.

FirstEnergy management has already identified over $20 billion of additional transmission investment in its existing systems beyond 2021. In our opinion, this ensures continued growth and economic returns for shareholders through the next decade.

Narrow-Moat State-Regulated Utilities FirstEnergy has 10 regulated distribution utilities serving over 6 million customers across approximately 65,000 square miles in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York. The regions served are one of the largest contiguous service territories of any utility in the United States. Five of the six states are restructured and generation is unregulated; the exception is West Virginia. FirstEnergy's two integrated regulated utilities in West Virginia have 3,790 megawatts of generating capacity.

We expect FirstEnergy to invest about $8.25 billion in its 10 distribution utilities between 2018 and 2022 versus capital expenditures of $6.2 billion from 2013 to 2017. The increased investment level is driven by improved regulatory frameworks with formula rate mechanisms expected to cover about 40% of these capital expenditures.

We have a high level of confidence that FirstEnergy’s nine distribution utilities in Ohio, Pennsylvania, and West Virginia will earn returns on invested capital above our estimate of the cost of capital for at least the next 10 years, thus fulfilling our basic financial requirement for a narrow moat rating. In addition, our confidence that returns will exceed cost of capital is improving in FirstEnergy’s 10th distribution utility in New Jersey, due in large part to the new infrastructure investment program approved in December 2017.

Ohio Ohio Edison, Cleveland Electric Illuminating, and Toledo Edison represented 35% of FirstEnergy's distribution deliveries in 2017. We estimate the three utilities in Ohio will contribute about 21% of operating earnings excluding corporate and other in 2018 following the separation from FES.

The deregulation of the Ohio power industry began with Senate Bill 3 in 1999, and the transition has been anything but smooth, with numerous legal challenges to the hybrid approaches the Public Utilities Commission of Ohio has taken. The proximity of inexpensive shale gas has pressured the profitability of Ohio’s coal and nuclear power plants. However, with FES separated, FirstEnergy shareholders’ only concern is the regulatory framework for distribution; we believe it is constructive for investors and have a high level of confidence that it will remain that way for the foreseeable future.

In October 2016, PUCO authorized FirstEnergy’s three distribution utilities to implement a distribution modernization rider providing for the collection of $204 million (grossed up for income taxes) annually for three years, with the possibility of a two-year extension. The DMR is a unique framework in that FirstEnergy has to demonstrate sufficient progress in the implementation of the grid modernization programs, not actual expenditures. The flexibility in this rider was driven by the desire of PUCO to assist FirstEnergy in maintaining its investment-grade ratings. Although the DMR does not specify an ROE, the grid modernization program included in the Electric Security Plan IV passed in 2016 incorporated a 10.88% ROE that includes a 50-basis-point incentive adder for grid modernization projects. PUCO also reaffirmed the existing base rate ROE of 10.5%, above ROEs in other states, which mostly vary between 9.5% and 10%.

We think the market has focused on the failure of Ohio and federal regulators to support FES’ generating coal and nuclear plants and not on the electric security plans. These unique regulatory frameworks have provided higher-than-average ROEs and riders. The DMR framework and PUCO’s willingness to assist FirstEnergy in maintaining its credit ratings is also overlooked by the market, in our opinion. These regulatory actions demonstrate the widening moats for FirstEnergy’s three regulated distribution utilities in Ohio and give us confidence that the three distribution utilities can earn above their cost of capital for at least the next 15 years, similar to other narrow-moat businesses.

Pennsylvania Met-Ed, Penelec, Penn Power, and West Penn Power represented 36% of FirstEnergy's distribution deliveries in 2017. We estimate that the four utilities in Pennsylvania will contribute about 29% of operating earnings excluding corporate and other in 2018 after the separation from FES.

In January 2017, the Pennsylvania Public Utility Commission approved a settlement agreement that provides for an estimated annual pretax operating earnings increase of about $203 million for FirstEnergy’s four utilities. Although the settlement agreement was “black box” and included no specified ROEs, we believe the rate case will allow the businesses to earn above their cost of capital for the two-year stay-out period. In fact, earned returns increased significantly in 2017 versus 2015.

We believe the Pennsylvania regulatory framework is constructive for shareholders due to the PUC’s use of fully forecast test years and rate riders for many infrastructure investments. These riders were reset to zero after the last rate case, but if costs exceed the amount recovered in the 2017 base rate case, then the rider restarts. This framework reduces regulatory lag and results in higher realized returns, giving us confidence that the four Pennsylvania utilities will earn above their estimated cost of capital for at least the next 15 years. Thus, we believe these four businesses have a narrow moat.

West Virginia and Maryland Mon Power and Potomac Edison represented 16% of FirstEnergy's distribution deliveries in 2017. We estimate that the two utilities serving West Virginia and Maryland will contribute 15% of operating earnings excluding corporate and other in 2018 after the separation of FES. Mon Power is an integrated utility that also owns two large coal plants and 40% of the 1,200 MW Bath County pumped storage hydroelectric plant, a total of 3,580 MW of regulated generation.

In terms of regulatory frameworks, West Virginia and Maryland have historically been difficult states for investors. West Virginia is home to 85% of the rate base of these two utilities. The Public Service Commission of West Virginia uses historical test years and has set ROEs below industry average. However, due in part to the regulator’s desire to support the coal industry, we believe recent decisions have been more supportive.

In addition to West Virginia’s support for utilities using coal, load growth is strong. Total distribution deliveries are expected to increase at a compound annual rate of 4.3%, driven by almost 10% projected industrial customer load growth. This compares with declining sales in FirstEnergy’s other jurisdictions. Strong load growth helps utilities improve returns between rate cases, increasing the margin above cost of capital and widening the moat.

In 2015, the PSC of West Virginia approved a black-box rate case settlement that didn’t specify an ROE, but PSC staff recommended a 9.9% ROE. In addition, when the coal-fired 1,984 MW Harrison Power Station was transferred from AY Supply to Mon Power in 2013 for $1.2 billion, a 10% ROE was allowed.

AY Supply tried to sell the 1,300 MW Pleasants Power Station to Mon Power for $195 million. Illustrating the support for coal in the state, West Virginia regulators approved the sale two weeks after FERC ruled it was not in the public interest. Unregulated AY Supply, an unregulated subsidiary of FirstEnergy and separate from FES, will transfer the plant to creditors of FES as part of the bankruptcy agreement.

West Virginia’s desire to support the coal industry gives us confidence that Mon Power and Potomac Edison will earn above their cost of capital for at least the next 15 years, supporting a narrow moat rating for these businesses. Although FirstEnergy will struggle to earn its cost of capital in Maryland, the portion of earnings from this less constructive state is not material enough to affect the overall narrow moat of these utilities.

New Jersey Jersey Central Power & Light represented 13% of FirstEnergy's distribution deliveries in 2017. We estimate that it will contribute about 11% of operating earnings excluding corporate in 2018 following the separation from FES.

Historically, New Jersey has been a difficult regulatory jurisdiction for investors. New Jersey has a strong consumer advocacy group that is active in rate cases and has significant influence with New Jersey’s Board of Public Utilities. In addition, the regulatory framework is poor, with historical test years used in rate cases and no allowance for construction work in progress and average to below-industry-average allowed ROEs. Although the last base rate increase that went into effect in January 2017 incorporated a 9.6% ROE, slightly lower than the industry average we have observed in the past year, the regulatory framework makes it difficult for JCP&L to earn its allowed rate of return. In fact, for the period ended June 30, 2016, and before the rate increase, the earned ROE for JCP&L was a dismal 2.1%.

However, we have recently observed improvement in the New Jersey regulatory environment. As of December 2017, new rules allow New Jersey utilities to adopt interim rates, subject to refund, if the BPU has not issued a final decision on a rate increase request after eight months. In addition, the new rules allow rate riders for infrastructure investment. Taking advantage of the new regulatory framework, JCP&L filed a four-year $400 million infrastructure plan on July 13 targeting enhancements in its distribution system that would improve reliability.

Pursuant to the new BPU infrastructure investment recovery rules, FirstEnergy has requested a rate rider with semiannual filings commencing in 2019. The ROE for the rider will be based on the most recent rate case. For JCP&L, a 9.6% ROE would be allowed based on the 2016 rate base settlement.

Even with the new infrastructure rider, we continue to have a below-average level of confidence that JCP&L will consistently earn at least its cost of capital over the next 10 years. Thus, we do not believe this business warrants an economic moat. That being said, the improvements in New Jersey regulation should allow FirstEnergy to earn above its cost of capital more often. The other piece of good news is that with FirstEnergy investing more heavily in transmission and other jurisdictions, we estimate that JCP&L will contribute only about 10% of consolidated operating earnings in 2022.

/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/20ab29d0-a934-4b10-b861-770e63c08853.jpg)